|

Why Should Your Clients Own Life Insurance?

Often, talk about changes in estate tax laws, capital tax brackets, retirement planning, and savings programs cloud the issue of protecting assets and loved ones. Why should your clients have the protection provided by life insurance … a solution that’s not associated with taxes or yield?

Put in simple terms, your clients should have insurance protection if they are concerned about:

Mortgage payments

If one partner in a marriage or union died, how would the remainder of the mortgage get paid? The surviving partner/spouse is now burdened with most of the same expenses but half the income. This is a need for a defined timeframe (the length of the mortgage), so a 15- or 30-year Term policy can ensure that mortgage is covered in case of an untimely death. Paying for College

Your clients may be putting money into a special college fund already; they may have started the minute they found out they were pregnant! But many parents worry about college expenses eroding their retirement goals. Yet, college funding is critical and uncertainties abound. From what they want to be when they grow up (Teacher? Astronaut? Firefighter? Doctor?), to what school they will attend (an in-state college or an Ivy League one?), to how much tuition will soar during those saving years. Like mortgage payments, this is a need for a defined timeframe (the duration of child(ren)’s college), so a 15- or 30-year Term policy can ensure tuition is covered in case of an untimely death. Plus, insurance is in a small group of assets (along with retirement and related annuity savings) that are exempt from students' funding eligibility! Retirement funding

The pension plan has all but gone the way of the dinosaur. Clients who still have pensions can count themselves among the lucky ones. And for many of your clients, debt may not be a problem, so final expenses aren’t an issue. But typical retirement planning is based on contributions from both incomes. Life insurance can fulfill the deceased spouse’s contributions. A Permanent policy is best for this type of protection, since you’re considering the later years, and a 30-year Term policy won’t cut it if they purchase it in their 20s or 30s. Unless … their Term policy has a conversion option (which is the only type of Term policy we recommend), which allows them to change their Term policy to a Permanent one at the same rate class at a specified time during the Term policy’s life. Income replacement

Is your client the sole breadwinner? Or the major breadwinner? What would happen to his wife if he died suddenly? With widows as one of the fastest growing segments of the U.S. population (more than one million women become widows every year, and the average age is 59½1), it’s important to provide them with peace of mind, safety, and security, and to protect them from rushing into financial decisions, paying for immediate needs, and stress. Plus, when one spouse dies, many times the remaining spouse’s risk tolerance becomes much more conservative since there is less potential for future contributions and conservation of capital may become a greater concern. A Permanent policy can provide the immediate capital needed. Final expenses

One of the reasons people buy life insurance policies for young children, in addition to the fact that it guarantees their insurability for later in life when an unexpected condition can render them uninsurable, is to cover final expenses. A traditional funeral costs about $10,000; but some caskets alone sell for that much. And medical expenses after a prolonged illness can bankrupt families. Medical problems alone contributed to 62% of all personal bankruptcies filed in 2007.4 The death of a loved one is the worst time for your clients to be worrying about liquidating assets to cover these final expenses. The proceeds from Permanent policies can be the source of that additional emergency cash. Estate equalization

How do you split a house? Let’s say your client has three children and a charity that’s near and dear to her heart. Her daughter has been her caregiver for several years and has lived in the house with her. Does she really want to leave that house to all three children, leaving them with the hassle of splitting the proceeds from the sale? And that’s IF they all want to sell it. With a life insurance policy (coupled with assets like the house), she can ensure all three kids and her favorite charity are treated equally and the way she intends at her death (when she’s no longer here to speak her wishes). Other taxes due at death

Estate tax laws can change (as we all saw in 2011). That’s a given, just like death and taxes themselves. With or without the step-up in cost basis at death, there are still taxes due at death. There may be probate taxes. There may be state taxes. But a major tax that many ignore or are unaware of is income in respect of a decedent (IRD), part of an inheritance which consists of taxable income to which the deceased person was entitled but failed to receive before death (examples include 401(k), IRA, 403(b), pension). IRDs are not eligible for the step-up in basis and may result in double taxation, income tax, and estate tax for the beneficiary. Business continuation

Life insurance is a great tool for business owner clients for funding buy/sell agreements, retaining key employees, and salary continuation/golden handcuffs. (You can learn more about these in two of our Business Insurance Advisor Tools)

Maybe your clients are business owners or have a high net worth. Maybe they’re still working toward their first million. Or maybe toward their first paycheck. Whether they’ve already accumulated wealth or are still building their financial foundation, life insurance is key to maintaining and growing their assets.

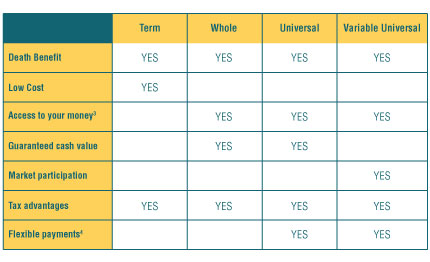

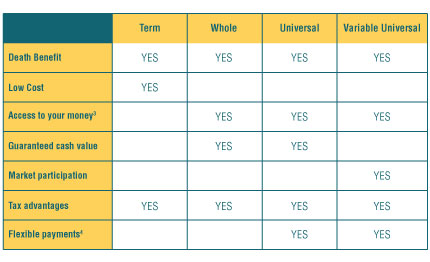

Here is a snapshot of the different types of life insurance and their characteristics:

1 U.S. Census Bureau, 2011

2 The American Journal of Medicine

3 Assuming the policy is not a modified endowment contract (MEC); most distributions are taxed on a first-in/first-out basis, however loans and partial withdrawals from a MEC are taxable and, if taken prior to age 59½ may be subject to 10% tax penalty

4 Assuming there is sufficient cash value to cover monthly policy charges; VUL has market volatility so it’s possible additional premiums may be required

Copyright © 2014 Low Load Insurance Services, Inc. Contents may not be copied, reproduced or redistributed without prior written permission of

Low Load Insurance Services or its affiliates.

|