|

A DI Tip a Day Makes Apathy Go Away

If you’re working and earning a paycheck (which most of your clients undoubtedly are), you need to protect your income from the possibility that you get too sick or hurt to work. These 31 tips will help your clients begin thinking about securing their future:

- Disability insurance is often referred to as income protection. Why? Because it protects your income if you are too sick or hurt to work

- Have you had a change in your life recently? A baby? Job change? Divorce? Retirement? Purchase of a vacation home? These are a few of the triggers for a policy review to ensure that any protection you have in place is still the right protection.

- Why should you protect your income? Because disabilities happen (3,000 per hour), and 1 in 4 of today’s 20-year-olds will become disabled before they retire.

- Life insurance and Disability insurance often go hand in hand; one providing a death benefit, the other a living benefit.

- Do you have retirement dreams? Don’t let a disability get in the way of those dreams and turn that home on the beach into a state-run old folks’ home.

- Don’t underestimate your earnings potential. (A 30-year-old making $50K today could earn more than $4.5M by the age of 65)

- Have you looked at the balance in your retirement and savings accounts? Could you retire tomorrow and live off your current savings? If not, you need income protection.

- Business owners face a triple threat if disability strikes: replacing personal income, keeping the business afloat, and transitioning the business if you are unable to return to work.

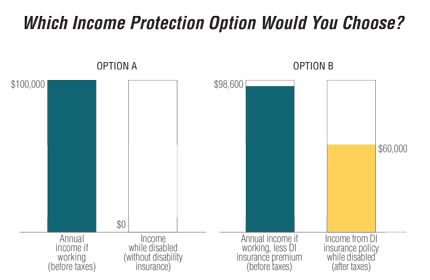

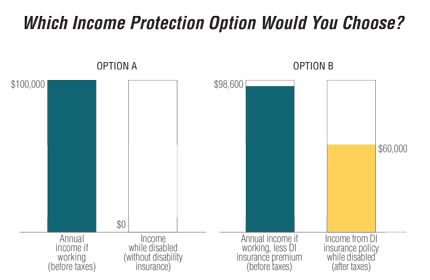

- Which option would you choose:

- If your income went away tomorrow, what would you give up first? Retirement savings? Car? Daughter’s dance lessons? Cell phone? Groceries?

- If you have an existing health condition, chances are you will still qualify for a modified DI policy that might not cover that condition but will cover an injury and the more than 3,000 other conditions that can arise.

- What does disability look like? Most times, you can't see a person’s disability. Most disabilities are caused by illnesses that aren’t visible.

- Think a disability won’t happen to you? Here are just a few of the conditions that can render you unable to work: Asthma. Carpal tunnel. Arthritis. Depression. Cancer. Irritable bowel syndrome. Retinal disorder. Stroke. Anxiety. Alzheimer’s disease.

- What’s your risk of becoming too ill or injured to work? It’s different for everyone, but consider this: a 30-year-old male, 6 foot tall, 200 pounds, non-smoker, who works in an office environment, healthy lifestyle, without any severe medical conditions. His chances of being injured or becoming ill and unable to work before he retires are:

- 17%: 3 months or longer

- 35%: chances of that disability lasting 5 years or longer

- 78 months: the average length of a long term disability for someone like him

- Chances are, most of us know at least three people who have been affected by illness or injury; whether they are the disabled person or the person who cares for the disabled person.

- Pop quiz: What’s the leading cause of disability? Are you thinking injuries? Think again. It’s muscle, back, and joint disorders.

- 8 in 10 people will experience back pain at some point in their lives.1

- Injuries account for just 10% of disabilities.

- Write down the names of three people who would be willing to run your errands for you or help you make ends meet if you became disabled. If you can't list three, or if you’re the type who doesn’t like to ask for favors, income protection will prevent you from having to ask family and friends to help.

- Do you have group disability coverage? If you do, did you know that your group DI benefit will more than likely be capped at an amount much lower than your take-home pay and that it will be based on salary only (not commissions or bonuses)?

- If you have group DI, here are some key questions to ask about your coverage:

- How long must I wait before collecting group disability insurance benefits?

- What percentage of pay (if any) will I receive during the waiting period?

- Will the plan pay benefits if I am working at a reduced capacity? If so, do I have to be totally disabled during the waiting period?

- What percentage of my income will I receive from this benefit? What is the maximum monthly benefit? Is bonus income or incentive pay covered?

- How long will the plan cover me in my chosen occupation?

- Will I have to pay taxes on benefits I receive?

- Will my benefits be adjusted for cost of living increases on an annual basis?

- Can I retain my coverage should I change employers?

- Group DI is a great place to start. Supplementing it with a personal DI policy is even better and will fill the gap between what your group DI will pay (roughly 50% of your current income) and what you are eligible for.

- Social Security will help me if I become disabled. If you are relying on Social Security, keep this in mind: of the 2.8 million working Americans who became disabled in 2011, 65% were denied.2

- Do you know that your health insurance won’t cover you if you become too sick or hurt to work? And it won’t pay your mortgage or car payment.

- Think about all the things you protect with insurance: your home, car, life, identity. If income isn’t on that list, read this: the chances you’ll use your homeowner’s insurance are about 1 in 88. The chances you’ll use your auto insurance are about 1 in 47.3 The chances are 240 times greater you’ll suffer a disabling injury over a fatal injury.

- Think income protection is too expensive? It’s actually affordable (typically just 1%-3% of what you earn) and less than what you might spend on little things each day (lattes, monthly date night, lunches out).

- There are disability solutions to meet every need and budget. The secret is to start small, then stick with it. Through the years as needs change and your income grows, you can apply for additional coverage and refine your strategy for achieving financial security.

- Your company can get group DI coverage with as few as three employees.

- There are 86 million Americans living with a disability today.4

- 84% of people feel that their ability to save for retirement has been significantly affected as a result of a life event.5

- If you woke up in a hospital tomorrow, would you be prepared?

For more DI tips, Kathy Copack is our resident disability insurance specialist.

Adapted from Principal Financial Group: 31 Tips for Income Protection

1 NIH: National Institute of Arthritis and Musculoskeletal and Skin Diseases

2 US Social Security Administration, Disabled Worker Beneficiary Data, December 2012

3 Disabled World

4 National Organization on Disability

5 HSBC Report: The Future of Retirement

Copyright © 2014 Low Load Insurance Services, Inc. Contents may not be copied, reproduced or redistributed without prior written permission of

Low Load Insurance Services or its affiliates.

|