|

|

|

|||||||||||||||

|

||||||||||||||||

|

||||||||||||||||

|

|

||||||||||||||||

| HOME | QUOTE REQUEST | ADVISOR TOOLS | ||||||||||||||||

|

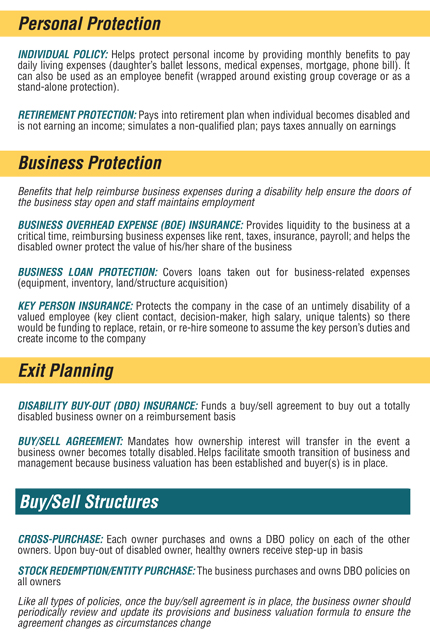

Mind Your Own BusinessWe’re not trying to be rude, but we’d like you to mind your own business. It’s not that we don’t like you listening in (on our monthly webinars or our annual LLIS Insurance Academy), because we love seeing you there. But seriously … are you minding your own financial planning practice when it comes to protection from disability? Because apparently business and income protection are top priorities for business owners, yet most of them don’t have any type of disability coverage. And having individual disability insurance is one thing; but when you have employees and even industries relying on you and your business, business DI seems like a no-brainer. “The next time you take a breather from the crisis of the day, consider this question: What would happen to your company if you died or became disabled? Many owners do nothing to plan for such events; they assume their families could sell their companies. They view death or disability as remote threats, and they spend their time worrying instead about everyday problems. Doing nothing, however, endangers all who depend on your success – your family, your partners or key employees, even your suppliers and customers.”1 We have found through the years that, while unsettling to think about, many business owners see the value in having life insurance to fund buy/sell agreements. But the inability of a business owner/partner to continue working due to serious illness or injury can be an even more problematic situation, especially without proper planning:

Do you discuss disability insurance with your business owner clients? Are you the owner of your firm? Are you your own advisor? If you’re not including disability insurance in your client meetings now, consider adding it to your checklist. Here’s why: While business owners typically purchase protection like fire/hazard and workers’ compensation, they often neglect business protection. Yet did you know: Less than 5% of disabling accidents and illnesses are work related. The other 95% are not, meaning workers’ compensation doesn’t cover them.2 Here are some key points to include on your business owner client checklist, and for you to consider for yourself if you own your advisory firm or are the successor in your firm’s succession plan:

Businesses are subject to enough challenges during their lifetimes. Why not mitigate your business’s risk and your clients’ business’s risk by planning now? And alleviate the often emotionally and financially difficult negotiations that result from not thinking ahead? It will require more than just a business valuation and DBO contracts; effective DI buy/sell planning involves the coordination of disability policies including DBO, BOE, and individual DI. We have helped many financial advisor firms put this critical protection in place. And we’re happy to help you and your clients come up with the right mix of solutions to protect both the business owner and the business. Contact our Disability Insurance expert, Kathy Copack, to begin the conversation.

1 Nation’s Business

Copyright © 2014 Low Load Insurance Services, Inc. Contents may not be copied, reproduced or redistributed without prior written permission of |

|

|||||||||||||||