ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2015

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

The short answer: it depends. So let’s look at group life and talk about when it’s a good deal … and when it’s not.

Group life insurance is sometimes offered as an employee benefit by larger employers. There’s usually a formula for the amount of insurance an employee can buy and a cap (e.g. the employee can purchase up to 1 or 2 times salary with a cap). One advisor’s client (Jack) who makes $50,000 per year would be eligible for a $50,000 or $100,000 policy, depending on the plan formula. Death benefits are usually capped at $500,000 or less.

The employer usually pays for the basic coverage, but premiums paid on any coverage amount over $50,000 are taxed to the employee using Table I of the Regulations under IRS Code Section 79.

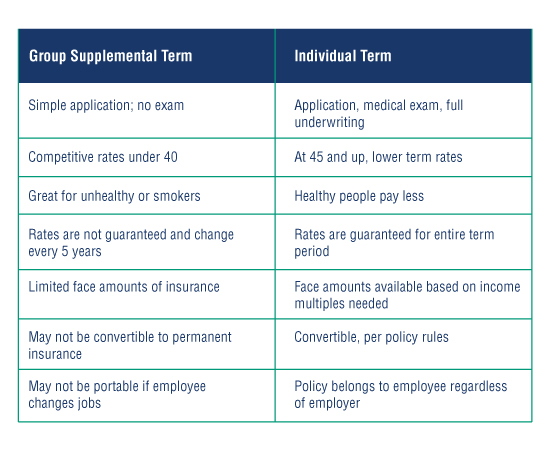

An employer might also offer Group Supplemental Life insurance. The employee pays the entire cost of this insurance and the premium is deducted from each paycheck. Is Group Supplemental Life Insurance a good deal? The short answer: it depends. If an employer is large enough, there is little or no health underwriting (no exams, no medical records ordered). The only health questions are about tobacco use. Again, Group Supplemental Life may have limits that are usually a salary-based formula.

But there’s a catch: premiums are based on male/female and smoker/non-smoker (yes, e-cigs are smoking) and they change every 5 years. So Jack, who’s 40, pays the same premium through age 44 and when he’s 45 there’s a jump in cost for the next 5 years and again at age 50, 55, 60, 65. So once he hits 45, if he’s still healthy, group supplemental could end up costing thousands more than individually owned and underwritten policies. Individual policies, on the other hand, can guarantee level rates for 10, 15, 20 or 30 years. So it’s important to compare not only the premiums today, but the cumulative premiums for the life of the term policy.

And what happens to group term when an employee retires? There may be very limited options available for conversion or for continuing the policy past age 65 or 70. Some policies automatically decrease in face amount each year -- with escalating premiums -- and end at age 75, significantly before the average life expectancy of most insureds. Individual policies, in contrast, can be continued by either paying the annual renewable term rates or converting to a permanent policy available from the issuing insurance company.

So who should have group term? Anyone whose employer offers to pay the entire premium. If it’s free, it’s good. And who should buy supplemental group term? Anyone who is under 40, especially if their coverage need is minimal. Anyone who is not in good health or is a smoker. Otherwise, individual policies will be more cost-effective. And it’s important to compare the group rates over the potential life of the employee (not just the current five-year premium) with an individually underwritten policy. Over the course of 15 or 20 years, group term is almost always much more expensive.

When your clients with supplemental group term are approaching their 40th or 45th birthdays, compare the group rates with individual term rates by going to LLIS.com to request a quote for individual term coverage. Its’s sure to save your clients money!

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".