ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2015

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Relying on family to care for you is an appealing option. You have their love and trust, and it’s comforting to know they would care for you and ensure your well-being.

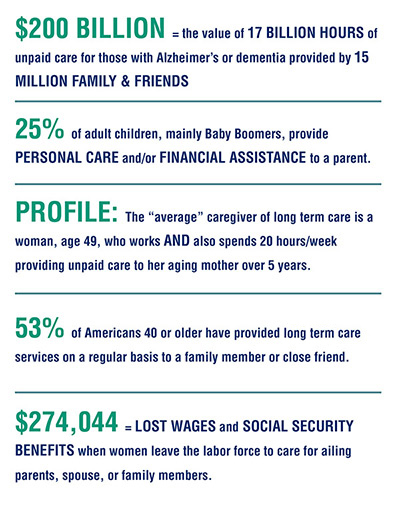

But what many don’t consider is the difference between a companion and a caregiver. Having family assist you is great, but studies show that relying on them day in and day out for your personal care takes a toll on their physical and emotional health. Family members who work and provide caregiving services for a loved one are much more likely to suffer from maladies such as high blood pressure, reoccurring pain and depression than those who aren't caregivers.1

Plus, many caregivers suffer from long term work and financial consequences from providing care. Nearly seven in 10 caregivers report making work accommodations because of caregiving responsibilities.2 In addition, 63% report loss of income, and primary caregivers contribute $8,000 of their own money, on average, towards care and services, which could put their own financial goals such as college for their kids or retirement at risk.3

Long term care insurance is a good solution to this problem. It pays for care when you need it and where you’d like to receive it. The majority of people—about 80%—who rely on care as they age get that care at home.4 Long term care insurance can pay for a wide range of care, from help with housework to visits from a nurse to care in an assisted living or nursing facility, if needed.

Long term care insurance gives you options and allows your loved ones to spend quality time—not caregiver time—with you.

This piece has been reproduced with the permission of Life Happens, a nonprofit organization dedicated to helping consumers make smart insurance decisions to safeguard their families' financial futures. Life Happens does not endorse any insurance company, product, or advisor © Life Happens 2015. All Rights Reserved.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".