ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2018

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s no secret. Maintaining good health is expensive. As a general rule, the more years you have, the more you’ll pay; even if you’re covered under Medicare. But there are things your clients can do to overcome the financial challenges that healthcare costs pose to their nest egg.

“People very, very much underestimate how much they may need [to pay for healthcare in their later years],” says Katie Taylor, vice president of thought leadership at Fidelity.

In fact, Fidelity estimates that the average couple retiring in 2017 at age 65 will spend $275,000 on general healthcare costs over about 21 years, including Medicare premiums and out-of-pocket expenses. Long term care costs are a whole different story. The need for long term care may result from an accident, stroke, illness, aging, Alzheimer’s disease, or other chronic conditions. Data about how long care can last is incomplete (since most care begins in the home). The average length of stay in a nursing home is 2.5 years for men and 1.5 years for women. With the average life expectancy post-diagnosis for Alzheimer’s patients at 8 to 10 years, it’s not uncommon for them to need care the entire time.1

A History Lesson

How did we get to where we are today? Medical technology is a wonderful thing. It’s helping us to live longer, healthier lives. On the flip side, it’s also requiring us to stretch our assets and keep them healthy too.

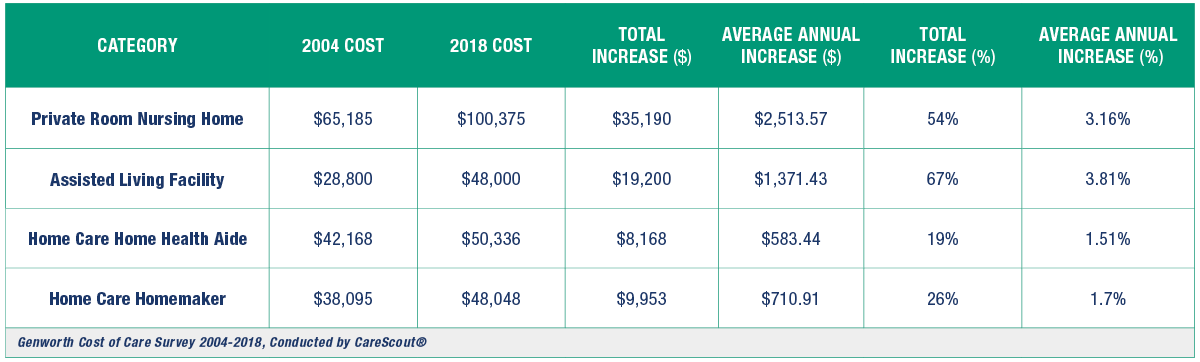

Here’s a look at the rising cost of care from 2004 to 2018:

The long term care industry has gotten some bad publicity in the past few years for repricing policies. Some insurers have even left the industry. But when you take a good look at the numbers, isn’t it easy to see why? The LTCi industry is still relatively young, and companies are constantly evaluating their risks.

Your clients are also evaluating: their life expectancy, health, asset allocation, retirement planning, and budgets. With your guidance (with LLIS as your trusted resource), they can see the big picture and not just dollar signs. Below are some tips we think will help them – and you – better understand LTCi and how to navigate through the confusion and misinformation.

We think that in many cases, LTCi policies remain an effective method of preserving your clients’ assets, ability to choose, and quality of life.

The 80/20 Rule

LLIS employs the 80/20 rule: When we help your clients build their LTCi policies, we work with you to figure out how much they’ll need toward care, then build a policy for 80% of it. The other 20% is more than likely already taken into consideration for everyday living things like food, clothes, toothpaste, and coffee. That keeps their premiums down while giving them the coverage they need.

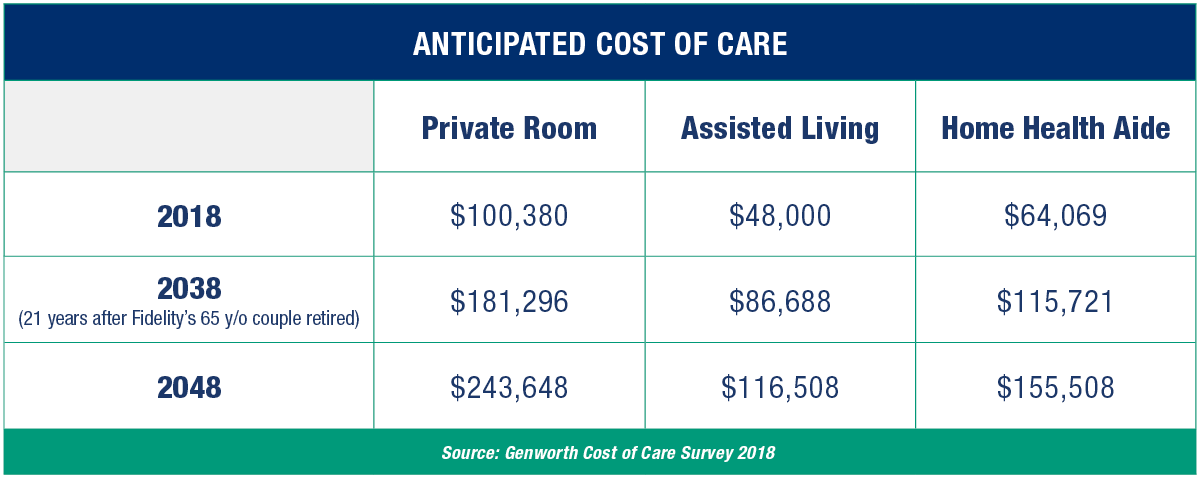

Let’s take that 65-year-old couple who retired in 2017. The average annual cost for a private room in a nursing home in 2018 is $100,380; assisted living $48,000; home health aide $64,069 (based on eight-hour shifts daily) according to the 2018 Cost of Care study by Genworth, one of the LTCi companies LLIS recommends. If they need long term care services 21 years after retirement, the costs are expected to be about double; and just 10 years later, another 50% higher.

If your clients have an HSA (giving them a triple tax break: tax-deductible contributions or pretax if paid by their employer, tax-deferred growth, and eligible expenses tax-free) and an HSA-eligible health insurance policy, it’ll go a long way toward offsetting these often-debilitating expenses.

Shop, Don’t Drop

If your clients go to the web to search for LTCi, they may never go back. Each insurance company has its own sweet spots. Premiums vary, along with coverages and health classifications. For instance: MassMutual has the lowest pricing for single females. Knowing those sweet spots can save a lot of time, energy, and frustration; and maybe even their retirement altogether. With a trusted financial advisor and a trusted insurance resource on their side, they’re more likely to get coverage and not drop the subject.

And what if a traditional LTCi policy just isn't right for your client? They have options.

Hybrids aren’t just cars

Remember when the first hybrid automobile came to market? It was the Toyota Prius. Some thought it was crazy. Some thought it was genius. Either way, hybrids have taken off with more companies jumping on the bandwagon (Honda, Lexus, Mercedes, and Hyundai among them). Each manufacturer offers different features. Insurance companies and their hybrids are no different.

Hybrid cars offer two sources of power in one vehicle. Hybrid LTCi policies offer two coverages in one policy, allowing your clients’ money to do double duty (along with immediately tripling, sometimes quadrupling, the pool of money available for LTC). And there are two types of linking benefits: Hybrid Life/LTCi and Hybrid Annuity/LTCi.

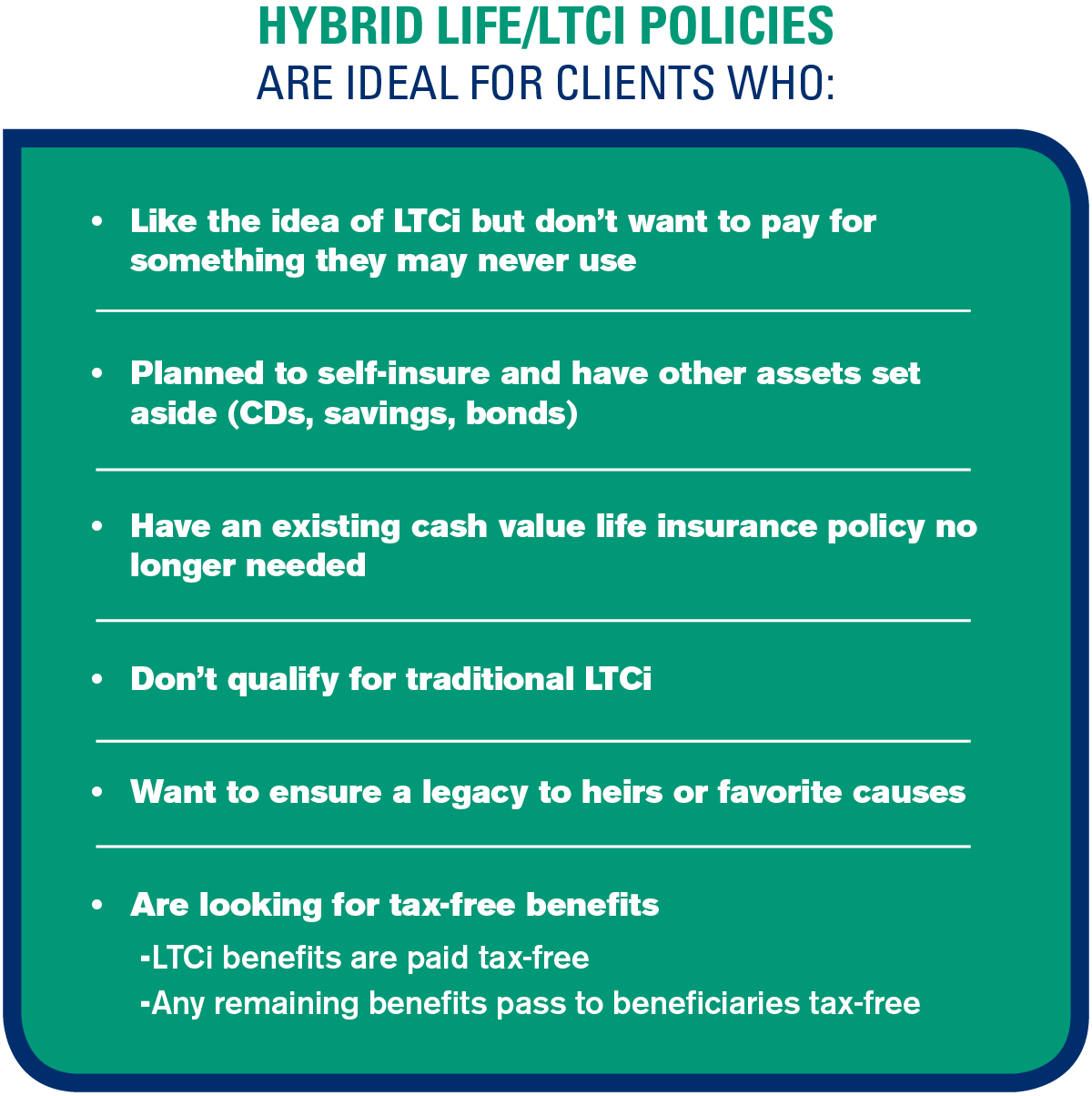

Hybrid Life/LTCi policies allow you to spend down the death benefit to pay for long term care if it’s needed. Upon death, any of the death benefit that's not used for LTC gets passed to the beneficiary(ies). And many plans have LTC benefits that keep going after the initial death benefit is exhausted.

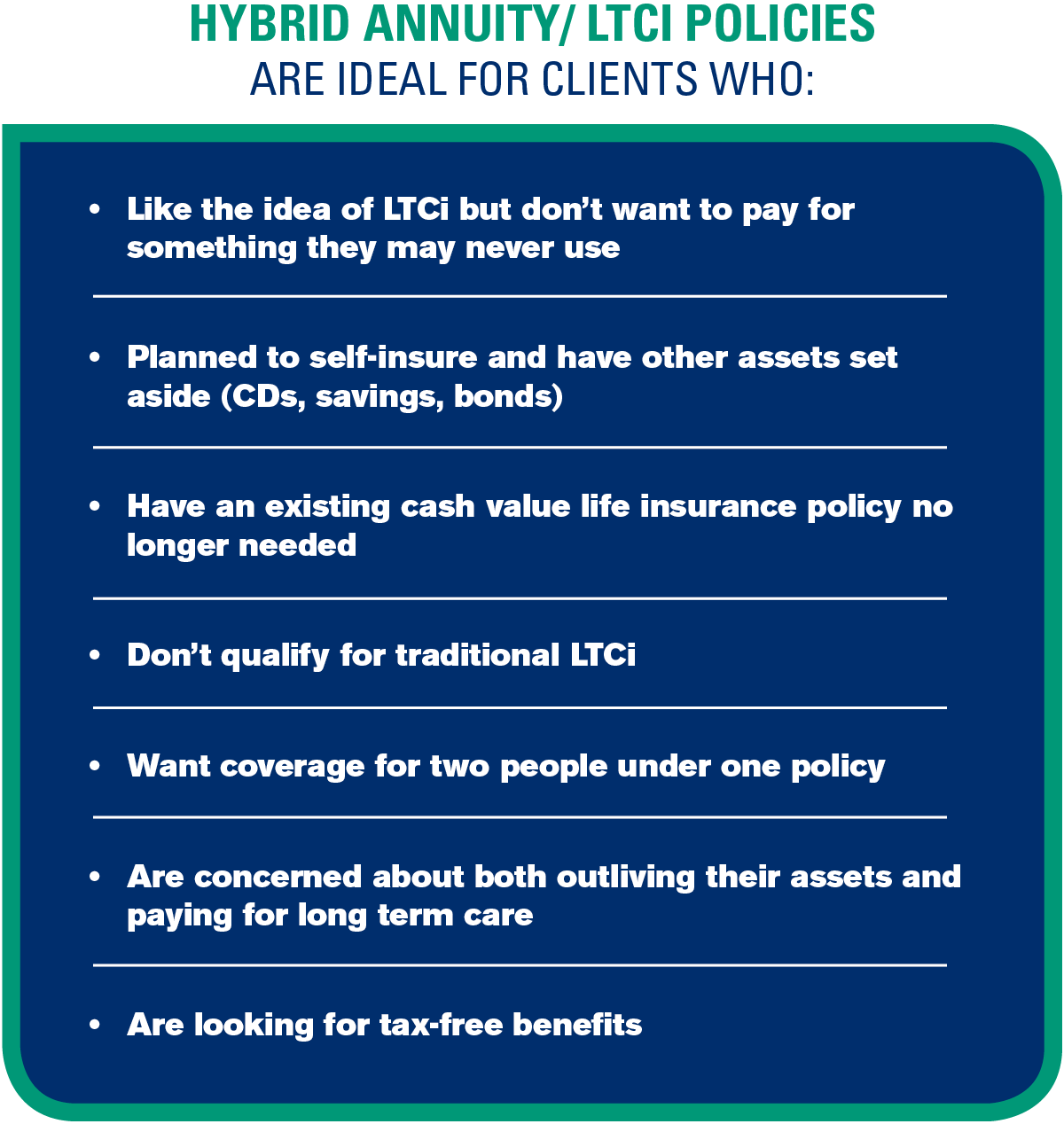

Hybrid Annuity/LTCi policies have cash values that grow tax-deferred and, unlike tradition annuities, are not taxed as money is removed from the policy when paid via the LTCi rider. If your client does not need LTC, can be redeemed for its accumulated value and upon death. If your client never needs long term care, the annuity portion can be redeemed for its accumulated value. Upon death, beneficiary(ies) get any remaining annuity value after withdrawals or LTCi benefits paid out.

Deferred income annuity

While annuities are one of the most confusing solutions in the insurance industry, this one is exactly what its name implies: an annuity that begins paying out later (like 70s or 80s). Deferred Income Annuities (DIAs) can be a good supplement to an LTCi policy. DIAs are a cross between deferred annuities and immediate annuities. Similar to immediate annuities, the monthly payout is fixed for life, creating a pension-like income in retirement.

All the single ladies (and men too)

Single clients may be most concerned about living longer and becoming a burden on their family. After all, there isn't another person in the household to provide care and they often don’t have as much support from their immediate families; meaning singles are more likely to have to pay for care. And singles now make up the majority of Americans.

And because the average life expectancy for women is longer than for men, women tend to need more long term care services.

They’re also more likely to move from their home to get care.

Sharing is Caring

Married couples or partners sharing a residence should take a look at shared care riders. The cost of the rider isn’t expensive, but the benefit it provides is priceless.

LLIS is conservative when it comes to riders; we don’t recommend many of them. But the Shared Care rider is one we think all qualifying clients know about. The reality is that as we get into our older years, we’ll start losing our independence – physically or cognitively -- and sometimes both.

A shared care rider protects your clients from paying too much for care and, conversely, needing more care than planned for.

In the first instance, one of the insured individuals dies after a short length of care. Their benefits would pass with them, along with premiums paid. The shared care rider means the remaining benefits are now available to the surviving insured.

In the second instance, one of the insured individuals needs care for a longer term than anticipated (think Alzheimer’s or dementia). The shared care rider means that, once their bucket of benefits is gone, the second insured’s benefit pool is available to pay for the care.

Taxes

Many clients also are not aware that their LTCi premiums may qualify for tax deductions. Individual taxpayers can treat premiums paid for tax-qualified LTCi for themselves, their spouse, or any dependents (including parents) as a personal medical expense. For your clients who itemize, medical expenses are deductible after they exceed the amount required to meet their adjusted gross income. The amount of LTCi premium considered a medical expense is limited to the eligible LTCi premiums as defined by Internal revenue Code 213(d) and is based on your client’s age. That portion of the LTCi premium that exceeds the eligible LTCi premium is not included as a medical expense.

As they age, their tax-deductible limit increases.

LLIS does not provide tax advice. Your clients should speak with an accountant for specific rules and limits that apply.

The biggest threat to a comfortable retirement for most people is not a stock market crash; it’s the cost of healthcare. For many, having an LTCi policy in place is more about peace of mind than affording a lengthy stay in a nursing home. Help your clients ensure a rewarding, longer life and protection for assets they’ve accumulated over the years. Chances are, they’ll need it.

Links you may like:

1 “Life Expectancy and Long-Term Outlook for Alzheimer’s Disease”, healthline.com

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".