ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

First Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

At LLIS, we work just as hard on a $100,000 policy as we do on a $1 million one. So the net worth of your clients isn't of concern to us. And, of course, all clients have different needs, wants, and goals; and their wealth often dictates what they value most in a trusted financial advisor (and in our case, your trusted insurance resource).

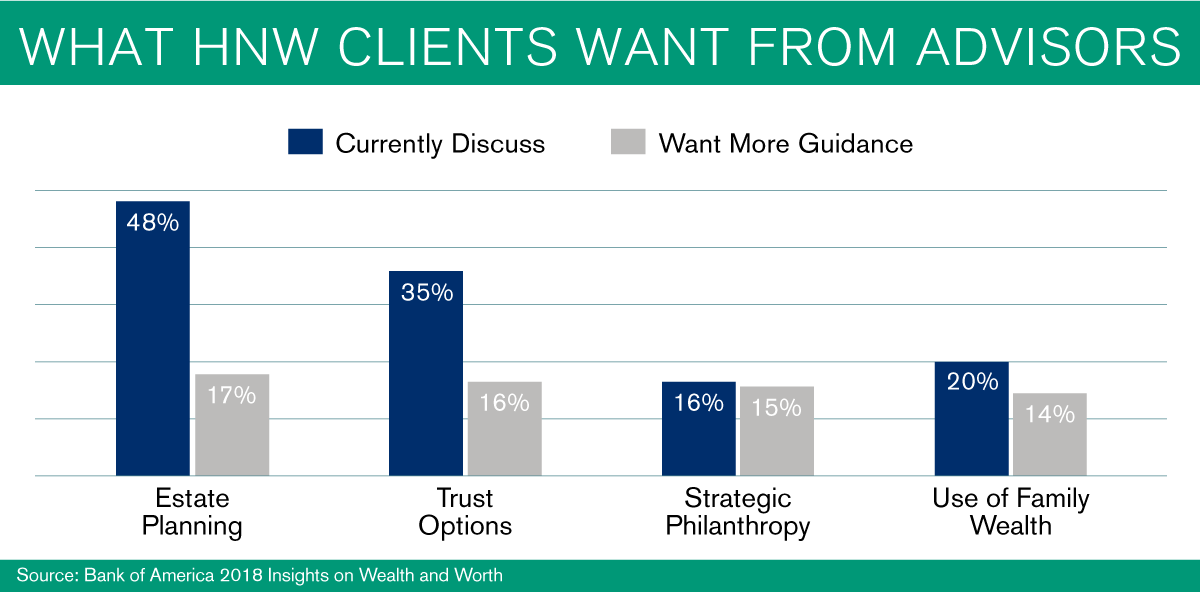

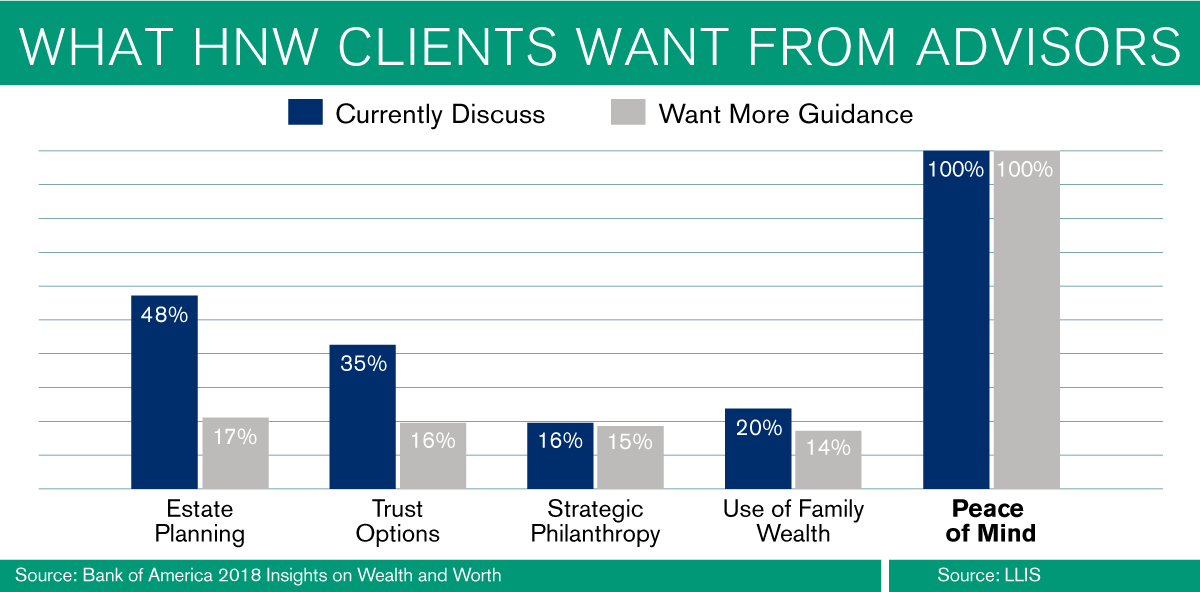

But we came across a Bank of America (BOA) study that intrigued us: What high net worth (HNW) clients want from advisors. Here is what that study revealed:

While clients may come to you for just one of these issues, they probably need help with all of them. The majority are retired or semiretired and you, as their financial advisor, often know more about them than anyone but their family doctor.

We thought we’d share with you what one of our advisor partners told us about a HNW client couple he’s worked with throughout the years and a bit about LLIS’s role in that work. Do you see any similarities in how you work with your HNW clients?

Advisor: Male, middle-age, extensive experience working with HNW clients (David)

Clients: Married couple (M/F), mid-50s when he began working with them, two children, assets included cash in the low millions, significant stock, nice home (Harry & Sylvia)

While many HNW individuals (HNWIs) create nonprofits of their own, Harry and Sylvia knew their passion and purpose, and it existed with established organizations. They’ve remained active with the philanthropies and regularly evaluate the impact of their giving. They are like most HNWIs when it comes to philanthropy and chose causes similar to the U.S. top three:

Education (27.9%)

Social services (15.7%)

Arts, culture, humanities (12.2%)

With a single premium Guaranteed Survivor Universal Life insurance policy (GSUL), Harry and Sylvia have met their charitable leverage goal of leaving a $1.5M policy to an alma mater and remainder amounts in their will for their church. Annually, they support that alma mater, their church, and the arts. They have chosen to contribute large donations to those organizations instead of giving small donations to all charities that ask. And they’ve chosen to be invisible donors for the most part. Their advisor had them set up a donor advised fund which spins off interest that they can give to their charity(ies). Their kids will inherit the ability to direct those funds.

How did the insurance policy leverage their support of their alma mater? They paid premium for 10 years of $12,000 annually into the GSUL policy (a Guaranteed Universal Life policy that covers two lives and pays a death benefit when the second insured dies). $120,000 cash turned into a $1.5 million policy guaranteed to be paid out at the second death.

Harry and Sylvia:

With David’s assistance, Harry and Sylvia are spending down their retirement accounts, mostly with family gifts and travel. They have established a legacy to their children and grandchildren, grown their money, and provided financially for favorite philanthropic causes. Additionally, David suggested they consider Long Term Care insurance (LTCi). They looked into both traditional LTCi and a Hybrid Annuity/LTCi.

Financially, Harry and Sylvia could afford to self-insure, and because they could afford to make it a single premium, they chose the Hybrid option that provides about $300,000 for each of them if/when they need it; and because the assets are pooled, each can access the other’s benefits if needed. They are protecting their assets and ensuring their comfort and care.

Hybrids can be an effective estate planning tool for people who have cash on hand and want to pass it on to their heirs. The funds in the annuity are growing with tax-free interest and, if they need to access the long term care benefit, the accelerated payments come out tax-free. Their current plan is to stay in their home until one of them needs more physical care than can easily be provided there.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".