ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Second Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

During this difficult time of the COVID-19 pandemic, I'm reflecting on the things people say, the actions they take, and how they relate to my own life. I imagine many of you are too. Something the Pinellas County Sheriff said recently got me thinking about annuities. Here is what he said on April 14th about opening the county's beaches:

"... look at where we are today and where we need to be going forward, and think about this. Use sickness as an example. If you're sick, you need to decide whether you're gonna take the medicine. If you're sick and you decide to take the penicillin, you don't stop taking the penicillin halfway through the cycle of the prescription. You finish it all the way through. And that's where we are today ... we are in the middle of this. We can't now just stop it because if we stop it then we're gonna get worse than where we were before. So think about it that way. We've got to finish the prescription. How long that's gonna take, we don't know."

His words rang true to me, both about reopening the beaches at this time and about annuities and your clients. The penicillin in this case is their income. If they've worked hard during their life, and have become accustomed to an income stream, why would they want that to stop?

I read this article in ThinkAdvisor recently; maybe you did, as well. The basic premise is that Wade Pfau (professor of retirement income and co-director of The New York Life Center for Retirement Income at The American College of Financial Services) crunched some numbers with the most recent economic volatility and has determined that “The 4% rule of thumb for income withdrawal in retirement has shriveled to only 2.4% for investors taking ‘a moderate amount of risk’.”

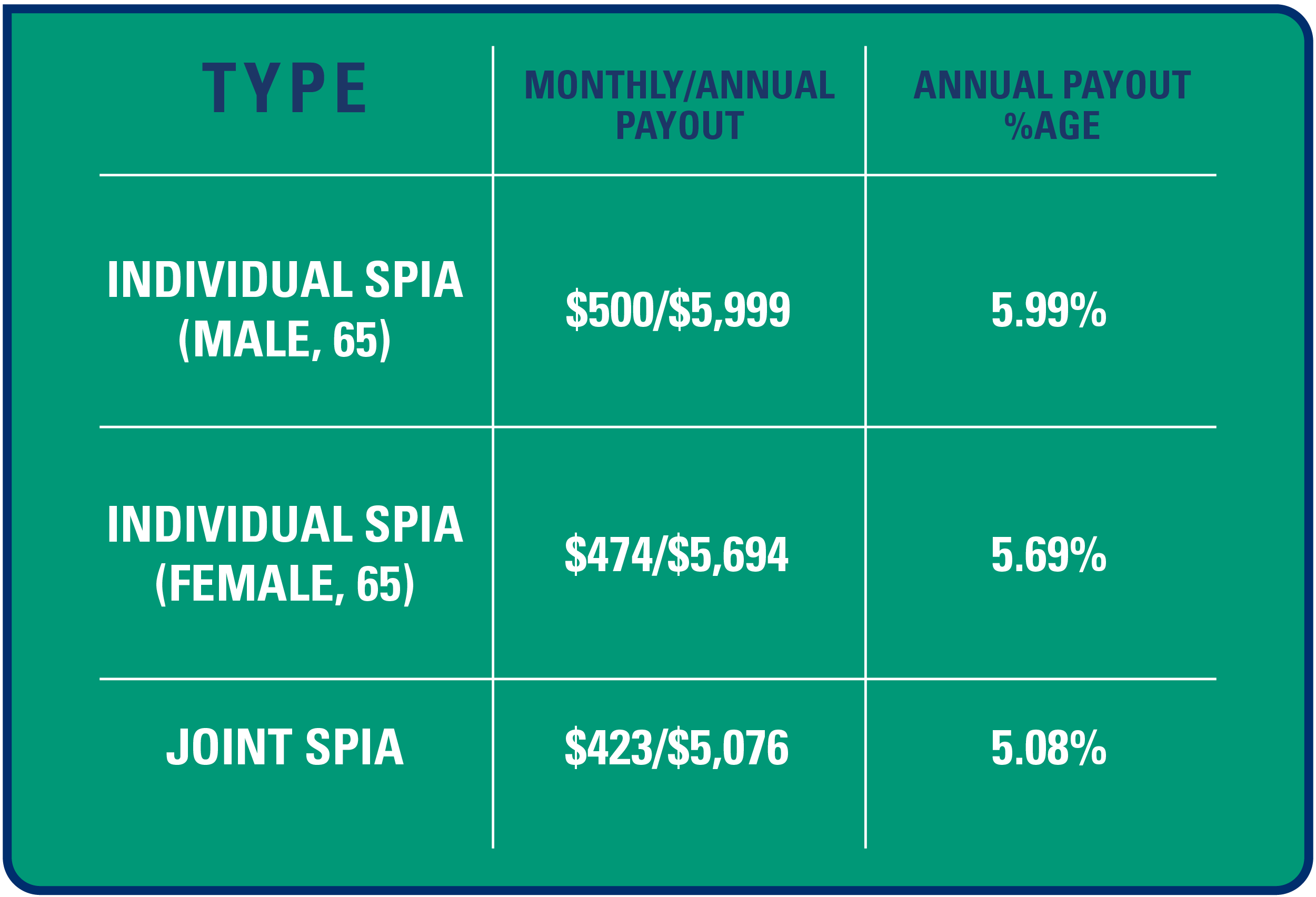

This means a simple income annuity can provide the safety of steady income, regardless of the ups and downs of the markets. So if clients can use a Single Premium Immediate Annuity (SPIA) to cover some basic monthly expenses, they don’t have to draw down other assets as quickly.

Consider a Florida client couple (with a $1.5 million retirement portfolio as of 4/27/20) purchasing a $100,000 SPIA:

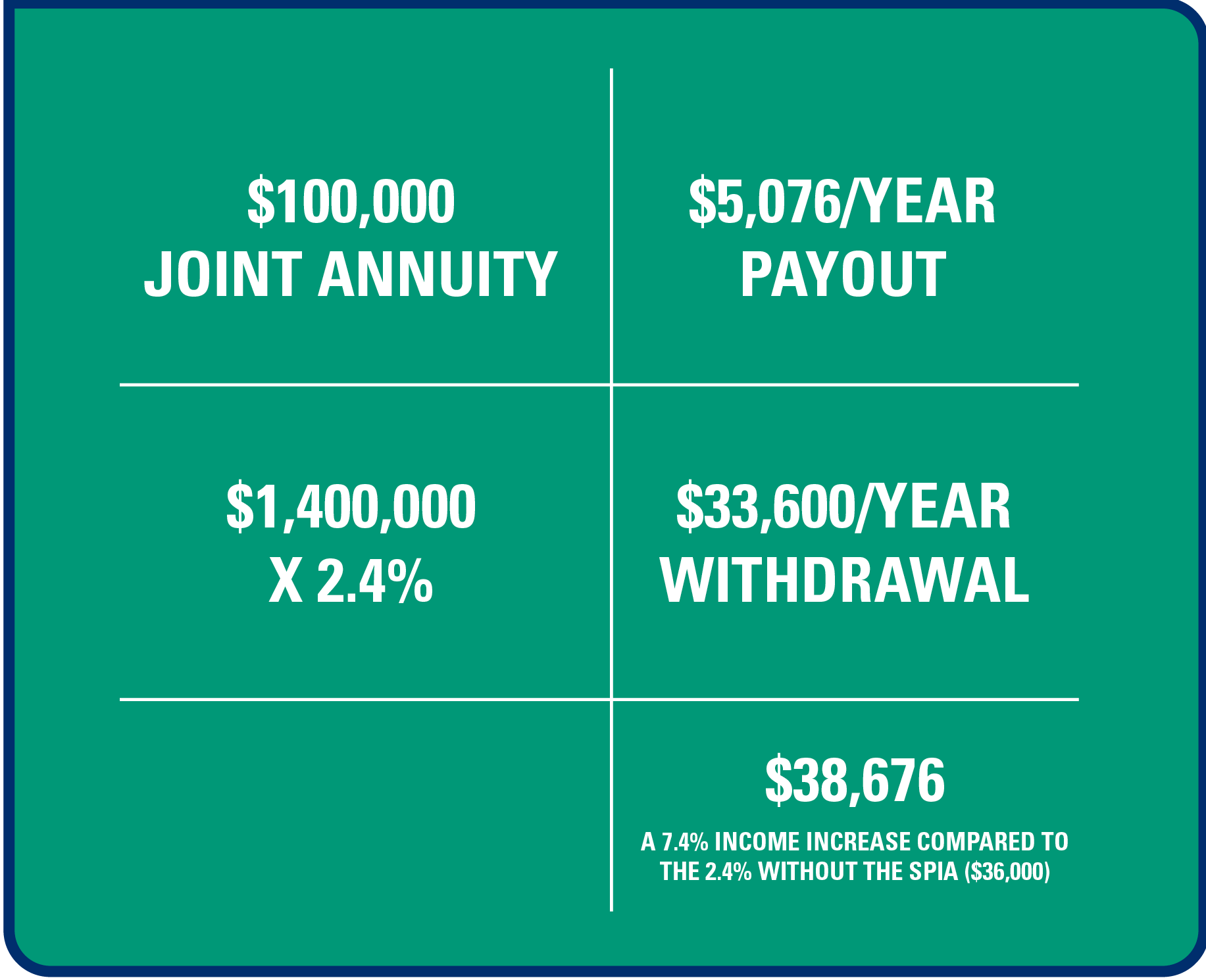

If you had spoken with this couple four months ago (no SPIA involved), you might have said they can take $60,000 per year (4% of the $1.5M nest egg) fairly comfortably. But with the new 2.4% number, that’s down to $36,000.

Conversely, if these clients chose the joint SPIA option above reallocating $100,000 of that portfolio, using the 2.4% withdrawal rate:

So is the Income Annuity/SPIA the answer to everything? Nope. But I can’t wait for the day when I’m retired and have no earned income coming in. Most other people might take a vacation or get a gold watch. Me? I want to get my first SPIA at my retirement party.

If you have questions about penicillin, please contact your PCP. If you have questions about this example or SPIAs in general, please contact Mark Maurer.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".