Who said insurance is boring? Obviously they never attended the LLIS Insurance Academy!

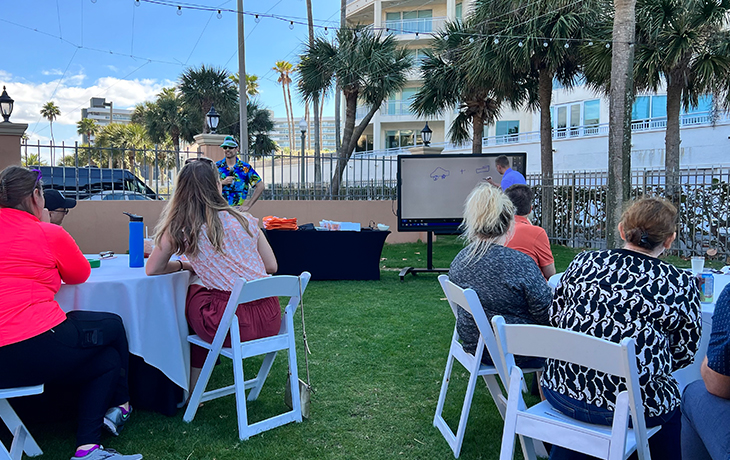

About 40 advisors attended this year’s Academy, back in person. For some, it was the first time attending an event since this COVID thing started. And it felt good to be together … and in the sunshine!

Highlights of the Academy include:

- An update about Washington’s LTC Trust Act from Mutual of Omaha’s Stephen Alloy, Advanced Markets Specialist. He called it a “template for the other states.”

- Implementation is on hold until 7/1/23

- Plan is to fix it

- NEW: Workers who live out of state but work in WA, military spouses, workers on non-immigrant visas, and certain disabled veterans may opt out under 2022 changes

- Several insurance companies halted LTCi sales in 2021; Mutual of Omaha and others are back

- States currently considering similar legislation: California, Colorado, Hawaii, Illinois, Maine, Michigan, Minnesota, Missouri, Montana, New York, Oregon

- How should you approach clients looking at possible state or federal action? Don’t wait. Think about non-working spouses. Personalized plans are better than one-size-fits-all. They’re portable. Higher wage earners get more benefit for their premium dollars. Tax credits and deductions.

- LTCi updates from Jill MacNeil:

- How to pay for care:

- Use personal income and savings

- Transfer the risk by purchasing an LTCi policy/a linked benefit solution (Hybrid Life/LTCi or Hybrid Annuity/LTCi)

- Care is received mostly in home (73%), followed by assisted living (18%), and nursing home (9%)

- Claims for traditional LTCi reimbursement policies end because of: Death (67%), Recovery (20%), and Benefits exhausted (13%)

- Age when claims begin (high to low): 80-84, 85-89, 75-79, 70-74, 90-94, <65, 95>

- Mark Maurer gave an annuity presentation that included:

- A combined 48% of investors (nearly half) either currently own (42%) or previously owned (6%) an annuity

- The aging Boomer population means that an estimated $59 trillion of wealth will be passed down to millennial children and heirs

- Gen X could be the primary beneficiary gaining up to $48 trillion

- What advisors need to know: Your clients may not have annuities, but their parents might; you need to know the options because they are going to ask you

- Kathy Bilodeau shared the following about DI for Business:

- If you were to go on vacation for six months, who and how would your business run while you’re gone?

- 79%: Chance a firm has 1 owner out for 3+ months

- 60%: Business owners use a financial professional

- 46%: Business owners have business protection

- Types of business protection:

- Business Overhead Expense (BOE): Reimburses business owner (small- to medium-size business) for business expenses incurred during a disability

- Business Loan Protection: Provides reimbursement for monthly business loan obligation

- Key Person: Provides a benefit to the owner (employer) if the key person (insured) becomes totally disabled

- Disability Buy-Out: Provides payment for owner(s) to purchase a disabled owner’s business interest (per a buy-sell agreement)

- Mark’s famous “dad jokes” (these are just a few, and they’re so much better when he delivers them!):

- What do you call a French man who wears sandals? Phillipe Phloppe.

- Where do sharks go on holiday? Finland!

- What's the most popular TV show under the sea? Whale of Fortune!

- Even earning CFP CEs by the pool:

- Go with the Flow, Four in a Row: Teams competed in Connect 4 with knowledge gained at Academy

- Academy Art: Pictionary with terms and phrases learned at Academy

Stay tuned for updates about the 2023 LLIS Insurance Academy. Registration coming soon!

And why should you register for 2023?

Academy Photo Highlights

![]() (877) 254-4429

(877) 254-4429![]() (877) 254-4429

(877) 254-4429