ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Second Quarter 2022

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

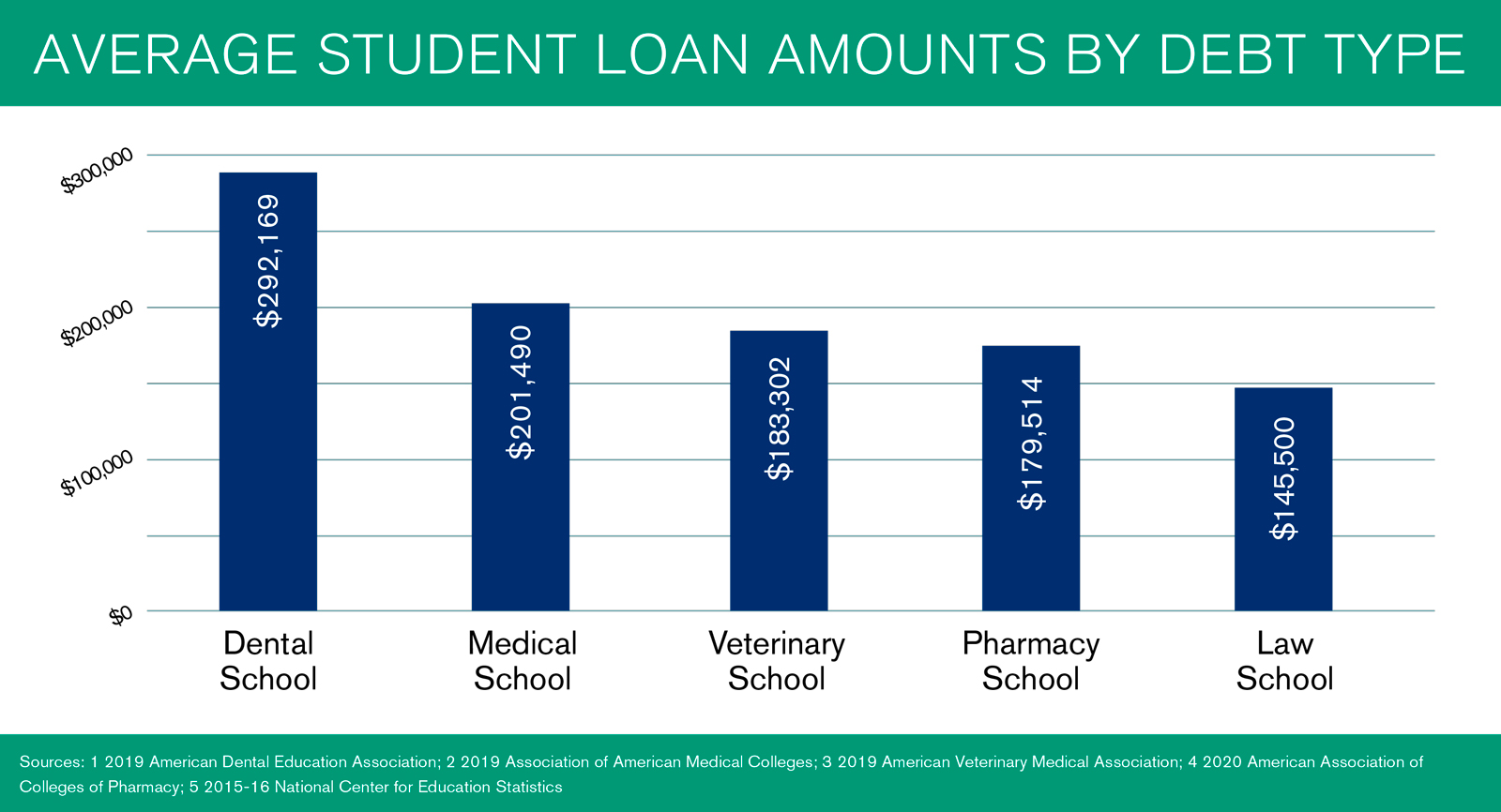

Do you have clients (or clients with kids) who are among the new class of graduates entering into their residency or fellowship programs or beginning that first year of grunt work after law school? Most will be on the path toward high net worth, simultaneously beginning to pay back large student loans. Have you talked with them about protection for that income and those loans in case they get sick or injured and can't work? (Yes, we know, that’s a whole ‘nother conversation: “You’re not invincible!”)

Until now, for most students, their largest asset has been a car. Maybe a house. They probably haven’t even stopped to think that their largest asset is actually their ability to earn an income.

The hope is that they will have long, lucrative careers in the profession they have spent so much time studying and that asset will grow nicely. But in the event a disability happens and they aren’t able to work (for a short or a long time), it’s wise to protect the investment of time and money they have made in that education. And even wiser to start that protection early since, well, you just never know.

While their new employers may provide group disability insurance (DI), group policies often fall short of providing the benefits needed, and supplemental DI can help your clients maintain a lifestyle closer to the one they’re used to. And because budgets are tight for many residents and fellows, we can help them find policies that provide substantial coverage with benefits and premiums that match their financial situation, and can even grow with them as they grow in their careers.

Consider these individual disability insurance (IDI) key features:

*LLIS doesn’t recommend a lot of riders with the policies we help your clients get, but these are two we definitely do, and especially for this type of client. To see a list of DI riders we do recommend, click here.

Your clients may be eligible for an individual disability policy while still in school. As a matter of fact, The Association of American Medical Colleges requires all medical schools to offer students disability insurance coverage; typically optional. However, that coverage may not be enough and may expire upon graduation or entering residency. An IDI policy would be a beneficial enhancement or replacement for that school policy.

We also like a program called the New Professionals Program (NPP). NPP helps eligible graduates get high-quality disability income insurance without proof of income. It offers a graded premium option, which helps make the initial cost more affordable at the onset of a career.

You can help these new grads get a financially secure start by educating them on the benefits of an IDI policy that will give them peace of mind with income protection, strong coverage, and the flexibility they need at this time in their life, sometimes with waived medical or financial documentation. And peace of mind as they advance in their profession because the coverage will grow with their career.

Our DI experts are here to help: Brian Ciccarelli & Kathy Bilodeau.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".