ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Third Quarter 2022

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s not just your clients’ health that determines their life insurance rates (and even whether they are approved or declined). What they do for a living or for fun can have a huge impact on those decisions as well.

Insurance company underwriters are trained experts at evaluating risk. It’s all they do day in and day out. And when someone applies for an individual life insurance policy, their habits, hobbies, and occupation will be on the list of possible risk factors.

Before we delve into individual policies, let’s explain the difference between those and group policies. Group life insurance (like insurance they get through an employer, union, trade organization) does not look at each individual’s lifestyle; instead, it relies on the risk of an entire group of people. Employers often offer it as part of a benefit package, partially or wholly subsidized for the employee. However, most group plans:

Individual polices offer better coverage and are either a good supplement to group coverage or an excellent way to insure your clients’ lives as a stand-alone protection.

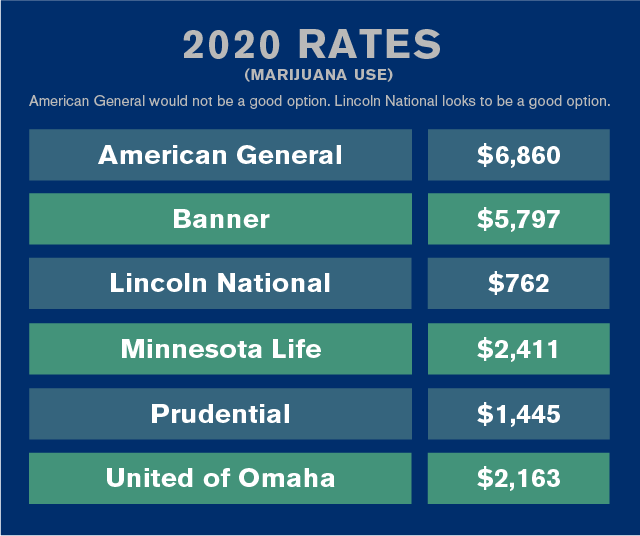

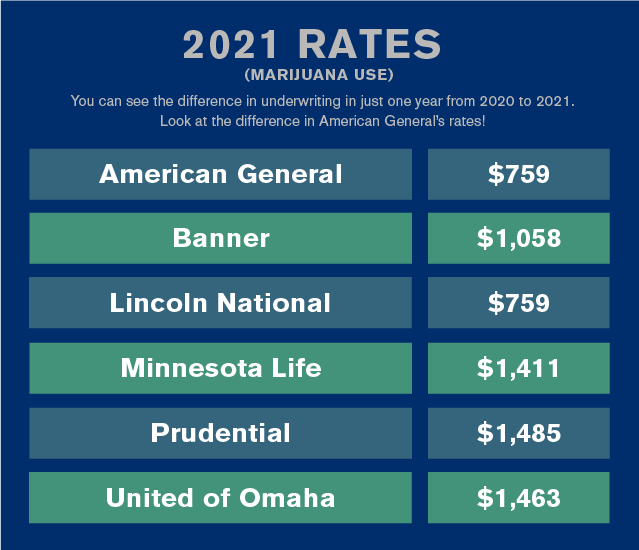

Since marijuana has been approved in many states for recreational use and even more for medical use, there have been a lot of changes in underwriting. When assessing your clients’ risk, the underwriter will consider:

What they won't consider is what state your clients live in. Marijuana is underwritten the same in all states since marijuana possession remains a federal offense.

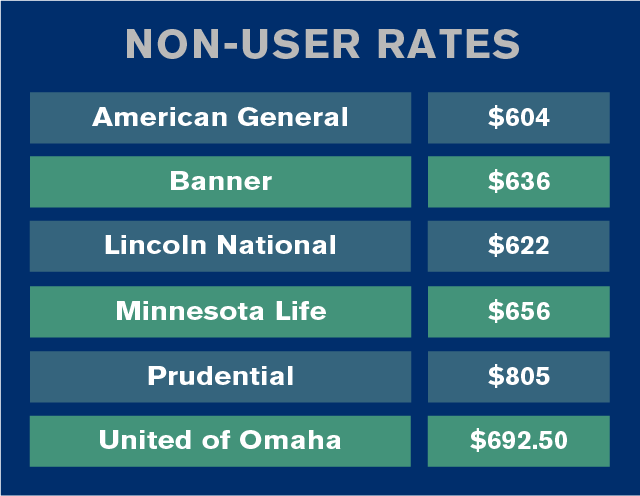

Based upon your clients’ answers to those questions, their underwriting result can be anywhere from approved at Preferred+ to decline, depending on the company*.

Here is a client example:

Mark (42 years old) lives in Colorado, where medical and recreational marijuana are legalized. He uses edibles fewer than twice a week on average. His advisor worked with us to get him the coverage he needed ($1 million, 20-year Term) to get his kids through college and pay off his mortgage.

You may think that serious exercise would be a good thing to insurance companies. But that’s not always the case.

Mountaineering and rock climbing, for example, are considered high risk activities by insurance companies. So are aviation, scuba diving, race car driving, and sky diving, and many more. Your clients may think that -- because of the years they have invested in learning, practicing, and experiencing -- they are experts at it. But underwriters will have a different view, with access to data that show claims resulting from such activities or avocations.

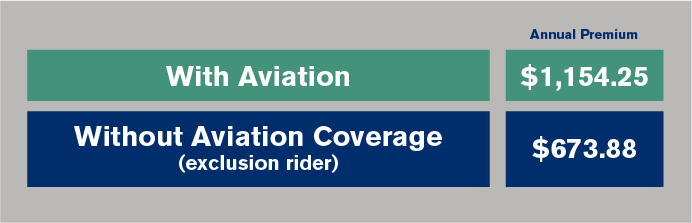

Participation in these activities and jobs does not mean an automatic decline. It’s a signal to underwriters that they need to do further consideration on your clients’ applications. They may be approved at a different rate class than they would have been without that hobby or occupation, or may be approved for a policy with a benefit exclusion that stipulates if they die while engaging in that activity no benefits would be paid.

Here is a client example:

Darren (age 32), a student pilot (has flown 60 hours), talked with his advisor about life insurance. He applied for $1,250,000 25-year Term.

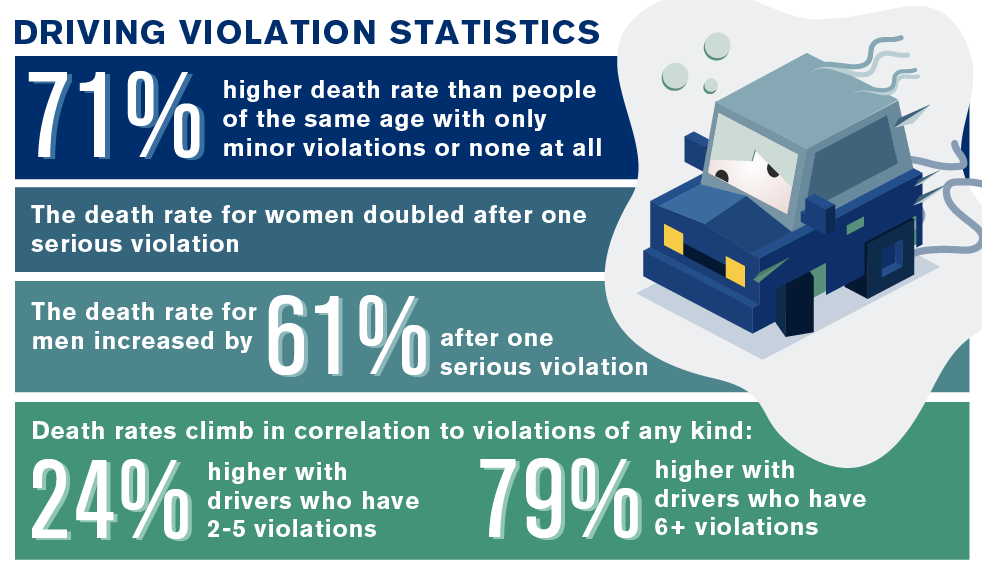

Underwriters typically pull an MVR (motor vehicle record) on applicants. What are they looking for that may be considered risky and impact approval and rates? Serious violations including:

Passport in hand. Ready to experience some of the world’s amazing places! That dream vacation your clients have in mind may affect their life insurance rates. Insurance companies consider the following when evaluating an application when it comes to foreign travel:

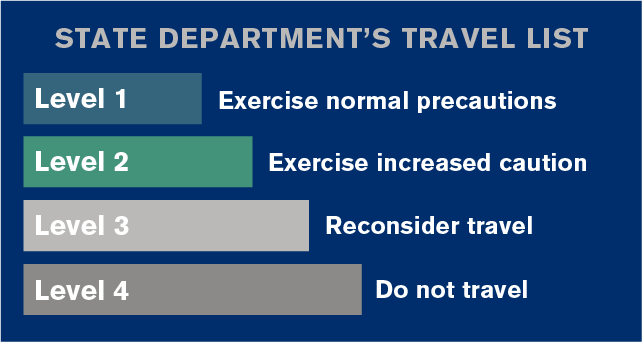

Going to Paris for a week vacation is one thing. Going to a village in Botswana for a mission trip is another when it comes to risk. Regional considerations include access to clean water, sanitation, health care, and possible exposure to other diseases like malaria. Normally, Levels 1 and 2 from the State Department’s Travel List are acceptable to insurance companies as they assess an application:

During the height of COVID-19, all foreign countries went to Level 4 (meaning do not travel), so we recommended your clients wait until they were back in U.S. and completed their self-quarantine before submitting an application.

Now, all companies have gone back to their pre-COVID guidelines. Most are fine with Level 1 (exercise normal precautions) and Level 2 (exercise increased caution) from the State Department. Level 3 (Reconsider travel) and Level 4 (Do not travel) may be a postponement or decline from an insurance company, so depending on where your client is traveling, we may suggest waiting before submitting an application. These are countries that are considered more dangerous to travel to (examples include Afghanistan, Ukraine, certain parts of Mexico).

Underwriting varies between insurance companies and from person to person. So it’s important to have someone who knows the sweet spots do the shopping and pre-assessment. One company might turn your client down or put them in a lower rate class. Another may approve them and at standard rates.*

*Different insurance companies underwrite differently for all of these topics. Don’t let your clients use an online quote engine that doesn’t do the shopping for them and doesn’t work with the insurance companies on hypotheticals to determine the best fit and reduce chances of a decline. (The lowest price like the ones they see on TV commercials may not be their best choice.)

LLIS has a number of experts in life insurance underwriting. Jenny Stiles is our New Business Supervisor, and your first line of contact. If she doesn’t know the answer, she’ll connect you with the person who does.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".