ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Every client is different, it’s true. But there are client types that share similar traits and needs. When it comes to long term care (LTC) and long term care insurance (LTCi), it’s definitely true. Let’s look at three client types and their specific LTC concerns and options:

Long term care is an issue that’s particularly important to women. They’re impacted as providers of care and, ultimately, as recipients of long term care.

More likely to need LTC*, women:

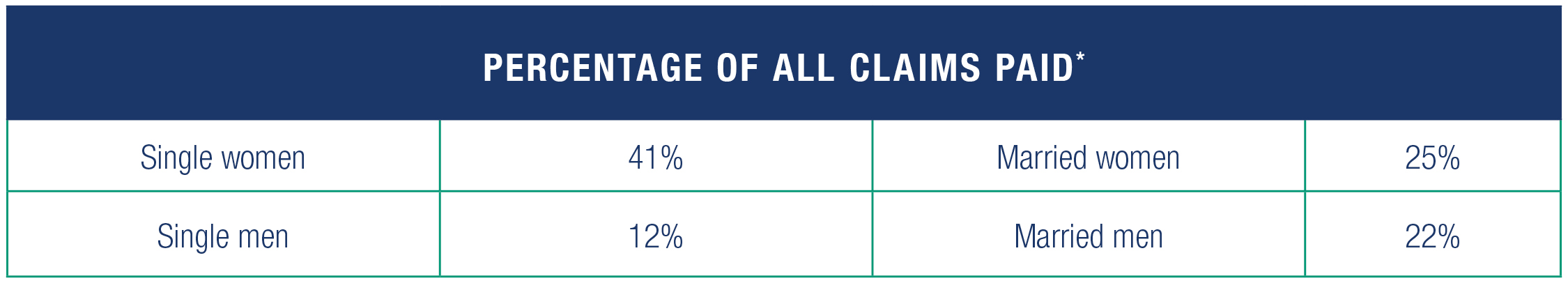

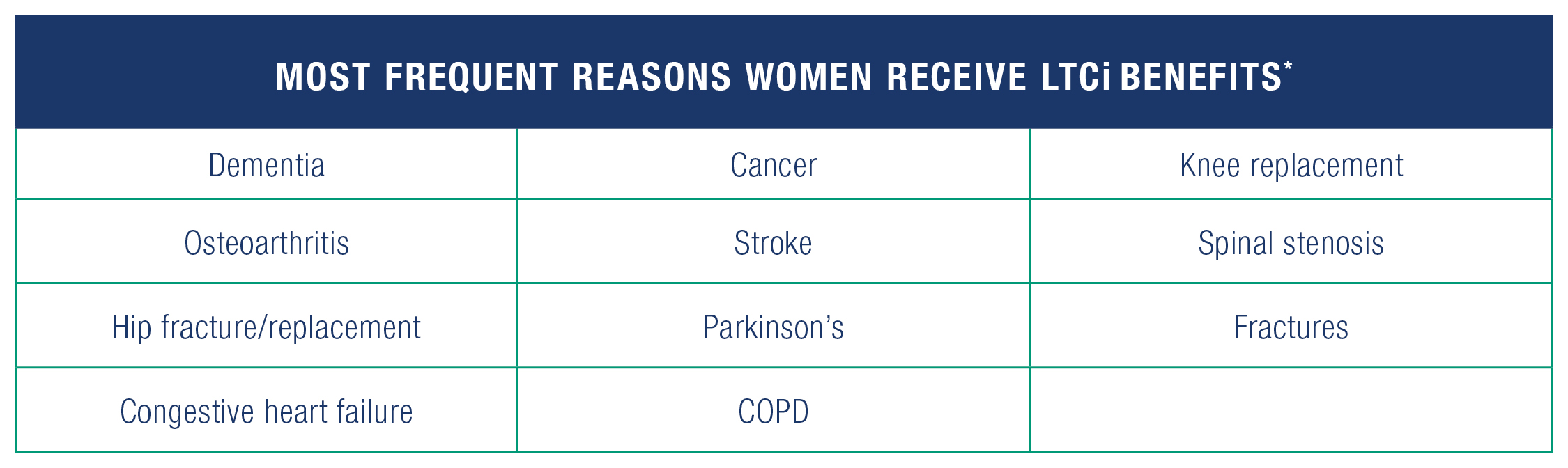

Most frequent reasons women receive LTCi benefits:*

These are common, everyday ailments. And millions of women are diagnosed with them every day in the U.S. Do you know any of them?

Tax deductible long term care insurance is a great benefit for owners and their key employees. Business owners have greater latitude in their ability to deduct long term care insurance costs than individuals or couples. Insurance companies offer many forms of LTCi plans and flexibility designed specifically to meet the needs of small, medium, and large employers.

Federal and Postal Service employees,active and retired members of the military, and qualified families who participate in the federal long term care insurance program had until September 30 to make important choices. Many were facing large rate increases. The Office of Personnel Management noted that longer life expectancies, higher than anticipated claims, and lower rates of return on the trust fund's investments accounted for the need to raise premiums.

While the federal LTCi policies are a good benefit to the employees, national experts recommended that these federal employees look into private market options to enhance or replace their coverage:

When switching policies (of any type), LLIS always recommends your clients make sure they’ve been approved before dropping existing coverage. And we notify them when it’s the appropriate time to do so.

Regardless of your client’s gender, age, or occupation, the time to plan is now. As professionals dedicated to helping people protect their assets, lifestyles, and choices, we encourage you to take this topic seriously.

Make Long Term Care Awareness Month the time you start planning.

* LifePlans Study of 2015 - 2016 Long Term Care Insurance Claimants

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".