ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Snoopy began his relationship with MetLife in 1985. Prior to that, he had military service as a flying ace in World War I. Now, MetLife is rebranding and wanted fresh blood, with a new look and new logo to reflect the modern, innovative company they’re becoming. If you’ve been working with us for a while, you saw our transition that began in 2014 with a new logo, followed by an abbreviation of our name to LLIS, and soon to come: a 24/7 advisor portal into the authorized portion of your clients’ files.

Snoopy did nothing wrong ... and yet he was let go. If this can happen to him, it can happen to anyone!

Now, before we get all sad-eyed and droopy-eared, Snoopy will be fine. He still has relationships with Hallmark, Warner Brothers, Target, a new movie coming out November 6th, and continued appearances including Macy’s Thanksgiving Day Parade. This lovable, friendly, approachable pooch has floated down Broadway 39 times, the most of any character … ever.

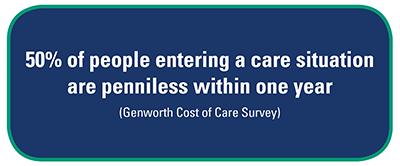

But what would happen to your clients if they lost their job? Do your clients enjoy the same multi-source income streams? What if a client had an extended illness and didn’t plan in advance with disability insurance? What if (like 57% of primary and 42% of secondary caregivers report) your client had to dip into savings to help pay for a loved one’s care? What if your client divorced a spendthrift, but made the split too late to preserve a good credit rating and avoid bankruptcy and foreclosure? What if your client’s child is diagnosed with an extreme illness and the medications cost enough to deplete savings?

Those are all hard to bounce back from, both emotionally and financially. Peanuts will lose $12 million in revenue from MetLife dropping Snoopy. But with his other endeavors, Snoopy can afford to pay for the rising costs of care. Not many clients are in that high net worth category, with the cost of three years of long term care expected to be $700,000 by 2050. Relying on Medicare or Medicaid is not a desirable option. Self-insuring may not provide enough.

Notice that three 3 of these directly relate to finances. The financial aspect of needing care is becoming more and more crucial as we live longer lives. Americans are living into their 80s, 90s, and many to age 100. Living longer means our risk of needing LTC services becomes greater and potentially very costly.

When it comes to health insurance, it’s easy for people to rationalize that payment. It’s a given (and now a requirement). Just like we eat when we’re hungry and buy clothes when ours are worn. But sometimes (and LTCi consideration seems to be one of them) we need to be dissatisfied with our current situation to act. People think there’s no urgency to purchasing LTCi. It’s something that will happen to them in the distant future. Some clients may worry that a long term injury or illness will deplete their savings, but what happens if their savings get depleted long before they need LTC?

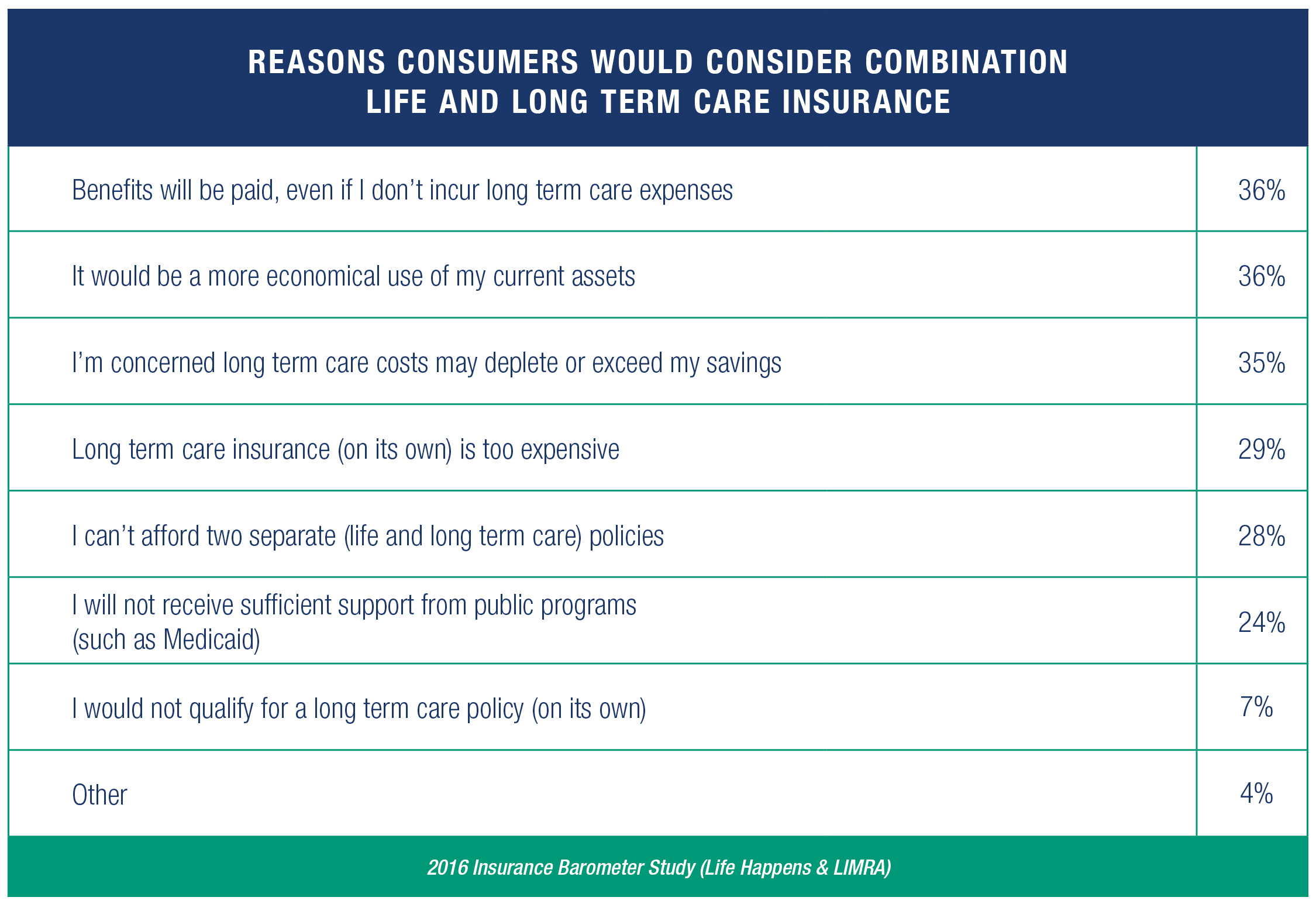

The good news is that there are more options available now than ever. Combination solutions (Hybrids) are one fairly new option, and they’ve changed the way clients view long term care insurance.

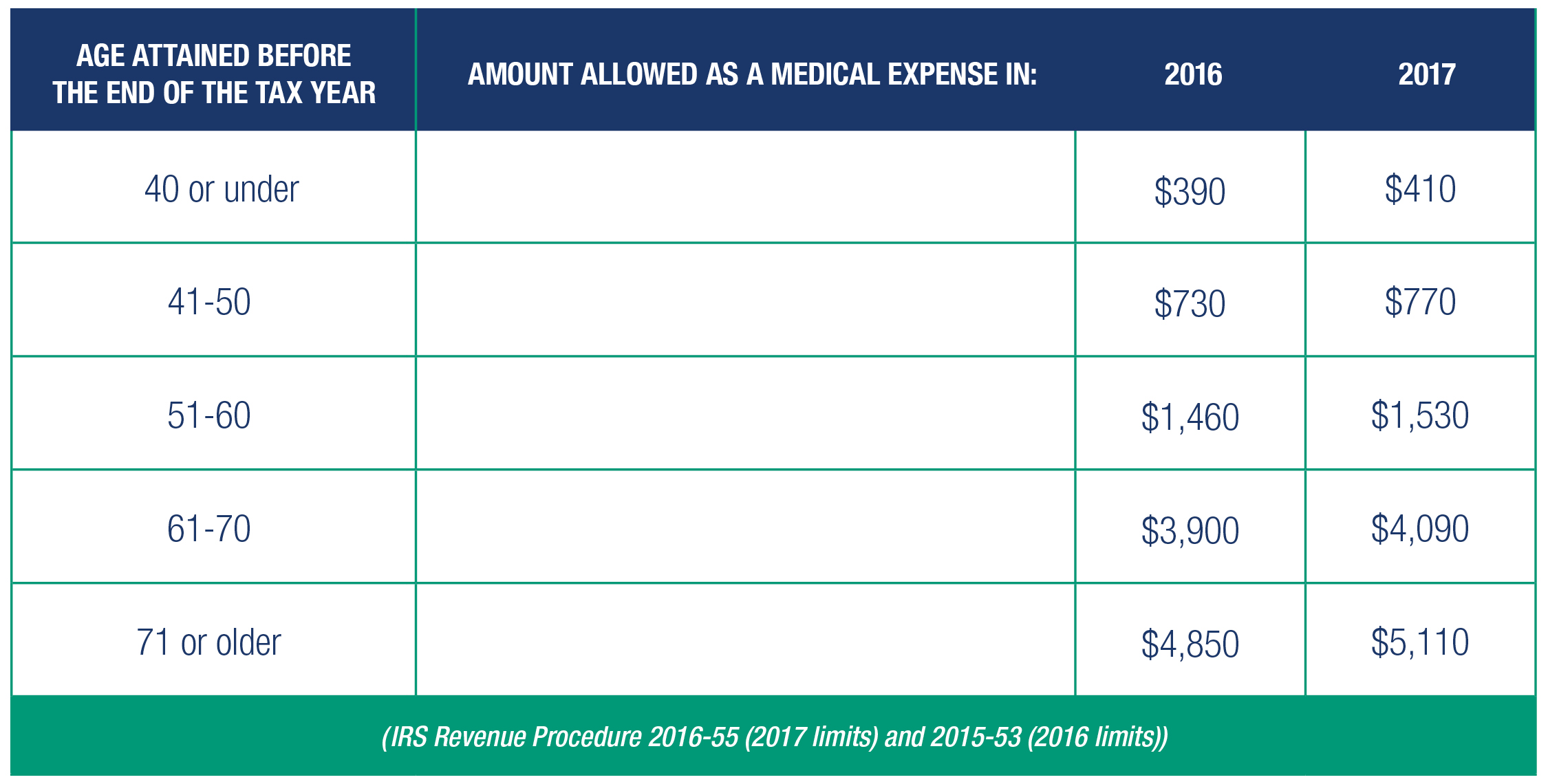

Premiums for qualified LTCi policies are tax deductible when they, along with other unreimbursed medical expenses (including Medicare premiums), exceed a certain percentage of the insured's adjusted gross income. These premiums are deductible for the taxpayer, spouse/partner, and other dependents as long as they exceed 10%. For taxpayers 65+, the threshold will be 7.5% through 2016. Self-employed clients can take the amount of the premium as a deduction as long as they made a net profit; their medical expenses do not have to exceed a certain percentage of their income. What is deductible as a medical expense is spelled out in Internal Revenue Service Publication 502*.

Deductibility limits for traditional LTCi policies (adjusted annually with inflation):

Recognizing that government can't pay the bill for long term care, federal and a growing number of state tax codes now offer tax incentives to encourage Americans to take personal responsibility for their future long term care needs. Want to know about your clients’ state deductibility rules?

They’ll be happy

knowing you helped them ensure they’re protected into the future.

* Members of teamLLIS are not tax experts. Clients should consult a tax professional for advice about taxes and insurance.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".