ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Your young clients (and quite possibly you too) probably wonder if it makes sense to buy LTCi now or wait. That’s an individual decision, of course, but there are a number of factors all clients should consider:

Here's an example of what waiting can cost your clients.

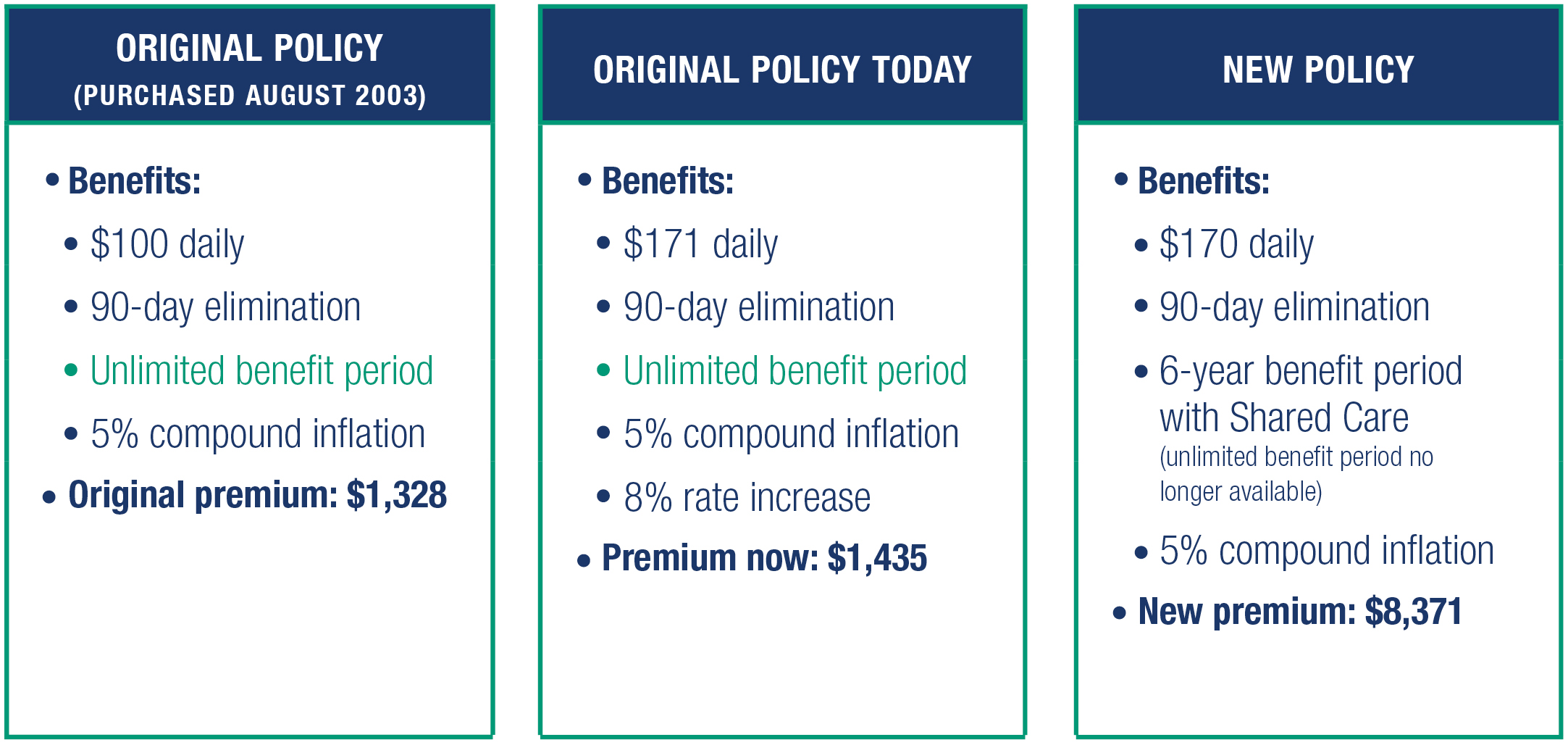

Maria and Norm bought their policy in 2003. They recently got a premium increase notice. Their advisor asked us to review their options:

Even with the rate increase (by tweaking a few benefits), the cost of a new policy far exceeds the cost of their original policy.

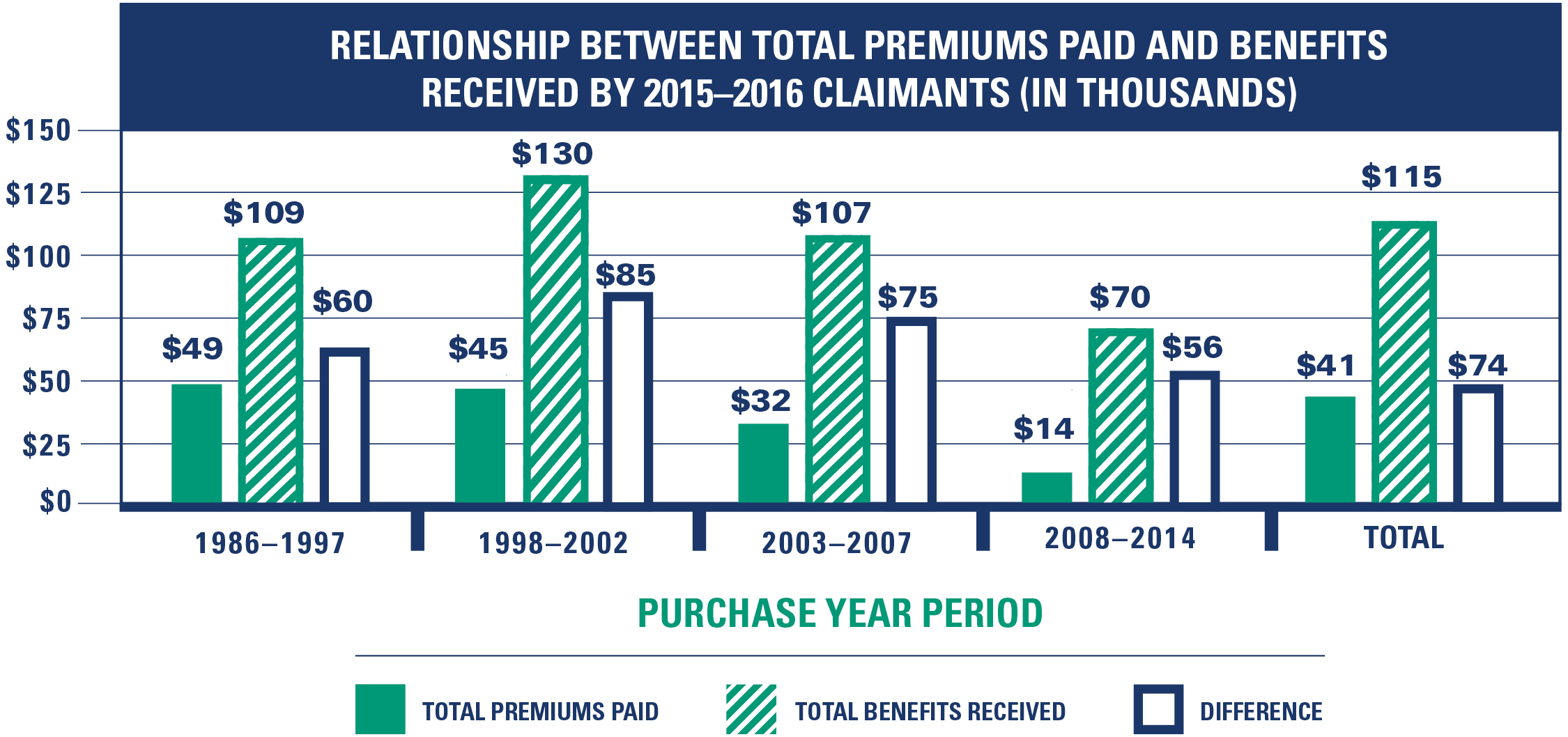

And when you compare premiums paid versus benefits received when care is needed, the LTCi benefits paid out almost always exceed premiums paid in1:

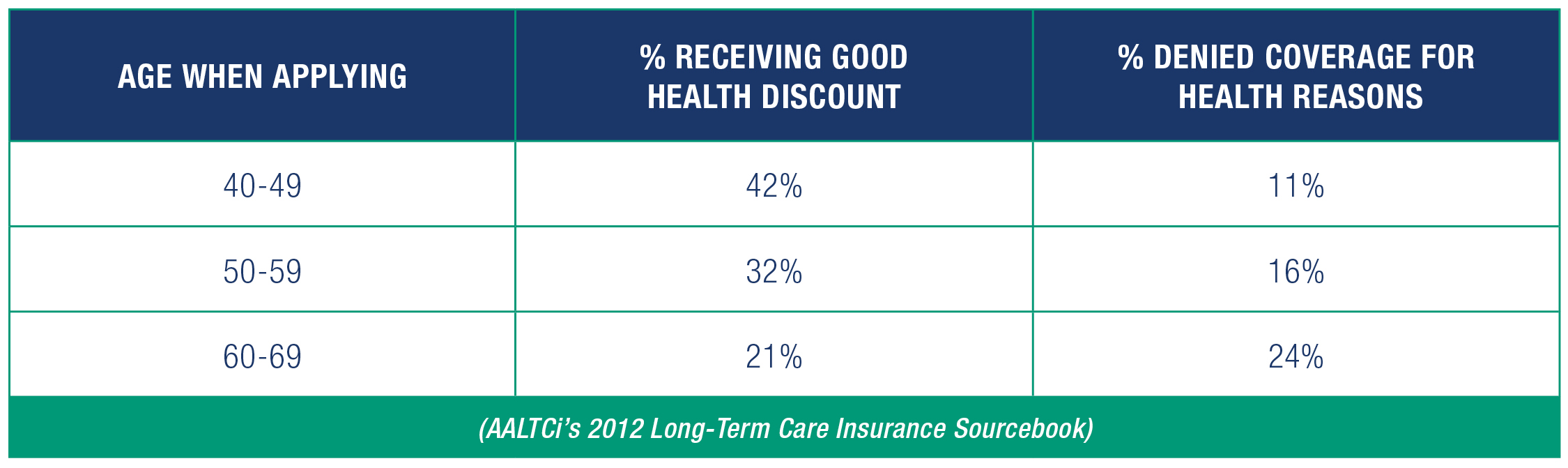

Rate classes: People's health is usually better at a younger age. If they apply now, they’re more likely to get preferred rates, locking in “good health rates,” which equals significant savings over the life of the policy.

Insurability: Underwriting standards change over time, as does our health. Waiting to plan can be a costly mistake; a change in health can make your clients ineligible for LTCi, no matter how much money they’re willing to pay.

Spouse discount: Spouses may become ineligible for coverage because of poor health. The spouse who stays healthy may only qualify for a reduced “spouse not applying” discount or none at all, compared to the full “spouses applying together” discount.

Assets: Buying long term care insurance now can protect them later.

Choices & Independence: Long term care insurance gives your clients greater choices and control over where they receive care. Most people prefer to stay at home as long as possible. Claims data shows about 50% of care is now being received at home.

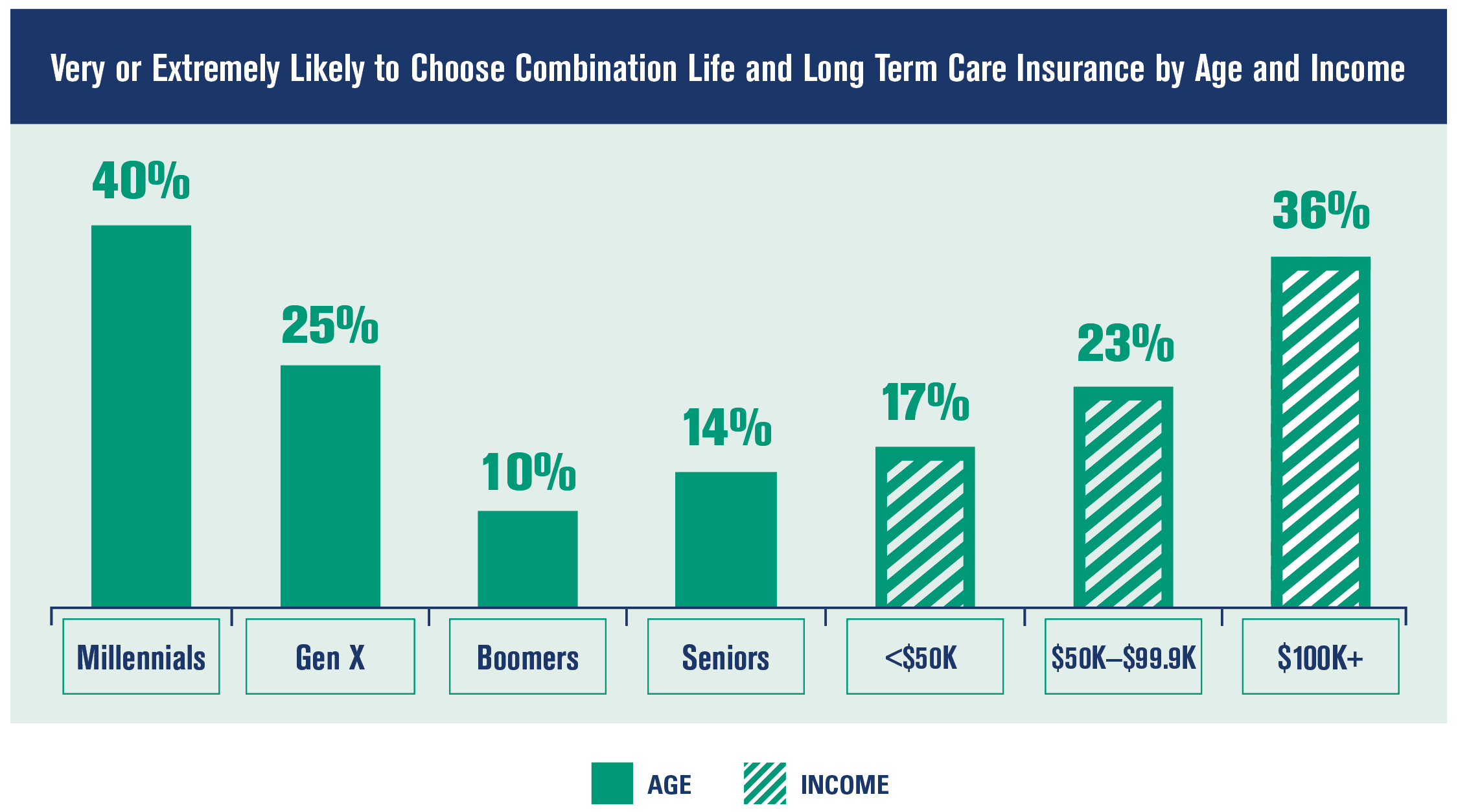

Linked Benefit plans (Hybrids): Your youngest clients are more likely to choose a combination product and so are higher income groups. And 1 in 4 people already covered by individual insurance would be very or extremely likely to choose a combination product if shopping for more. Clients with permanent insurance might be particularly interested in a Hybrid Life/LTCi policy since they may be able to roll their current cash value into a combination policy.2

As fee-only financial advisors (FOFAs), you know part of the problem is that most people don’t even begin to think about planning for their advanced years until they are near retirement; the median age is 58-59. Long term care is part of that planning. It doesn’t cost your clients anything to run the numbers and find out how much LTCi protection costs them now and will save them in the future. Jill MacNeil, our long term care insurance specialist, is here to help.

1LifePlans Study of Long-Term Care Insurance Claimants

22016 Insurance Barometer Study (Life Happens & LIMRA)

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".