ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FIRST QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

March is full of awareness. Days for some things. The entire month for others. As we prepare for these 31 days of March, let’s gain some awareness of what they mean for you and your clients in the world of individual life insurance, long term care insurance (LTCi), disability insurance (DI), and hybrids.

The major underwriting factors that insurance companies use to evaluate risk and determine premium cost are health, family history, lifestyle, occupation, and finances (this differs by insurance type). By type, underwriting considerations look like this:

Permanent life insurance: mortality (with liberal guidelines)

Term life insurance: mortality (with strict guidelines)

DI: morbidity and financial

LTCi: morbidity, lifestyle, and mobility

Hybrid Life/LTCi & Hybrid Annuity/LTCi: similar to traditional LTCi underwriting

Do you know when your clients can get coverage (despite certain medical conditions many think make them uninsurable), when they will be declined, when you should recommend they apply, or when to send them to LLIS to determine their eligibility?

Here is a list of some March awareness observances and Q&A about each. Read the questions, then click for the answers. How many will you get right?

The month of March

National Colorectal Cancer Awareness Month

Your 56-year-old male client has a history of colorectal cancer (diagnosed six years ago, treated with radiation only), and was diagnosed with Type 2 diabetes three years ago (controlled with diet and exercise).

Multiple Sclerosis Education Month

Your 54-year old dentist client was diagnosed 13 years ago with MS. She is stable with no limitations in activities, no complications, and is fully at work.

Sleep Awareness Month

Can clients who have been diagnosed with sleep apnea get coverage for:

National Nutrition Month & National Athletic Training Month

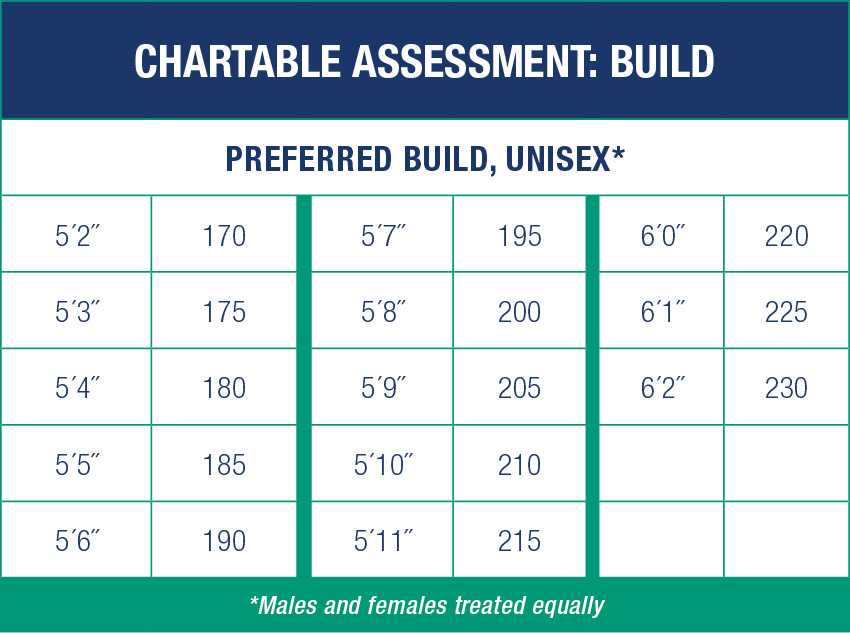

It’s easy to forget a few pounds, and under- or overestimate your height or weight.

National Bleeding Disorders Awareness Month

Days in March

March 10: National Women and Girls HIV/AIDS Awareness Day

March 20: National Native American HIV/AIDS Awareness Day

March 24: American Diabetes Alert Day

A diagnosis of diabetes means an automatic decline for LTCi, DI, and life insurance.

How did you do?

LLIS used a qualitative data analysis tool to determine these rankings. (Translation: a series of quick online searches done at 2:00 am).

Acutely aware: 10 to 12 correct

Trainably aware: 6 to 9 correct

Awareness deprived: 1 to 5 correct

Unconscious: 0 correct.

Learn more by calling our solutions specialists or by reviewing our insurance glossary and advisor tools.

As we tell your clients in our e-brochure "What Underwriting class will I get?": the more we know, the more we can help. And the more transparent they are, the better we can match them with the right insurance company and coverage. While you, as their financial advisor, may not know your clients' health issues, teamLLIS needs to find out. (Translation: "She looked healthy when she came to our office" usually isn’t an accurate evaluation of their health status.) It is our firm commitment to you and your clients that we will not sell, trade, or give away personally identifiable or personal health information to anyone, except those specifically involved in the insurance application processing. And personally identifiable information is securely stored while in our possession.

*table ratings: Charges added to standard class when health issues exist that, in the eyes of the insurance company, require a higher premium. Most insurance companies will offer policies with table ratings up to Table 12.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".