ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s the New Professionals Program, designed specifically for students and recent graduates to protect their earning potential with disability insurance. The underwriting focuses on what they are capable of earning with their degrees; not what they are earning when they apply for DI.

The timing for you to read this couldn’t be more perfect. In July, med students will create their personal profiles in the Electronic Residency Application Service. And residency programs will create their profiles too. The process goes until the 3rd Friday in March, Match Day!

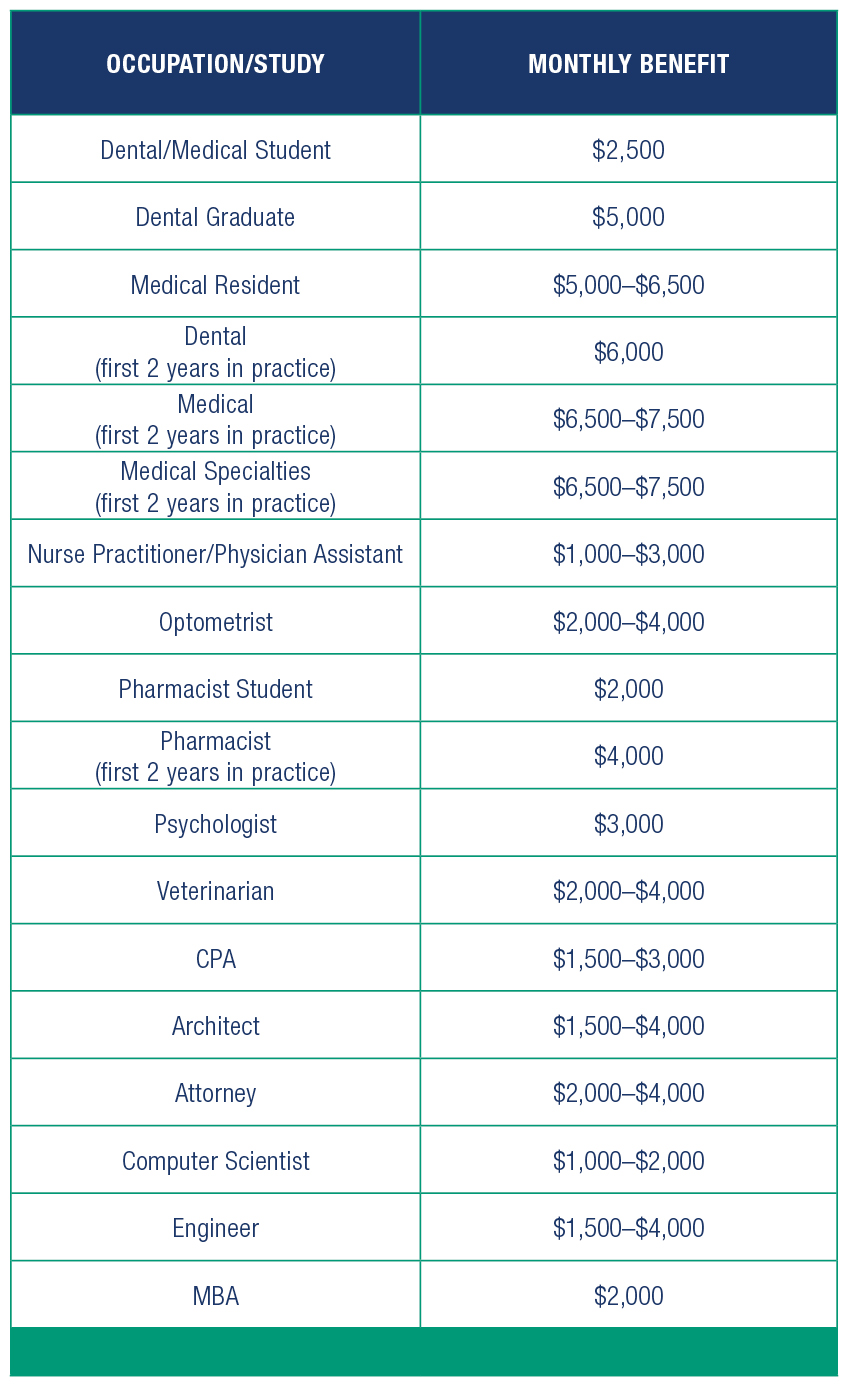

What types of professionals does this apply to? It’s available to students, residents, first-year professionals, attorneys, CPAs, veterinarians, engineers, architects, various medical professionals (including interns, residents, fellows and those in the first year of practice, along with nurse practitioners and physician assistants), and others. Medical professionals are generally able to enroll in the program as early as their third or fourth year of med school. And some other professions can enroll while still completing their undergraduate degrees. This can be especially valuable for high-income professionals like physicians, who would have a difficult time finding work at a comparable salary in the event of a disability.

Why do we mention NPs and PAs specifically? Because those are among the fastest growing occupations in the medical arena, expected to grow nearly 38% within the next decade.

A recent study by Hartford Financial Services Group, revealed that only 45% of young professionals across the country have any form of short-term disability insurance and, even worse, only 39% have any form of long-term disability insurance.

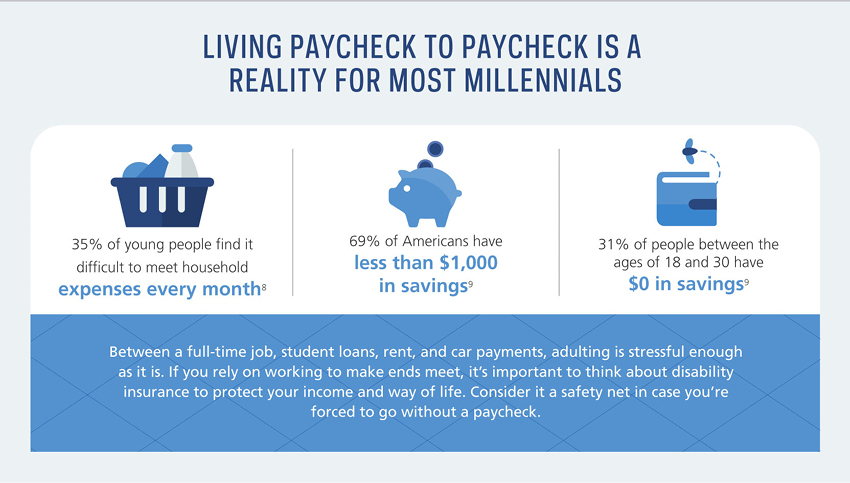

But for new professionals, the ability to earn future income (human capital) may be their largest (or only) asset. In fact, no financial documentation is required in the underwriting process. And when it comes to medical residencies, they typically involve long hours and low pay; especially compared to what these new professionals can earn later. A typical 30-year-old earning $50,000 a year could earn $4.5 million by age 65.

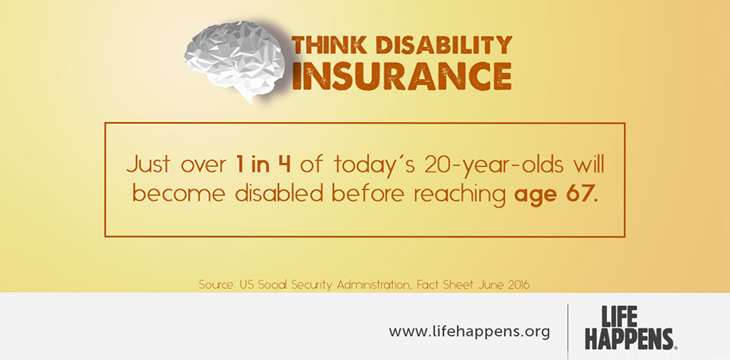

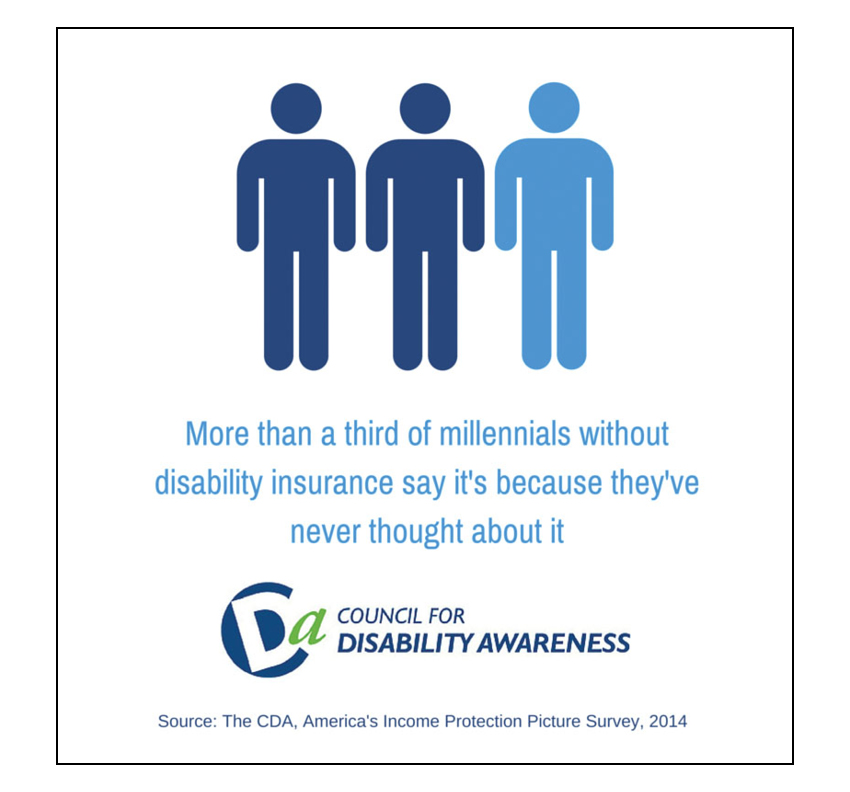

You may hear this from young clients: “Why would I need disability insurance? I’m young!” It’s easy for these busy young professionals to think that way. After all, they’re young and healthy. But will their future be bright and sunny if, due to a disability, they can't earn an income? The facts are:

So is it important for FOFAs to stress the importance of putting the appropriate protections in place now to help these young clients remain independent well into the future? We think so.

When you have the conversation with them, your NPP-eligible clients may tell you: "My new employer is giving me disability insurance." How would you reply to that? We hope your reply includes:

And the big question: What's in it for them? NPP benefits payments that will help them maintain their lifestyles and their bank accounts if they become disabled.

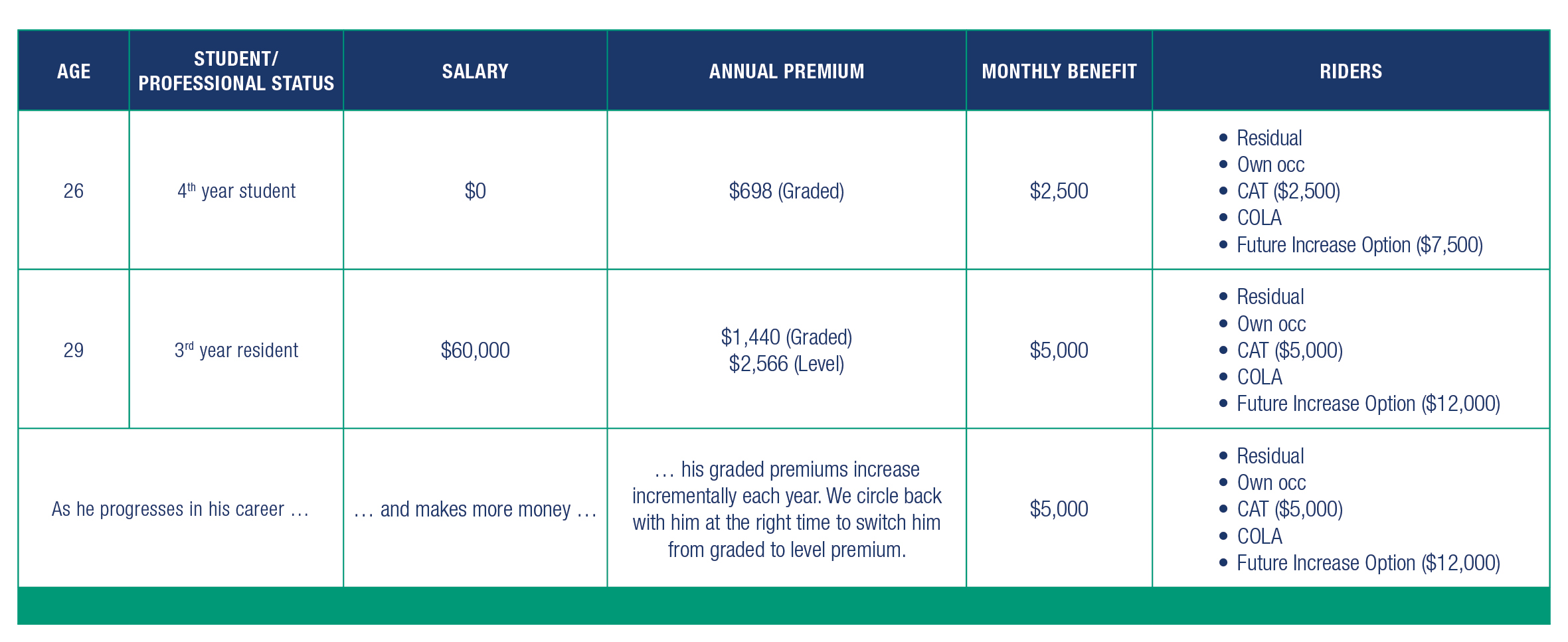

We can help you help them find the appropriate coverage. And, as a bonus, a graded premium option can help to make the initial cost of coverage more affordable while your young clients are establishing their new career. Let’s look at the example of Carl, who is an invasive radiology student.

For more information, please contact Kathy Bilodeau. She’s not your typical insurance agent.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".