ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s a big decision. Whether it’s a Lotto win or a retirement plan: take it in one lump sum or annuitize it?

Before the Lotto explosion and in the early days of workplace retirement plans, defined benefit (DB) pension plans were the predominant workplace retirement plan. They were paid as annuities, giving the retiree a guaranteed steady flow of income that couldn’t be outlived. But in the last few decades, DB plans provided by employers have dwindled. Now defined contribution (DC) plans are the only workplace retirement programs with any significance (typically 401Ks), leaving the burden of ensuring the accumulated savings last their lifetime up to the employees.

An April 2017 Harris Poll conducted an online study among more than 700 defined benefit and defined contribution (DC) plan participants. It was designed to understand consumers’ attitudes and decision-making about lump sums and income annuity payments from several sources, including DB and DC plans.

The Advisor’s Role (including LLIS, the Advisor’s Insurance Advisor®)

The allure of a lump sum payment is tempting. It’s almost as if Benjamin Franklin himself is talking to you from the paper of the $100 bill on top of the stack, saying “Take me! Take me!”

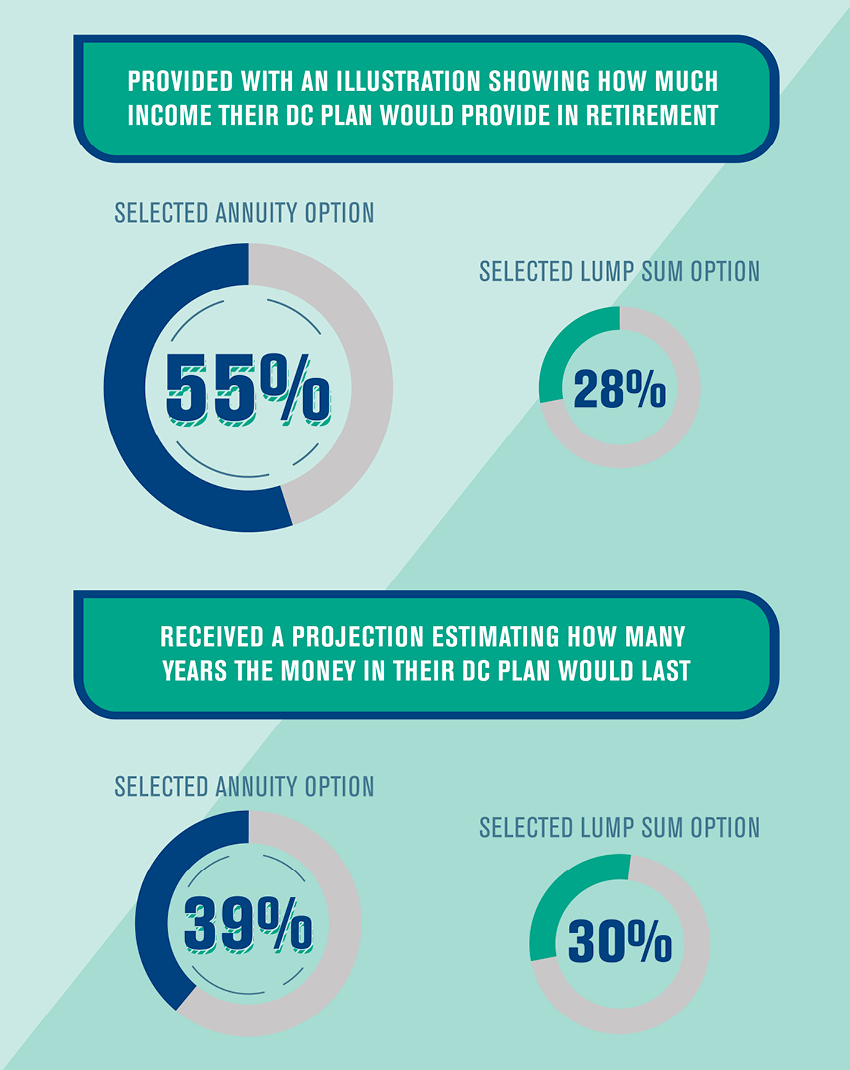

But the more information they have, the more your clients are likely to avoid immediate satisfaction and think long-term solution, according to the Harris poll.

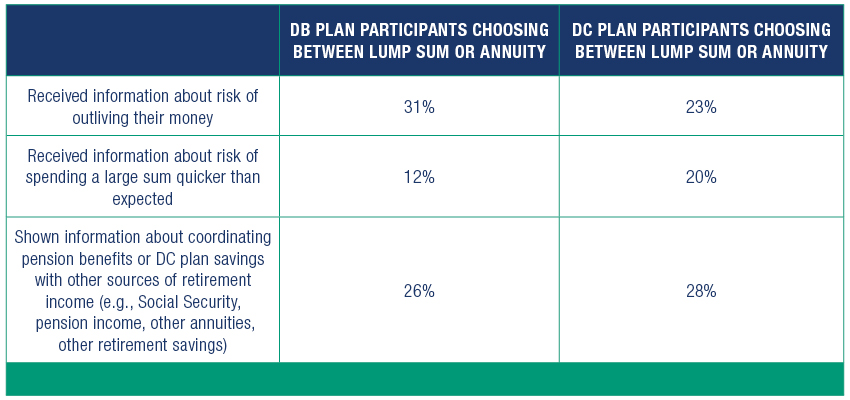

It’s well documented that people simply don't know enough about longevity and the risks of running out of money. Current actuarial projections: 65% of people aged 65 will live to age 85, and 25% of people aged 65 will live to age 95, with some living well beyond age 100 or more. That means that many of your clients can expect to live 20 to 30 years or more in retirement. And the tax treatment of both options is also an area where most people need guidance. This is a good opportunity for FOFAs to help clients by providing information that is clear and complete to enable them to make informed decisions about lump sum offers versus annuity options.

Both the DB and DC plan participants in the Harris poll who took the lump sum cited financial circumstances at choice time as the number one decision-making criteria (58%). Few of them considered their health (27%) or family history of longevity (20%).

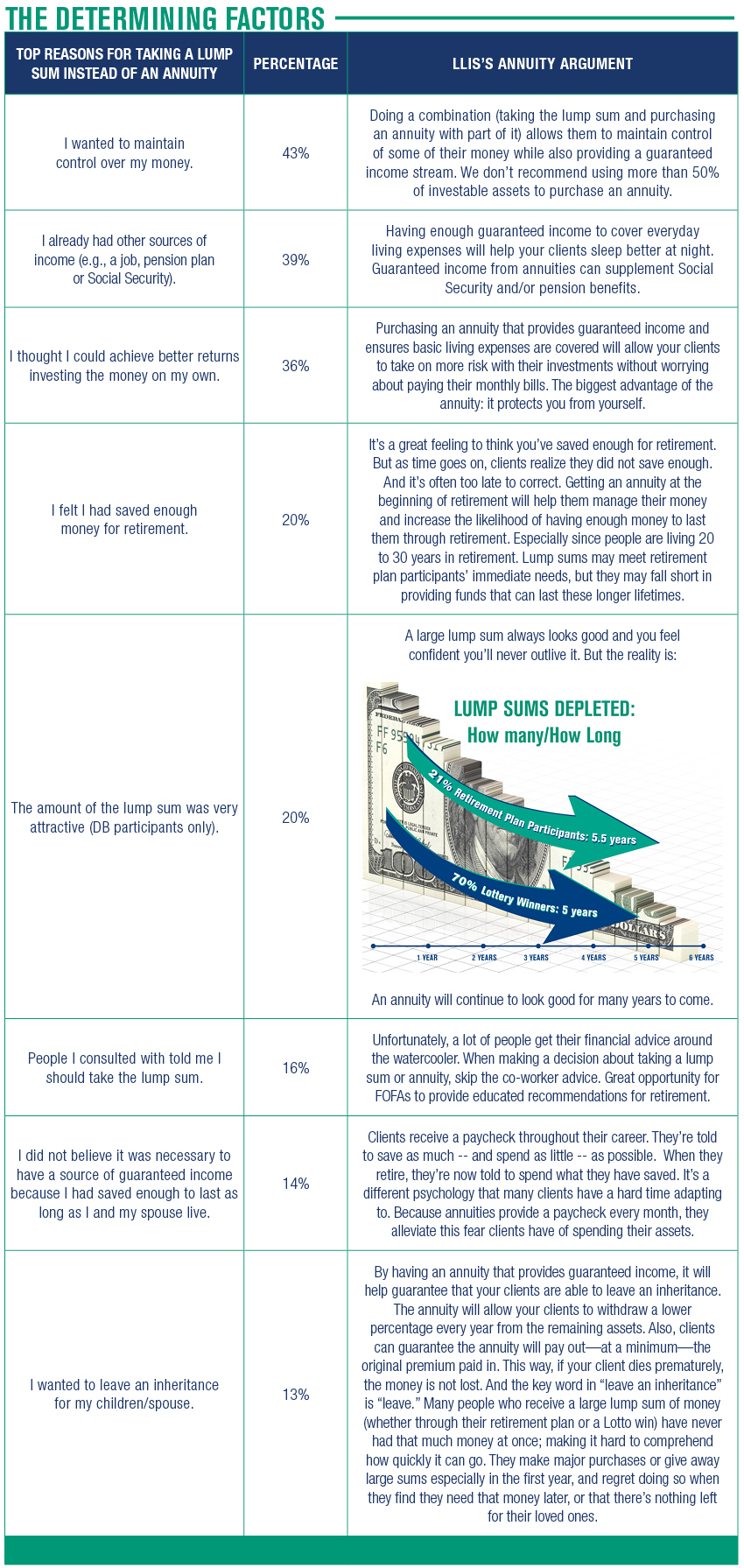

The Determining Factors

Plan participants in the Harris poll gave the following reasons for choosing the lump sum over the annuity; and we share our argument about why the annuity is the better choice:

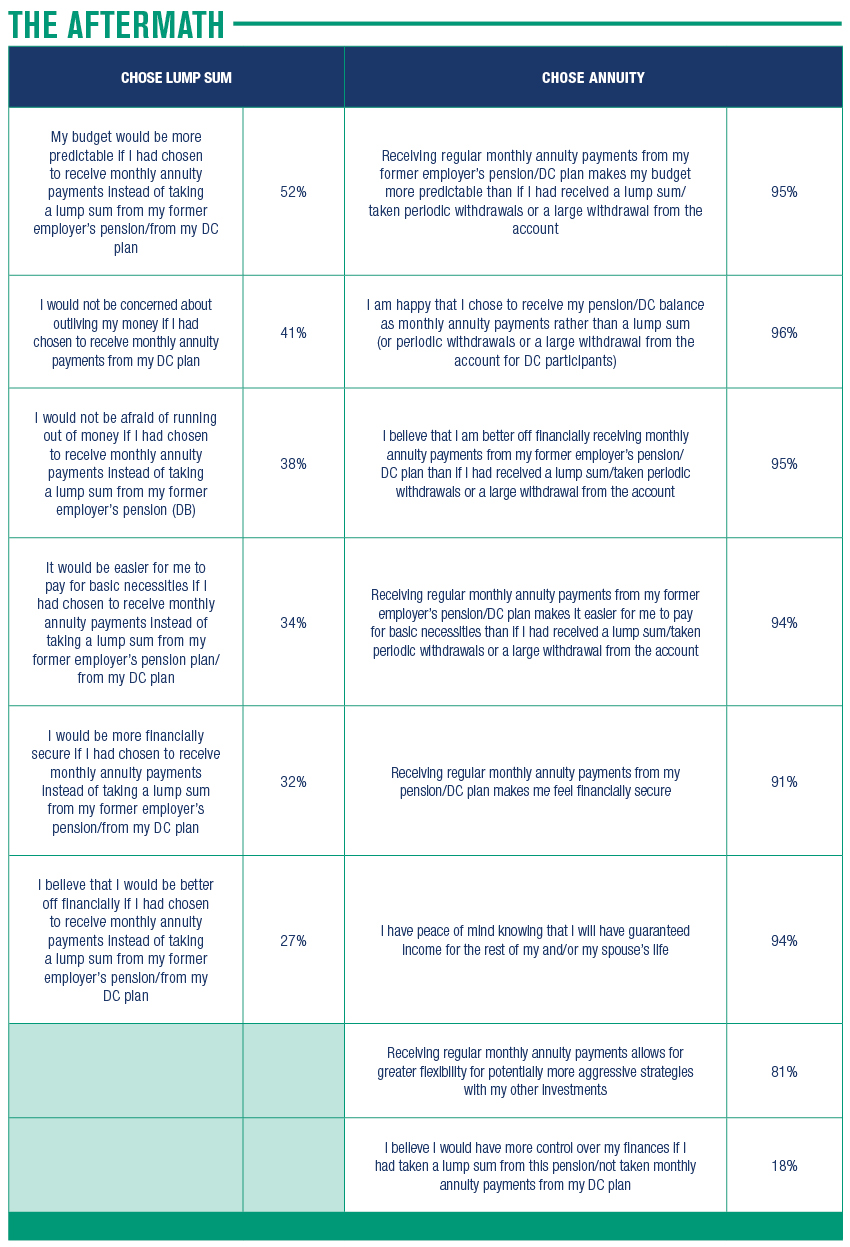

The Aftermath

What did plan participants say after they’d made their choice of lump sum versus annuity? Well, as the old saying goes, hindsight is 20/20 for those who chose lump sum.

So whether you’re advising a Lotto winner or a soon-to-be retiree, be sure they have all the information and illustrations they need to make an informed decision. And if purchasing an annuity is part of your clients’ financial plan, Jerry Skapyak is our annuity go-to guy.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".