Marijuana use (medical and/or recreational) is one of the most controversial topics in the U.S. today. Some people are for it; some opposed. And life insurance companies are not exempt from these different stances when it comes to underwriting.

Similar to nicotine, underwriting for marijuana use differs from company to company, person to person. To-date, there are no standard industry guidelines or best practices. And the history of marijuana usage is a long and winding road. LLIS, as a company, does not take a stance on the issue, but we believe it’s important for advisors to have the facts when discussing marijuana use with their clients seeking insurance protection.

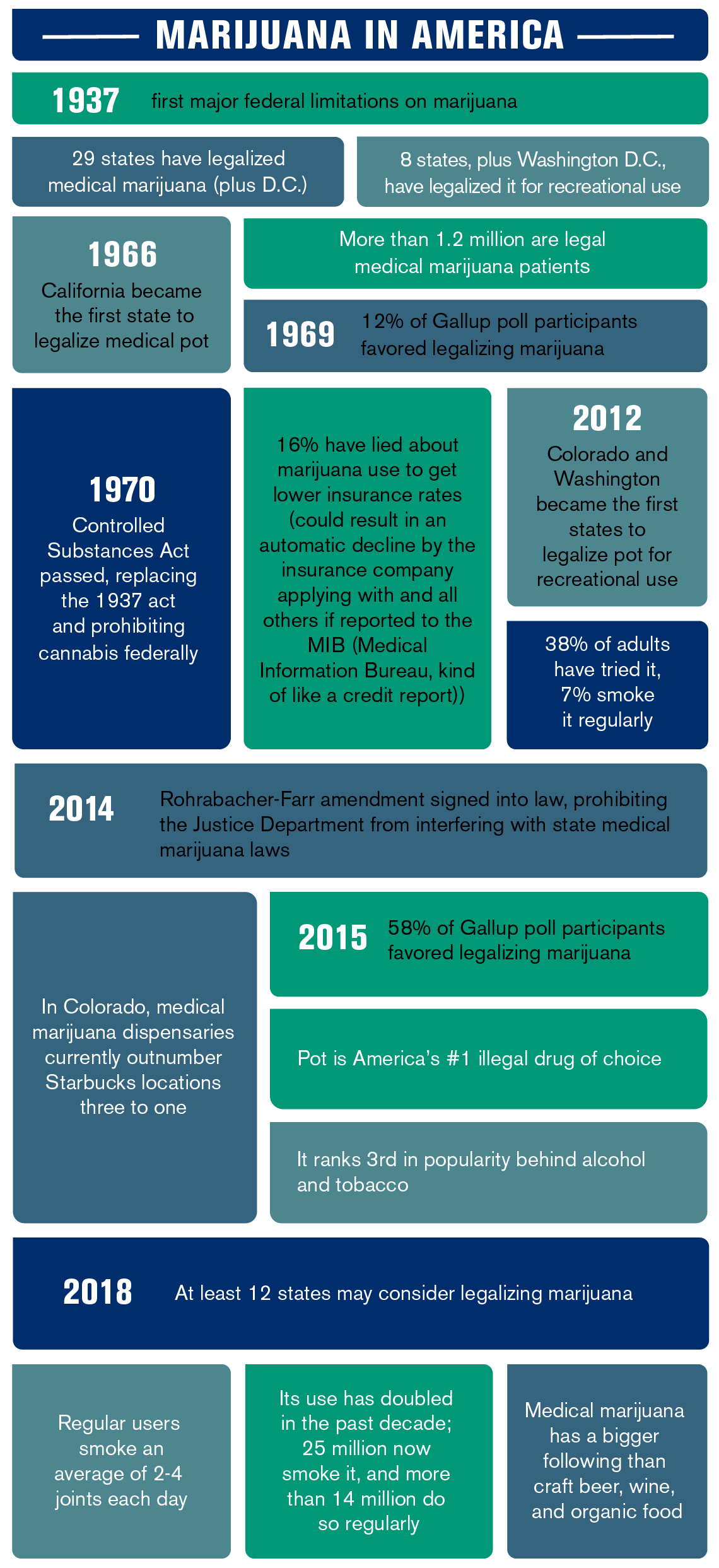

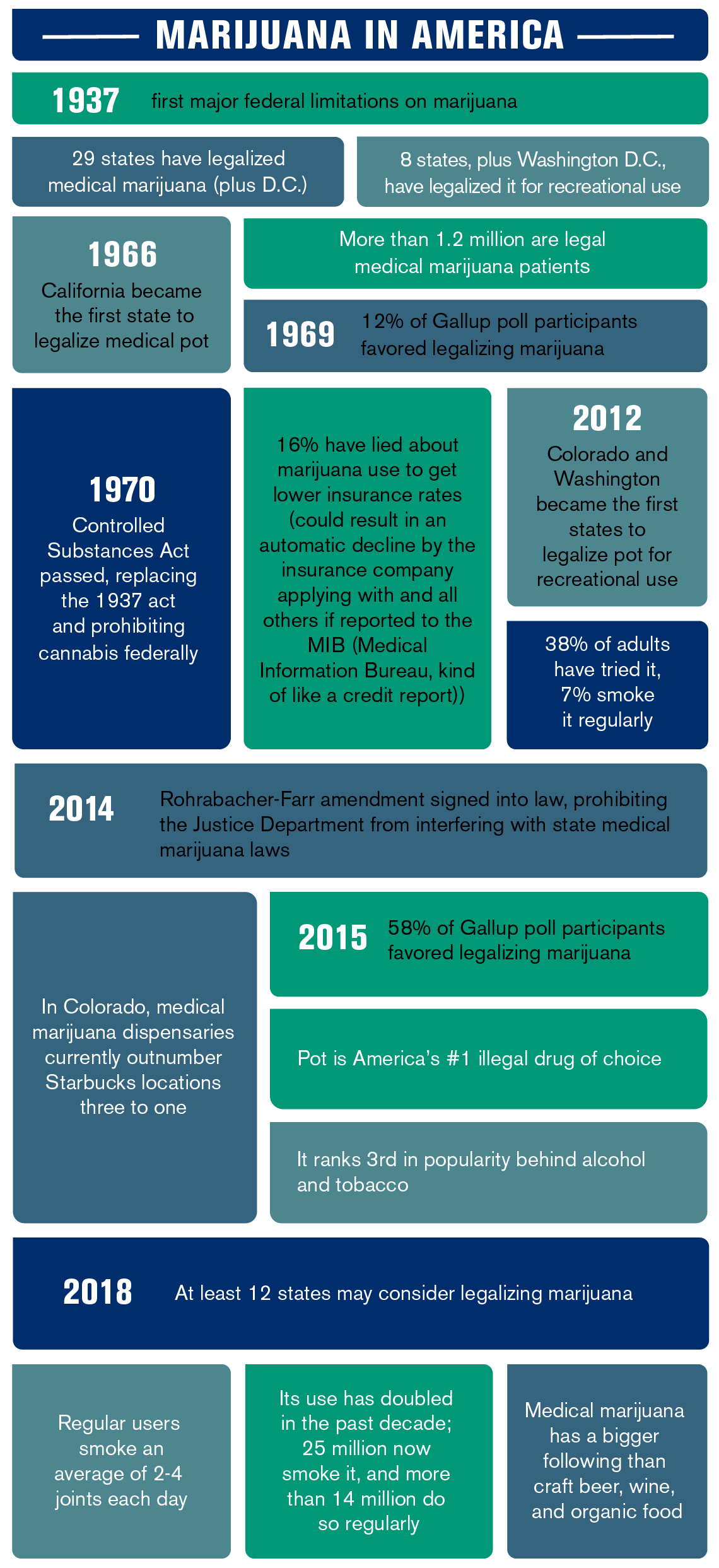

Let’s start with a little history of pot and our population.

While there are no industry guidelines for underwriting marijuana use, life insurers all take a holistic look at a potential insured’s life: are they a good driver, do they rock climb, do they drive race cars while chasing tornadoes?

And how does marijuana fit in? Will they outright reject marijuana users because it’s an illegal drug in many states? You and your clients probably have a lot of questions about marijuana and underwriting. Between our own knowledge and conversations with underwriters at the insurance companies we currently work with, we came up with a list of questions and answers for you and them.

- Can I be prosecuted if I admit to using pot in my insurance application interview?

- No. Due to HIPAA laws, you’re safe.

- Can I get life insurance if I use marijuana?

- As a general rule, insurance companies are pretty conservative. Pretty understandable, since their entire business revolves around assessing the risks of everything around them.

- In the past, life insurance companies often automatically denied coverage. Today, marijuana usage and the life insurance landscape have changed, and companies quite often offer coverage and at reasonable rates.

- But there are additional things to consider when compared with those who don’t use marijuana. Underwriters’ main concern is tetrahydrocannabinol (THC), a chemical compound found in the marijuana plant that creates the euphoric high.

- And each company has its own rules and regulations when it comes to determining acceptable risk. Your approval, underwriting class, and premiums will vary greatly depending on:

- Daily vs. occasional user

- Recreational vs. prescribed user

- How you choose to use your marijuana (edible vs. smoke/vape)

- How do insurance companies differentiate marijuana and tobacco?

- Marijuana smokers don’t typically chain smoke; meaning they smoke less

- Some life insurance companies consider pot smokers as smokers and charge tobacco rates

- Marijuana doesn’t contain nicotine; tobacco does

- Tobacco use can be more harmful to users’ lungs than low to moderate marijuana use

- Life insurance rates for smokers average 3x non-smoker rates

- Does it matter how often I partake?

- Yes.

- Many insurance companies don’t consider occasional marijuana use as smoking; they have guidelines and rates specific to marijuana users (different than the guidelines for nicotine users)

- Marijuana users are no longer automatically grouped in with the same risk category as nicotine users (or declined)

- Marijuana users can get approved with a non-smoker rate even if they light up occasionally

- Underwriters classify a client’s use of marijuana depending on several factors:

- How often they smoke, vape, or consume marijuana

- The last time they used it

- Whether they use it recreationally or medically

- Recreational users will likely only be scored on their frequency and date of last use

- Most insurance companies will consider you a smoker if you partake (regardless of smoking or ingesting) more than once a week

- Just like tobacco smoking, the less you smoke, the better your health classification will be and the lower your premiums will be. We’ve had clients get rated as non-smokers, similar to rates for clients who smoke the occasional cigar while golfing.

- Heavy recreational use often counts as smoking and could get you denied or higher premiums.

- What if I just don’t admit on my application that I smoke pot or eat pot brownies occasionally?

- Just like with all questions in an application interview, don’t lie. Paramedical exams (that often include blood and urine tests) may show it in your system. And if an insurance company determines you’ve lied, you may be reported to the MIB (Medical Information Bureau) and denied not only by that insurance company, but possibly by all insurance companies. Think if it sort of like a credit report. And even if you’re approved, evidence of lying can void the policy, leaving nothing for your beneficiaries.

- The same goes for e-cigs. They are considered nicotine, and will show in paramedical exam results.

- What if I don’t smoke pot when I apply, but start doing it after my policy is in place?

- Once a policy is in place, insurance companies don’t do tests to check for evidence of usage. The insurance exam is one and done.

- What type of rate class can I expect if I’m an occasional marijuana user?

- If you’re an occasional user (defined by each insurance company individually) you can qualify at a preferred rate class as long as your urine comes back negative for traces of THC. If your urine does show THC presence, the company will not consider you an occasional user. Marijuana can be detected for 13 days, but there are reports of some people showing positive for marijuana as far out as 90 days.

- If you use marijuana only twice a month, you may receive a standard plus rate class.

- If you use marijuana once a week, you may receive a standard rate class.

- However, if you use daily, then chances are you’ll get a tobacco rate class or be declined, even if your use is from a vaporizer or ingestion.

- Does it matter if I smoke it or consume edibles?

- For now, insurance companies are not giving leniency if marijuana is eaten rather than smoked.

- Underwriters are concerned more about overdoses with edibles since they have a higher concentration of THC.

- What if I live in a state where it’s legal medically?

- You’ll need to provide proof of the prescription.

- If you have a prescription for medical marijuana, you could still qualify for the best life insurance rates, but insurance companies will want to know what condition the marijuana is prescribed to treat and why. Your underlying medical condition will be factored into underwriting.

- If your prescription is for a condition that doesn’t normally affect your rates, you’re better off than the casual marijuana smoker. But if it’s for something significant, you’ll be rated based on the normal risks associated with that condition or disease.

- Medical marijuana is often intended to help treat debilitating symptoms. But severity is subjective and open to interpretation.

- Medical marijuana can be a double-edged sword: even if a condition isn’t considered serious by the insurer, you’ll be treated like a recreational user. But if the condition is considered serious, it’s also likely to be uninsurable (AIDs, cancer, and severe arthritis are some examples).

- Even if your serious condition is insurable, the cost of the life insurance policy will still probably be high (regardless of the medical marijuana prescription).

- Most insurers will consider insuring medical marijuana users after a review of medical records. But, even if approved, you may be rated as a smoker.

- It’s still important not to lie. Underwriters are concerned about the medical impact of the drug, not whether or not it’s legal in your state of residence. They don’t want to turn you in; they just want to know how to rate you and how much to charge you.

- How can LLIS help?

- Each case is looked at on an individual basis. There is no universal guideline among insurance companies.

- If additional details will provide an underwriter with more information and understanding of a particular situation (more than they’ll get on an online application), LLIS can include a cover letter explaining the marijuana use with your application.

- Of the 15 companies we work with and contacted for this article:

- Occasional usage class/rate:

- Standard non-tobacco: 5

- Tobacco: 4

- Preferred: 6

- How do they define occasional? Here are some examples:

- Less than 5 times per week: Non-smoker rates

- Less than 1 time per month: Best class (names of classifications vary between insurance companies)

- Less than 2 times per week: Preferred

- Rare usage (twice per year): Preferred Plus

- Under 24 times per year (2 times per month): Preferred

Here is a recent example of one of LLIS’s first experiences with a client who was upfront about her vape marijuana usage:

An advisor introduced us to his female 36-year-old New Jersey client who told him she vapes marijuana once or twice a week. LLIS did the shopping for her (contacted 10 insurance companies) and provided her with multiple quotes for a 20-year, $1 million policy, that ranged from:

- $3,772 annual premium (the same rate as a tobacco user)

- $677 annual premium (the same rate as a non-tobacco user)

Her transparency paid off because it allowed LLIS to find the right insurance company and policy for her, and prevented the insurance companies from finding out on their own through paramedical exams, which could have gotten her into a hemp (oops, heap) of trouble.

It’s safe to say that while the U.S. differs on marijuana issues, so too will insurance companies. And our knowledge of insurance company sweet spots will save your clients who partake both time and money, whether that use is for recreational or medicinal purposes.

If you have specific questions about marijuana underwriting, please contact:

Mark Maurer, life insurance

Kathy Bilodeau, disability insurance

Jill MacNeil, long term care insurance

![]() (877) 254-4429

(877) 254-4429![]() (877) 254-4429

(877) 254-4429