ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Fourth Quarter 2019

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s the last month of the year. And while November was long term care insurance awareness month, it’s important to keep it top of mind for your clients year-round.

Long term care (LTC) is often confused with healthcare. But according to the U.S. Senate Special Committee on Aging, LTC is quite different from other types of healthcare. The goal of LTC is not to cure an illness. It’s to enable a person to function, so they may live independently. Long term care consists of medical, personal, social, and specialized housing services to support people who have a disability or chronic illness and have lost some ability to care for themselves. It can include assistance with some of the most basic -- yet intimate -- aspects of daily living like getting dressed, bathing, and toileting.

As we begin planning for the next 12 months, here are 12 reasons you should be talking to your clients about the important, yet often overlooked, protection of long term care insurance (LTCi).

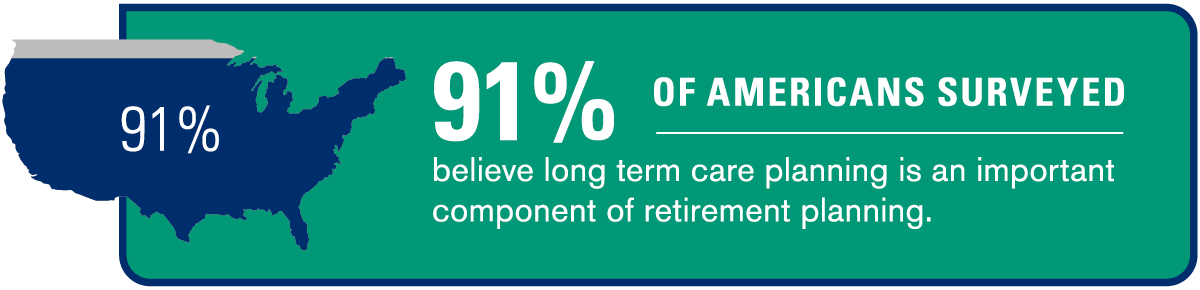

1. It’s part of retirement planning

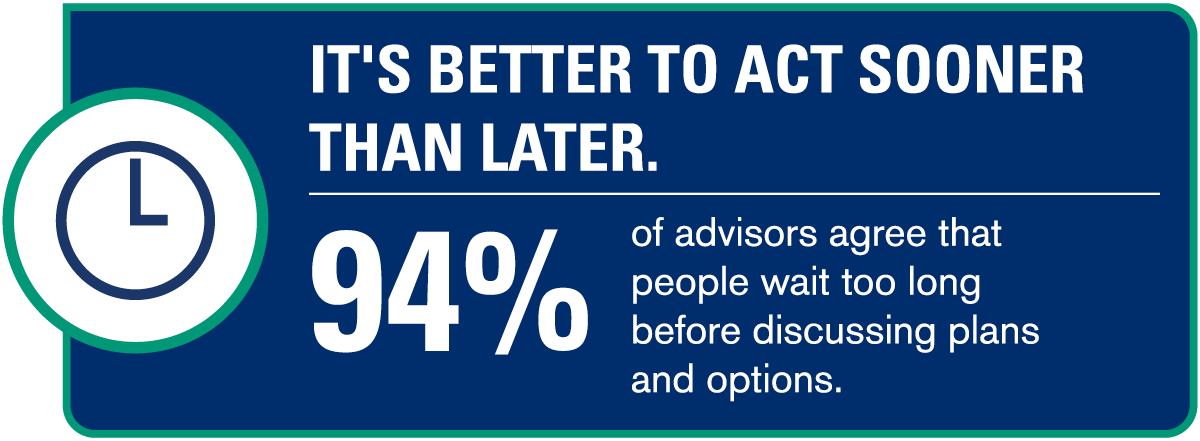

2. It’s better to act sooner than later

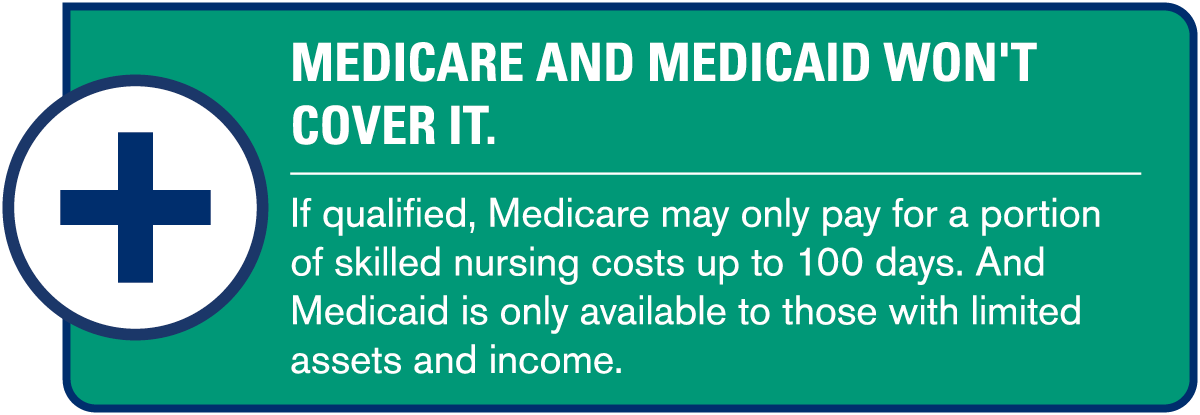

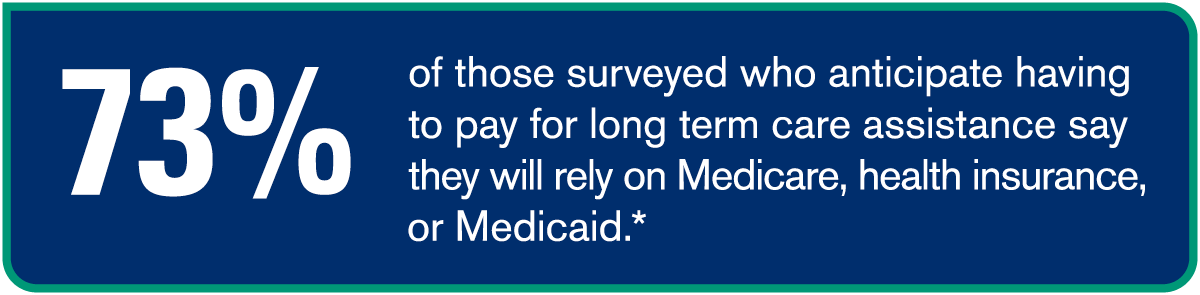

3. Medicare and Medicaid won’t cover it

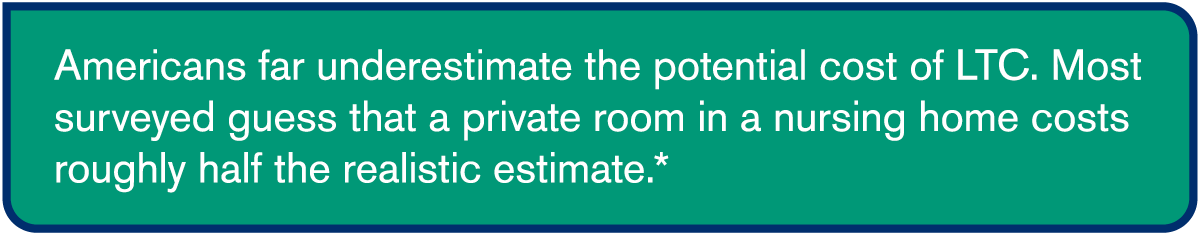

4. It may cost more than they think

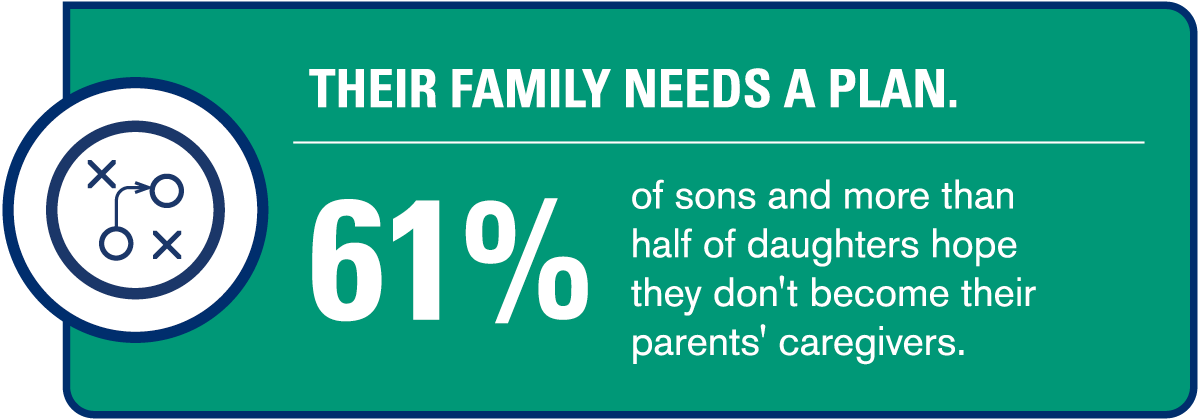

5. Their family needs a plan

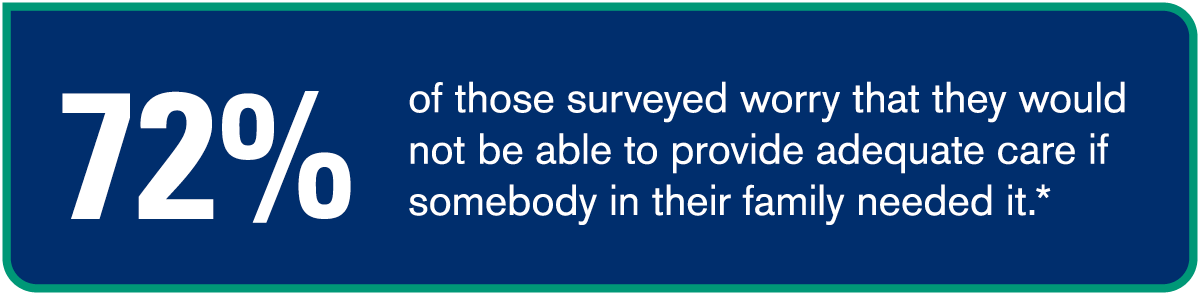

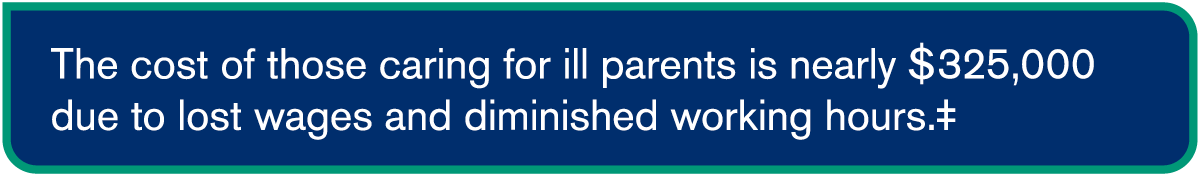

6. Professional caregiving is usually a smarter idea than familial caregiving

7. The “Sandwich Generation”

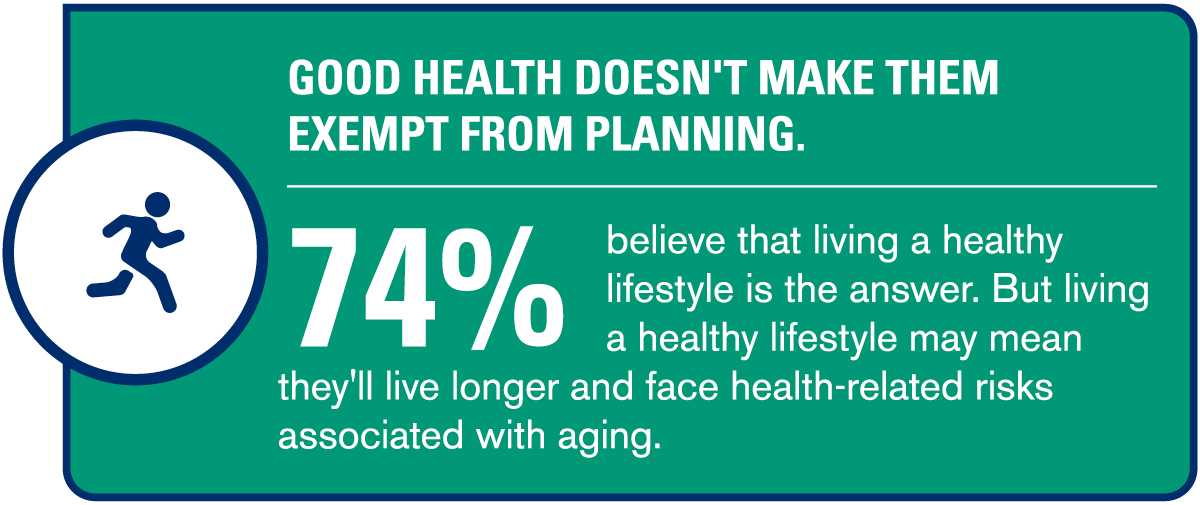

8. Just because they’re in good health doesn’t mean they shouldn’t plan

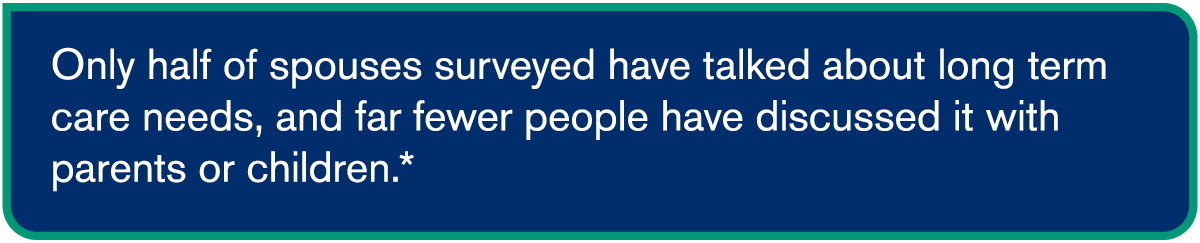

9. They’re probably not talking about it on their own

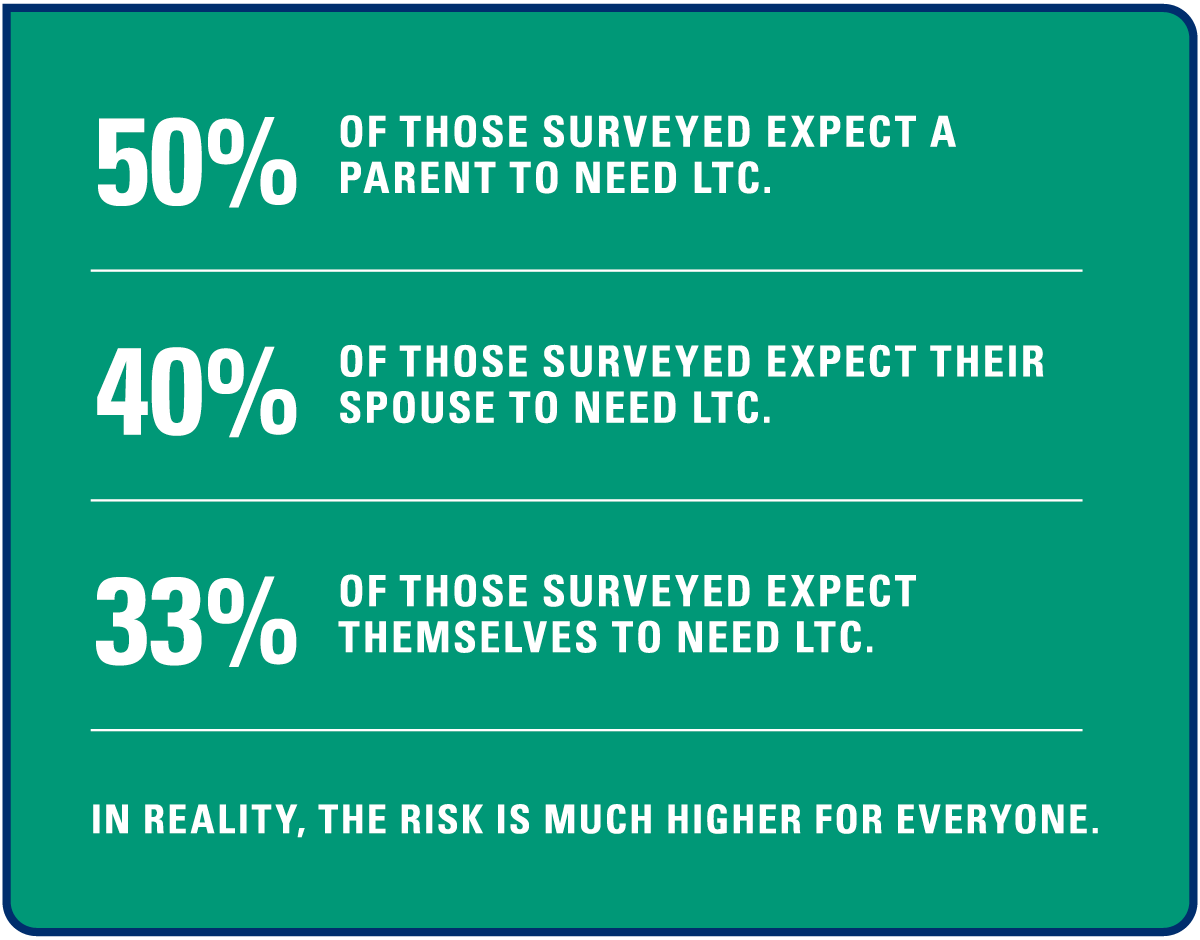

10. If they are talking about it, they’re probably downplaying their personal risk

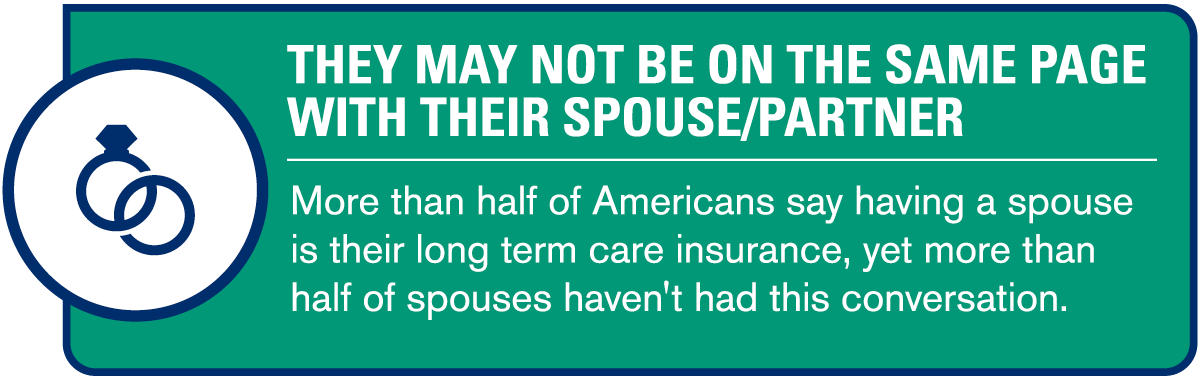

11. They may not be on the same page with their spouse/partner

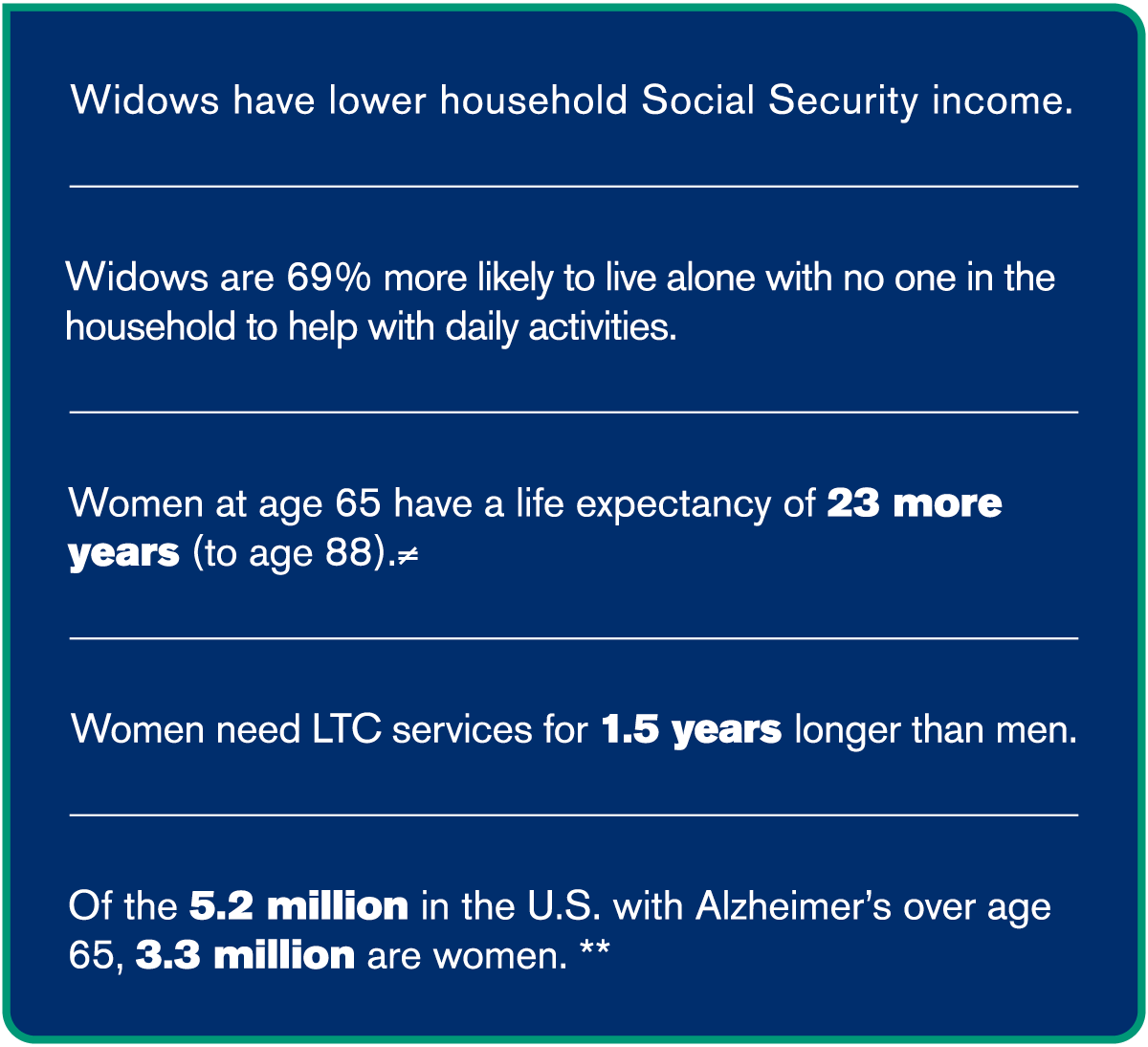

12. If your clients are single, the need is even greater, especially if they are single women (and since, on average, the longevity prize goes to women, they are at greater risk of needing care when they are single)

13. Even if they can afford to self-insure, there are tax advantages

Jill MacNeil is LLIS’s LTCi specialist and she’s available to discuss your clients’ needs with you in 2019, 2020, and beyond!

*Versta Research, “2017 LTC Marketing and Thought Leadership Research, Findings from Surveys of Advisors and Consumers,” October 2017

‡Family Caregiver Alliance, “Women and Caregiving: Facts and Figures,” February 2015

≠American Academy of Actuaries and Society of Actuaries, “Actuaries Longevity Illustrator,” January 2016

**Alzheimer’s Association, “2016 Alzheimer’s Disease Facts and Figures,” January 2017

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".