ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Fourth Quarter 2019

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Every year I make a New Year’s resolution. It’s really more of a commitment to something I’m doing – and want to do more of – rather than something new. Most of the time, it feels like my have-to-do list is pretty full already. So I’m really not adding any new values to my life’s equation; I’m increasing the current ones.

We figure your have-to-do list and your clients’ have-to-do lists are probably pretty full too. So we thought it would be helpful to provide you with this list of 2020 Insurance Resolutions. These are not new ideas, but Re-Solutions that may help solve issues (or prevent them altogether) your clients can encounter without them.

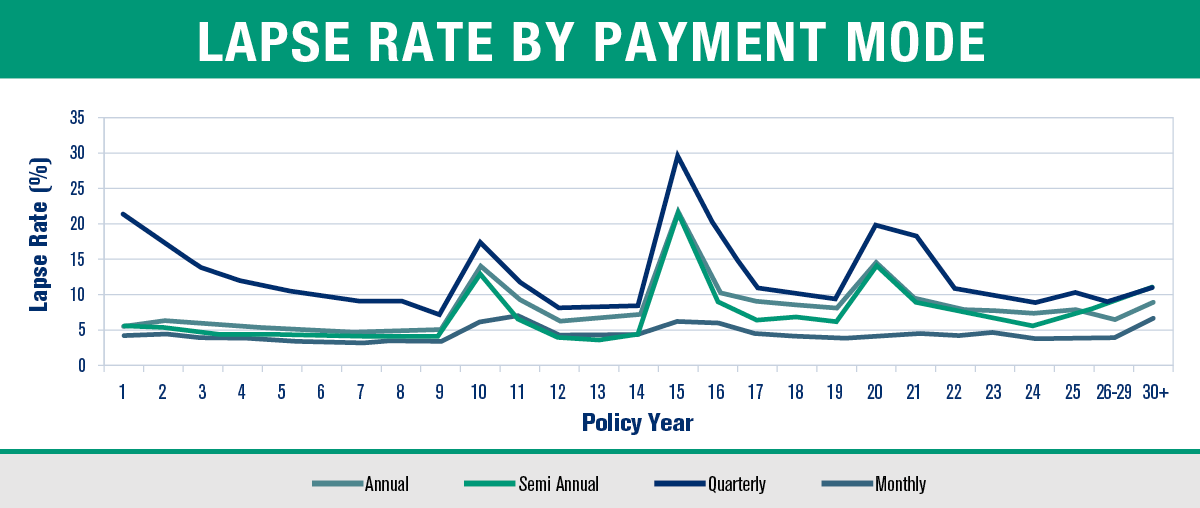

Every year we work with your clients (and maybe even you) because a premium payment was late, forgotten, lost in the mail, or eaten by the dog. So one resolution is to set up automatic drafts for the policies. Monthly bank draft is the most common option and is available with just about every insurance company.

Most companies also allow bank draft for other payment options (like annual and quarterly). Our Policyholder Services Team is the best out there, and as helpful as duct tape, but your clients would probably prefer to work with them on getting a current illustration instead of reinstating a lapsed policy when bank draft premiums would have saved the day.

Did a client get married? It may be time for a beneficiary change from parents to a spouse. Or divorced? Get that ex off the policy and give it to the kids.

If the kids are minors, we recommend not naming them as the policy’s beneficiary since the money can’t be paid directly to a minor. We’d look at other designs to ensure the insurance proceeds are available to use for the children’s care without delay.

If the beneficiary of a life insurance policy is a trust, it’s important to make sure the trust also has established a bank account (or the trustee has the power to do so). It can be very hard for a client who has just passed away to open a bank account.

We have a helpful advisor tool on our website to help you guide your clients toward policy reviews when life changes may affect their insurance needs.

Many of your clients took out individual disability policies when they first signed on with you. And, hopefully, over time their income has grown. They may have group DI coverage from their employer too. Are they taking full advantage of their individual disability policies or do they need to supplement their group coverage with a personal policy? Things that can change include:

It’s important they (or you or LLIS) are on top of these DI plans. A disability can be a financial catastrophe for many. Without income replacement, going to a $0 paycheck can devastate a financial plan. And even 60% of income while on claim can be troublesome. If your clients have DI coverage but have maxed out, an additional policy may be their best protection.

ALLiS is our anytime, anywhere access to LLIS. And it’s got some cool stuff online for advisors to use (and your clients too). You can see the status of clients currently in the application process, and you can:

Hear our own Jenny Stiles (no voice-over actors here!) walk you through some of the things ALLiS has to offer. We celebrated ALLiS’s second birthday in October and she’s going strong!

Thank you for working with LLIS in 2019. We look forward to a new decade with you and we resolve to continue to put you and your clients first in all we do!

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".