ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

First Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Luis was married, in his early 40s, and had two young boys. He and his wife were in perfect health (as far as they knew). One day while volunteering at the boys’ school, she suffered a fatal brain aneurysm. Luis immediately became a widower. His sons immediately became motherless. The couple had consulted with their financial advisor who recommended life insurance for both of them, even though she was a stay-at-home mom (to provide for the economic value the family would lose if they lost her). His was a much larger policy (since he was the sole breadwinner). But the proceeds from her $400,000 death benefit allowed Luis to provide many of the things his wife did for their sons when she was alive: a tutor, a nanny (who cooked, cleaned, and cared for his sons while he was at work; getting them to the bus stop, taking them to appointments and soccer practice, doing laundry, coordinating and organizing the family’s activities), and counseling.

It's a simple answer to a difficult question: How will my loved ones manage financially if I were to die? Anyone depending on your clients’ income or the unpaid work they do would most likely struggle if they were to pass away.

Life insurance offers protection from financial loss resulting from death, and can be used to protect both personal and business interests. It’s a contract between a policy owner and an insurance company in which the insurer agrees to pay a sum of money to a beneficiary(ies) at the insured's death, and the policy owner agrees to pay premiums at regular intervals or in a lump sum.

Loss is never easy. And money doesn’t bring happiness. But the cash payout from his wife’s life insurance policy allowed Luis to grieve at the same time he made sure his sons were taken care of in the best way possible.

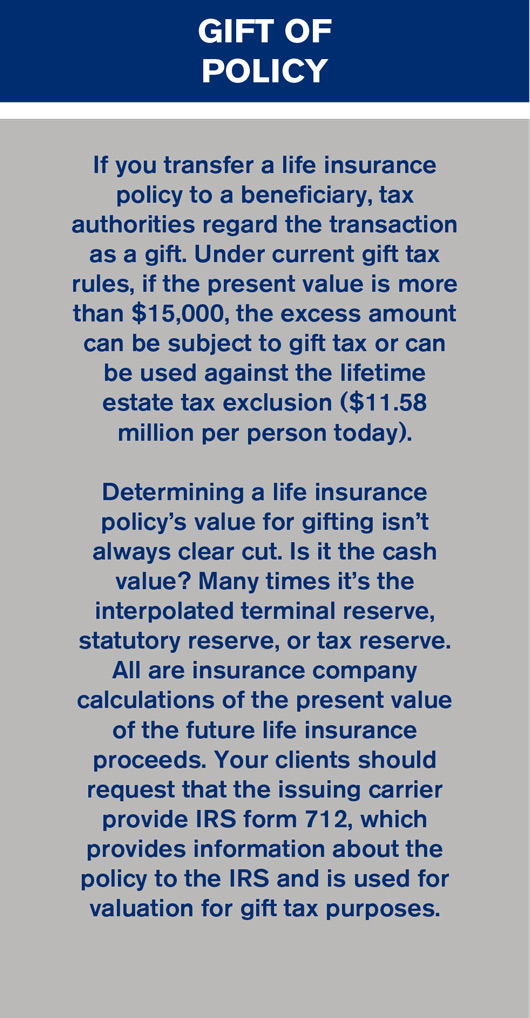

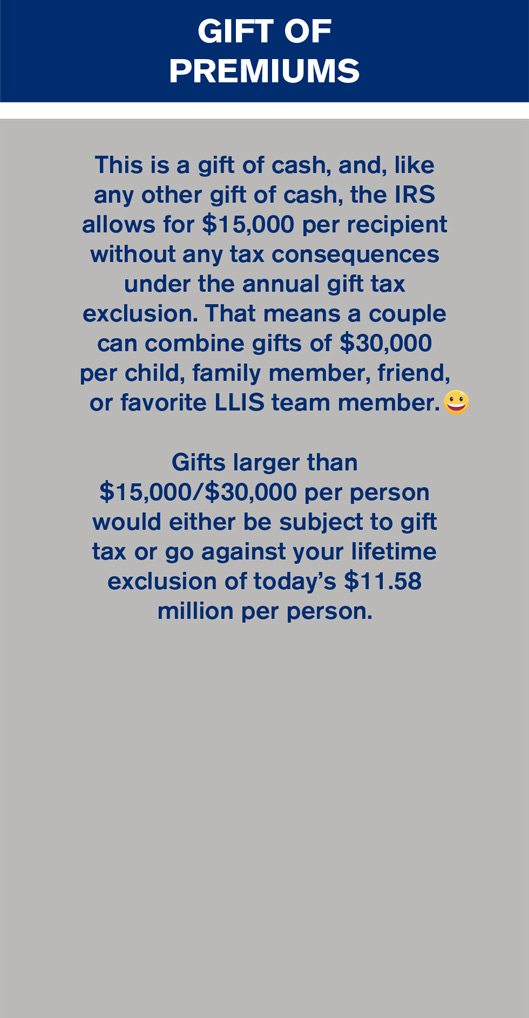

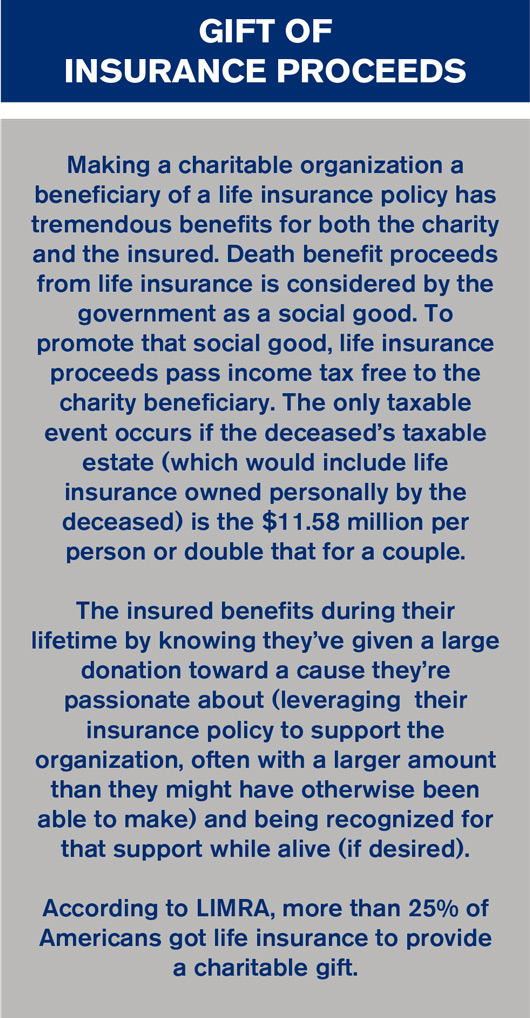

Life insurance policies are often used as gifting strategies for individuals. There are generally three types: gift of policy, gift of premiums, gift of insurance proceeds.

Here are three more reasons for your clients to consider giving the gift of life insurance:

Getting life insurance is a simple act your clients can take today to ensure their loved ones are protected financially tomorrow and offering them protection against the unexpected for years to come. It’s a long-lasting gift. And it doesn’t even have to be wrapped!

We hope you’ll encourage your clients this heart month (and always) to act so they can live out their 2.5 billion heartbeats with a sense of peace knowing their legacy will be fulfilled and they have put in place the protection their loved ones need for their lives, care, and financial security.

Crazy For Love

‘Til death do us part. It’s part of almost every wedding ceremony. And sometimes love can make people do crazy things. We don’t recommend, though, that they take the ‘til death do us part as seriously as these folks*:

- In 2012, Alexey Bykov wanted to be sure his future bride took that line seriously. He hired a team of filmmakers to fake his death. Right in front of her! Paramedics told her he was dead, and he sprang up and asked her to marry him. Surprisingly, she said yes.

- Radiologist Carl Tanzer took ‘til death do us part wwwwaaaayyyy too seriously (especially since there’s no evidence she even liked him). He became obsessed with a woman in 1930 when she was a patient in a Key West, Florida hospital. She died in 1931. In 1933, he exhumed her body and took her home to live with him. Their living arrangement lasted for seven years; the police arrested him for wantonly and maliciously destroying a grave and removing a body without authorization.

* Mental Floss, February 13, 2019

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".