ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

First Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

You probably have clients who have some type of heart condition. After all:

It’s pretty obvious that heart conditions can cause significant risk for insurance companies. For that reason, odds are that some of those clients think they won't qualify due to their heart condition. But a lot has changed in the life insurance industry. Do they know the latest underwriting standards? Do you?

We thought American Heart Month was a good opportunity to take a look at some of those changes, many of which have occurred in the last year, 365 days, 35 million heartbeats, during a COVID outbreak. So we asked Mark Maurer, CFP®, LLIS’s President and CEO to share his experience.

Claudia Molina (LLIS Marketing): Let’s start with, in general, what has happened in the last year in the life insurance industry?

Mark: A lot! Insurance companies have seen more applications than ever. Probably because people have more time with the lockdown or they’re considering their own mortality more than ever.

C: How has the industry responded?

M: They’ve really stepped up. They’ve put into place a number of new processes to make the application process easier for everyone involved:

C: What’s new specific to the heart?

M: This isn’t necessarily since COVID, but it’s worth noting. Heart conditions used to be either an automatic decline or a pricey rate. But there have been so many advancements in detection, treatment, and prevention of heart conditions that insurance company underwriters now look not just at the disease itself, but at each person’s situation.

The COVID-19 pandemic, though, has changed how certain medical conditions are viewed, and heart disease has not escaped those changes. For typical applicants, the pandemic has not affected approvals; Standard rating is common for most people with mild heart conditions and no other health complications. For those with more severe forms of heart disease, table ratings (maybe with flat extra charges) are to be expected from most insurance companies. It’s important to note, however, that in the current COVID environment, most insurance companies are postponing applications from clients whose heart disease would result in a low to moderate rating (like Table 4) due to the higher risk if they were to become infected with the virus (especially the older population). For example, American General will postpone any case not expected to be approved Standard or better for ages 60-69. And since the average in the U.S. for a first heart attack in men is 65 (72 for women), clients in this age range would often have a sub-Standard rating for several years. By limiting the issue classes to Standard or better, the company is limiting the applicants who may have recently had heart disease. That may make it more difficult for clients with heart issues to get new coverage until the COVID situation improves.

You can find a chart of the different rating types here.

C: What do life insurance company underwriters look for when it comes to heart disease?

M: There are a number of factors that go into both the coverage decision and the premium:

Treatments (normally recommended when preventive measures haven’t been enough): Medication: Underwriters look at whether or not the medication is controlling the condition and also the potential side effects; and how many medications the client is taking (three medications to control blood pressure poses a higher risk to the insurance company than someone taking just one, and multiple medications can lead to negative drug interactions plus multiple side effects). Surgery: Surgeries provide underwriters with an idea of the severity of the condition since surgery is typically recommended in situations where other treatment plans were not successful. However, past surgery can also be positive because, if it corrected a condition (such as a bypass graft for a clogged artery), that would be a better risk than someone with that condition who did not have surgery.

Treatments (normally recommended when preventive measures haven’t been enough): Medication: Underwriters look at whether or not the medication is controlling the condition and also the potential side effects; and how many medications the client is taking (three medications to control blood pressure poses a higher risk to the insurance company than someone taking just one, and multiple medications can lead to negative drug interactions plus multiple side effects). Surgery: Surgeries provide underwriters with an idea of the severity of the condition since surgery is typically recommended in situations where other treatment plans were not successful. However, past surgery can also be positive because, if it corrected a condition (such as a bypass graft for a clogged artery), that would be a better risk than someone with that condition who did not have surgery.C: What hasn’t changed about life insurance underwriting since COVID?

M: Insurance companies set their own underwriting guidelines, so they’re different for each insurer, making it critical for your clients to be up-front with us about their medical information (some are more lenient in their underwriting of heart and other medical conditions). We know each company’s sweet spots and will help your clients find the one that works best for them. They won't get that from an online search engine or a company rep, and they may end up paying for it (literally) in the end.

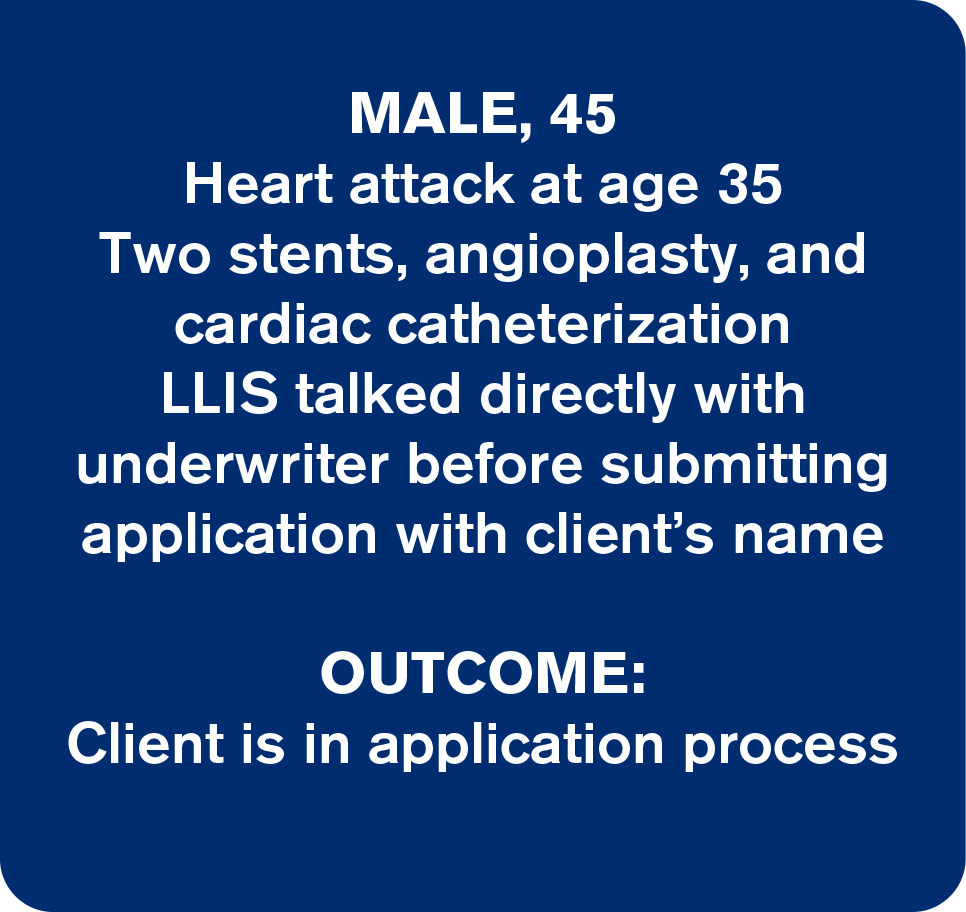

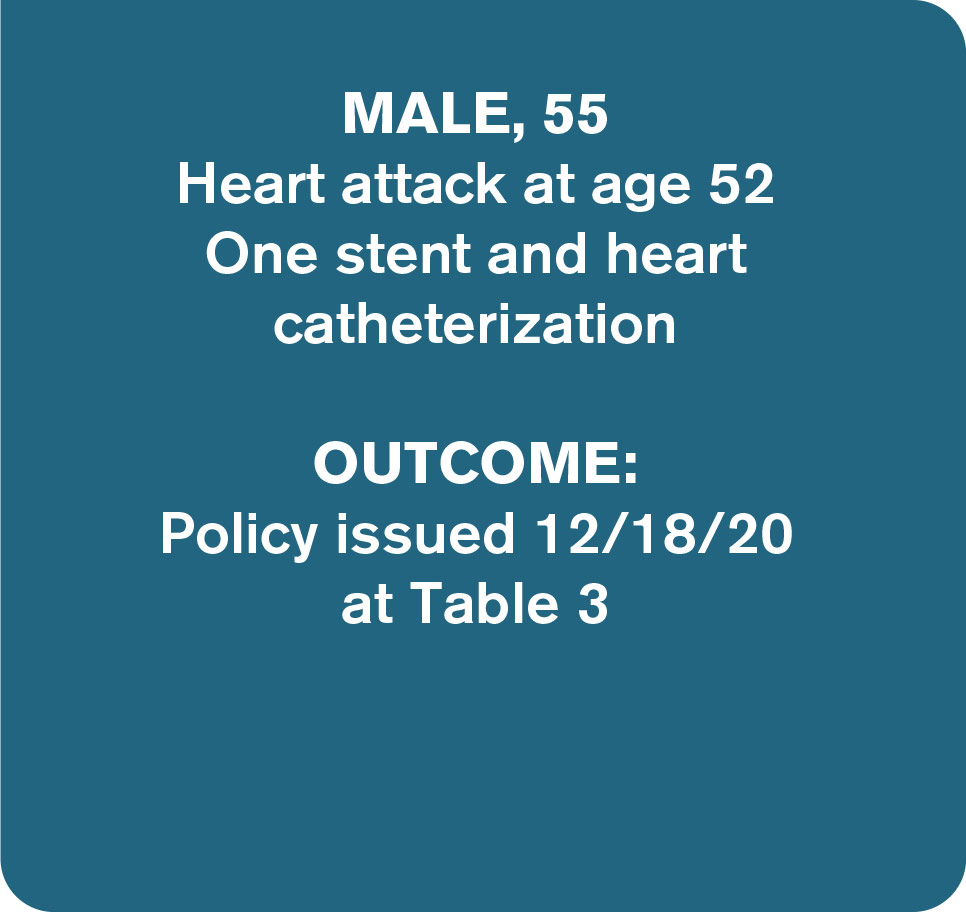

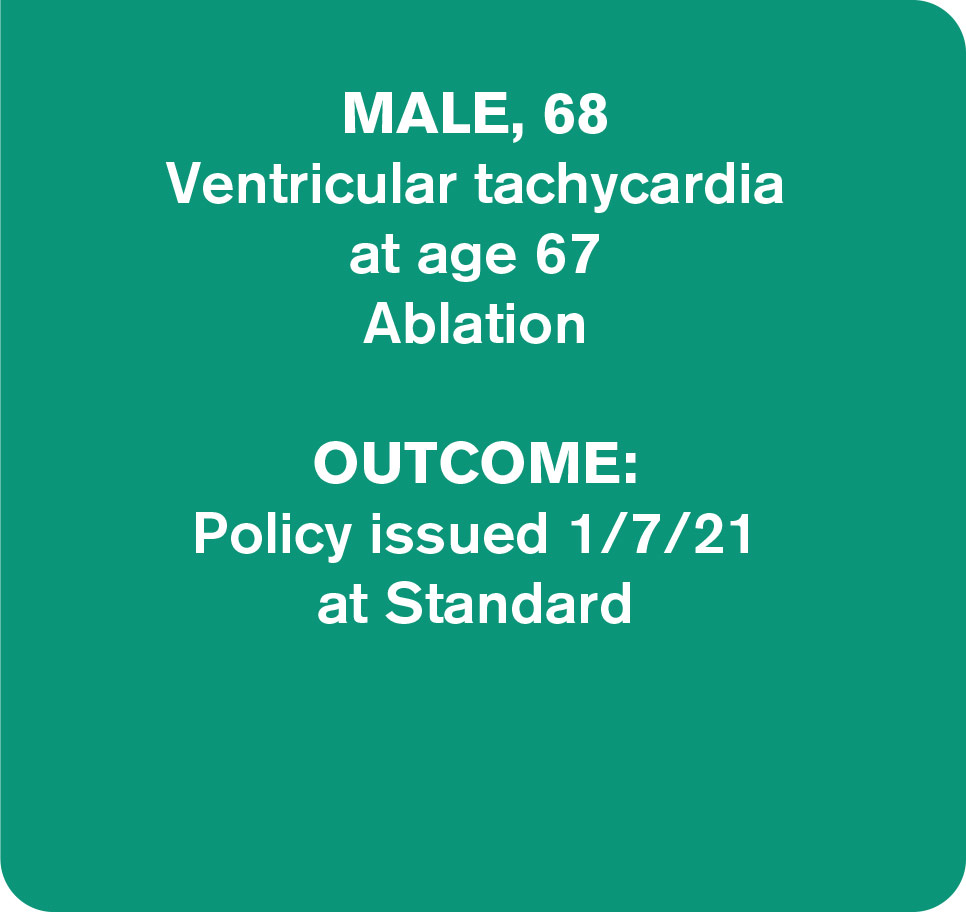

C: Can you give us some examples of clients you’ve worked with recently with who had heart conditions?

M: Sure.

Notice we didn’t provide examples including females. While heart disease is sometimes thought of as a man’s disease, the CDC says it’s the #1 cause of death among women in the U.S. (1 in 5) and that almost as many women as men die from it each year. That makes us wonder: Do your female clients know their risk? If they do, are they not pursuing life insurance because they think they’ll be automatically declined?

C: Has COVID also affected underwriting for disability (DI), critical illness (CI), and long term care insurance (LTCi)?

M: No. For heart conditions, they remain:

C: Do financial advisors need to know about their clients’ health conditions?

M: This varies from advisor to advisor. Some advisors find that the more they know, the better they’re able to help them plan. Others prefer to let their clients maintain more privacy. Some advisors like to do the quote request for their clients. Others direct them to our website to fill it out on their own. The good news is that we give advisors the choice of how to navigate their clients’ application process and we can do that deep digging for them.

C: Do you have a crystal ball picture of what you think the insurance industry will look like post-COVID?

M: I sure wish I did. It’s yet to be seen what will happen with underwriting for heart conditions and others as the vaccine rolls out. But I do think that the process modifications the insurance companies have made will stay, and hopefully continue to improve.

1 American Heart Association, AHA Journal Circulation.

2 Centers for Disease Control and Prevention. Underlying Cause of Death, 1999–2018. CDC WONDER Online Database. Atlanta, GA: Centers for Disease Control and Prevention.

3 Virani SS, Alonso A, Benjamin EJ, Bittencourt MS, Callaway CW, Carson AP, et al. Heart disease and stroke statistics—2020 update: a report from the American Heart Association.

4 Fryar CD, Chen T-C, Li X. Prevalence of uncontrolled risk factors for cardiovascular disease: United States, 1999–2010. NCHS data brief, no. 103. Hyattsville, MD: National Center for Health Statistics; 2012.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".