ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Third Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

The special needs market is extremely underserved. And there’s a lot at stake: valuable government benefits and the financial security of siblings and other family members. Yet a whopping 88% of parents who have children with special needs have not set up a trust to preserve their child’s eligibility for Medicaid and Supplemental Social Income benefits.1

You see, if a special needs child (or anyone, for that matter) receives an inheritance or other sudden influx of wealth, the child may lose the invaluable government benefits mentioned above. With a special needs trust in place naming the trust as beneficiary, the assets are held for the child and the government benefits are maintained.

While there is more than one type of trust, we are focusing on third-party (supplemental) special needs trusts funded with assets of the special needs individual’s parents, grandparents, other relatives, or even family friends. The trustee has discretion to use trust principal or income for the beneficiary’s benefit without reducing government benefits; it doesn’t provide for basic support and maintenance because the government assumes the responsibility for providing food, clothing, and shelter.

One of the most effective ways to fund a special needs trust is with life insurance. And one of the most cost-efficient life insurance options is a second-to-die policy (Survivorship Universal Life, SUL), which provides coverage for two people, pays death proceeds at the death of the second insured, and is generally less expensive than two separate policies. And given the costs of caring for special needs children, families are smart to consider their options and weigh the benefits and costs.

We’ll share with you the story of one client’s situation: The Daletis Family.

They have three grown children: a 35-year-old son, a 30-year-old daughter, and Elsie, a 23-year-old special needs daughter. Elsie was born with IDIC15 (Isodicentric chromosome 15 syndrome), a chromosome abnormality that affects many different parts of the body. People with this condition have an extra chromosome made of two pieces of chromosome 15 stuck together end-to-end.

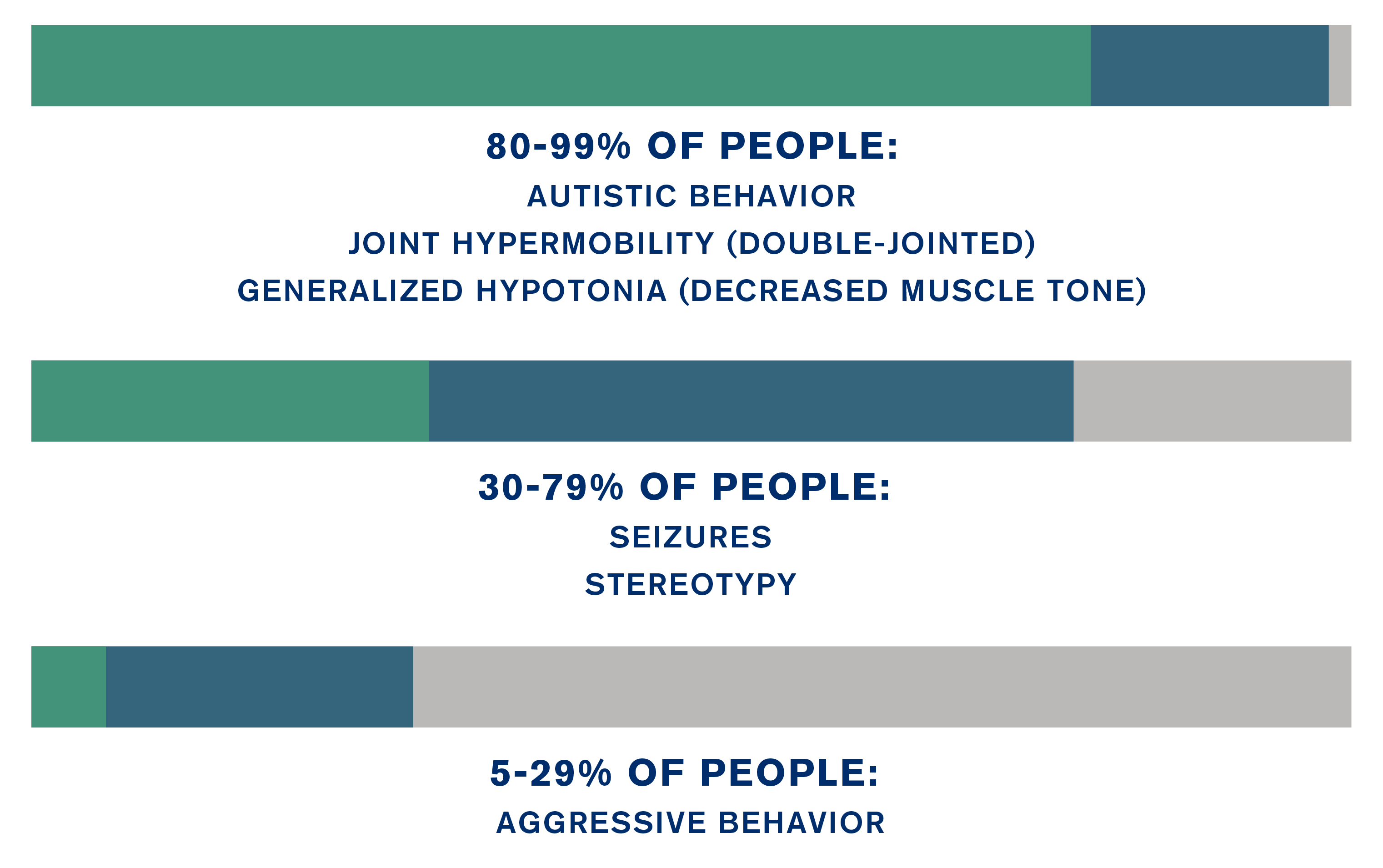

People with IDIC15 often have developmental delays, intellectual disability, communication difficulties, behavioral problems, and distinctive facial features, along with the following symptoms (the symptoms Elsie has had most of her life):

At 23 years old, Elsie cannot read or write, her speech is almost unintelligible, and she depends on her mother to help her with most of the activities of daily living (bathing, dressing, eating, continence, toileting, and transferring). It’s unlikely she’ll ever drive, hold a job, or earn an income. The likelihood of Elsie living on her own at any point in her life is slim. And, while they certainly will help care for Elsie, The Daletises don’t want the financial burden to fall on her two older siblings.

So they sought the help of their financial advisor and a trust attorney. They determined the best option to provide for Elsie was a special needs trust with an SUL policy with Mr. Daletis as the primary insured/owner and Mrs. Daletis as the joint insured/owner. The special needs trust was designated as the policy’s beneficiary.

Both in their 50s, they were healthy at the time they obtained the policy, thankfully. (Mr. Daletis has since had a massive heart attack and five stents.) This is what it looks like:

The special needs trust can pay for trips to visit family, theme park tickets, OTC medicine, iPads, TVs, Netflix, DVDs of her favorite shows, care for her companion dog Ginger, the medical marijuana that is helping to reduce the number of her daily seizures, and so much more that neither Medicaid nor SSI pay for. Life insurance is just one asset the special needs trust will own upon Mrs. Daletis’s death.

In addition to the death benefit, the SUL policy provides downside protection from market fluctuation, cash value accumulation potential, and a flexible design. For the companies LLIS works with, the minimum face amount is $100,000 and issues ages are 20 to 79. And obviously, the younger your clients are when they get the policy, the lower their annual premiums will be. Another benefit to the SUL policy is that it allows an otherwise uninsurable person to be one of two people insured as long as the other insured is in good to even “just OK” health.

An SUL policy can also be an effective tool for someone involved in a devastating accident, which can be life-changing for both the survivor who now has special needs and the family facing tough decisions about how to care for the survivor immediately and long term, both medically and financially.

Their advisor tells us that Mr. and Mrs. Daletis thank her often for nudging them to pursue this protection for Elsie. If they had waited just a year, Mr. Daletis would certainly not have been rated Table H or better and Mrs. Daletis had stopped working at Elsie’s birth.

We hope this article may be just the nudge one financial advisor needs to reach out to a client in a similar situation.

I’m Mark Maurer, President & CEO of LLIS. If I can help you and your clients determine the best protection for their special needs loved one, please reach out to me at 877-254-4429 or email me.

1 Special Needs Planning https://specialneedsplanning.net/statistics; United States Census Bureau https://www.census.gov/library/stories/2021/03/united-states-childhood-disability-rate-up-in-2019-from-2008.html

2 Kuhlthau K, Hill KS, Yucel R, Perrin JM. Financial burden for families of children with special health care needs. Matern Child Health J. 2005;9:207–18.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".