ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

If you look up the definition of life expectancy you will find something like this:

the average expected length of life; the number of years that an average person of a given age can be expected to live

But as Casey Stengle (the NY Yankees manager from the ‘60s) said: “If you have one foot in a bucket of ice water and the other foot on a hot stove, on average you’re comfortable.”

Life expectancy is a weighted average. Without going into the mathematical details, about 50% of people live to life expectancy and another 50% live past life expectancy. According to the 2010 CSO Mortality table*, a female age 40 has a life expectancy of 41 years. But according to the table, more than 50% of them will actually live past age 81.

As we age, life expectancy adjusts. For the 50%+ of females still alive at age 81, their life expectancy at age 81 is 8½ years or 89½. But at age 89½ there are still approximately 25% of our original group of 40-year-old females alive.

Averages are difficult to work with, especially when it concerns how long we’re going to live. A good rule of thumb: most people -- on average -- will live three to five years longer than their oldest parent (or grandparent).

Life expectancy calculations are important as you develop a client’s personal financial plan, for both investment strategy and retirement planning. From an insurance point of view, if your client is seeking coverage until death, the length of time you need to plan for insurance coverage is affected by how you and your client choose to look at life expectancy. For 49% of females age 40, having coverage to age 81 would be long enough. To be 75% sure of meeting their insurance needs, you may need to plan until age 89½. And to be 90% sure, 25% would need coverage until age 95 or beyond. The only way to ensure 100% certainty the coverage would last until death is a guaranteed lifetime benefit. (Ask about the Guaranteed Universal Life policies we recommend.)

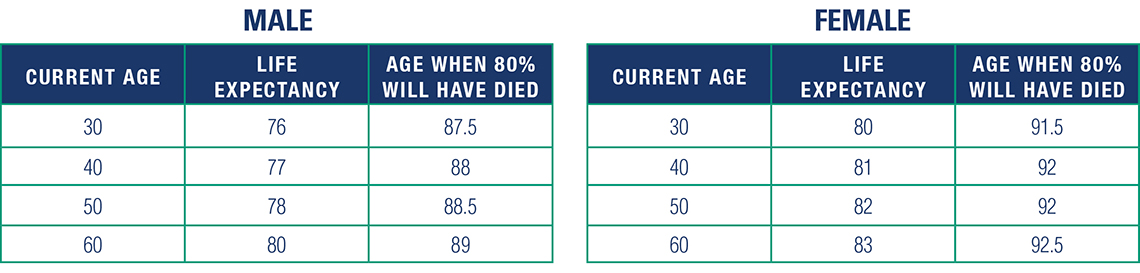

But what if you and your client decide to work with the “80% rule”? This means the financial plan would be based on the age when 80% of the people a certain age will have died. This may be much longer than you realize and much longer than just life expectancy. The following chart is based on the 2010 CSO Male and Female Tables for the USA. It illustrates the life expectancy for certain ages followed by the “80% rule” (when more than 80%+ of those people have died). The implication for financial planners is that 20% of their clients will still be alive---even at the advanced ages.

Accurate life expectancy calculations are critical to helping your clients create and modify their financial plans. As your clients live longer due to medical and technological innovations, they run a greater risk of outliving their retirement assets. Planning involves determining how much clients are spending and projecting those expenses into the future. It also takes into consideration the way clients wish to spend their retirement years. Managing their risk position means considering life insurance to replace assets lost from traveling the world, buying a retirement home, or paying for unexpected illness or long term care. (We work with a number of long term care insurance providers and can help your clients with that protection too.) LLIS can help you “inspect what you expect” so your clients’ high (or low) expectations are met, and their legacy and loved ones are financially secure when the time comes.

*Note: 2017 CSO Mortality Tables have been published with details about pricing life insurance policies, but not life expectancy data. The new mortality pricing for life insurance policies assumes we are living slightly longer. The longer mortality credits are larger at younger ages to reflect improvements in treating childhood medical conditions. These improvements are on most ages, with only small improvements/changes in life expectancy as we get into our 90s.

If you would like a client’s life expectancy calculation or the 80% rule for a specific age, contact advisorservice@LLIS.com or call us toll-free at (877) 254-4429.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".