ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

We occasionally have clients who aren’t approved as they hoped. They got quoted Preferred Plus and for one reason or another, they get approved as Standard. And guess what that means? Their premiums are also not as they hoped; they’re higher!

This is one of the surprises we try to avoid for your clients. Transparency is key: if they’re truthful during the interview process, then LLIS and the insurance company will have a clear picture and the client can avoid an unhappy surprise. Persistency and patience are also key: Your client’s willingness to hang in there while we work on their behalf and provide additional details if required may make all the difference.

Sometimes they say they’re a non-smoker; but the paramedical exam results show otherwise.

Sometimes they report their height and weight as 6’0” and 190 pounds; but the paramedical exam results show 5’11 and 205 pounds. That may bump them into a different rate class and a higher premium.

Sometimes they begin the insurance planning process and become pregnant in the middle of the journey.

And sometimes the paramedical exam may show skewed results. This was the case for one client whom we’ll call Bobby.

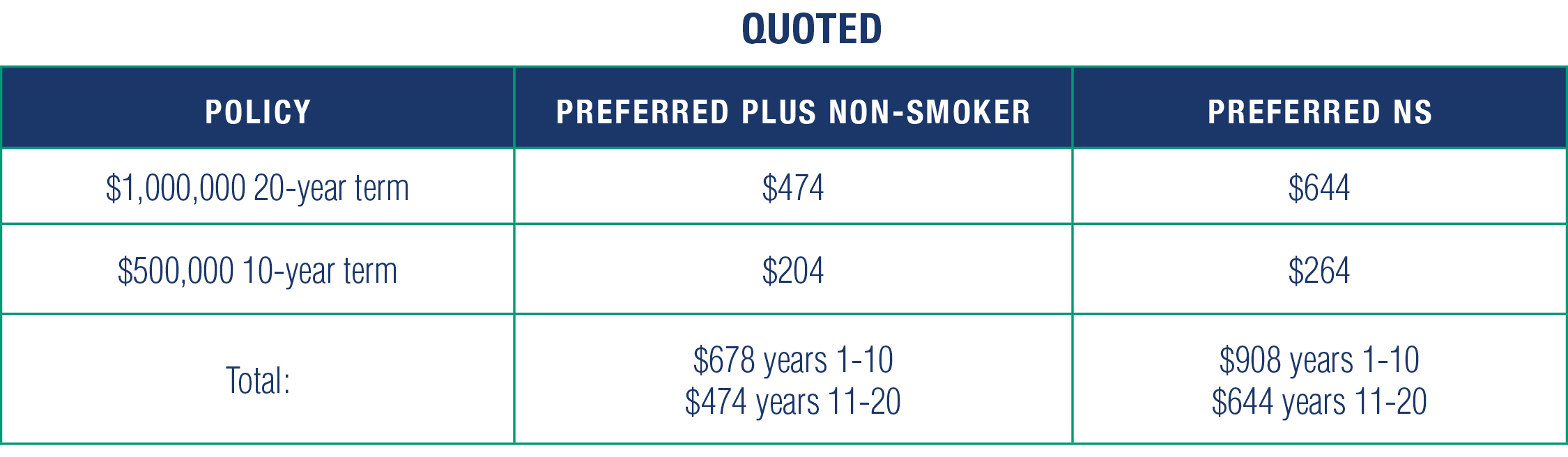

Bobby was in his mid-30s, married with no children, and applying for layered coverage: 20-year term insurance with a face amount of $1 million, and 10-year term insurance with a face amount of $500,000. Based on the information provided, he was quoted:

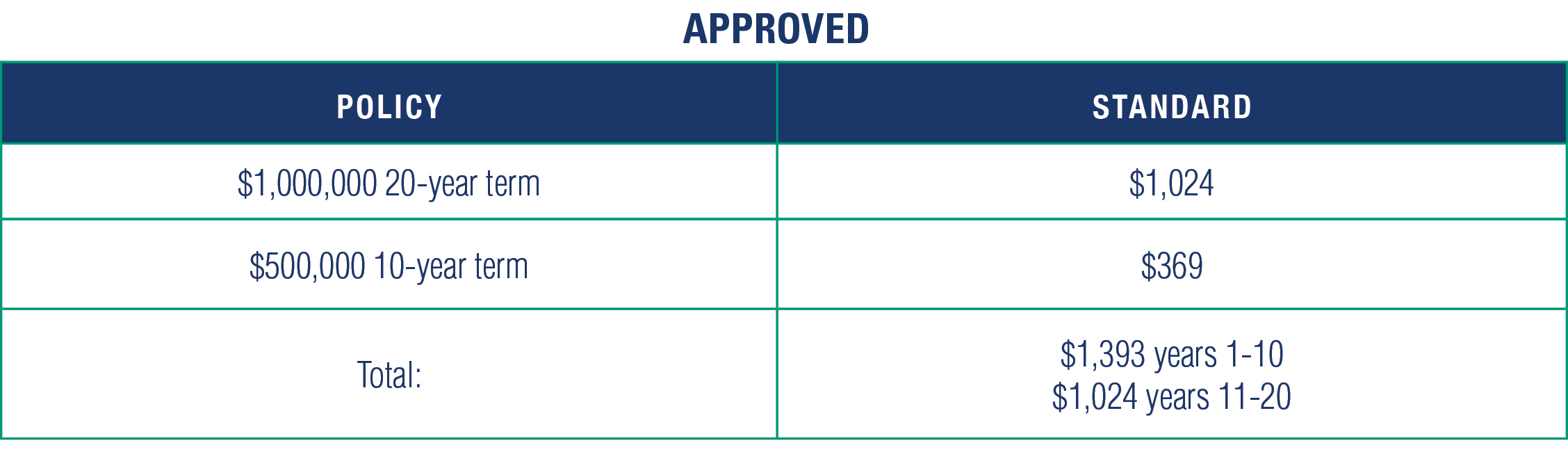

Bobby thought of himself as healthy. He eats good food, exercises, and doesn’t engage in risky behaviors. So when his paramedical exam came back indicating he had high blood pressure, he was more than surprised. And not a happy camper since he was looking at Standard rates and annual premiums $715 higher than Preferred Plus NS for the first 10 years, and $550 higher in years 11-20. That’s an additional $12,650 out of his pocket.

We shared the approval with Bobby and recommended he consult with his doctor to find any recent blood pressure readings we could use as “ammo” toward getting him a better approval. He sent us the following email:

“This is in reference to the higher insurance premiums quoted to me because of high blood pressure readings.

Here's the reason for the discrepancy: There are different sized cuffs for reading blood pressure. Small cuff for smaller arms. Bigger cuff for bigger arms. My doctor guessed the nurse who came to my house -- on behalf of the insurance company -- used the smaller cuff on me. Since I have big arms (and yes, I got a little ego boost out of that, heehee), the smaller cuff squeezed more on my arms and gave a higher reading.”

Both were within normal range.

How does this story end? The insurance company reviewed the additional information and offered Bobby two term policies at the Preferred Plus rate class, saving him $12,650. He happily accepted!

Happy client. Happy advisor. And teamLLIS? Lovin’ Life In the Sunshine, knowing the advisor and his client were happy with our Long Lasting Indispensable Service.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".