ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Layering. Stacking. Staggering. Whatever you call it, it can save your clients money. While the most common time periods for term life insurance are 20- and 30-year term, that's not always the best solution. For most of us, our need for life insurance will change as we age; just like our lives change. We’ll gain assets and pay down or pay off liabilities and debt. Which means our need for life insurance may also decrease.

Real-world example of term layering

One advisor recently asked us to help her 35-year-old physician client (whom we’ll call “Doc”). Doc is a urologist, married, and has two kids (ages 1 and 3). She has a large amount of student loan debt from medical school. And she values their exotic biannual vacations (Malaga, Spain, Costa Rica, Morocco). She and her advisor had calculated she needed $3 million in term life insurance and had set a retirement/financial independence goal at age 65. Doc was in good health, so we determined in our pre-underwriting that she would qualify for the Preferred rate class.

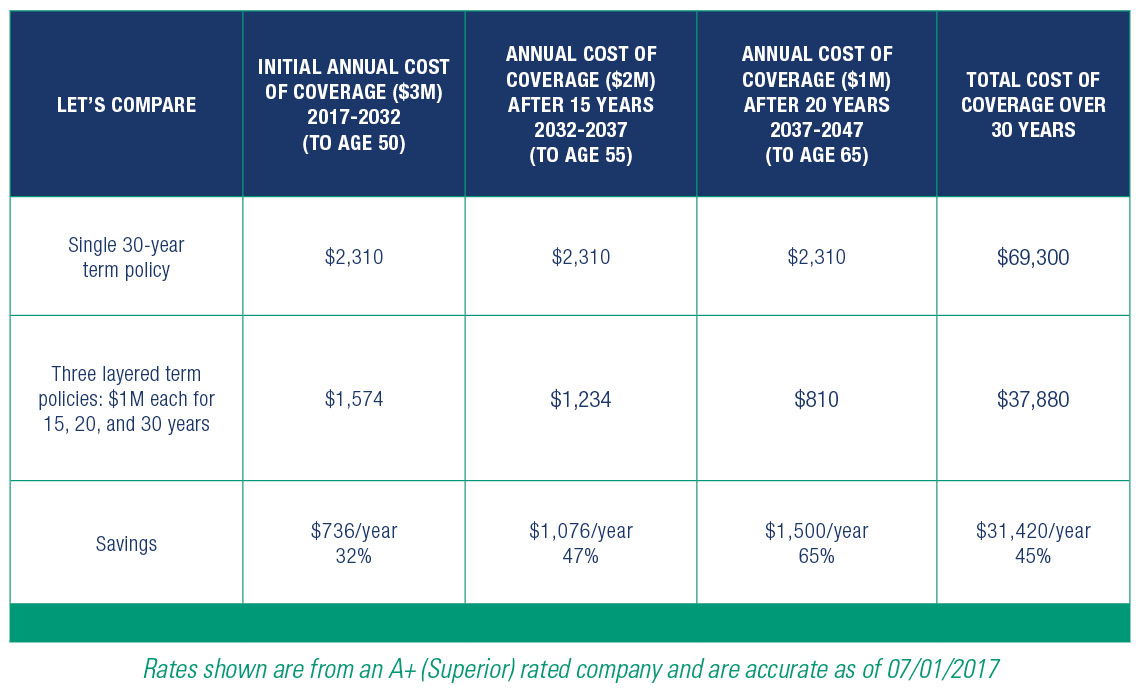

We gave Doc and her advisor these two options:

As each term policy drops, so do her premiums, but she still has the appropriate amount of coverage that suits her lifestyle and her family needs at each term period.

The three layered policies we recommended were with the same insurance company. This provided Doc with bundled rates (similar to buying a 24-pack of soda from Sam’s Club versus a 12-pack from Publix and another 12-pack from Kroger). And she needed just one paramedical exam that was used for all three policies. It is possible, however, to get the layered policies from different insurance companies if those options work best for a client.

Your clients can also layer four term policies, depending on their individual circumstances and needs. And most insurance companies offer terms of 10, 15, 20, 25, and 30 years.

Can layering be the right solution for your clients? Here are some questions to ask them before calling LLIS (or we will ask them for you!):

Another benefit to term layering is flexibility. If Doc’s financial situation changes in a few years, and she no longer needs the same amount of coverage, she can cancel one of her policies without any fees or penalties. Unlike other types of insurance, canceling a term insurance policy is relatively easy; you can either stop making payments on that specific policy, or cancel your coverage in writing. In addition to the money saved, this flexibility provides Doc with two intangible – yet valuable - byproducts: peace of mind and money. Doc plans to put her savings toward their biannual vacations (which is good because they now have two children to take along).

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".