ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Ahhh, fall. That time of year when the temps start dropping, the leaves start changing, and your clients start thinking about the year ahead. And health insurance. But their personal health isn’t the only thing they ought to be considering:

Their financial health is in the balance during open enrollment too. Life insurance and disability insurance are two benefit elections that often get overlooked because “it won’t happen to me” or “I’m healthy, I don’t have to start worrying about this yet.” And open enrollment season is a good opportunity for FOFAs1 to have an open dialogue about life and disability insurance, guide clients, and help them reassess their plans.

Life insurance during open enrollment

Let’s first define the two types of life insurance your clients may have available to them through work:

Group life insurance can be one of the most valuable benefits for your clients whose employers offer it. It’s not uncommon to find offers of $500,000 in coverage for the monthly cost of one barista-prepared coffee confection. And sometimes (as noted above) it’s provided free by the employer.

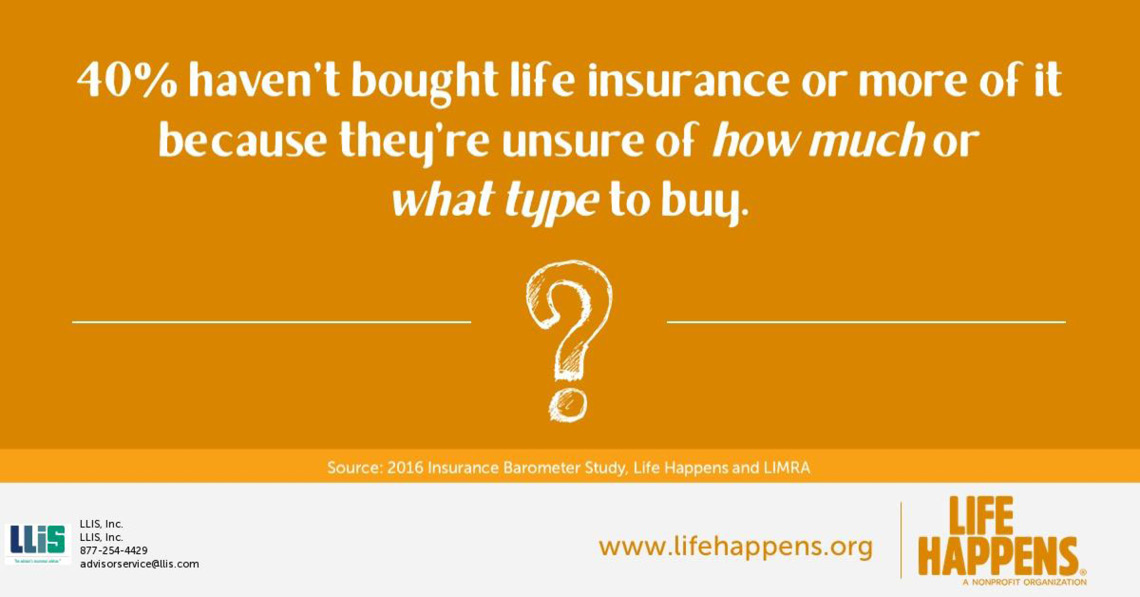

And while they’re considering their group options, this is also a good time for your clients to consider individual life insurance as either a supplement to the employer-paid insurance or in its place. In fact, only 44% of all life insurance policies in 2015 were through groups (which included employers, places of worship, and other associations).2

Here are some questions you should ask your clients about group and individual life insurance this month:

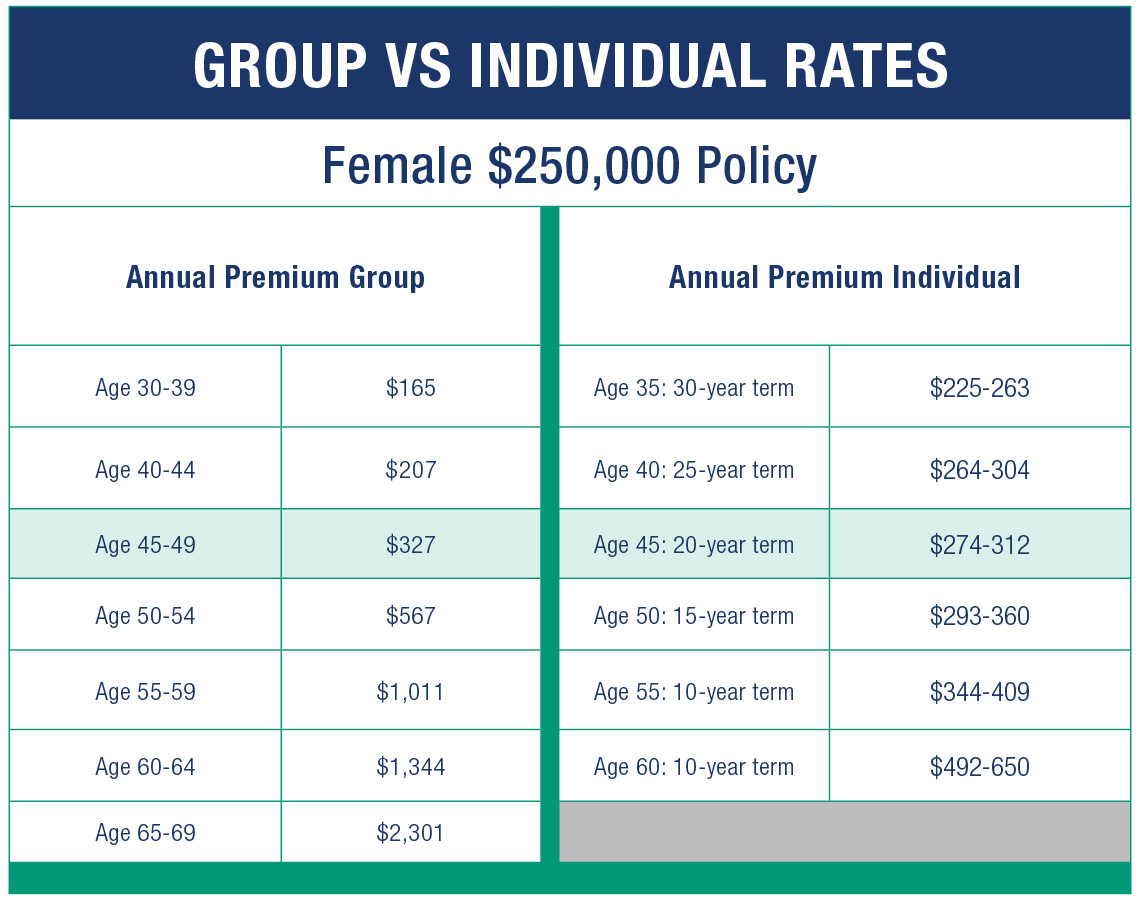

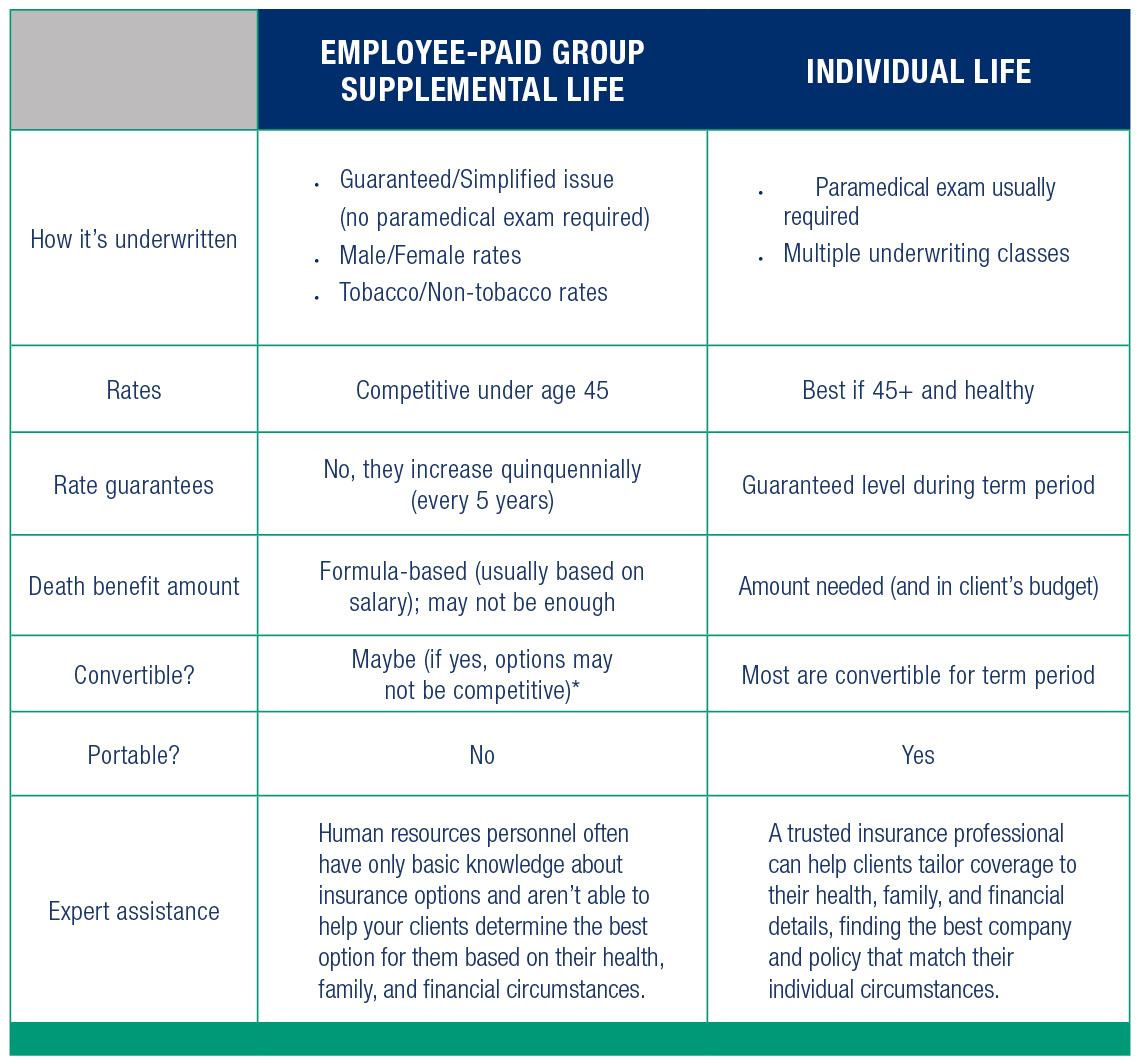

In addition to the employer-paid group life insurance, people often have the opportunity to self-pay for supplemental group coverage during open enrollment. Here is an at-a-glance look at the differences between the types of life insurance available to your clients (not employer-paid):

*They may be able to convert their group policy to an individual one, but it may cost significantly more.

Disability Insurance (DI) during open enrollment

What is your clients’ biggest asset? If they’re not retired, it’s probably their ability to earn an income. That income pays for the little things like their child’s ballet lessons and their weekly designer coffee; and the big things like the mortgage, college, and retirement. Disability insurance is insurance for their income.

During open enrollment, most employees think about health insurance and contributions to their employer-sponsored retirement plan. But what if they were unable to continue those contributions? 62.1% of all bankruptcies involved a medical event. Common diagnoses and the mean out-of-pocket expenses tied to them include3:

Non-stroke neurologic illnesses like multiple sclerosis: $34,167

Diabetes: $26,971

Injury: $25,096

Stroke: $23,380

Mental illness: $23,178

Heart disease: $21,955

A recent Harvard University study revealed that 72% of individuals who filed for bankruptcy due to medical expenses had some type of health insurance, which debunks the myth that only the uninsured face financial catastrophes when hit with large medical bills.

Without DI to keep income coming in, dreams of a beach condo may become a nightmarish shared hospital room in the event of a disability. Most people haven’t planned for replacement income if they couldn’t work due to illness or injury. And most don’t consider it until they have a family member, friend, or co-worker experience a medical challenge that brought about financial challenge. But most don’t have you.

Open enrollment is a good time for you to talk to your clients about individual disability insurance as either a supplement to the employer-provided insurance or in its place. Here are some questions you should ask your clients about group and individual DI this month:

What happens if your clients have both an individual DI policy and a group policy? Their individual policy will always be the primary one and will pay full benefits regardless of any other benefits and cannot be reduced. But the opposite is not always true. Group disability policies often offset against Social Security benefits, workers’ compensation benefits, or other group insurance benefits, but they almost never offset against benefits from individual disability policies.

And what about their internet research? If your clients have done any looking on their own, they probably think they can't afford disability insurance. That's where a trusted resource like LLIS comes in. Our DI experts, up-to-date knowledge about the market, and individual attention make budgets and policies align. We can customize a plan that provides the needed protection and keeps it affordable by substituting or removing benefits that put costs beyond their reach or aren't among their biggest concerns. Everyone on teamLLIS is salaried, so commission is never a consideration when working with your clients. And since service is the only thing we sell, we work just as hard on a policy with a $5,000 monthly benefit as we do on a $15,000 one.

The good news is that more employers are offering group long term DI insurance.

However, fewer employees were insured by long term DI insurance benefit plans. We suspect that one reason for this decline is that people are choosing to purchase their own income replacement plans, separate from their employers.

Short-term Disability (STD)/Long-term Disability (LTD)/Workers’ Comp

Most advisors we work with counsel clients to build an emergency fund to self-insure a short-term disability, and purchase a long-term disability policy for long periods out of work. But LLIS helps clients with both types (STD and LTD) to offer options for every client’s circumstance.

STD: the most common causes are pregnancy, injury, and digestive disorders

LTD: the most common causes are back problems (and other joint and soft tissue pain), cancer, mental health, and heart disease.

Those are pretty common issues and probably ones your clients face themselves or know people who do. It's important for individuals to have this type of coverage, and also for employers to offer it (DI is a great employee retention and benefit tool).

Your business owner clients simply provide LLIS with a census that indicates names, dates of birth, occupations, and salaries of employees. We provide them with a quote that covers their group (typical STD is 60% to $5,000/month max and LTD is 60% to $6,000/ month; more is available if the group is a high wage earner type group) and work with them to ensure premiums meet their budget and coverage meets their needs.

“I’m covered by worker’s comp” is a response advisors tell us they hear often from clients when the topic of disability insurance comes up. But:

So don’t let the conversation end there.

Learn more about disability insurance here.

Click here for an at-a-glance look at group vs. individual DI.

During open enrollment season, don’t forget that not all clients have access to group DI. They need your help (and ours) even more!

Time is of the essence

It’s always a good idea to look at options. With LLIS helping your clients, we do the shopping for them to find the right insurance company and the right insurance policy. Even if the cost of an individual policy is slightly higher than their group coverage, it’s still probably a better bet because of its portability. Help your clients choose wisely.

Contact these teamLLIS members about open enrollment and individual policies for your clients:

Jerry Skapyak (life insurance)

Kathy Bilodeau or Brian Ciccarelli (disability insurance)

1 FOFA=Fee Only Financial Advisor

2 American Council of Life Insurers

3 The American Journal of Medicine, 2009 study

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".