ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2018

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

There’s a common misconception that small- to medium-size businesses can't or shouldn’t offer group life and disability insurance to their team members. But that’s far from the truth. Here are some real-life LLIS client examples to show you how it’s being done.

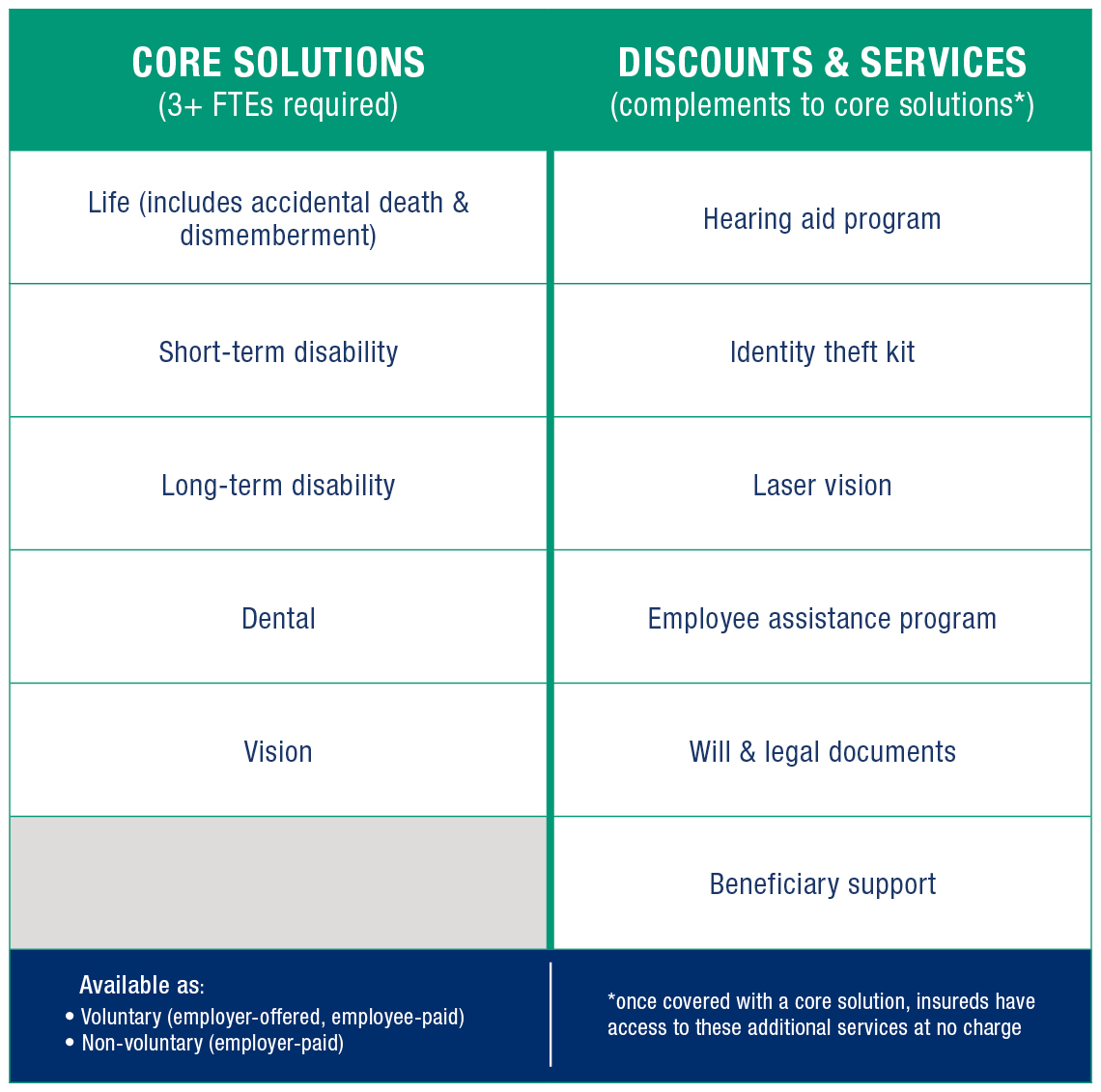

Let’s start with the types of group insurance LLIS can help your clients with and that form the basis for this article:

Once we start working with you and/or your client, there is some basic information we need to know to help us determine which insurance company(ies) to recommend and to provide initial quotes:

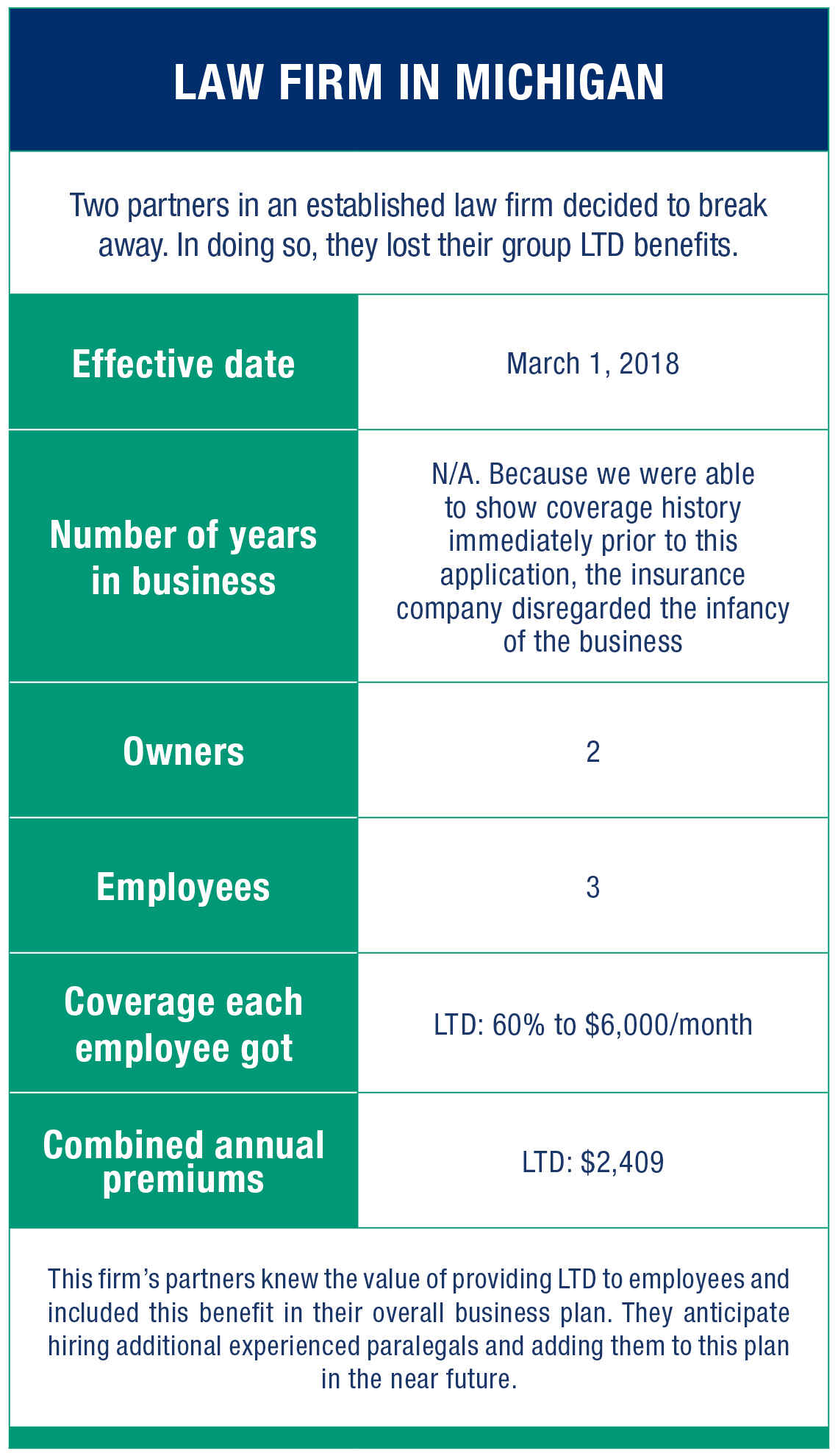

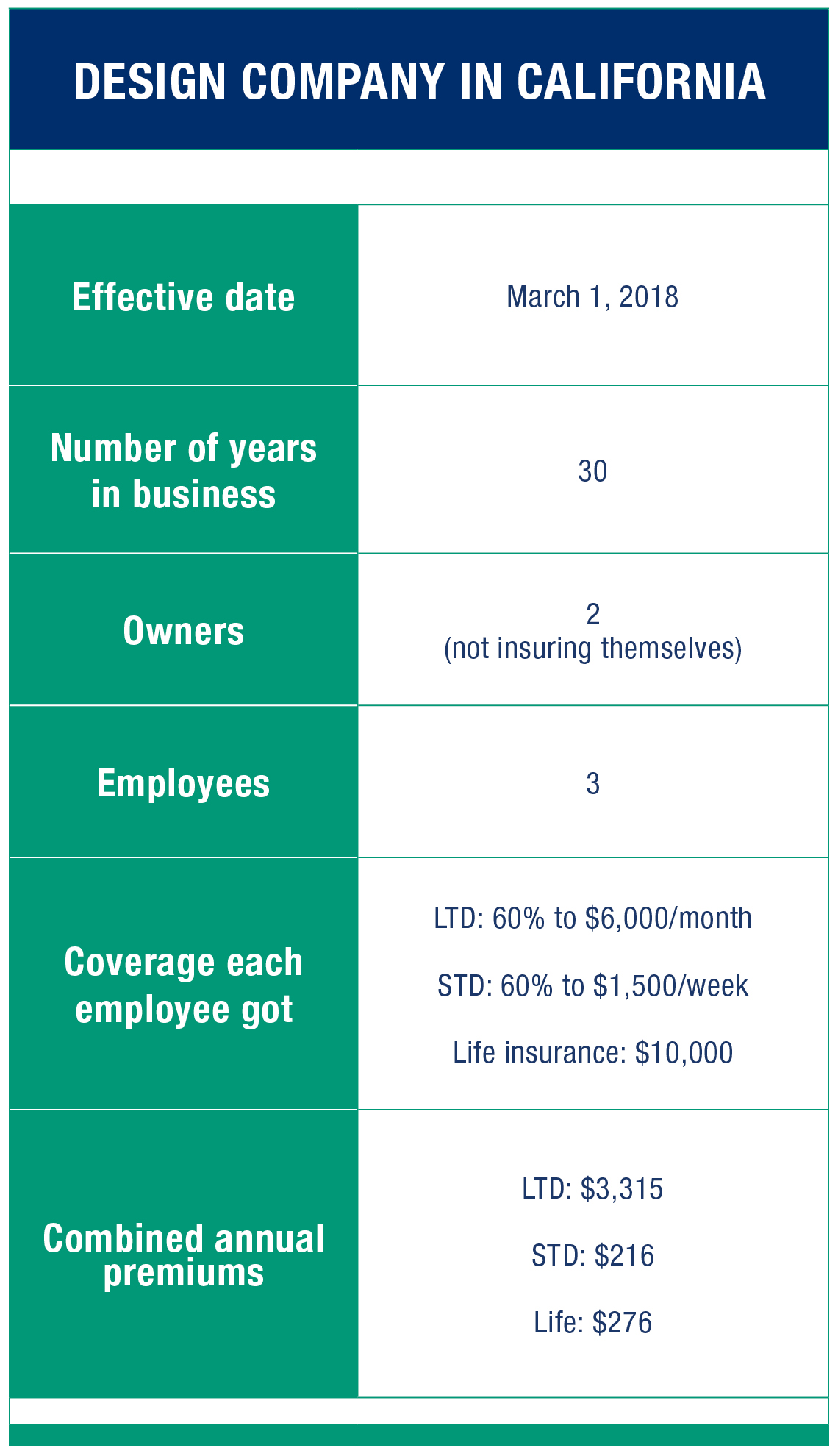

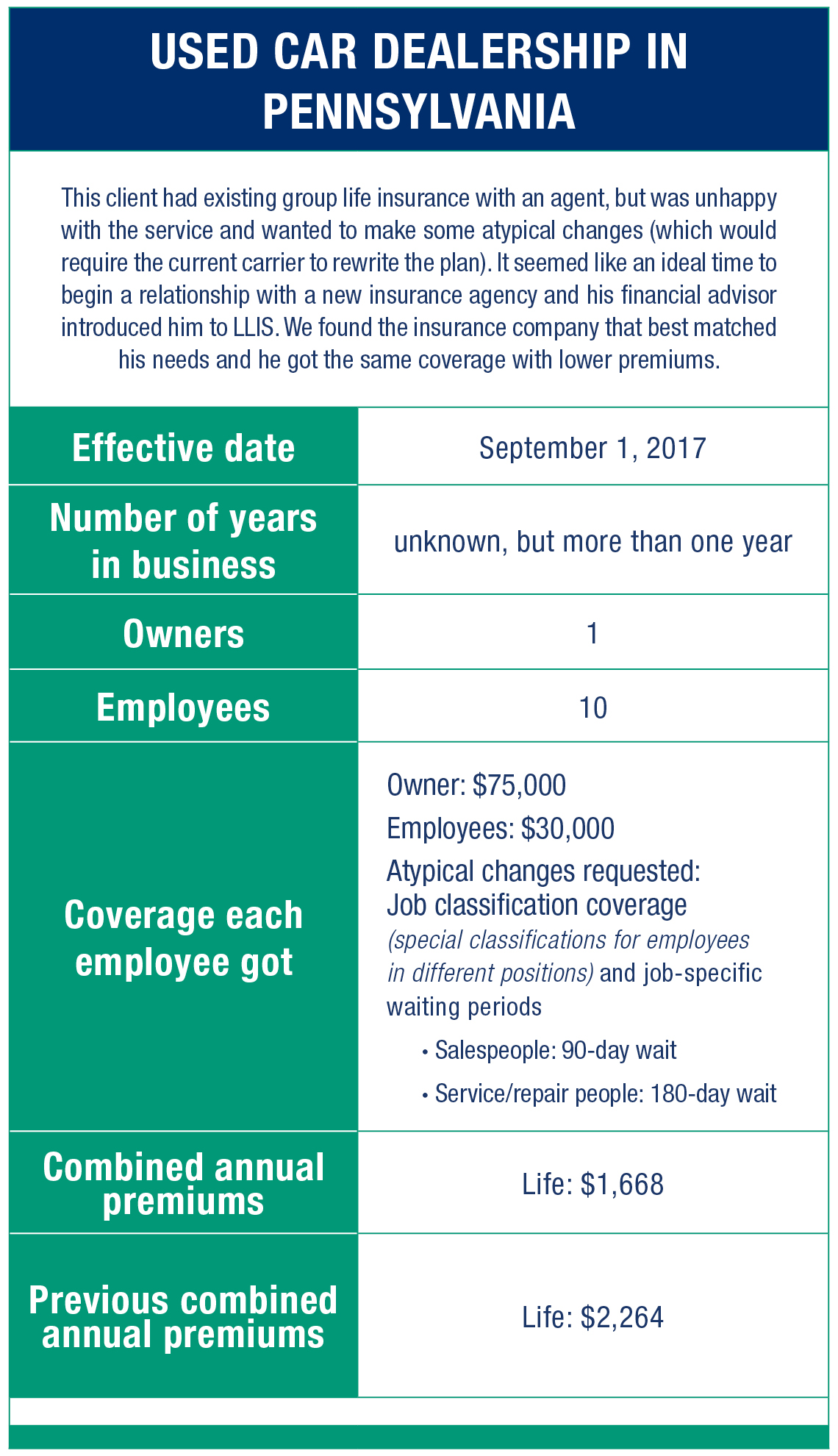

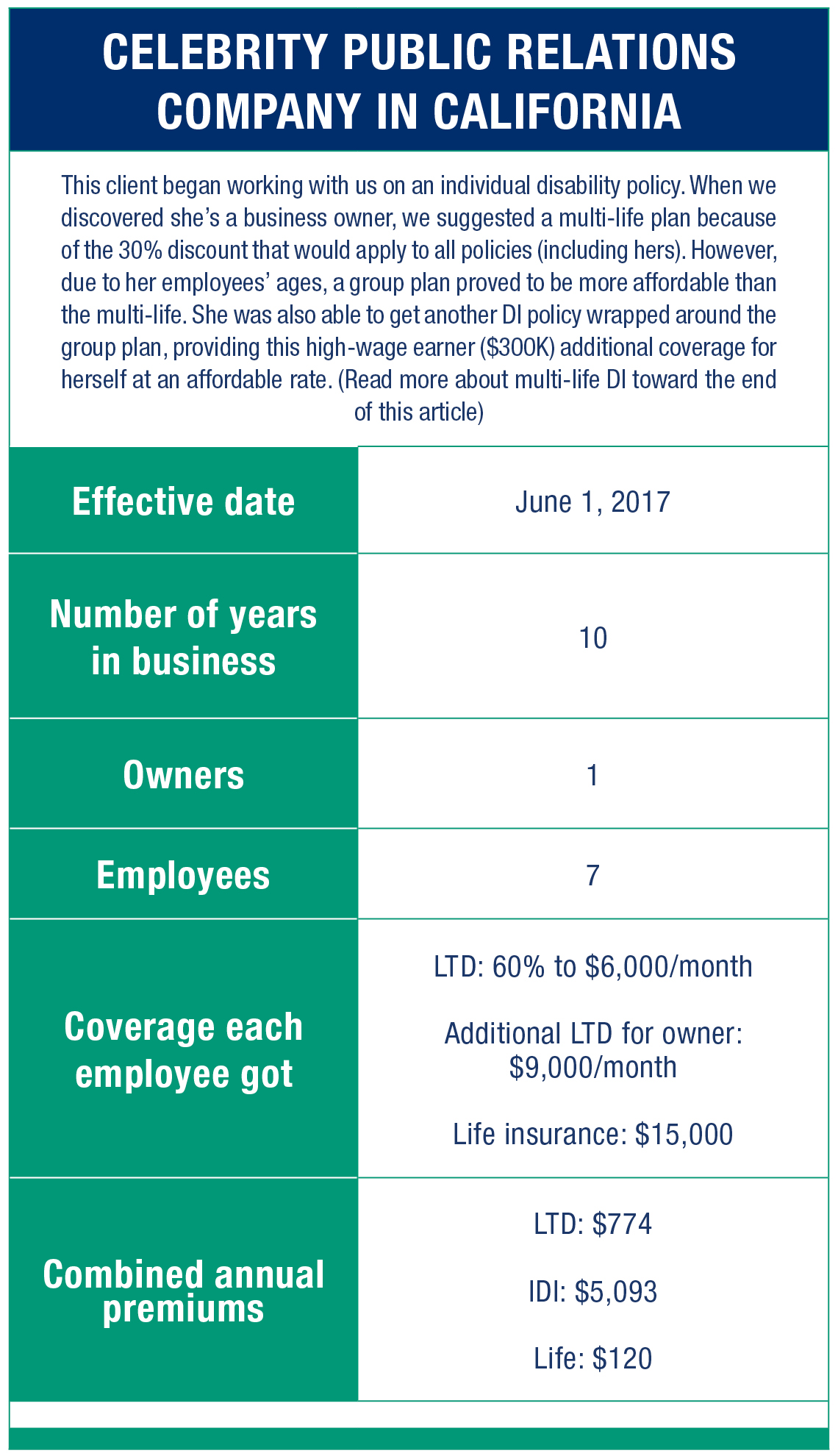

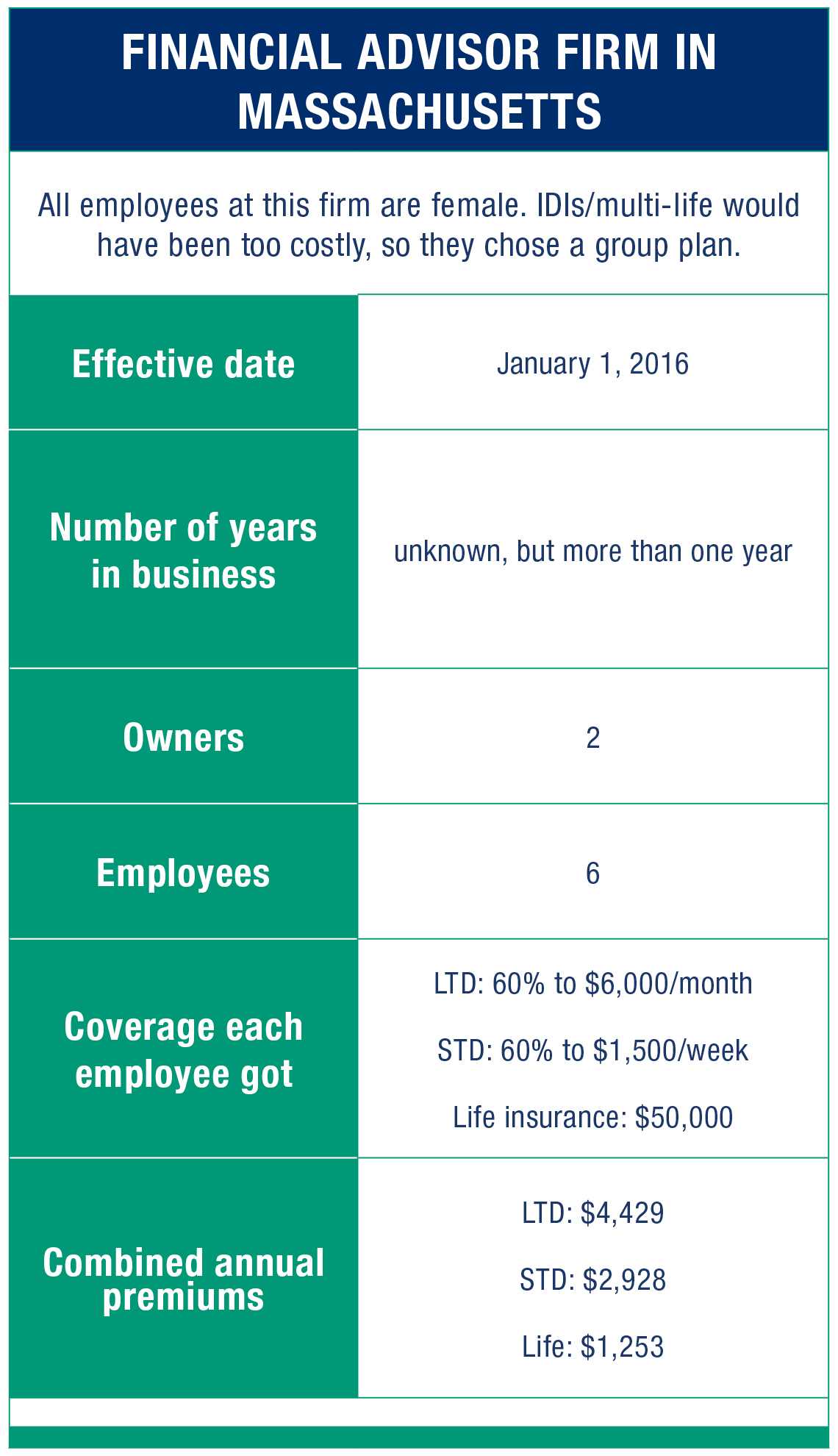

Here are the stories of some clients LLIS has worked with recently. (Note: all are non-voluntary (paid by the employer); the clients realized value in offering this as an employee benefit and in savings by doing so.)

More about Multi-life

You’ve seen how group coverage can be a terrific benefit for employees and owners of small- to medium-size businesses. And we introduced you to multi-life coverage with its accompanying discounts. Here’s more about this solution that’s ideal when group coverage isn’t a viable option or isn't the best option:

Here is an example of how one client used the multi-life program in her practice:

A female dentist purchased an individual LTD policy for herself. Soon after, she decided to offer an employer-paid basic DI policy as a benefit to her two hygienists (also female), and the coverage then became multi-life. How did this dentist benefit?

And there’s one more way we can help your clients with small- to medium-size businesses save money on DI:

The 10% Affiliation Discount*, applicable in the following scenarios (either voluntary or non-voluntary since all policies are IDI):

*not available to medical professionals

Your business owner clients are probably not familiar with these plans. We’re here to help. With simple explanations or intricate ones. For hypotheticals or actual client needs. And because income protection is critical to your clients, LLIS has two subject matter experts to assist. You can reach us at (877) 254-4429 or Kathy Bilodeau or Brian Ciccarelli.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".