ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2018

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

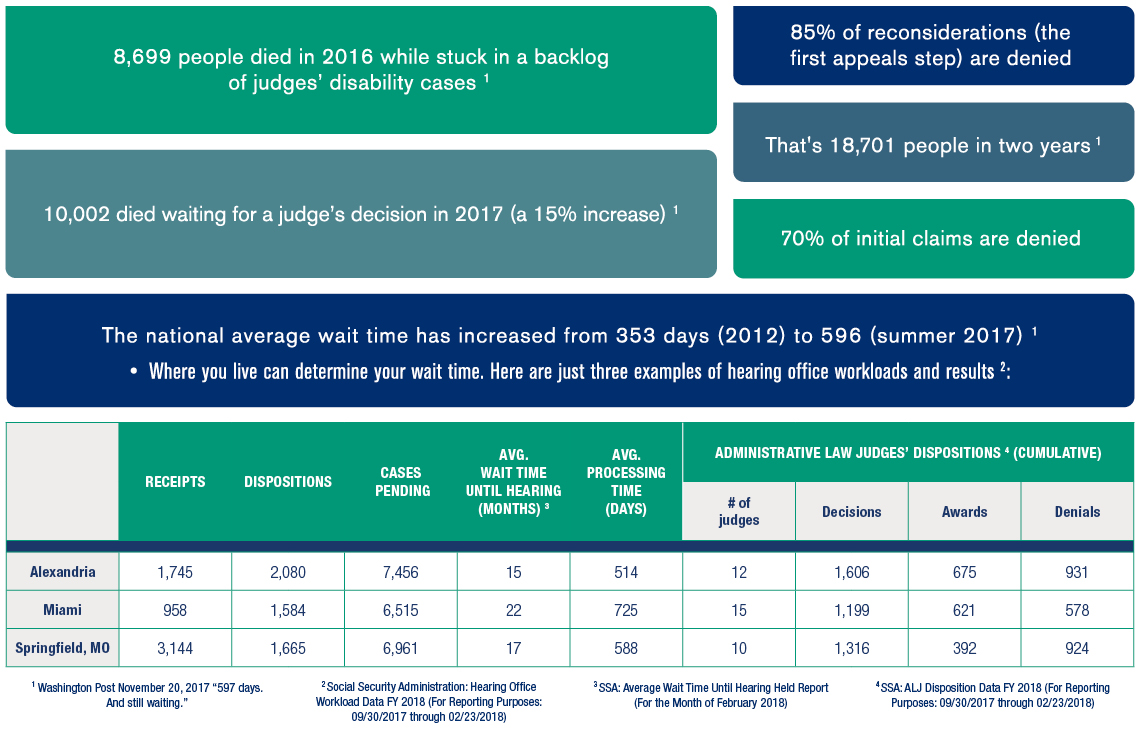

Most advisors we work don’t typically have a client base that will fall into this category. But there is the occasional instance when a client isn’t in as secure a financial situation as they (or you) would like, and there are more times than not when they have a family member or friend who says they’ll turn to SSDI in the event of a disability event.

But facts are facts, and they’re not in favor of these individuals.

Three major factors are to blame for these issues:

There isn’t enough to go around. There are too many people and not enough money.

Many Americans simply could not survive without an income stream for two years. During this wait for SSDI, the individual is unable to work. And the losses mount.

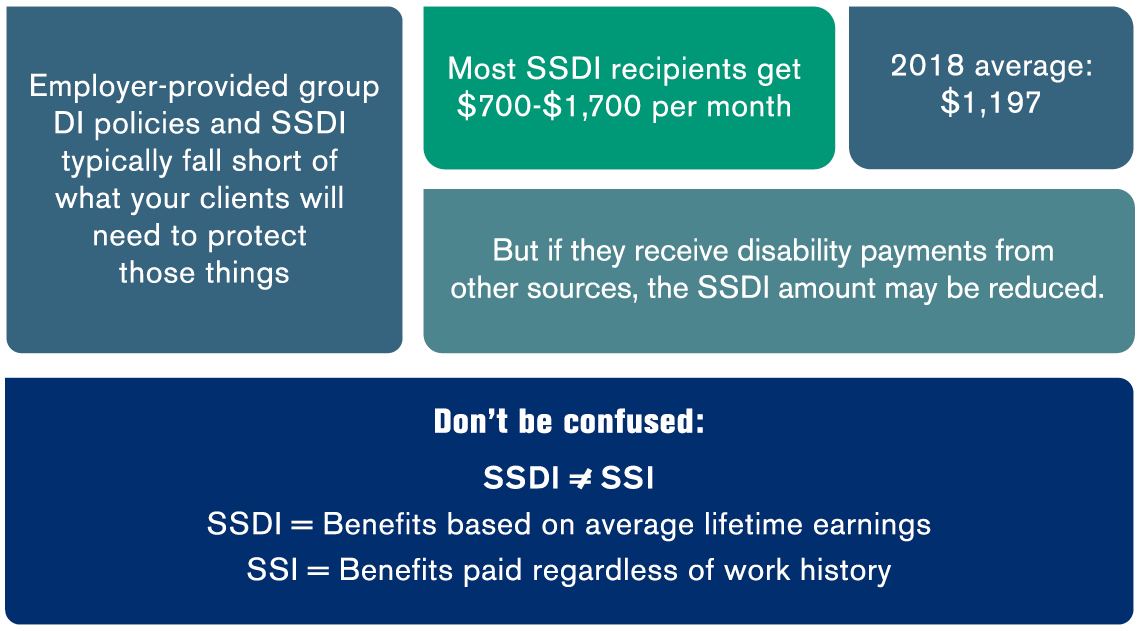

It’s no surprise that, while LLIS’s disability experts evaluate each of your clients’ distinct situations, they usually recommend some type of individual DI policy, even if they have a group policy through work or think they would apply for SSDI. Why add an individual policy to a group one and/or SSDI? One word: Protection.

This chart shows the distinctions between employer group and individual DI policies.

The problem is also the solution: not enough people have protected their income with disability insurance.

In fact, 51 million working Americans are facing a growing crisis: a lack of adequate disability insurance coverage to protect them in case of illness, injury, or pregnancy. That's equivalent to the populations of Florida and Texas combined.1

Most of your clients probably couldn't survive on $1,700 (the largest possible SSDI monthly payment) or on a group policy’s 60% max of their pre-disability income.

And we can help you help them understand that. We have website tools and two DI specialists at your service.

Kathy Bilodeau | Brian Ciccarelli | https://llis.com/advisors/advisor-tools | https://llis.com/clients/client-tools

1 American Council of Life Insurers

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".