Some disabilities go away. Some don’t. It isn’t easy either way, but there are things you can do to help ease the transition to this new way of life.

Grieve.

- Grief is usually associated with death. But there are many other times in life when we grieve. And everyone grieves differently. Do it however you need to.

- Before disability and now may be two completely different scenarios.

- Chronic sorrow: a term Simon Olshansky coined in the early ‘60s. Olshansky, director of the Children’s Development Clinic in Cambridge, MA observed parents of mentally handicapped children experiencing caregiving burdens that triggered chronic sorrow, a normal grief response to their sense of loss often triggered by life events like birthdays, and peers marrying and having children. You don’t get over chronic sorrow; but you do learn to live with it.

- The five stages of grief: Elisabeth Kubler-Ross developed this theory in 1969.

- Denial

- Anger

- Bargaining

- Depression

- Acceptance (when the emotional pain begins to decrease)

File a claim. Immediately.

- Each insurance company has a standard packet of forms to be completed, but those forms are standard only to that company (not industry).

- For Group DI: claim forms and filing information will be available from the employer’s HR department.

- For Individual DI: claim forms and filing information will be available from the insurance company.

- Get all your ducks in a row. Compile and review (and re-review) all the forms, statements, and records, then submit them to the insurance company to review. Typical medical and vocational evidence and forms required: claimant’s statement, financial documentation, medical records, doctors’ opinions and evaluations, functional capacity exams, and other relevant information to prove you’re unable to work.

- Alert doctors to expect phone calls from the insurance company.

- Stay on top of things and, if the claim is denied, file the appeal as soon as possible.

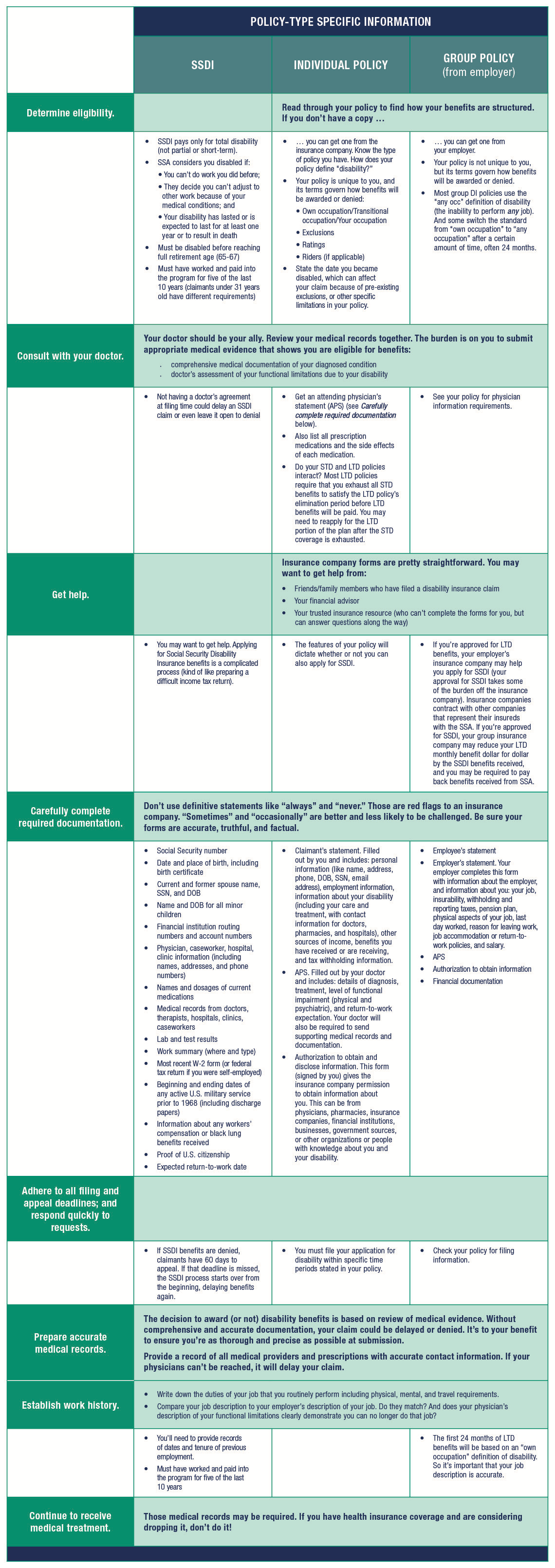

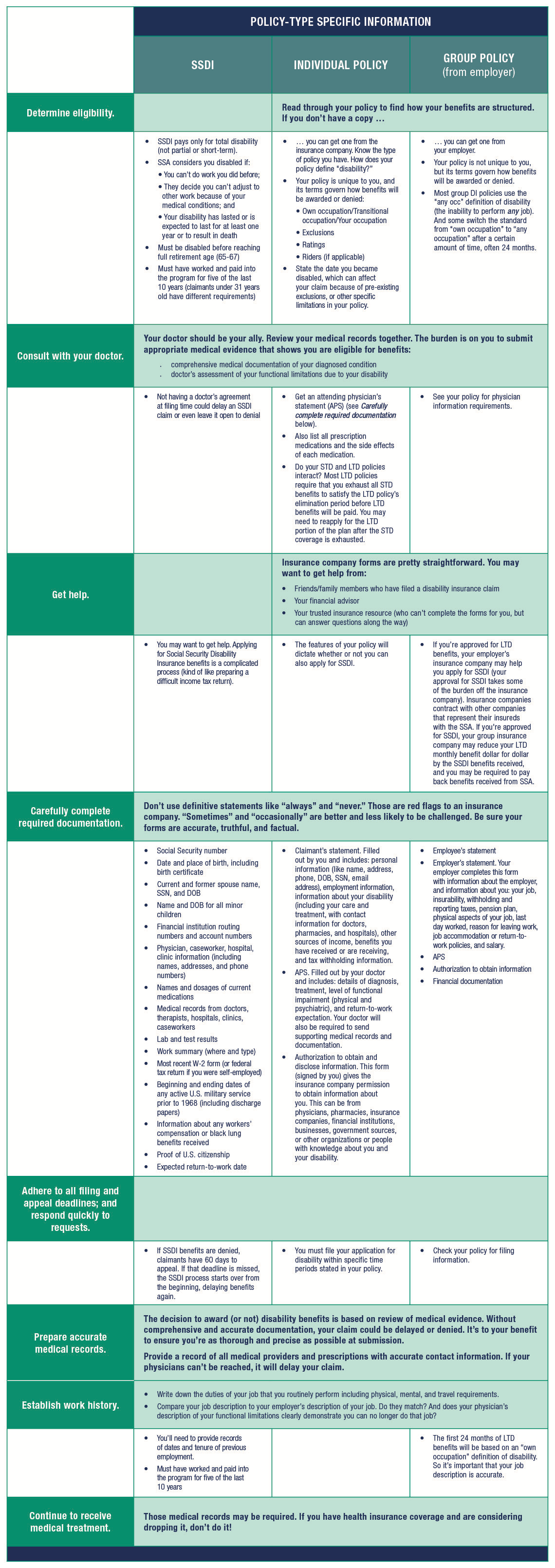

- Here is a checklist of things they should have/do when filing the claim:

Find meaning.

- Meaning in your relationship with the disabled person and in your own life. What do you love most about that person? Will your new role include being an advocate for the cause of your loved one’s disability? If you become a caregiver, it’s often noted that caregivers grow and change along with the person in their care.

The disabled individual must also find meaning. He or she was probably used to getting up and going to work every day. How will that time be spent now?

Adjust to the new normal.

- What used to be may not be anymore. And comparing this new life to pre-disability life or other people’s normal will only end in disappointment.

- Talk to a professional.

- Celebrate the disabled person’s achievements. Running a marathon may not be in his or her future, but there will be other milestones to cheer.

- The disabled individual must also adjust expectations. He or she was probably used to getting around without assistance: driving, walking, making their own plans. How will all of that happen now?

Make adjustments to the home/car.

- These can be adjustments for safety or for ease, or both.

- The internet can be a helpful source for the adjustments specific to your loved one’s disability.

- Consult with an occupational therapist.

- The DI company may provide a professional to help with these adjustments. Check the policy.

Allow others to help.

- The professional services available will depend on where you live. There are day programs, respite workers, companion visits, medical professionals.

- The disabled individual’s doctor and/or occupational therapist can help identify these in your area.

- Family and friends will want to help too. Let them! Imagine if the scenario were reversed and you were offering to help someone else. They can run errands, lend a shoulder, visit, and even help with caregiving.

- Accepting help may be difficult for your disabled loved one. Be patient with him or her and be encouraging about accepting the help. Remind your loved one that people aren’t helping because they feel sorry; they’re helping because they want to, and they would want help if the roles were reversed.

Seek therapy.

- It can help the disabled individual with accepting loss, finding new meaning and strength, and accepting assistance.

- It can help you manage your emotions and frustrations, face difficult decisions, and support your loved one.

The disability of a loved one is not an easy time, whether it’s for the short term or the long term. And it comes with many – and large – expenses. While a disability insurance policy can’t help your clients grieve and find meaning, it can help them adjust to the new normal, pay for professional help and changes to the home, plus other important and costly things like transportation, medical bills, groceries, credit cards, and household expenses.

When your next client plan calls for insurance to protect their income, contact one of LLIS’s disability insurance experts for assistance: Kathy Bilodeau or Brian Ciccarelli.

![]() (877) 254-4429

(877) 254-4429![]() (877) 254-4429

(877) 254-4429