ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

THIRD QUARTER 2018

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

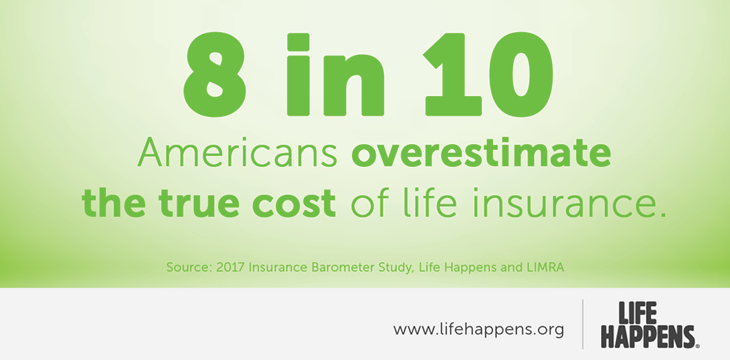

Life insurance should be a part of your clients’ financial safety net. But we often hear, and advisors have told us they do too, that life insurance is just too expensive.

Most of the time, that objection comes from a lack of knowledge or a myth that your clients have heard and believe. But affordable life insurance is possible for most of your clients. And not having it can cost their loved ones dearly.

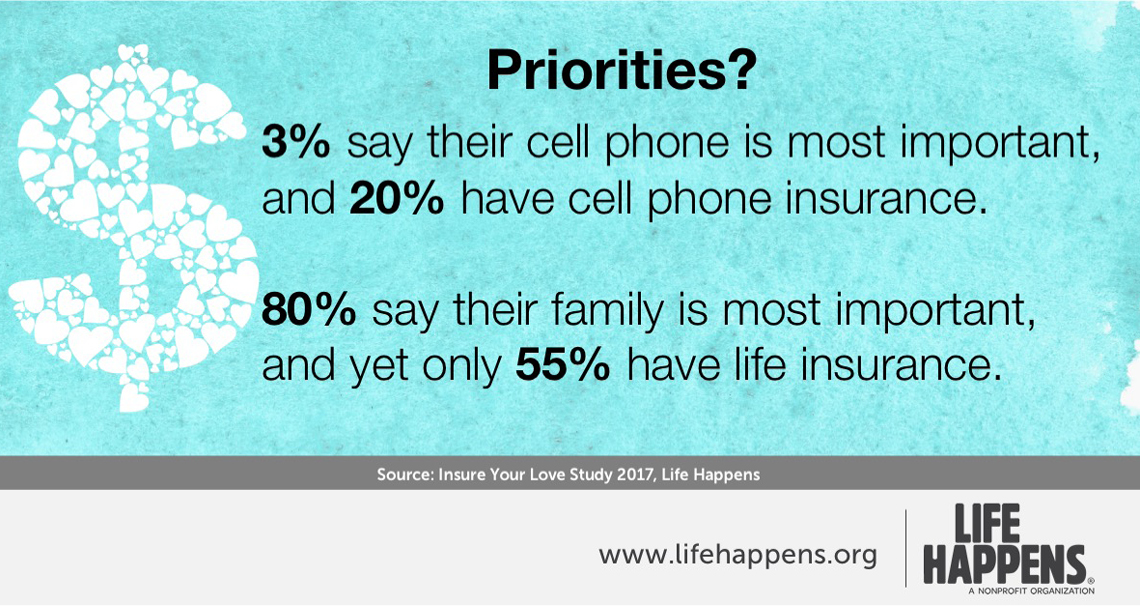

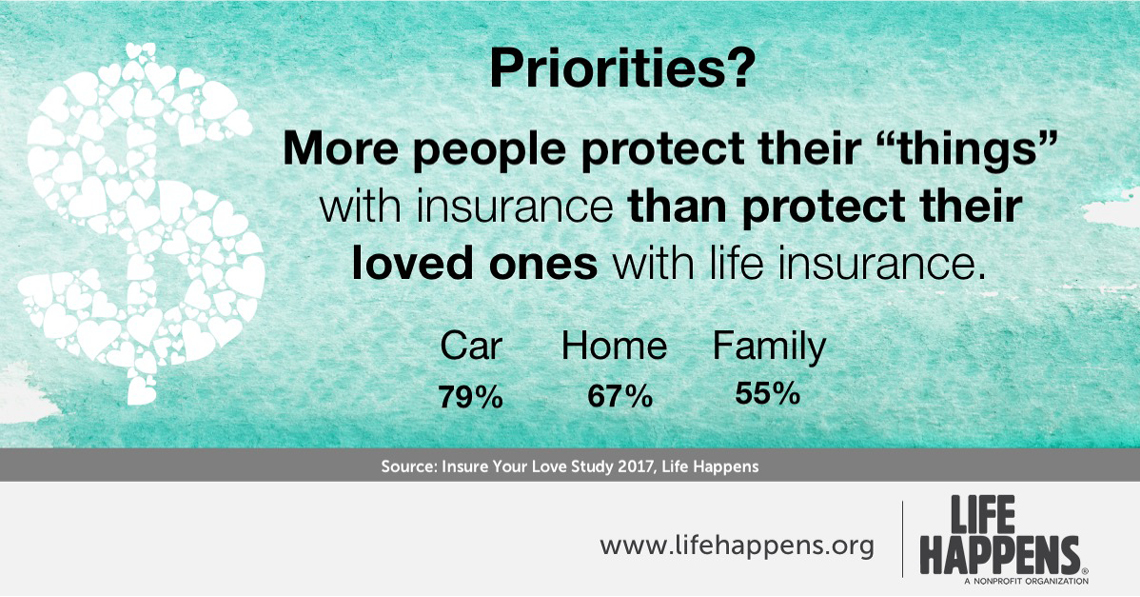

It often comes down to shifting priorities:

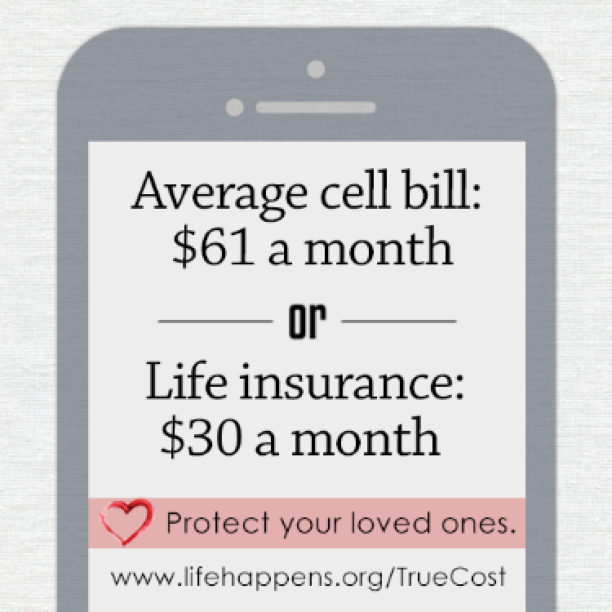

Or shifting spending patterns:

Life insurance costs depend on a number of factors including the classification, coverage amount, riders chosen, type of policy, and term length.

Classification

Classifications vary depending on insurance company and your clients’ underwriting. A number of factors determine their classification (which, in turn, determines their premiums) including:

You can learn more about underwriting classifications here.

Coverage amount

Determining this involves two questions:

As you probably expect, policies with higher face amounts cost more, and so do policies that last longer (referring only to term insurance).

Determining #1 is usually a factor of their income and assets. Does anyone depend on them financially? If they were to die, would their family members be able to maintain a similar style of living? Is the coverage needed for end of life expenses? Funeral expenses? Is it for a business partnership? What is the value of the business? What are their long-term financial obligations? The 10X income rule is the most simplistic way to help your clients determine coverage needed. LLIS can help, and we have a calculator on LLIS.com to get you started.

Determining #2 requires a deeper dive. For instance, a 30-year-old client couple’s needs may change through the years. If they have children, they may want coverage until those kids are out of college and self-sufficient. If they have a 30-year-mortgage, they may want coverage until that mortgage is paid off. How long do their financial obligations stretch out?

Coverage amount will also depend on how many people are being insured by the policy. When two people are seeking coverage together, a joint policy may be their best option.

Do you know a couple who always wears matching Christmas sweaters? Or always goes as salt and pepper or Batman and Robin for Halloween? Sometimes this togetherness can be annoying, but when it comes to life insurance, insuring two people with one policy may be cheaper in the end.

Most joint life insurance policies are permanent, like universal life (UL), and have cash values that can earn interest. UL policies are usually more expensive, but their cash value can provide flexibility. There are also joint term life insurance policies that expire after 20 or 30 years.

Proceeds from these second-to-die (aka survivorship) policies are paid out after both policyholders are gone. They’re best for your clients who don’t need income replacement after the breadwinner dies or who do need the death benefit to pay for end of life expenses, estate taxes, or funeral expenses. It’s also good for clients who want the proceeds to leave a legacy to heirs.

Riders

Riders can add more protection (against illness, financial woes, and family member coverage), but they can also be expensive. That's why teamLLIS recommends them only in specific cases and on an individual basis. Here are some of the ones we find most beneficial for your clients:

Policy type

Life insurance comes in many different forms. Term is the most common and most affordable; permanent policies are more expensive but have extra perks, like an investment-style cash component. Typically, teamLLIS recommends term life and universal life, depending on the age, life circumstances, and budget of each of your clients.

You may have heard this before: Everyone should buy term and invest the difference. As a general rule, this makes sense. But a permanent policy may fit your clients’ needs better, especially if they need coverage for their entire lives (to provide for a special needs child or family member; to cover estate taxes; to act as an investment if they need the life insurance, are in a high tax bracket, and have maxed out all other tax-advantaged options).

We’re often asked why we don’t normally recommend whole life policies. Simply put:

Universal life, on the other hand, is a flexible premium so your clients can choose how to pay, whether they want to pay all years, 10 years, etc.

When does LLIS recommend whole life policies? When a parent or grandparent wants to purchase life insurance for a child, with dividends purchasing life insurance additions every year for a growing death benefit going forward.

Term length

When term insurance is the best solution for your clients, determining the length of coverage is the next decision.

As mentioned under coverage amount, the term of the policy(ies) depends on the financial obligations of your client and their individual circumstances.

Term insurance policies generally come in the following term periods: 10, 15, 20, 25, and 30. And with premiums that are guaranteed to stay level during that period. Most people, and some insurance representatives, are unaware of a practice called term layering (aka, term laddering). It’s often a less expensive option for your clients and provides them the right amount of coverage as their insurance needs change.

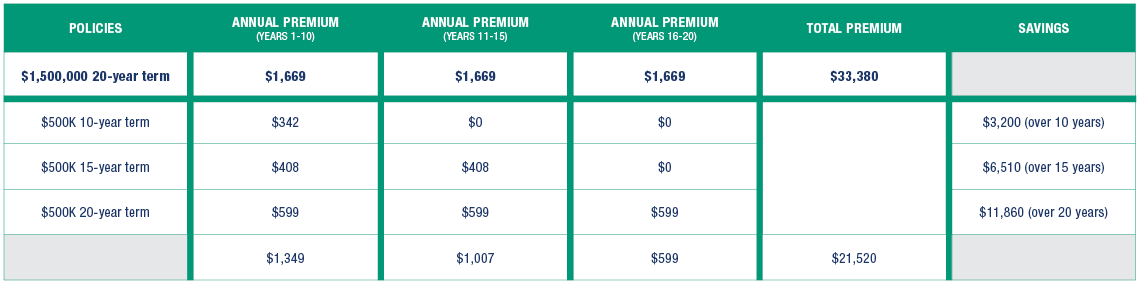

Take Abraham and Erica for example. They’re a married couple with two kids: Sam, 11 and Sara, 8. They determined – along with their advisor – that a $1,500,000 policy covering Sam would be needed for the next 20 years. They came to LLIS for a quote. Abraham qualified for standard non-smoker rates and his annual premium would be $1,669. Our advisor services expert suggested term layering to better suit their changing needs and to save them money. This is how his term layering worked out:

| When term is the best solution for your clients, teamLLIS recommends policies that have a conversion option, basically locking in a death benefit payout for their beneficiaries. It allows them to convert their term policies to permanent ones at the end of the term period. This is a great option for clients who need coverage for a longer period than originally anticipated or for clients whose health has declined (since no underwriting or exams are required). LLIS will even send your clients (and you, if you want) our NOTE (Notification of Term Expiration) so they don’t miss any important deadlines. |  |

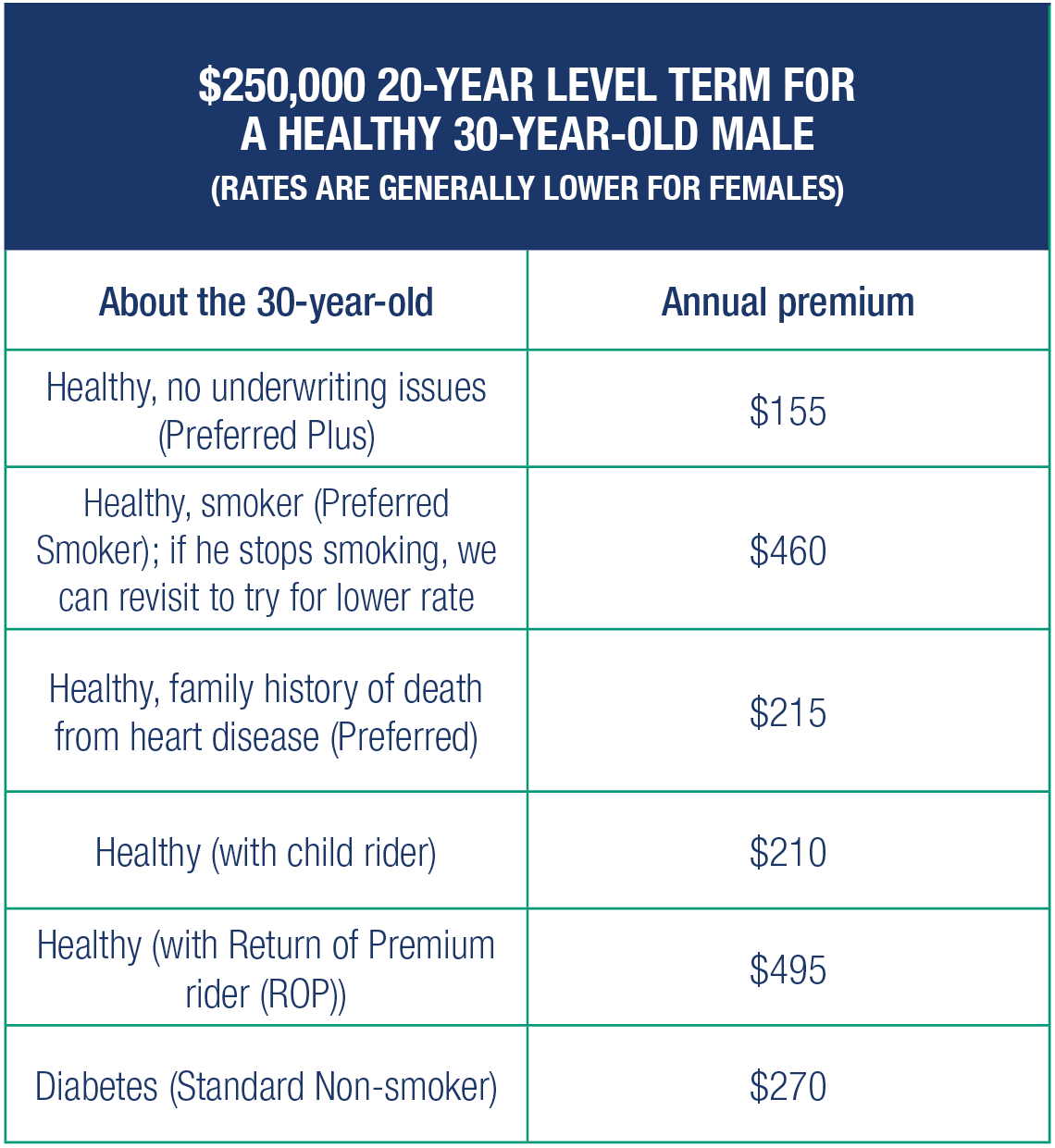

In a recent survey1, 66% of Americans said they didn’t purchase life insurance because it’s too expensive. LIMRA’s 2017 Insurance Barometer Study asked people what they thought a $250,000 10-year level term life insurance policy would cost for a 30-year-old male in good health. The median estimate given was $500, proving that there’s an overwhelming lack of awareness. Here’s the reality (and, because we would not recommend a 10-year term policy for a 30-year-old since he’s in his highest income earning years, we’re insuring him for 20 years):

Even a client with a health condition can get good rates, depending on the condition and its severity.

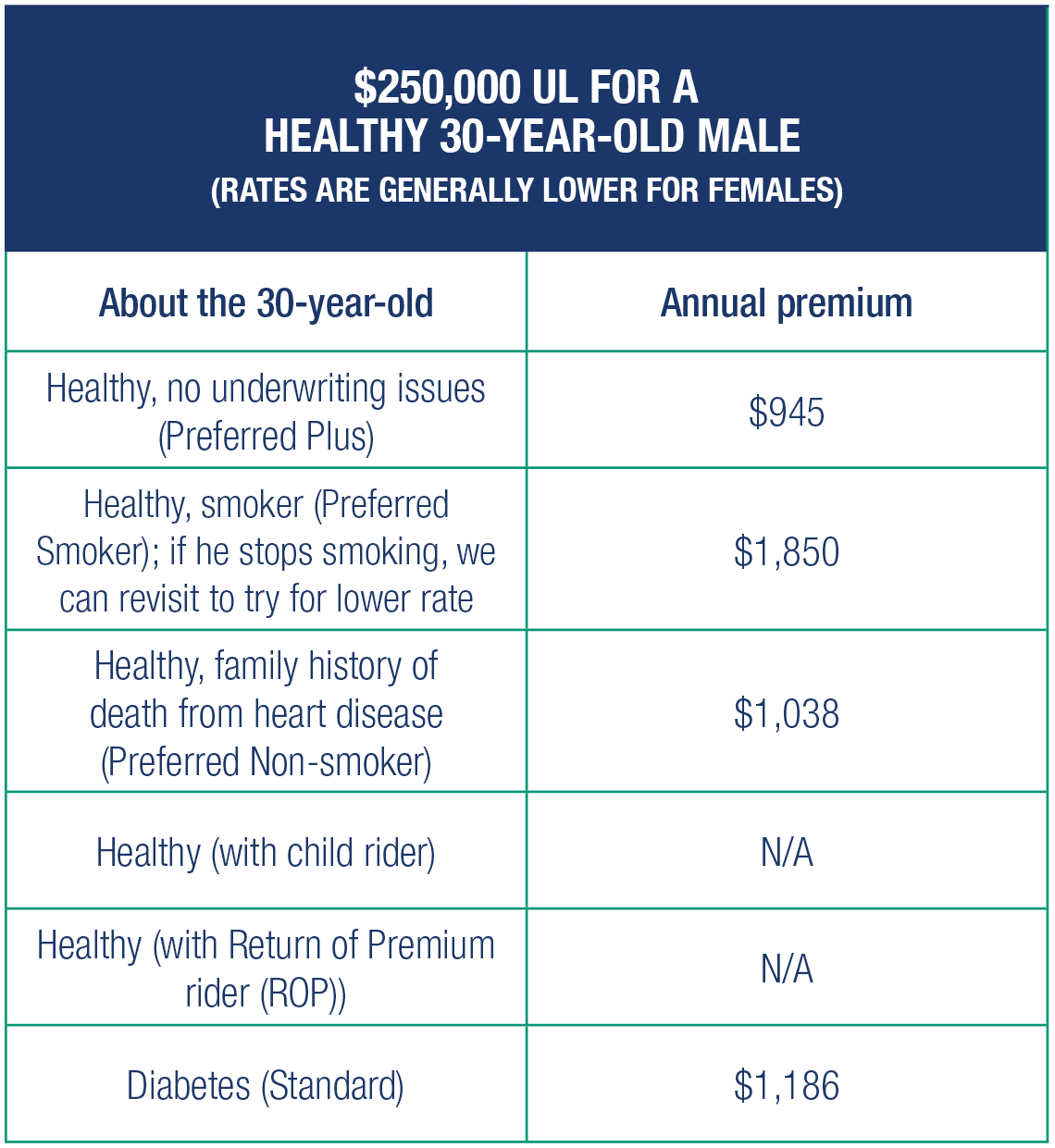

While a no-lapse guarantee universal life (GUL) insurance policy will cost more, it will also provide guaranteed death benefit and premiums and an accumulation value, all of which will last his lifetime.

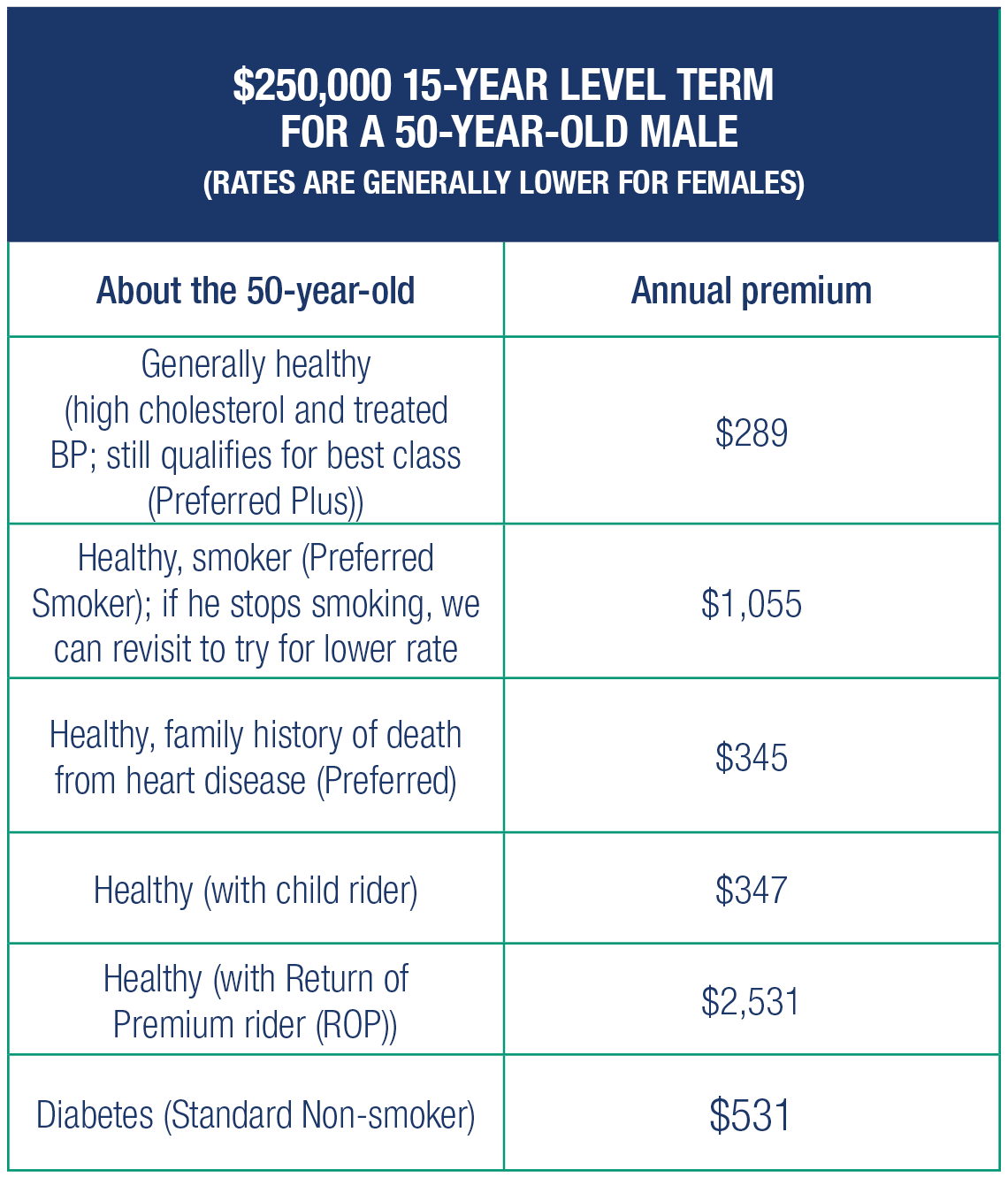

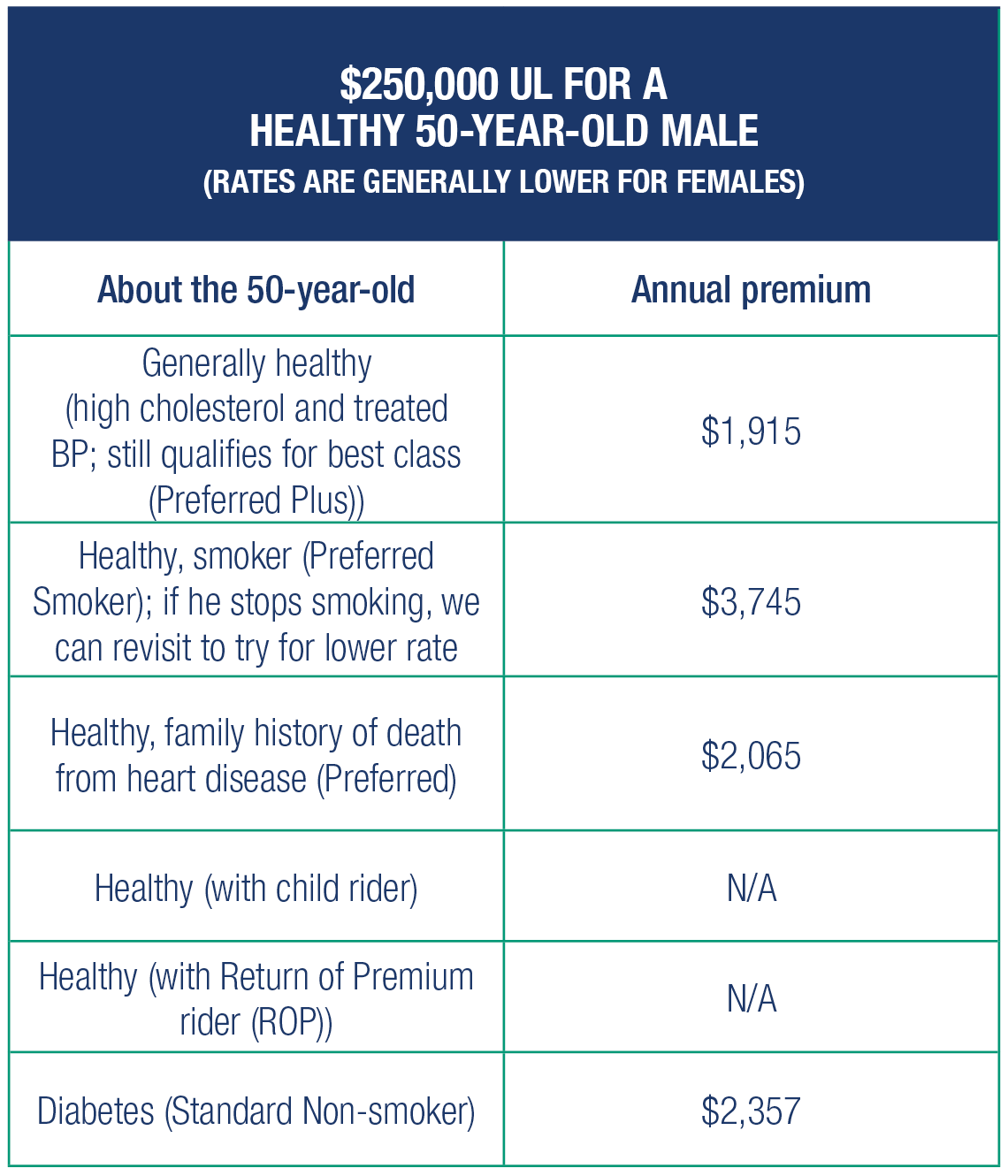

It’s true that, as a general rule, life insurance gets more expensive as you get older. That's because most people are healthier when they’re young, making premiums lower. But it can still be quite affordable. Because we wouldn’t recommend a 20-year term for a 50-year-old (why pull from retirement funds?), we’ll look at a 15-year term.

It also pays to compare. LLIS knows each insurance company’s sweet spots, and we’ll do the shopping for your clients to find them the best rates for the coverage that best matches their need.

The bottom line for your clients: Premiums for life insurance can vary greatly, but you'll never know what your costs will be if you keep putting it off.

1LIMRA, a life insurance research organization

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".