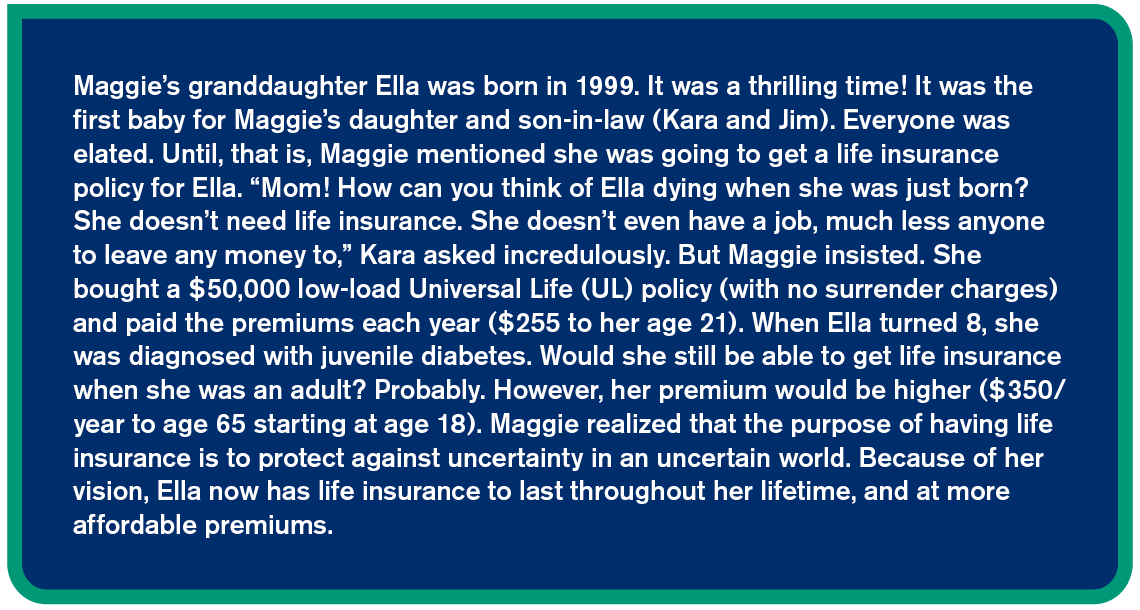

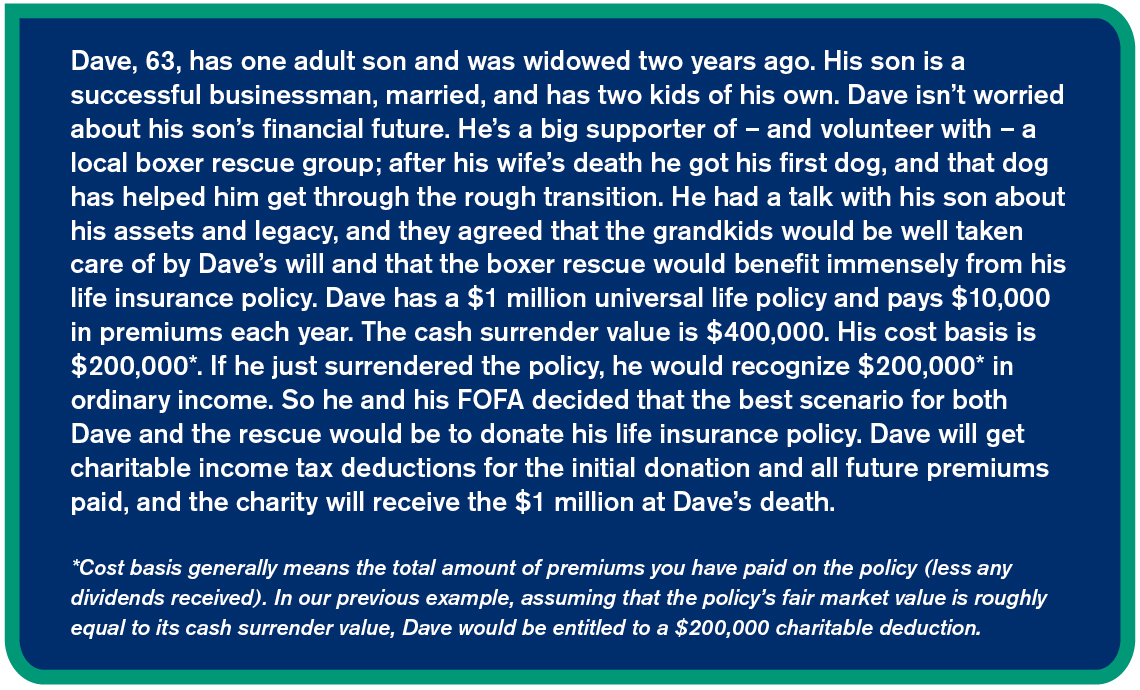

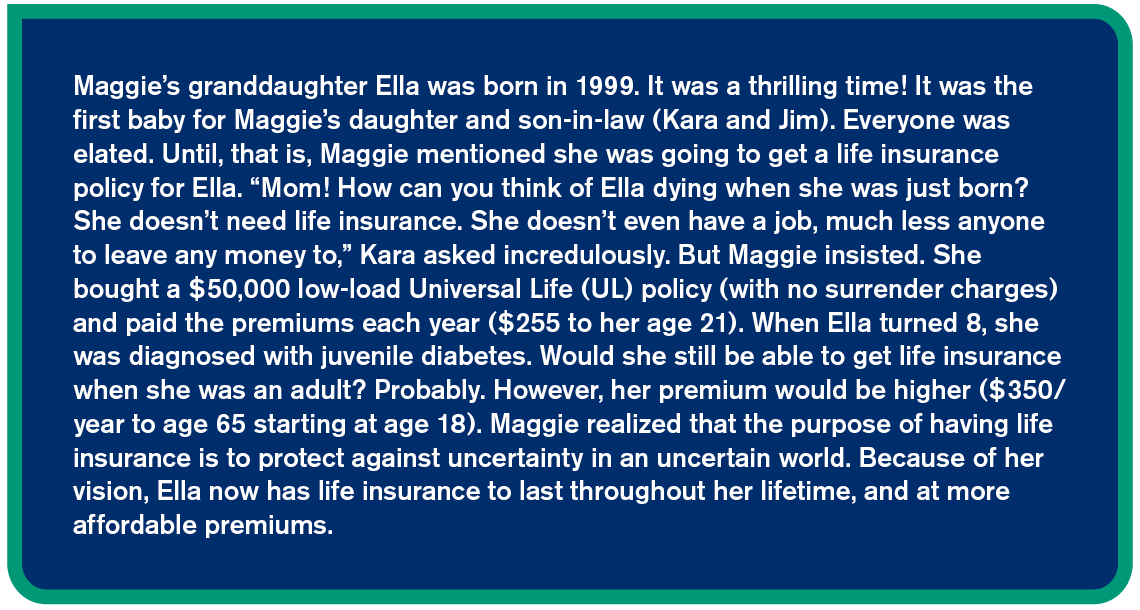

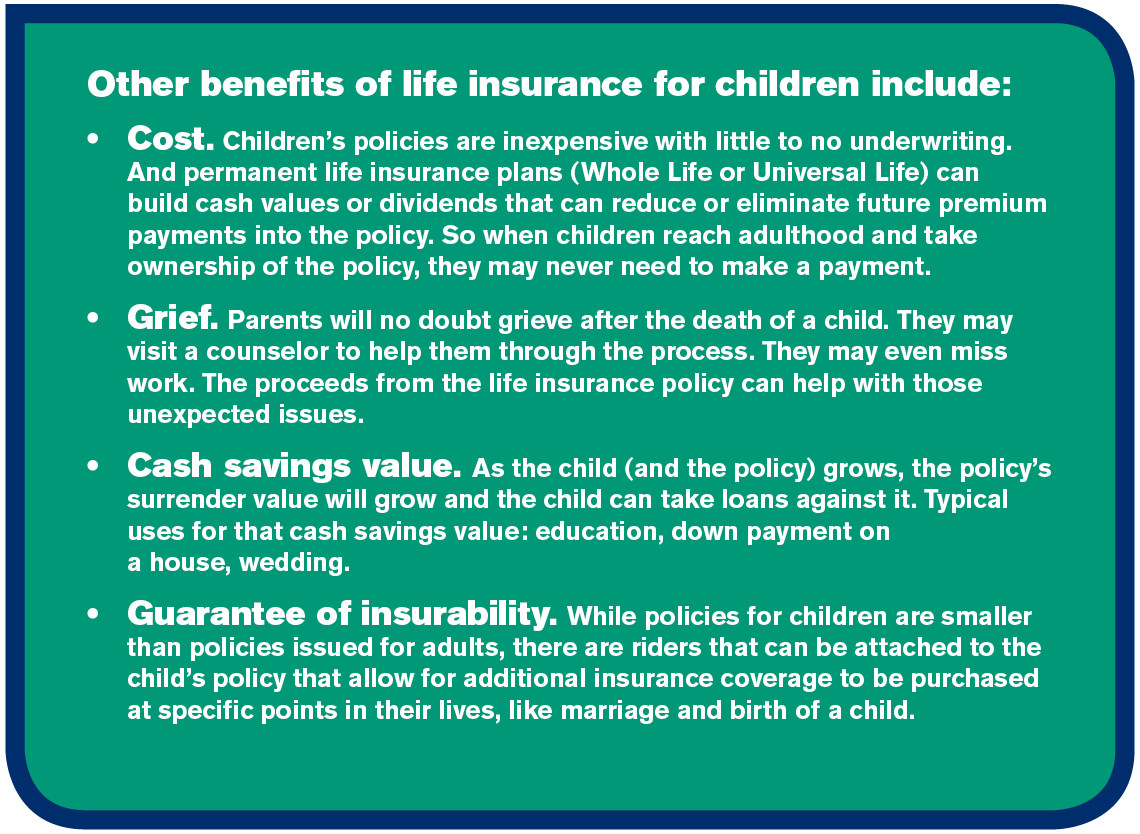

Yup. Kids. People often overlook the importance of securing life insurance coverage for their kids. They’re young. They have no liabilities; nothing that requires protection with insurance. But having life insurance for a young child insures their future insurability; in other words, ensuring they have some type of life insurance to last their lifetime, no matter what health conditions arise as they age.

We often hear that if the desired outcome for clients is a source of savings, they can get a higher rate of return in an investment account. But we go back to the uncertainty; the market can be volatile. Cash value growth in a life insurance policy offers a guaranteed rate of return, regardless of what happens in the market. And team LLIS doesn’t recommend insurance policies purely as investments or savings streams; instead cash value in policies would be an extra benefit in addition to the others mentioned in this article.

And if the thought of taking out a life insurance policy specifically for their child is something your clients just can't wrap their heads around, they have another option. When parents apply for new term policies (and some UL policies) they have the ability to add a children’s rider with no underwriting, lower costs, and just one policy to track. Plus, the child has the option to convert the term policy to a permanent one at a certain age (often 25).

Here are some other people who may not consider life insurance but probably have people who would benefit from it:

Stay-at-home parents:

- While a stay-at-home mom or dad doesn’t bring home a paycheck, they do bring economic value to the household. And as the income bracket rises so does that value and, expectedly, the coverage needed. While a working parent may be bringing home a great salary, the things the non-working parent handles daily for free can really add up in his or her absence ... to the tune of about $163,000 for a stay-at-home mom1 (note: 1 in 5 primary caregivers for preschool age children is a man)2:

- Housekeeping (the national average for bi-weekly professional house cleaning is almost $4,000/year)

- Nanny (the average American family pays nearly $10,000/year/child for daycare and more than $28,000/year for a nanny3)

- Chauffeur

- House manager/buyer/maintenance supervisor

- Barber

- Chef

- Psychologist

- And because those services are being provided without cost, they are typically not factored in to financial planning and investment considerations, so part of that great salary is already earmarked for college funds, stocks, and retirement accounts. Click here to read the 2005 story of Dennis and Jodie Danduran.

Retirees:

- Among the insurance companies we work with, your clients can get a term life insurance policy until age 80, and a UL policy until age 85. Why would someone at that point in their lives want or need life insurance?

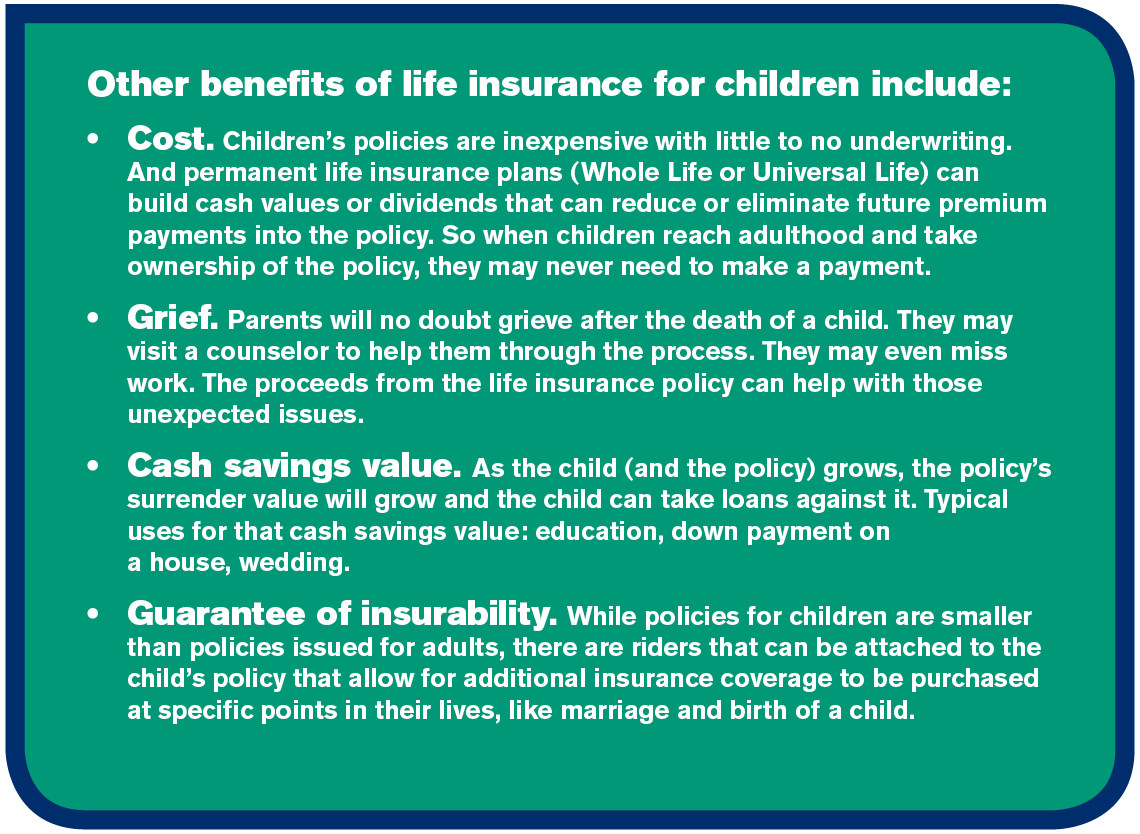

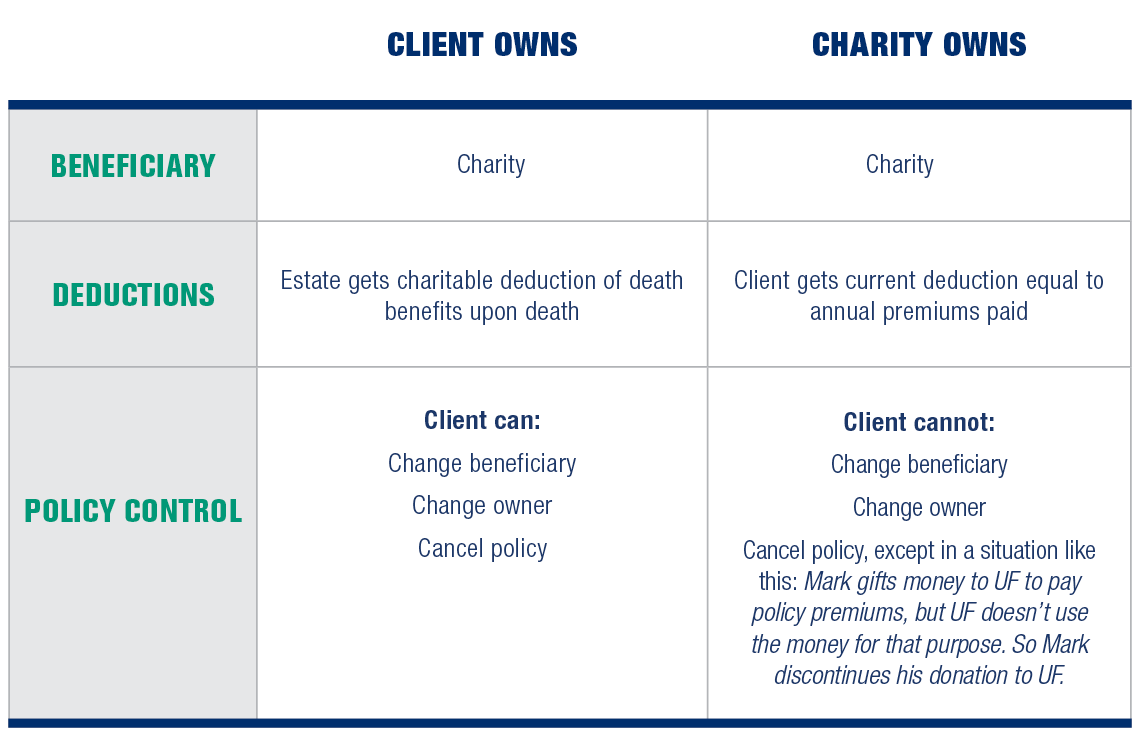

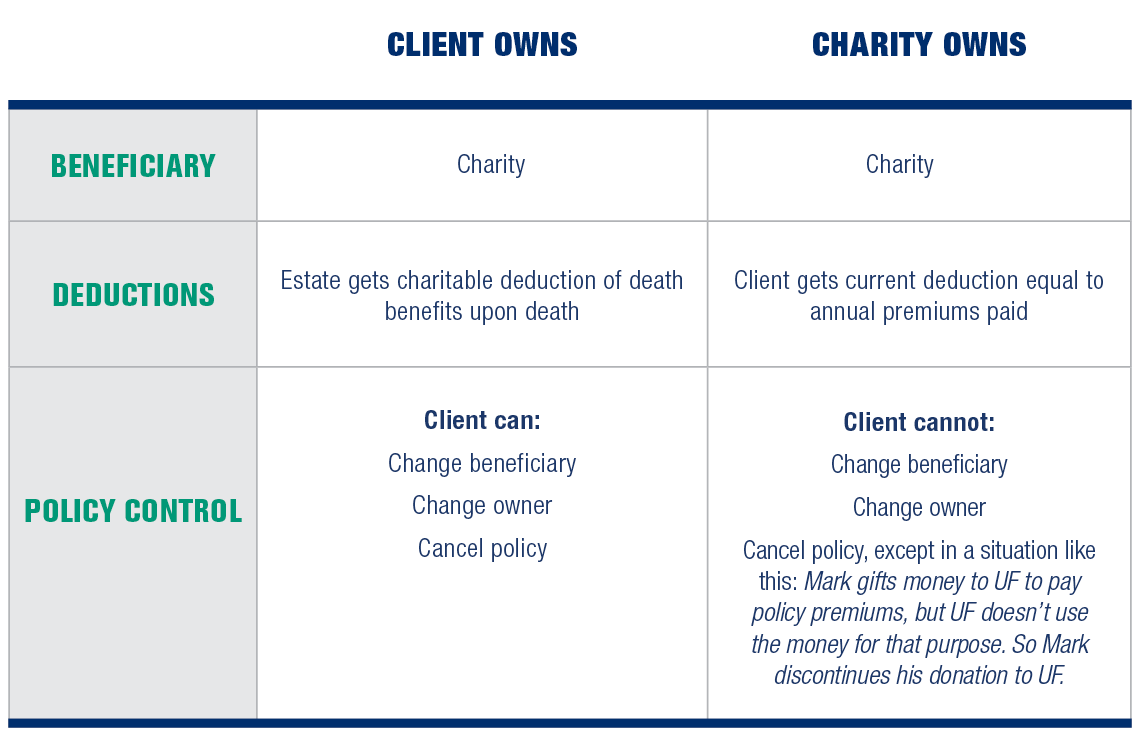

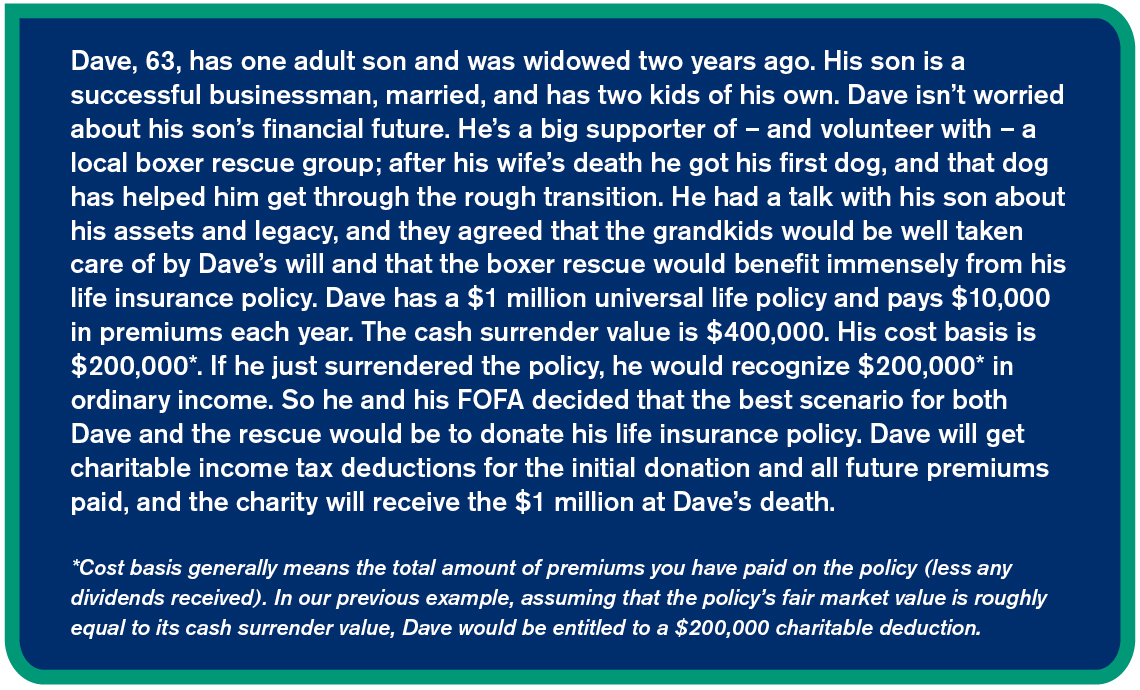

- To maximize a legacy to a favorite charity or learning institution. This type of planned giving allows your clients to leverage current cash flow into a substantial endowment and make larger gifts than they might otherwise be able to afford, while generating current tax benefits. And it can even be structured so your clients are recognized while still living. This can be an important asset to a nonprofit because if it’s structured, funded, and managed properly, it can provide a substantial amount of liquid wealth not tied to the market. Which means that in the long-term, it can reduce the organization’s portfolio risk. The benefactor can give to the charity in several ways:

- an irrevocable gift of an existing policy that is fully paid for

- gift a policy that requires additional annual premiums

- name the charity as a beneficiary of a policy the donor continues to own and pay for

-

- It’s often surprising to clients to learn that they can't necessarily deduct the policy’s face value or cash surrender value. Their deduction is limited to the lesser of the policy’s cost basis or fair market value (determined by an evaluation of several factors like the cost of a comparable policy, the cash surrender value, and the insurer’s actuarially calculated reserves).

- To pay estate taxes

- To provide for the care of a disabled child, spouse, or sibling

- To offset the loss of retirement income to spouse at death (Read about pension max here)

- It allows parents to balance distributions of property or business interests to children

- It allows parents to spend all their money and still leave an inheritance to their children or grandchildren. Survivorship Universal Life (SUL) is a good option in this case. It’s affordable,

since the death benefit isn’t paid out until after both people have passed on (less expensive than two separate policies), and allows them to spend most of their earnings on what they want to do, like travel.

- It can save a child from losing the house you’ve co-signed for if they hit hard times and you’ve passed on

-

- It can collateralize loans. The older we get, the more debt we take on (or we take on debt with a longer amortization). Like the empty-nester couples who actually upsize once all the kids are gone.

- It can help with business transition planning. Life insurance can help provide the funds needed to transfer ownership of a business. For family-owned businesses, it can help the business survive (for those working in it) and equitably provide for non-interested family members.

- It can help preserve an estate. Even if your clients have dipped into their assets during retirement, a life insurance policy will leave death benefit proceeds that pass income-tax free to their beneficiaries to help offset federal estate taxes, keeping their estate intact.

- To help a surviving spouse pay for end of life care. Let’s say you have one member of a couple who has aged in good health and the other one who’s been plagued with health issues. If the healthy partner predeceases the unhealthy one, someone will need to provide care. A life insurance policy for the healthy partner can ensure the surviving loved one gets good care that requires more and more money as the years go by.

Do you have clients who have kids, are seniors, or are stay-at-home parents? Share this with them. They need to know.

1U.S. Census Bureau

2Care.com

3Salary.com

![]() (877) 254-4429

(877) 254-4429![]() (877) 254-4429

(877) 254-4429