ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Third Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

While group life insurance through an employer has some definite benefits, its biggest downfall is its lack of portability (you often can’t take it with you when you leave). And as COVID-19 creates historically high unemployment rates, that's an important consideration.

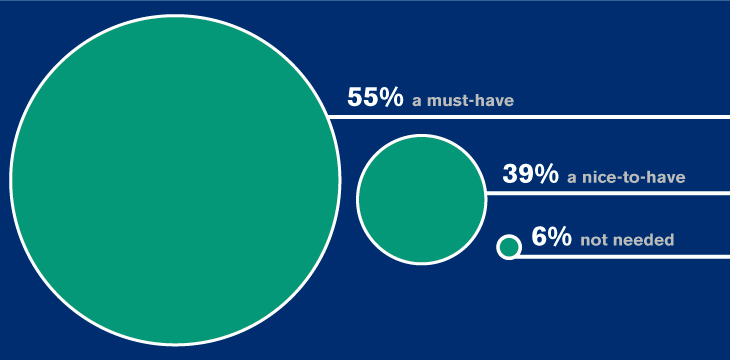

MetLife’s 18th annual U.S. Employee Benefit Trends Study (2020) showed just how important employees consider life insurance:

An employer-sponsored group life insurance plan offers:

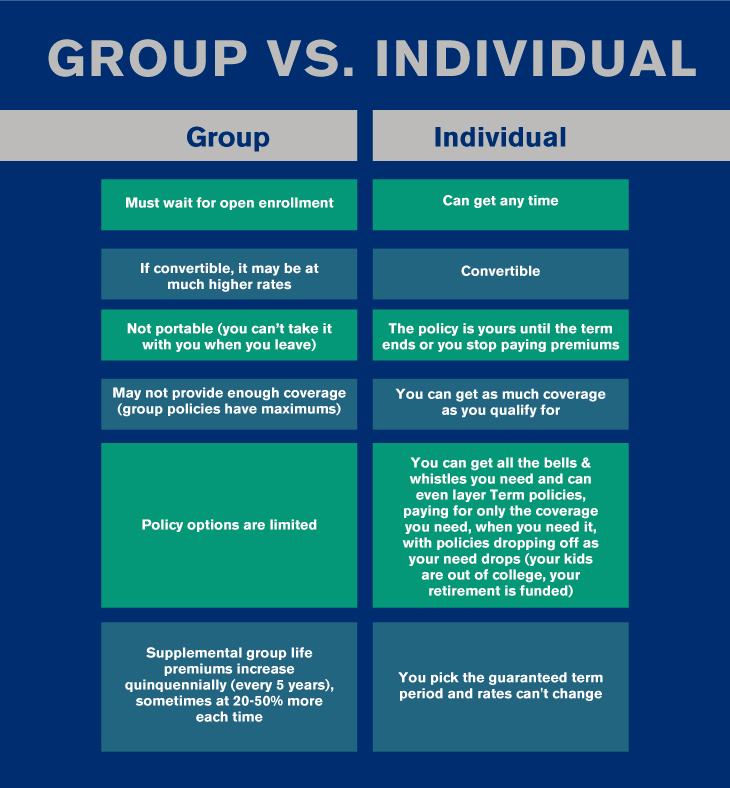

But when talking to your clients about their need for life insurance, it’s important to keep in mind these differences between Group Life and Individual Life:

In today’s environment (and any time your clients are at risk of losing their jobs), losing employer/group life insurance can mean the employee is less equipped to manage and recover from the impact of the COVID-19 crisis. An individual life insurance policy (to either supplement a group policy or on its own), offers peace of mind and eases stress about the “what-ifs.”

As of July, the Coronavirus had resulted in 16.4 million Americans losing their jobs, compared to 6 million the year prior.* Along with their job and paycheck going away, many of them are losing benefits, including life insurance.

Have any of your clients lost their employer-provided life insurance? You may want to talk with them about at least a temporary solution like Term life insurance to bridge the gap while they are unemployed. Insurance companies consider employment as they evaluate an applicant’s risk, but if your clients act quickly and apply either before their job is gone or soon after, their chances of approval are good. Good financial history is also a plus, like on-time mortgage and car payments.

Or, if your unemployed client has a partner who is also covered and they have shared dependents, they may want to consider increasing the partner’s coverage to help offset the loss of the unemployed partner’s policy.

And, despite the bad rap insurance companies often get in the media, many are making special accommodations for life and disability insurance for employees who lose coverage as a result of reduction in hours, layoff, or furlough.

Many years ago, I created a streamlined insurance calculator to help advisors determine with their clients the amount of life insurance needed. It’s a good place to start, and takes into account any group coverage they may have.

As always, we are here to help. Contact any one of our solutions experts for help with Term life insurance. And if you’re considering Permanent life insurance for your clients, I’m just a phone call or an email away. We’ll help ensure your clients have enough (coverage and peace of mind).

Mark W. Maurer, CFP ®

President & CEO

*Bureau of Labor Statistics

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".