ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Third Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

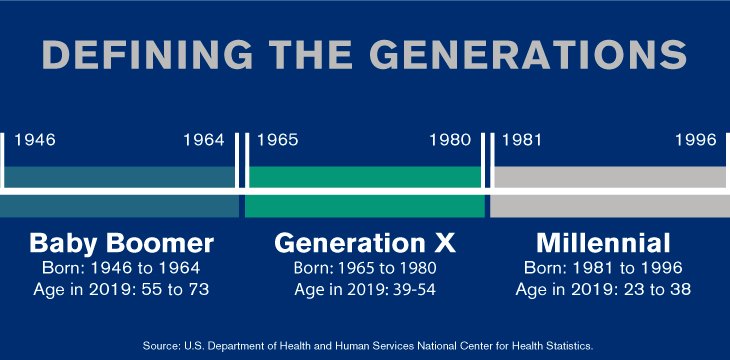

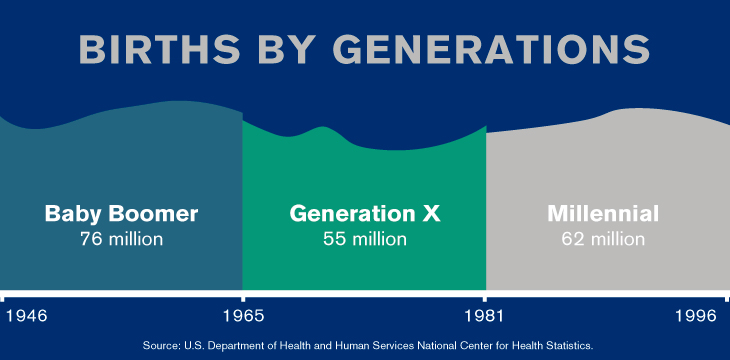

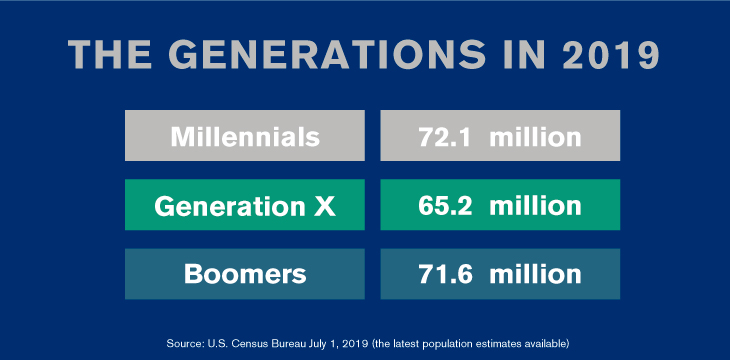

As of July 1, 2019, Millennials officially outnumber Boomers. We thought it was a good time to look at the differences (and similarities) in these two generations.

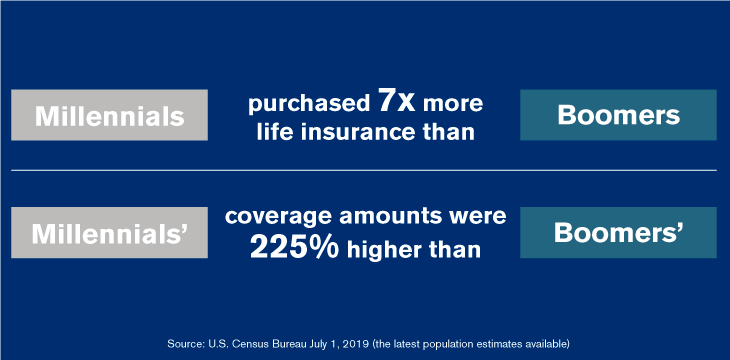

We looked to ALLiS to see where your Millennial and Boomer clients stand when it comes to life insurance policies.

It seems your clients are trending along with the generational numbers. And it makes sense: Millennials are early in their careers with many income-earning years ahead of them; Boomers are closer to (or in) retirement.

Life Happens’ “Tough Talks During COVID-19” report surveyed Americans across the generations (18–56+), and they shared many of the same concerns.

The five topics dominating dinner conversation:

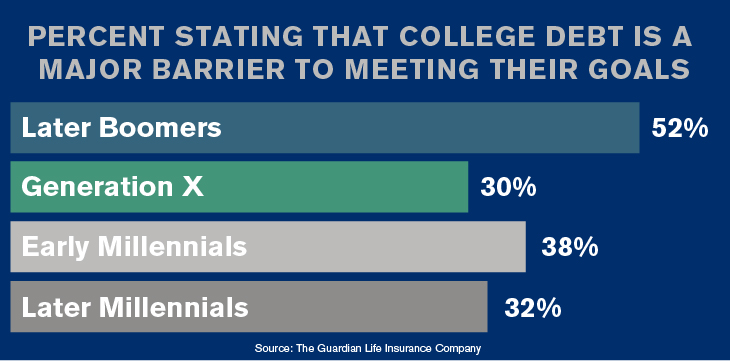

Another concern both groups share is college debt. Guardian Life recently conducted its financial wellness study, College Debt in America: The Case for Tuition & Loan Repayment Benefits, which revealed:

The report looks at the $1.5 trillion of college debt and its effects on the workforce: stress, financial confidence, and the growth of cross-generational debt (Boomers who took on debt to fund their children’s college tuition, and Millennials struggling to pay off their own student loan debt while saving for their children’s college funds). Millennials’ tuition rates are about 300% higher than Boomers’ were, and about 10% of them have college debt in the six-figures. Boomers, at the same age, owed only about $2,300 (today’s dollars).

Here are some differences between the two generations worth highlighting:

These differences highlight the importance of financial education for Millennials, and helping them not only to grow their assets, but protect them. Term insurance is the type of life insurance (along with disability insurance to protect their paychecks) LLIS recommends most for your clients in their 20s and 30s. It offers these clients -- most of whom are just beginning to build wealth -- low-cost peace of mind for a finite amount of time (usually 10 to 30 years) to cover college expenses (whether for their kids’ education or their own student loans), mortgages, and retirement saving. And the term policies we recommend are convertible, meaning they can be converted to permanent life insurance policies as your clients age (and they have more assets and resilient income) if they need continued coverage.

Term insurance isn't the only coverage that has a recommended client type. Below is a list of the different types of insurance we help your clients find (by generation) and who at LLIS to contact:

Term life insurance: Millennials and younger GenX

Permanent life insurance: Older GenX and Baby Boomers

Disability insurance: Millennials and GenX

Critical Care insurance: Millennials, GenX, and Baby Boomers (and anyone maxed out on DI still needing more)

Long Term Care insurance: Older GenX and Baby Boomers

Hybrid Life/LTCi & Hybrid Annuity/LTCi

Annuities: Older GenX and Baby Boomers

Life Settlements: Baby Boomers, Silent Generation, and anyone who doesn’t need a policy anymore or has critical health conditions

These are, of course, generalizations, and your clients may need different coverage at a different point in their life than what you see here. It’s always best to contact one of our subject matter experts to talk through what fits their individual needs.

And it’s also important that your clients have their coverage reviewed regularly.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".