ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Third Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

We’ve seen shutdowns across the world and media reports filled with stories of tragic loss of life. We’ve been sequestered in our homes, working from home, schooling from home, eating at home, canceling travel. COVID-19 has affected our lives in so many ways.

But has COVID-19 affected the life insurance industry? You betcha.

It has given rise to the realization that good health can be stolen and longevity is not a given. COVID-19 has acted as a catalyst of sorts, driving some who had hit pause to finally go through with getting coverage.

“I’ve seen stories on the news about people who were otherwise healthy get hit hard by Coronavirus and even die. And I couldn’t help but think ‘Man, I hope their family will be OK.’ I had looked into getting a policy but held back, thinking we were financially stable and didn’t need it. But those stories scared the heck out of me, and the thought of something happening to me, and my family needing to live without me and my salary made me really look at things in a different way. So I revisited coverage with my advisor. While I hope I’m not affected by Coronavirus, now I at least feel better about the fact that I’ve done what I could for my wife and kids if the worst happens.” – an advisor’s client who got a life insurance policy in July

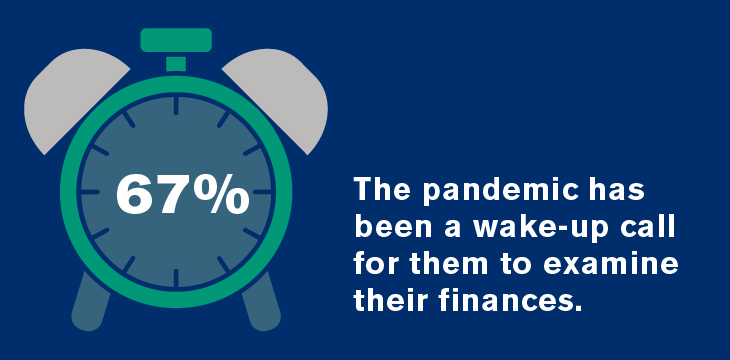

Life Happens (a non-profit supported by more than 140 insurance companies and associations, focused on education about life, disability, and long term care insurance, and annuities, and their role in a strong financial foundation) conducted a survey in May/June 2020 to gauge how the pandemic has affected Americans’ thoughts about the financial security of their families.

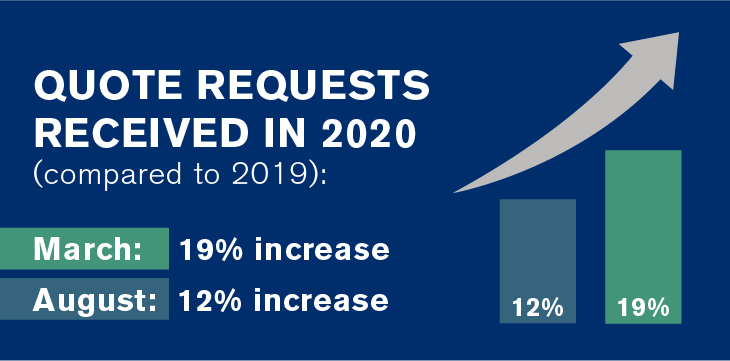

We’ve read the stories about life insurance applications increasing during COVID-19, and we wondered about the validity of them. So we looked to our ALLiS to see how our online quote requests from your clients have looked, by the numbers:

March and August have seen the biggest spikes to-date.

Life insurance companies and agencies (not typically early adopters of new technology) quickly created work-arounds to deal with the pandemic and a possible surge in applications. They initiated the Good Health Statement (your clients confirm there have been no changes to any statements on their application when it’s policy issue time); and began waiving paramedical exams (when data like electronic health records and prescription databases will suffice). We’re proud to say that we have been at the forefront of technology for you and your clients, so we were ready!

The bottom line about life insurance during COVID-19 is no different than normal times: some is better than none.

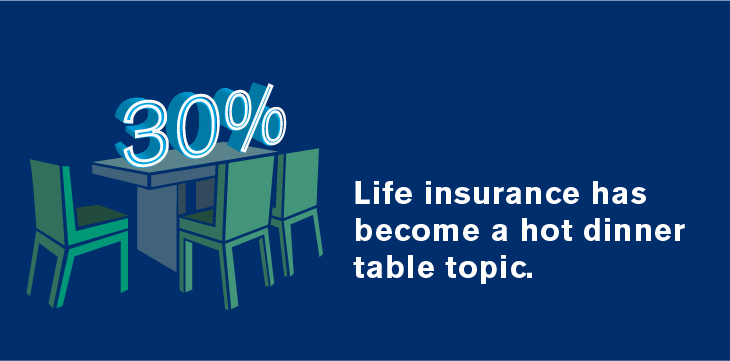

And the Life Happens survey had an encouraging result: Many felt more comfortable talking about financial matters around the dinner table (40% feel uncomfortable having these discussions today vs. 45% in January 2020 before the pandemic hit).

teamLLIS is here (well, in our respective homes) for you and your clients when they need to determine their need and the amount of that need. Call us at (877) 254-4429 or email one of us and we’ll get to work. Talking to us is always free; so is our review of existing policies.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".