ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Fourth Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

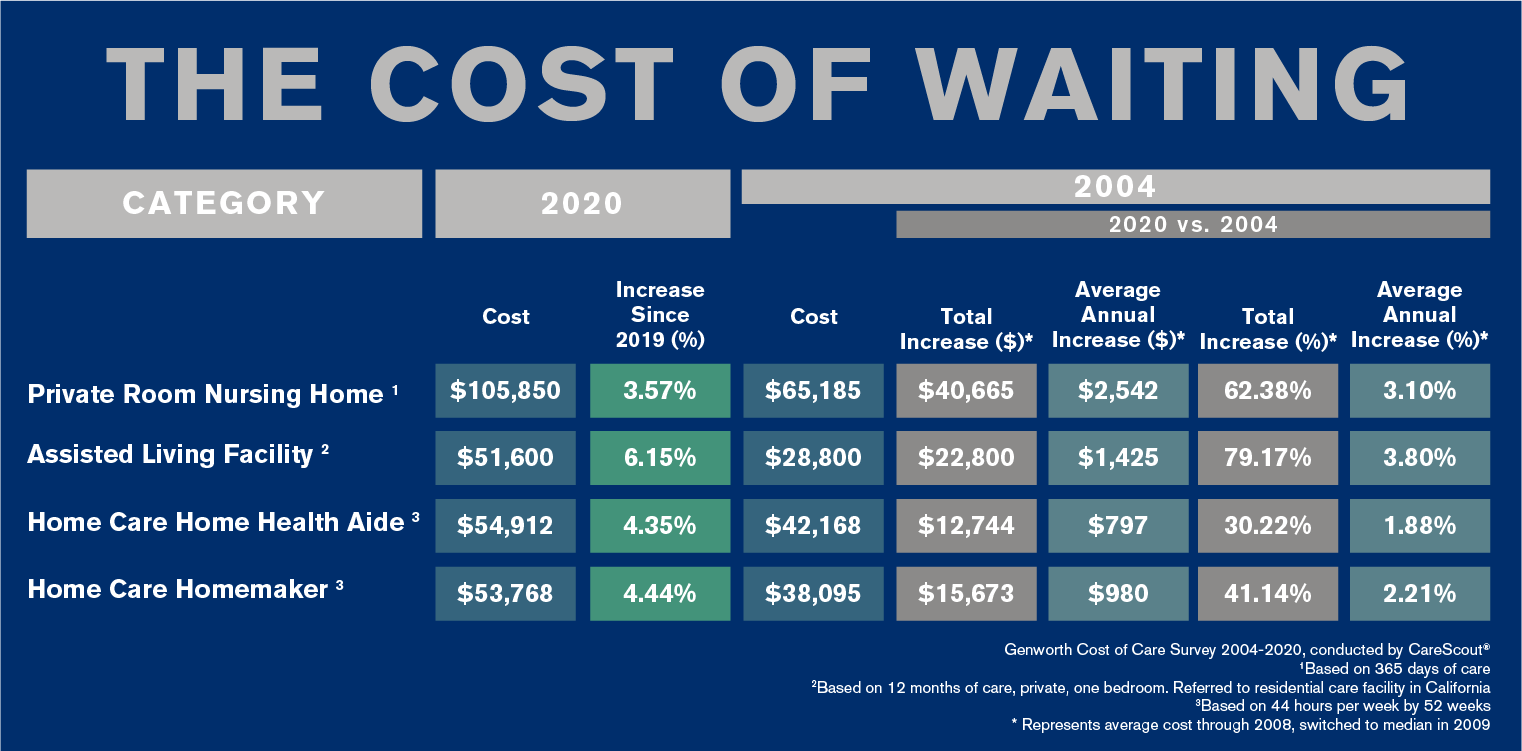

LTCi costs have risen from 1.88% to 3.8% each year from 2004 to 2020, outpacing the U.S. inflation rate of 1.8% and the average savings account rate of .05%.

The age we recommend your clients look at LTCi policies is from 55 to early 60s. Every year they wait, premiums go up. And health declines.

Jill MacNeil can help you determine if now is the time for your clients to get an LTCi, Hybrid Annuity/LTCi, or Hybrid Life/LTCi policy, and what the cost of waiting could be for them. Also, click here to see When People Buy LTCi.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".