ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Fourth Quarter 2020

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

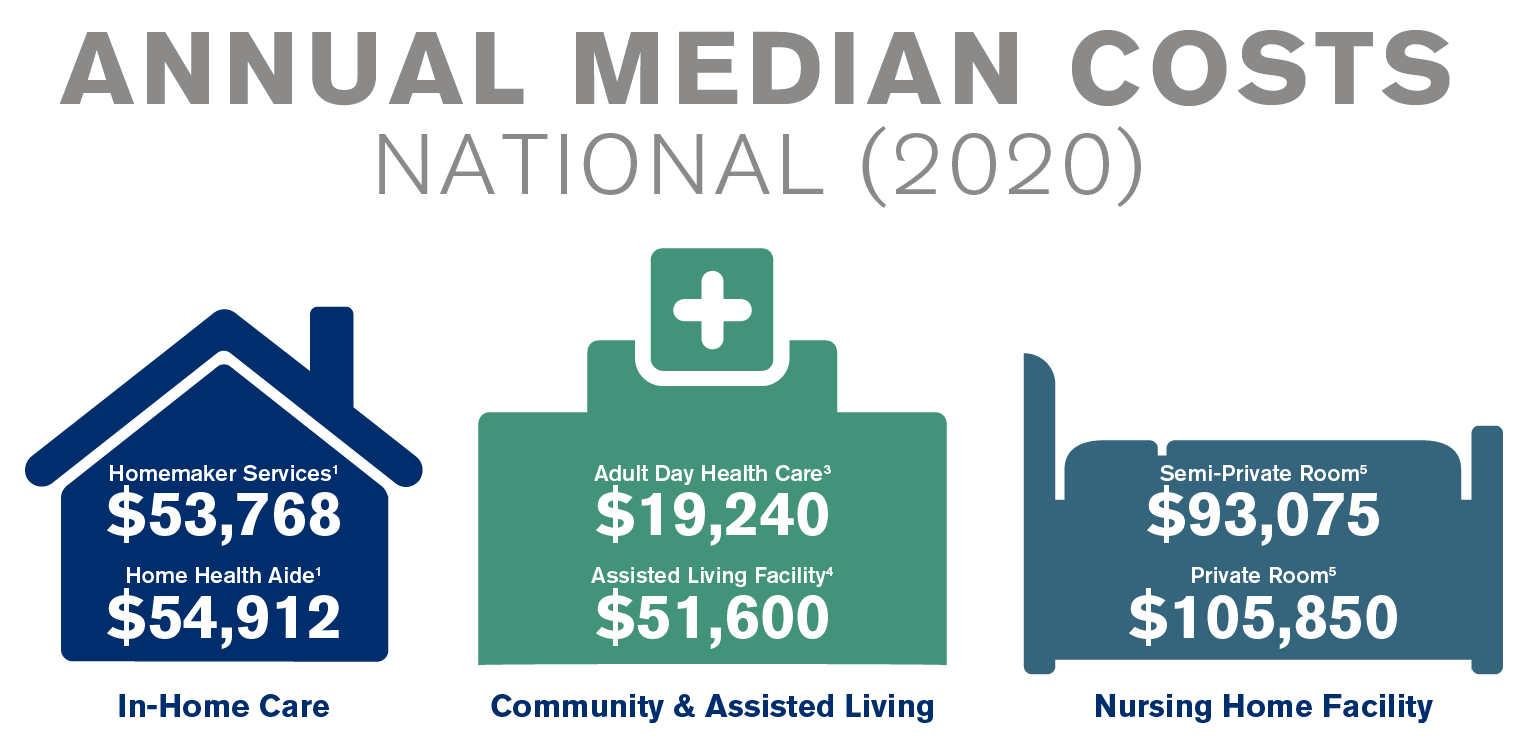

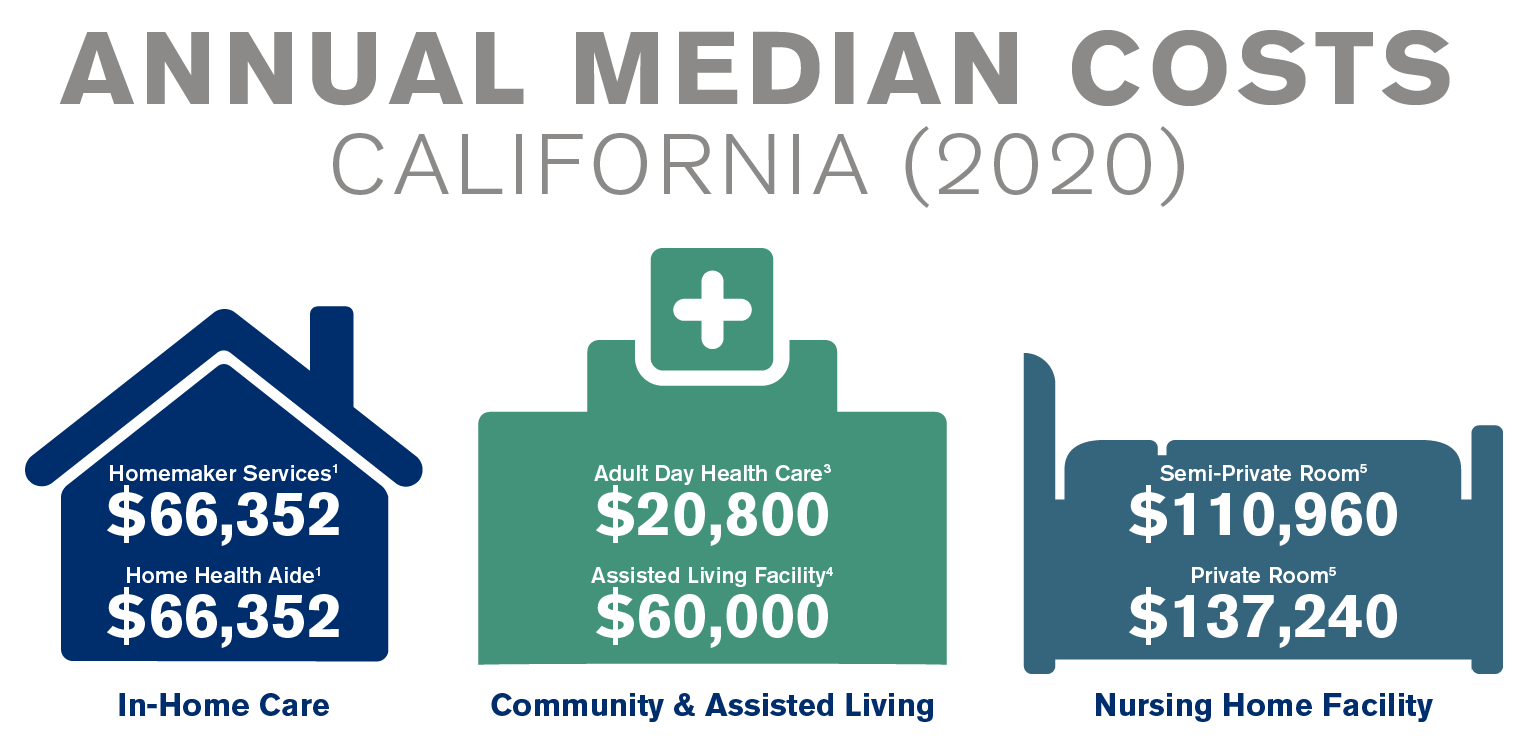

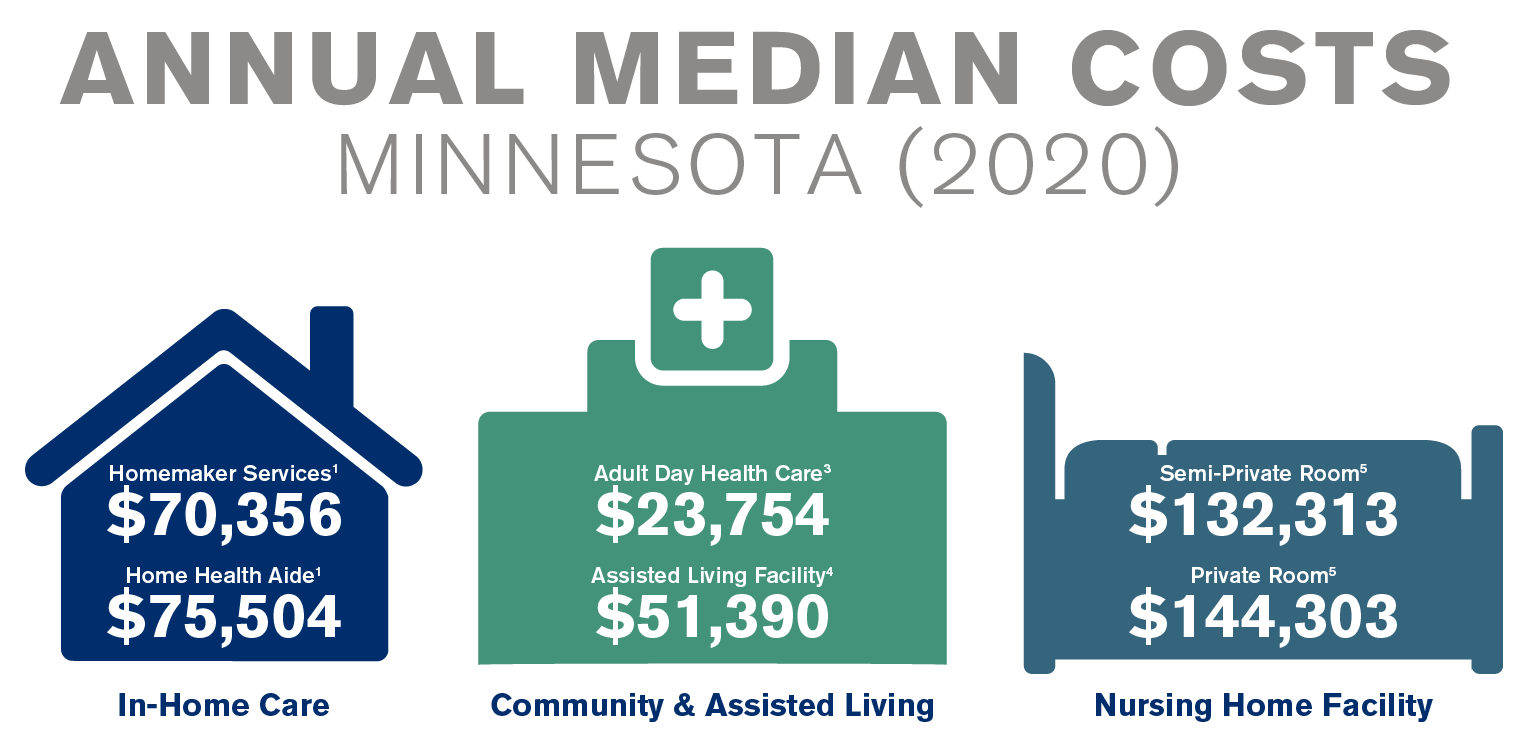

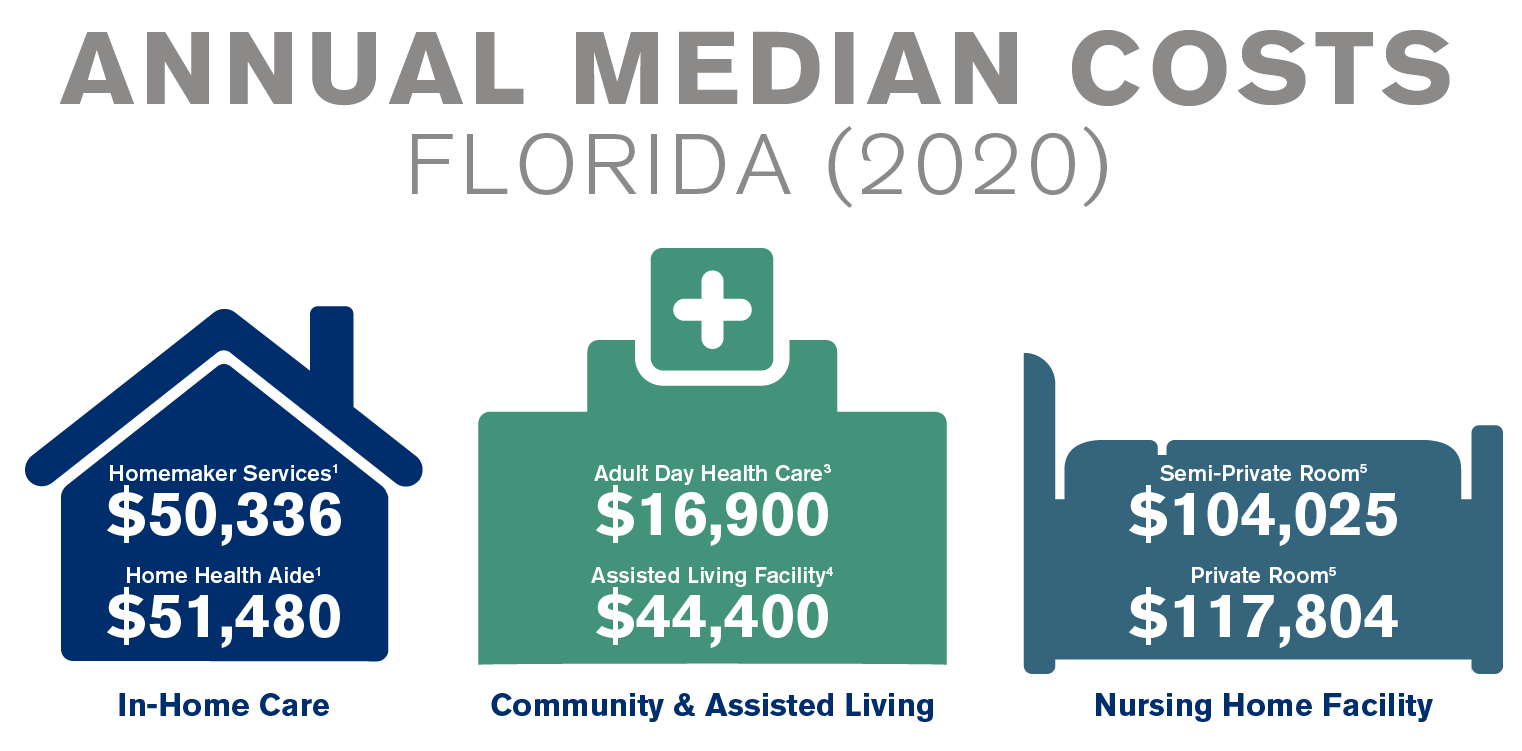

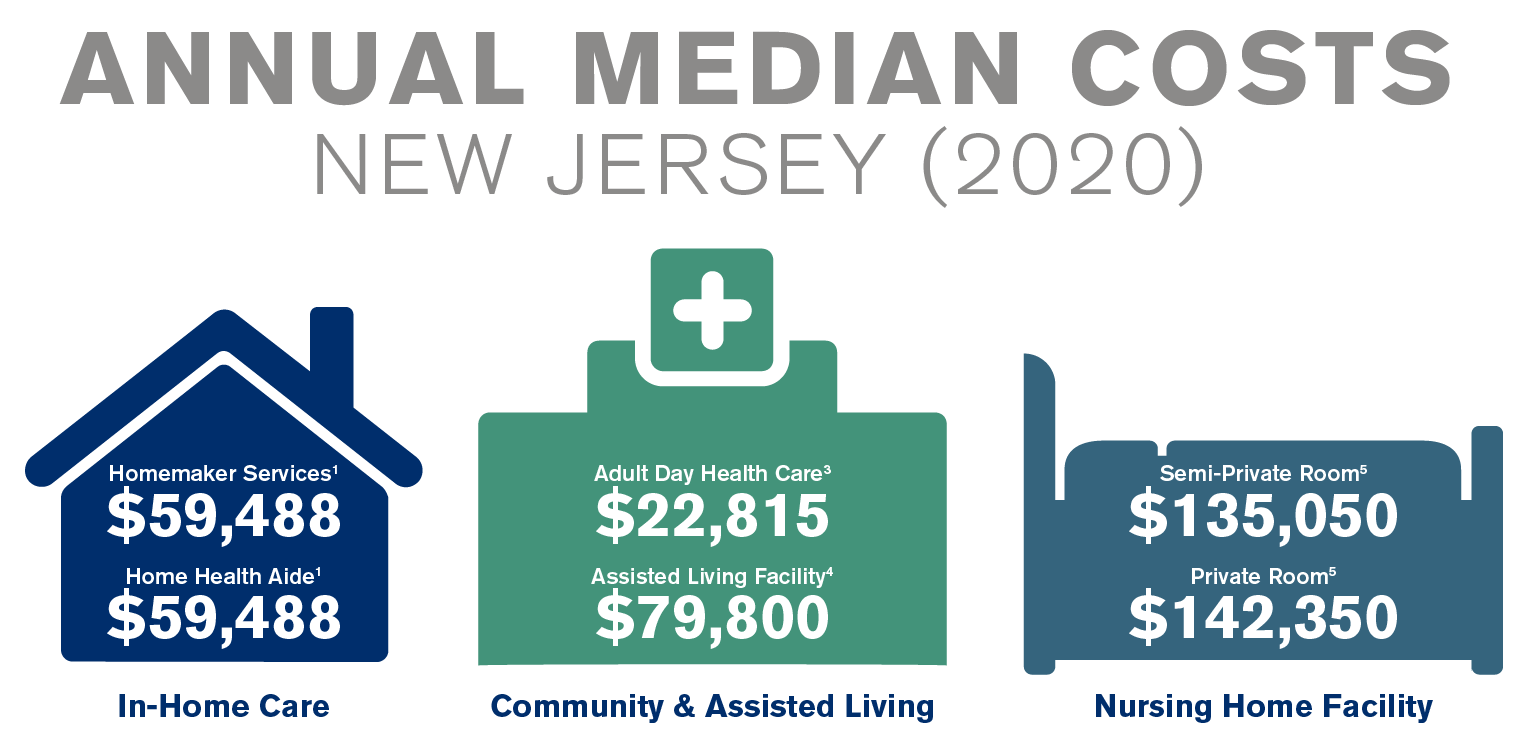

If your clients have liquid assets of $500,000 or less, they may not be good candidates for a long term care insurance (LTCi) policy, since the premiums may drain their retirement savings. Conversely, if their liquid assets are upward of $5 million, they can probably self-insure. If you have clients who fall in between, read on to find out what they may lose by not having either a traditional LTCi policy or a hybrid LTCi policy:

You can access the cost of care in your area here, and plug in those numbers on your clients’ financial planning calculations. And rely on LLIS as the expert. There are many solutions available, and we can guide them to what makes sense, given their individual circumstances and the pros and cons of each company and solution. Plus, we’ll pre-underwrite to determine which companies may consider them favorably, saving them time, frustration, and money.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".