ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Fourth Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

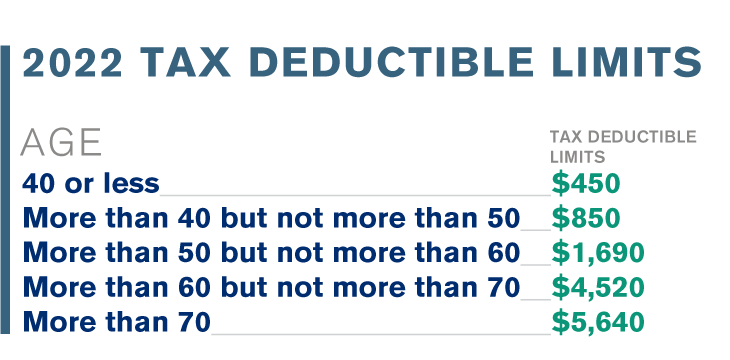

For the first time since The American Association for Long-Term Care Insurance began reporting this information, the IRS did not raise the tax deductible LTCi limits for 2022.

What does that mean for your clients?

According to IRS Revenue Procedure 2021-45, deductions for a couple age 70 or older:

2022: $11,280

2021: $11,280

2020: $10,860

2019: $10,540

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".