We applaud Washington state for realizing that LTC planning is not the same as retirement planning, and for looking for ways to make LTC affordable for everyone. But like most types of insurance, it’s not a one-size-fits-all scenario, and it’s no easy task.

Lessons Learned (We Hope)

Similar to working out the kinks in go-live system changes, the WA Cares Fund has had some serious gaps and issues that affect everyone involved:

- The WA Cares Fund exemption website crashed on the first day.

- Self-employed residents are not required to participate. Other states will probably require everyone to be taxed, regardless of W-2 status.

- Triggering an LTC claim: Usually 2/6 ADLs or cognitive impairment are required to go on claim. WA requires 3/10 ADLs and there is no “or”; dementia won't qualify for the WA plan. The result? It’s more difficult to qualify for claim.

- Vesting requirement leaves out retired and nearly retired residents permanently.

- Insurance companies didn’t have time to plan. Most were forced to stop accepting new applications for policies much sooner than the WA deadline.

- Left out of benefits:

- People already retired or planning to in the next few years (unable to vest)

- Non-working spouses (not covered in WA’s program)

- People who move/retire out of state (even if vested); it’s not portable like a private LTCi policy

- People who are classified as employees in Washington state, even if they never lived there

Next in Line

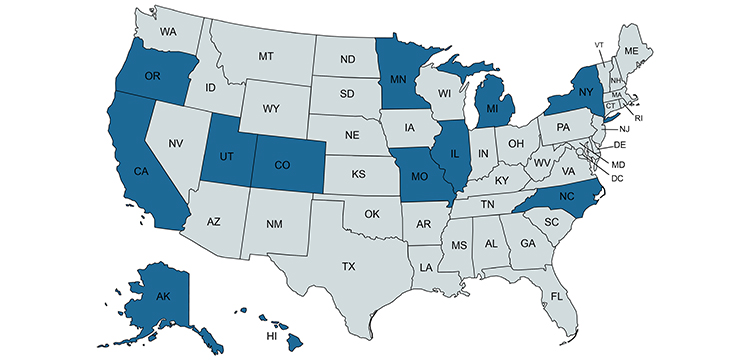

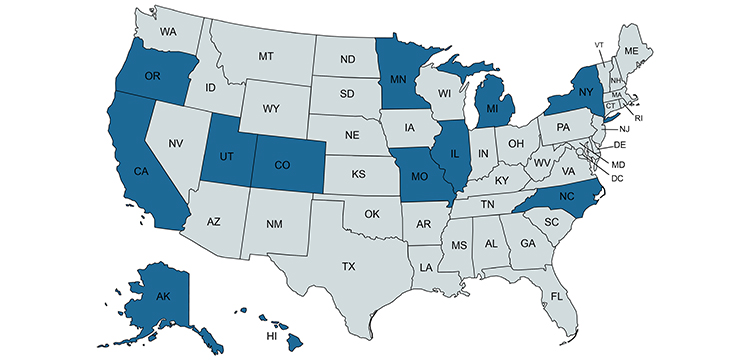

The 12 states in blue are considering adopting a program similar to the WA Cares Fund:

Hopefully those states take note and improve upon the WA model.

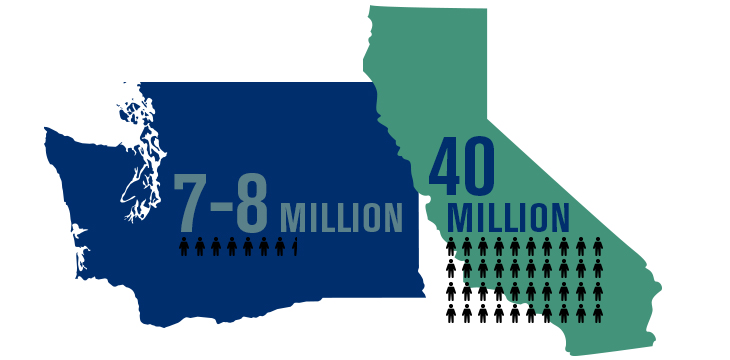

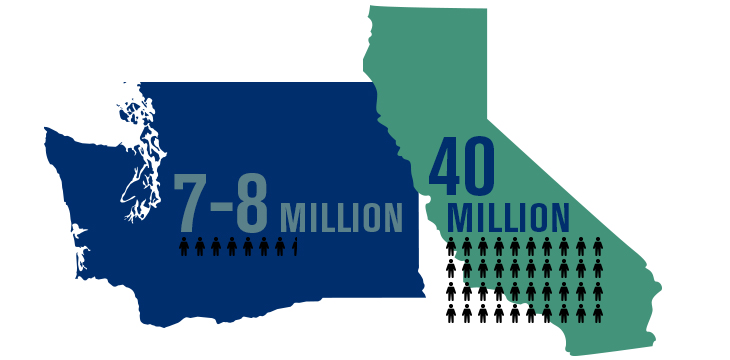

From what we are hearing, California is expected to be next, with their program beginning in 2023. But that means CA residents will probably need to start planning in 2022. And it’s not impossible that a state may sign a bill offering no opt-out if your clients don’t already have a private policy in place. As noted above, the WA program nearly shut down the LTCi industry. While insurance companies will be tweaking their processes and watching these states, keep in mind:

The WA Effect on Your Clients

False security and false information:

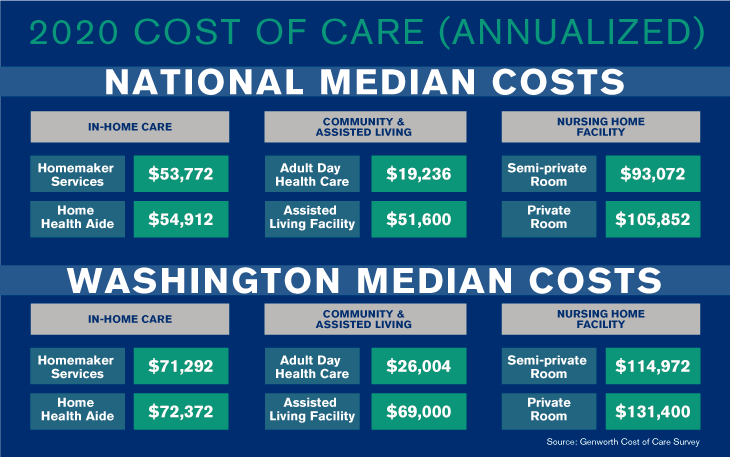

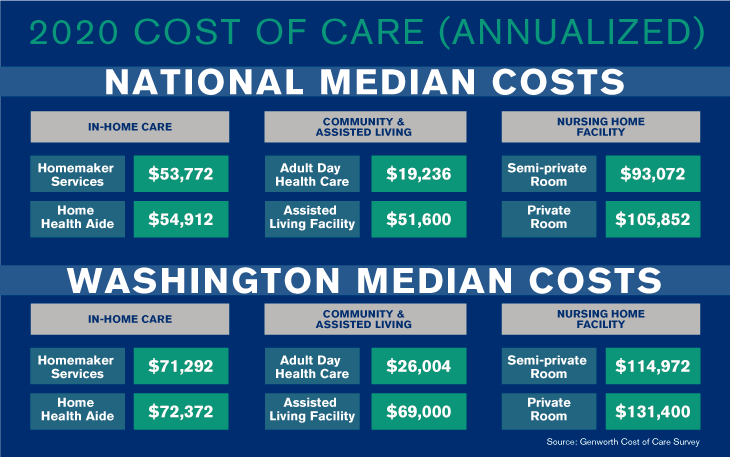

Will a pool of just $36,500 be enough to cover your clients’ LTC needs? Unfortunately, WA Cares Fund has left some thinking that the state is taking care of their LTC needs. Probably not.

Other important factors in the amount of coverage needed:

- The median survival time from dementia diagnosis is 5.1 years for women and 4.3 years for men*

- Average long term care needs: Women 3.7 years, men 2.2 years**

And in the state’s campaign to explain the need for this program, erroneous information was distributed, inferring that the LTC industry is broken. To the contrary, the LTCi industry (still relatively young) has evolved with the introduction of innovative solutions like Hybrids (Life/LTCi and Annuity/LTCi) and correcting itself based on experience. The risk of this bad press is an infusion of mistrust in your clients’ minds when it comes to LTC planning. We share this information with you so you can engage in factual, trustworthy discussions with your clients. We are happy to engage at any point you and they are comfortable.

Why Discuss LTC and LTCi With Your Clients Today?

As we anticipated, Washington was just the first:

- Avoid the potential rush created by the WA plan and its immediacy

- It’s more affordable now than tomorrow; costs go up as your clients age and health doesn’t improve as time passes

- Allow their loved ones to manage care, not be caregivers (click here for more information about caregivers)

- Non-working spouses unable to vest were not covered in WA; may be similar in other states

- Opt-out opportunities may require a policy purchase date prior to a governor signing a bill into state law; there’s no guarantee that there will be an opt-out for state programs

- Opt-out considerations:

- High earners who may pay far more in taxes than they will receive in benefits

- Clients who want more control of care choices (WA requires use of state-approved services)

- Young, upwardly mobile clients whose salaries will significantly increase may pay far more in taxes than they will receive in benefits

- Workers living out of state (unless, somehow, other states make their programs portable)

- Insurance companies may increase minute policy requirements to help control the number of applications and/or risk of intentional lapse. Some companies also increased minimum premiums during the WA process.

- Clients are more likely to work with you now as part of their entire portfolio, not just a plan for tax avoidance later. And if they live in one of those 12 states and have been hesitant about getting LTC coverage, this may get them to act. You want them to retire on track and pay less taxes ... with good planning.

- Plan, plan, and plan with private LTCi coverage:

- Maximum flexibility in choices with no state oversight

- Choose the coverage they want and need; state programs are one-size-fits-all (regardless of taxes paid in)

- Choose benefit payment model (WA program pays by direct reimbursement for care to approved providers; private LTCi offers benefits options, whether cash indemnity or reimbursement benefits)

- There’s potential for means testing

- Guaranteed premium (state plans may be subject to tax increases)

- Flexible premium choices (W-2 employees are subject to tax every year they work)

- Guaranteed inflation based on general CPI, not healthcare specific CPI increase; WA inflation not guaranteed

- Portability between states

- Hybrid solutions for clients “use it or lose it” averse; the WA program doesn’t refund any unused tax/premium paid at death

- A private LTCi policy will provide far more comprehensive coverage than WA’s $36,500, whether or not there is a tax opt-out

- In WA, some policies didn’t pass the rule of the definition of LTC. LLIS can help your clients get a 7702B policy that will qualify no matter what. If they can't qualify for a 7702B policy, they can still plan for the gap between the $36,500 and actual expenses with a chronic illness rider or other form of insurance to set aside for LTCi purchases.

- Essential part of financial planning

- Avoid reallocating retirement income at the last minute or liquidating assets (and the tax implications and market conditions)

- What would children think if planners didn’t help protect paretns from the looming issue?

- Eliminates strain and disagreements between children and other family members

To help you have the conversation with your clients, here are links to LTC cost information now and into the future (by state):

* AALTCI.org/LTCFacts-2020

** https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

![]() (877) 254-4429

(877) 254-4429![]() (877) 254-4429

(877) 254-4429