ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

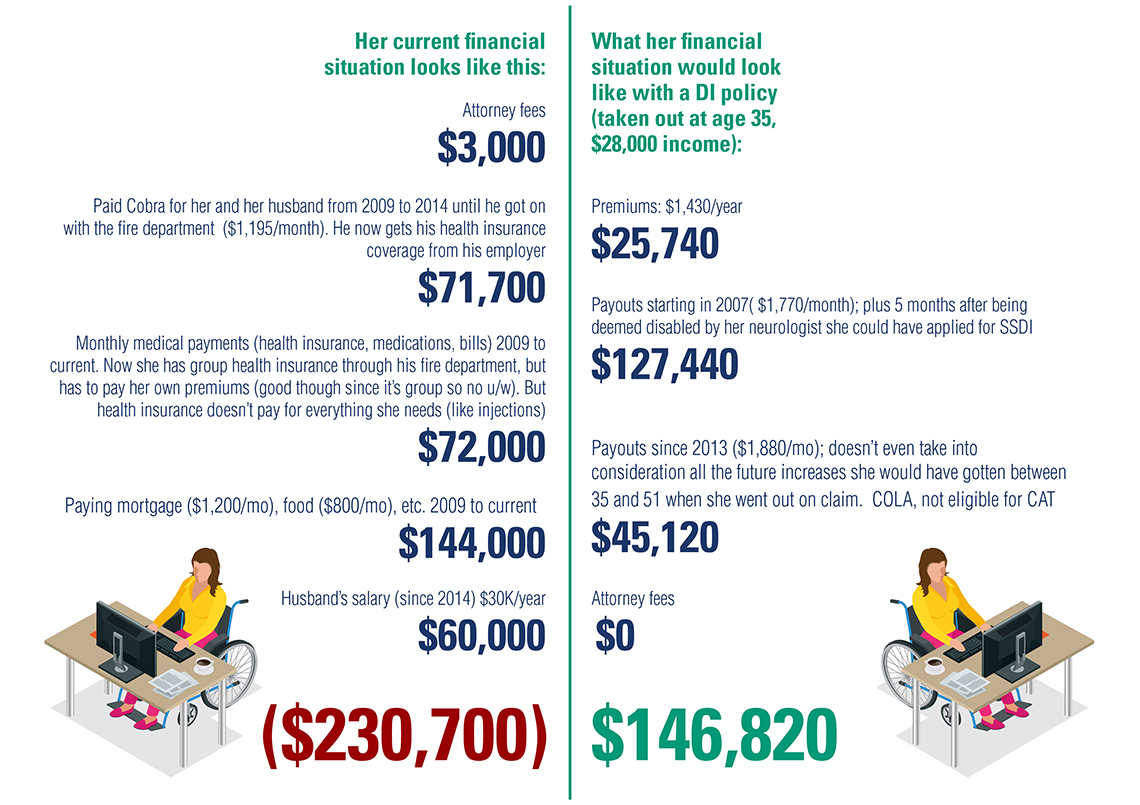

I’ve known Trish since 2002. Unfortunately, I became a disability specialist six years later. This is the story of Trish’s life now (without DI) and how it would look if I had known then what I know now (with DI).

Trish was like most of us: working hard (earning $48K/year), saving some, having fun, and spending some. Then came 2007. Four words no one wants to hear that would alter the course of the rest of her life: “You have multiple sclerosis.” She continued to work.

In the next four years, Trish was diagnosed with asthma and epilepsy, had four eye surgeries for glaucoma, and the side effects of her medication made it increasingly more difficult to consider any type of work. (Interferon destroys the immune system and makes you more susceptible to illness.)

In 2011, the vicious cycle took its toll. Medication for one condition caused side effects that disturbed the other conditions. It was like having a terrible flu every day of her life ... and worse. And when work stopped in 2011, so did her paychecks.

Despite her multiple diagnoses, doctors didn’t deem her fully disabled until 2013. She applied for Social Security Disability Insurance (SSDI) in August 2015; a process that can take one-and-a-half years. Now if you’ve listened to any of our monthly webinars or attended LLIS Insurance Academy, you’ve no doubt heard us say what a nightmare the SSDI application process is and how many people are denied coverage. Well, because her neurologist didn’t send in the correct paperwork, Trish was denied. She hired an attorney and is now enduring the lengthy and agonizing appeal process which, according to her attorney, can take up to 24 months to even get a date assigned for her case.

Trish is now 53.

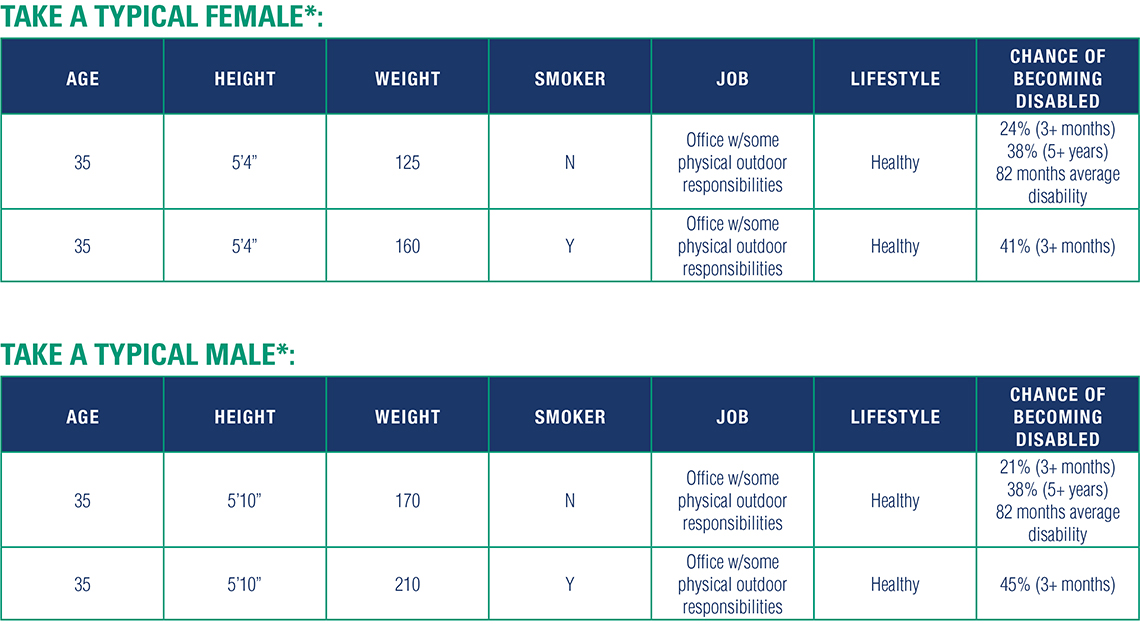

You may be thinking “Trish’s case must be a one-in-a-million chance." If only that were true.

Thankfully for Trish, her father had amassed a large estate by the time he passed away in 2011, mostly in liquid assets. That gift from him has allowed her to live a somewhat comfortable life despite not being able to work, with the interest from the bequeath offering her an income to get through the SSDI elimination period and appeals process, and money to pay attorney fees, the mortgage, food, clothing and many of her standard expenses.

Who knows if her appeals process will end in her favor. It’s stories like Trish’s that motivate me to talk to my friends and family (and you and your clients) about the importance of protecting income. Trish’s MS is multiple sclerosis. It’s too late for her to get disability insurance. Have this important conversation with your clients before their MS hits: Miserable Situation. Majorly Sorry.

*CDA’s PDQ disability risk calculator

This story shared by Kathy Bilodeau, DI Specialist

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".