ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s always good to have a backup plan. We have weather backups for weddings; college students are encouraged to have them (when choosing majors); even Jennifer Lopez had a backup plan in her 2010 movie of the same name.

What about the importance of a backup plan to pay for things like the mortgage, insurance, food, and a child’s karate lessons?

If you knew of a great backup plan that’s cost-effective and can be tailored to your clients’ individual needs and budgets, wouldn’t you tell them about it and encourage them to look into it?

Disability insurance protects your clients’ most valuable asset -- their income -- and is so customizable that it’s almost impossible to not find the right fit for a client.

Unlike most types of insurance that have distinct and limited rate classes, disability insurance (DI) offers some unique tools that can save money and increase your clients’ likelihood of protecting themselves with a Plan B. Exclusions are sometimes added to policies to indicate that -- instead of declining coverage -- an insurance company will insure your client for all causes of disability in the policy except one pre-existing condition (for example: a client with back problems may get an exclusion for back-related issues, but will be covered for the 3,000ish other causes). And then there are money-saving features and techniques, which are the focus of this article.

For your business owner clients, multi-life discount features (some vary by insurance company):

Benefits to the business:

Benefits to the employees:

For personal or business purposes (some vary by insurance company and state):

Group DI doesn’t offer discounts. However, if three employees within a group (association, corporation) decide to supplement their Group DI with individual DI, the multi-life discount can be applied to that additional coverage.

Additionally, if it’s an employer-paid group plan, the employer gets a 5% discount (on basic life, short term disability, long term disability, dental) when three qualifying lines of coverage are chosen for the group members (basic life, short term disability, long term disability, vision, and dental).

With customization comes choices. And those choices affect your clients’ premiums.

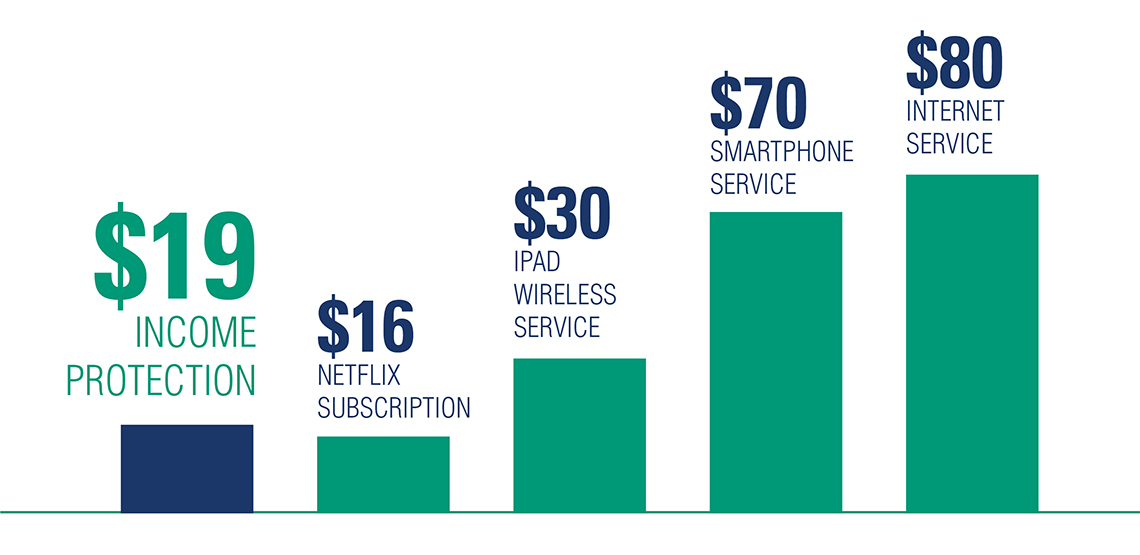

The best way to save on DI is to purchase it when you’re young and healthy. And premiums are often less than average monthly technology expenses.

Let’s look at Tristan’s situation.

| Gender | Male |

| Age | 25 |

| Monthly benefit | $1,000 |

| Occupation class | 5A (pharmacist) |

| Elimination period | 90-day |

| Benefit period | to age 65 |

| Riders |

|

| Premium | $19/month |

Help your clients prepare for the worst and count on the best. No one likes to think about the possibility of becoming sick or injured, much less paying for backup plans. TeamLLIS will work within your clients’ budgets to make income protection affordable. We know each insurance company’s sweet spots and we’ll customize their coverage: beginning with quotes based on the maximum amount they may be eligible for, consulting with you and/or them, then applying any available discounts, tweaking policy features, and removing riders. You’ll give them peace of mind knowing this backup plan will take care of their mortgage and family if a disability happens, protecting their incomes without breaking their banks.

LLIS has two disability insurance specialists to help you and your clients: Kathy Bilodeau and Brian Ciccarelli.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".