ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2016

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

You may own your own firm. You probably have business owner clients. So you know the time and commitment it takes to build and grow a business, provide for your family, and take care of employees. But when disability strikes business owners (and the average disability absence lasts 2.5 years), there’s a triple threat:

1. Maintaining their own and their employees’ current lifestyles

2. Keeping the business’s doors open

3. Keeping the business intact

So why should a business owner help employees (and themselves) protect their income? Because it’s good for business.

Good for the employer: 1 in 4 of today’s 20-year-olds will become disabled before they retire. Consider the impact on productivity and the other employees.

Good for the employees: 64% say having a good employee benefit plan encourages them to work harder and perform better. And nearly ½ of employees say they couldn’t pay $1,000 for out-of-pocket medical and living expenses after an accident.

Yet 64% of business owners have no exit plan. And age of the business factors in to the disability insurance equation:

We believe that’s because growing business owners seem to be consulting financial professionals more than established owners.

The bottom line is that doing nothing endangers all who depend on the company’s success.

Offering group DI is a good start. Let’s look at one financial planning firm that recently took that step.

The partners decided in 4Q2015 that disability insurance for themselves and their employees was good business. So they called Kathy Bilodeau to start the process.

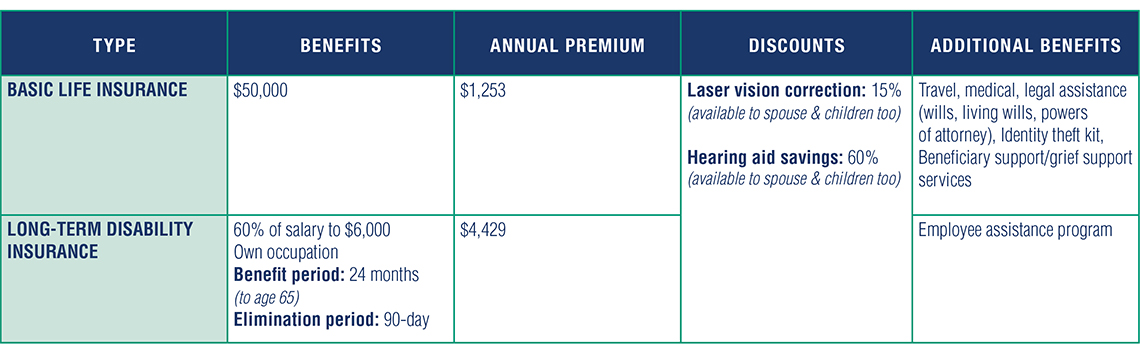

The firm has eight females. They decided on employer-paid coverage that looks like this:

So at an annual cost of $4,582, this financial planning firm has provided protection to their employees and themselves that will prevent their firm from closing its doors after a disabling illness or injury to one of the employees.

Not only is covering owners and employees with disability insurance good for business, it’s also good for taxes: The firm gets to write off premiums as a business deduction; employees only pay taxes on the DI benefit if they become disabled and go on claim.

Read more about disability insurance and businesses here. For an individual consultation about DI being good business, we have two good experts who can help: Kathy Bilodeau & Brian Ciccarelli.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".