ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Second Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Eyes are on Washington now (employers, employees, and other states). The state that brought us Starbucks, Jimi Hendrix, Bing Crosby, and apples passed a law mandating long term care (LTC) benefits for all residents and it’s coming fast. It’s the nation’s first public state-operated long term care insurance (LTCi) program, designed to relieve pressure on the state’s Medicaid LTC expenditures and to be paid for by a .58% tax on employees’ wages.

There IS a way your Washington state clients can opt out of the tax and benefits:

| Washington LTC tax | LTCi policy |

|---|---|

| Your clients must live in WA to get benefits (even if they’ve paid in for years) | Travels with your clients no matter where they live |

| A one-size-fits-all plan | Tailor for your clients’ needs: elimination period, benefit amount, inflation option, partner discount, shared care, home health care, state partnership plans |

| Your higher-income clients benefit more from opting out because the tax is based on their income, but the LTC trust benefit amounts stay the same. So they can end up paying a lot for a little. | |

| No cap on wages for calculations (All wages and remuneration, including stock-based compensation, bonuses, paid time off, and severance pay, are subject to the tax) | Choose how much you want to spend on a policy |

| The payroll tax is paid only while the Washington state employee is working | Premiums are paid for the Washington state employee’s lifetime |

| If Washington state raises tax rates, more money out of your clients’ pockets | More comprehensive coverage, and no effect if Washington raises tax rates |

It’s still a good idea to keep an eye on how this unfolds; it may become a blueprint for other states or even a federal level plan. According to the Washington State Department of Social and Health Services: “By reducing the burden on the state’s Medicaid system, the Long-Term Services and Supports Trust Act will save taxpayers $3.7 billion by 2052.” Because Medicaid is the largest payer of LTC costs in the U.S. today and states administer their Medicaid spending, all eyes will likely be on how Washington does over the next few years, thinking billions in savings!

Learn more about the new mandate here and here:

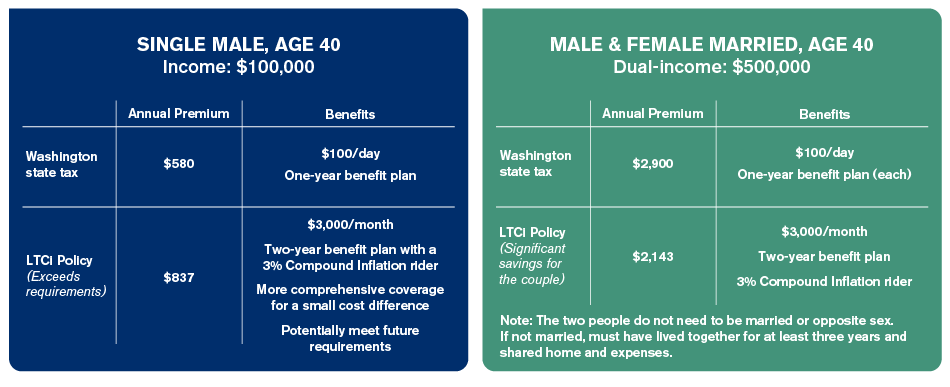

We’ve been asked this question a lot. The statutes give very little guidance, other than it should be LTC coverage that would last at least 12 months. So in the absence of guidelines, our recommendation is that your clients’ individual LTCi plans meet/exceed the benefits provided by the state’s plan. Here are a couple of examples:

Contact Jill MacNeil now for questions or quotes and to get applications started ASAP if you feel an LTCi policy would be best for your clients.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".