ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Second Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s official: Americans are living longer. And many of them are concerned about running out of money.

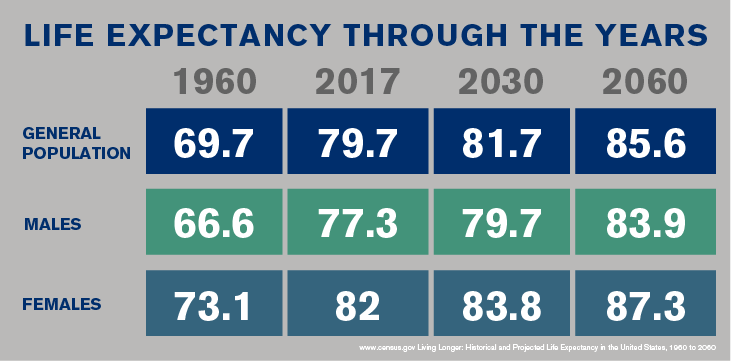

Life expectancies have increased significantly. Today’s 65-year-olds can expect to LIVE to 84 (male) and 86.51 (female)1. Here is a look at how they’ve changed over the years.

Those extra three to five years may not seem like much, but when it comes to retirement security, it can be catastrophic.

So … what can you help your clients do to secure their retirement years (including the extra ones that come about when life expectancy charts change)?

Guarantee some income for them with an annuity. You/they don’t have to LOVE them, but if you/they are among the many who hate annuities, it’s time to rethink things. And just a little knowledge can go a long way with that. Here are some LOVE-HATE things about annuities (things we at LLIS LOVE; things many Americans think they hate but just may not understand):

|

|

|---|---|

| Annuities aren’t a good investment. | We agree. Annuities are insurance. They’re protection for living a long life and against the need to take on more investment risk to try to generate the income needed. |

| Annuities are not tax efficient. | Annuities are long-term solutions, and earnings in all types will compound on a tax-deferred basis until your clients begin taking withdrawals, annuitize, or surrender the annuity. That means they can build more retirement savings than they would have been able to if their earnings were taxed as income. And, while IRAs and 401(k)s also offer tax deferral, their contributions are typically capped. Annuities don’t typically have any government-imposed annual contribution limits. |

| Annuities have lots of hidden charges. | There are many types of annuities. Fixed deferred ones are designed for accumulation, providing a set interest rate for a specified number of years with no additional expenses. If your clients choose to add riders or other optional features (and LLIS only recommends riders sparingly) to the policy, there may be a charge for the added benefit; if they surrender the policy during the withdrawal charge period or withdraw more than the penalty-free amount, they may be subject to withdrawal charges. Also, some annuities are low-load. |

| Annuities are illiquid. |

Sometimes true. Even though annuities are not as complicated as many think, they’re also not a one-size-fits-all solution. Your clients may be able to withdraw a specific percentage of accumulated value every year after the withdrawal charge period from fixed deferred annuities. Nonqualified annuities beyond the surrender charge period: Without surrender charges, the policy owner can receive the entire value of the annuity at any time. Therefore, the annuity is as liquid as any other investment asset that would create taxable gains upon liquidation. Fixed annuities with a return of premium guarantee: With a fixed annuity guarantee of premium, surrender charges cannot decrease the initial amount invested. At most, the policy owner will sacrifice interest. While this is never a desired outcome, it’s similar to a Certificate of Deposit. Fixed deferred annuities: surrender charges gradually decrease over time. |

| I have enough to get through retirement. |

Your clients entering retirement now are experiencing significant loss due to the shift to less annuitized income from Social Security (at any given retirement age) and employer defined benefit plans. Annuities complement these sources of income and provide value at older ages when mortality rates rise and survivors will more than likely incur staggering medical expenses. Additionally, if your clients can put off claiming SS benefits, they can increase those benefits by 25% or more. Plus, your clients may have savings to use as precautionary reserves for medical and long term care expenses or to leave to heirs. Actuaries use mortality credits in annuities that provide higher incomes at older ages. Higher income households are more at risk of medical expense risk because they have significant 401(k) balances, can afford better care, are likely to live to more advanced ages, and probably won't qualify for Medicaid benefits. For low- and middle-income clients, the desire to leave a bequest reduces (but does not eliminate) the value of annuitization. For higher income clients, it increases the value of annuitization since basic consumption needs take a smaller share of their income and wealth. With those needs met, annuitization allows a greater share of their wealth to be invested in equities, increasing the expected size of bequests. Therefore, medical expense risk and bequest motives do not negate the value of annuitization for most of your clients, and significantly increase the value of annuitization for higher income households most likely to have substantial 401(k) balances.3 It’s a mind shift for clients: Focus on the income they can draw from their nest egg instead of the size of the nest egg. |

| The payouts from annuities aren’t worth it. | CRR researchers used average life expectancy data, annual annuity payout data, and interest rate data for each year to calculate an estimated dollar value for the insurance an immediate annuity provides. They found that someone who bought annuities needed less wealth at age 65 than someone who didn’t purchase an annuity, based on average life expectancy data.2 |

| I may never use an annuity, so my money will go to waste. |

Many annuities provide death benefits. Immediate annuities offer several payout types that ensure payments to beneficiaries: Period Certain, Lifetime with Period Certain, Lifetime with Installment Refund, and Lifetime with Cash Refund. There are also Hybrid solutions (aka linked benefits, asset based care, and combination insurance) that allow your clients' dollars to do double duty. Life and Annuity & LTCi and Annuity are the types of hybrids available. Get more information: |

| Annuities are only sold by sketchy people who are out for their own personal gain. | Not LLIS! We work as hard on a $100,000 policy as we do on a $5 million one, and only recommend policies and extras that are beneficial to your clients. We love the “Ned Ryerson” insurance agent depiction from Groundhog Day, but that’s not us. Plus, annuities aren’t as confusing as people think, especially when you have an expert guiding you. |

Annuities can bring your clients peace of mind, decreasing their stress levels about finances and allowing them more time to LAUGH. And don’t we all need more laughter in our lives?

Our annuities expert is Jerry Skapyak. He LIVES to talk annuities and would LOVE to guide you and your clients to the annuity(ies) best for them.

1 NAILBA

2 www.census.gov Living Longer: Historical and Projected Life Expectancy in the United States, 1960 to 2060

3 Center for Retirement Research at Boston College, July 2016, Number 16-12

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".