ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

Second Quarter 2021

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Your clients probably know someone who has had a heart attack, stroke, or cancer (or had it themselves). But they probably don’t know about critical illness (CI) insurance (aka critical care insurance), a little-known income replacement solution similar to Disability insurance (DI).

And your clients probably realize the value of life insurance: Financial security for their loved ones. But do they understand the impacts on their savings after recovering from a critical illness?

Fun fact: Critical illness insurance was invented by a South African surgeon who noticed that, thanks to medical advancements, his patients were recovering from major illnesses but then suffering from the financial impacts of that survival.

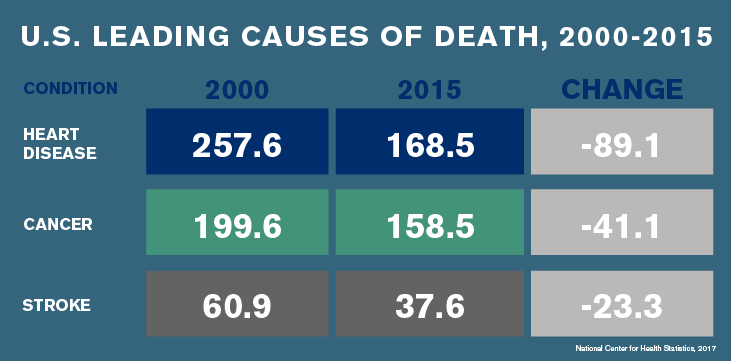

Here’s a look at how heart disease, cancer, and stroke deaths have declined from 2000-2015:

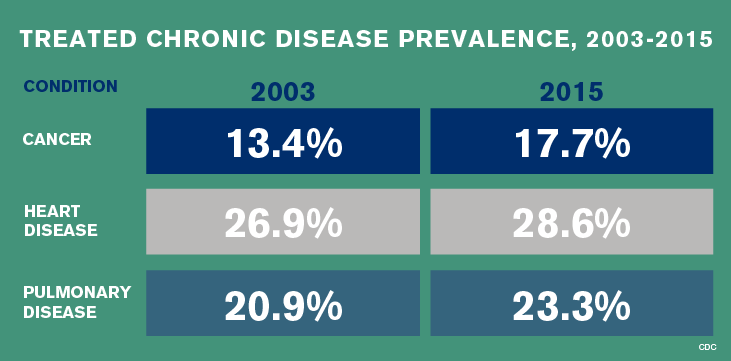

And the prevalence of treated chronic diseases from 2003-2015:

Two of the biggest benefits of CI are: The money is paid in a lump sum (that may be income tax-free) directly to the insured person and can be used for anything: your medical care, lost wages, extra time off work, travel for treatment, health policy’s coinsurance and deductibles (which seem to be increasing exponentially), experimental treatments, home modifications, mortgage, utilities, and even food; and the insured can get separate payouts for multiple conditions.

And, while teamLLIS recommends riders sparingly, CI offers some riders that are both unique and favorable:

Where CI differs from DI is in who it covers. Some occupations are hard to insure with DI, but ideal candidates for CI:

Coverage is both affordable and flexible and is attractive to your clients who may be:

*Critical illness insurance offers an additional layer of protection for people with DI through their employer (which is capped at 60% of salary and doesn’t take into account bonuses and commissions). Since government employees’ DI coverage is based on government limitations, CI is a great tool for them to amp up the benefits to help them live life as close to pre-illness as possible.

You can read more about critical illness insurance here and by reaching out to our CI specialist Kathy Bilodeau.

1 Harvard Health

2 National Vital Statistics System, Mortality Data, www.cdc.gov/nchs/nvss/deaths.htm

3 CDC

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".