ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

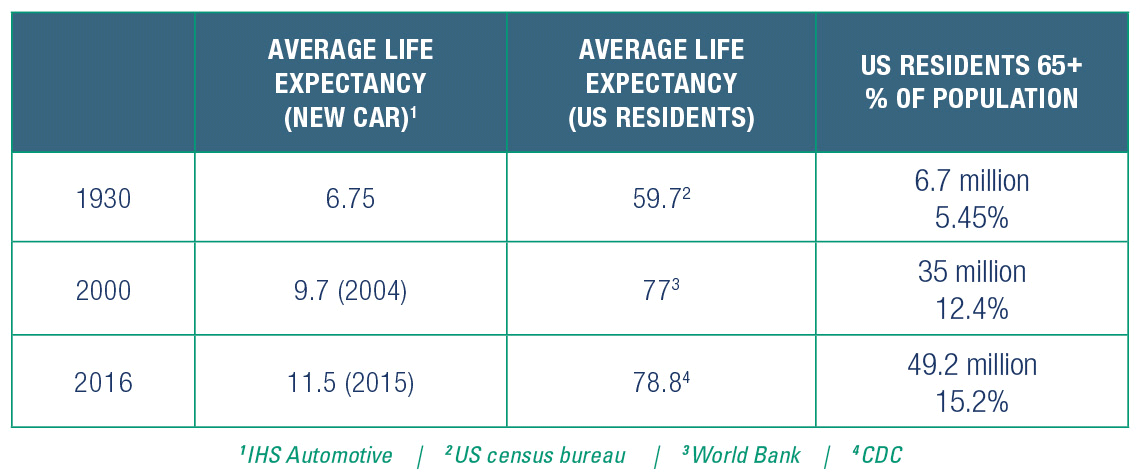

Because the better you maintain something, the longer it will last. And as we all know, innovation is making it easier to maintain both our vehicles and our lives.

Innovation is also making it harder to maintain a nest egg and manage the costs of care. Let’s take a look at some projected retirement healthcare costs for a 65-year-old couple:

And this is just everyday healthcare; not long term care. Only 18% of workers feel very confident they will have enough money to pay medical expenses in retirement.5

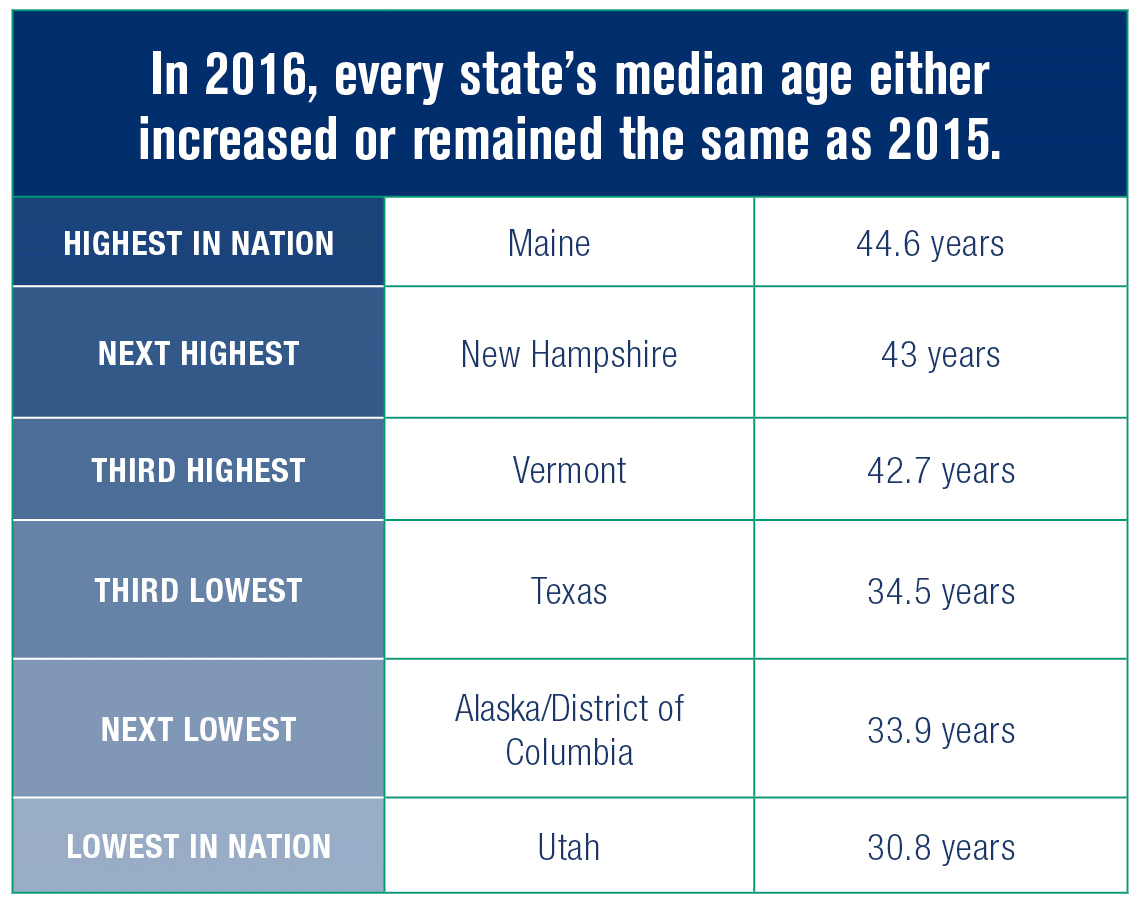

So we find ourselves at an important crossroads of health and wealth, and one where fee-only financial advisors (FOFAs) can have a tremendous impact on their clients’ lives: The longevity curve.

Some of the most common reasons people need LTC stem from conditions that not long ago were untreatable or resulted in death much sooner.

Cancer Facts in the U.S.7:

Alzheimer’s Facts in the U.S.8:

Chronic conditions (like diabetes and high blood pressure) facts in the U.S.4:

Given those staggering numbers and the volatility of our financial markets, your clients are looking at ways to protect (much less grow) their hard-earned retirement funds; to live comfortably while they live longer. Can they do it? Yes... if they plan correctly. And what are their rewards for this planning?

Your clients want to enjoy retirement without making drastic lifestyle changes, relying on help from others, or accepting a substandard level of care. Planning for the income to make that retirement vision a reality boils down to three important unknowns:

They want the greatest lifestyle benefit with the lowest amount of risk. LTCi policies and combination policies (Life/LTCi or Annuity/LTCi) can help them effectively manage those risks.

Think of long term care spending risk like you think of investment risk. A significant drop in the market can wreck the value of your client’s retirement nest egg. But they accept some volatility with the hope for higher returns. And they diversify their portfolio for some protection. Healthcare spending risk is even more volatile. Retiree spending stays level in most categories (and sometimes even declines) as we age. Healthcare expenses, however, typically increase with age (especially long term care) and as their costs outpace their income, the volatility can devastate your client’s nest egg.

While we may spend less on our cars as they last longer (because they’re being manufactured better: improved emission standards and electronics made with more stringent requirements), it’s clear that our expenditures on long term care will continue to grow as we all last longer.

Learn more in our e-brochure Long Term Care by the Numbers.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".