ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

It’s hard to pick just one since there are so many! But this one stands out among the rest:

If they’re not single right now, chances are they’ll end up single.

From the Society of Actuaries:

From the Alzheimer’s Association:

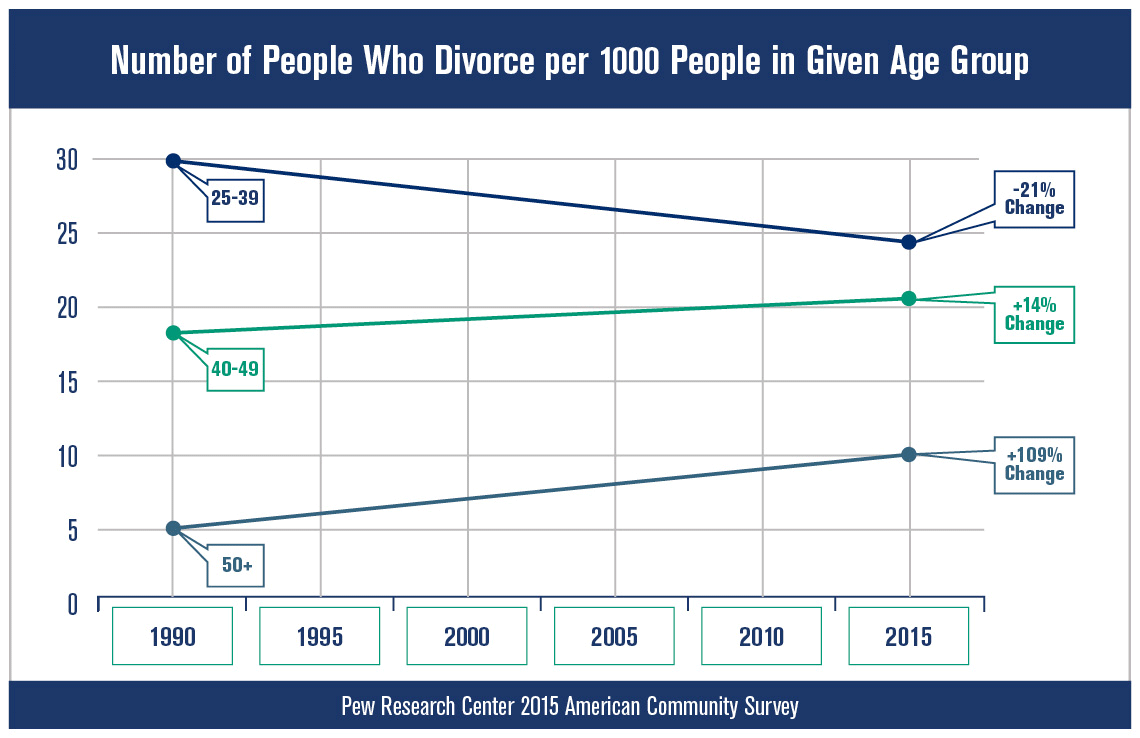

In addition to becoming widows, it’s also a fact that more and more women will be divorced as they enter their later years.

And if your clients live alone (whether they’re female or male), they’re more likely to need paid care than if they’re married, or single and living with a partner. But since women outlive men by about five years on average, they’re more likely to live at home alone when they’re older. Chances are, they’ll need some sort of assistance.

Single or married, planning for long term care is essential for women.

Given all the information above, it’s not surprising that women account for two-thirds of all LTCi claim benefits paid. So it makes sense that they’d pay more for coverage than men (just like smokers pay more for life insurance and drivers with bad driving records pay more for auto insurance).

But there are things LLIS can do to help your female clients save on their LTCi premiums:

Jill MacNeil is teamLLIS’s long term care insurance specialist. She can help you find the right solution for your clients and will share with you why she knows firsthand the importance of LTCi for women.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".