ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

FOURTH QUARTER 2017

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

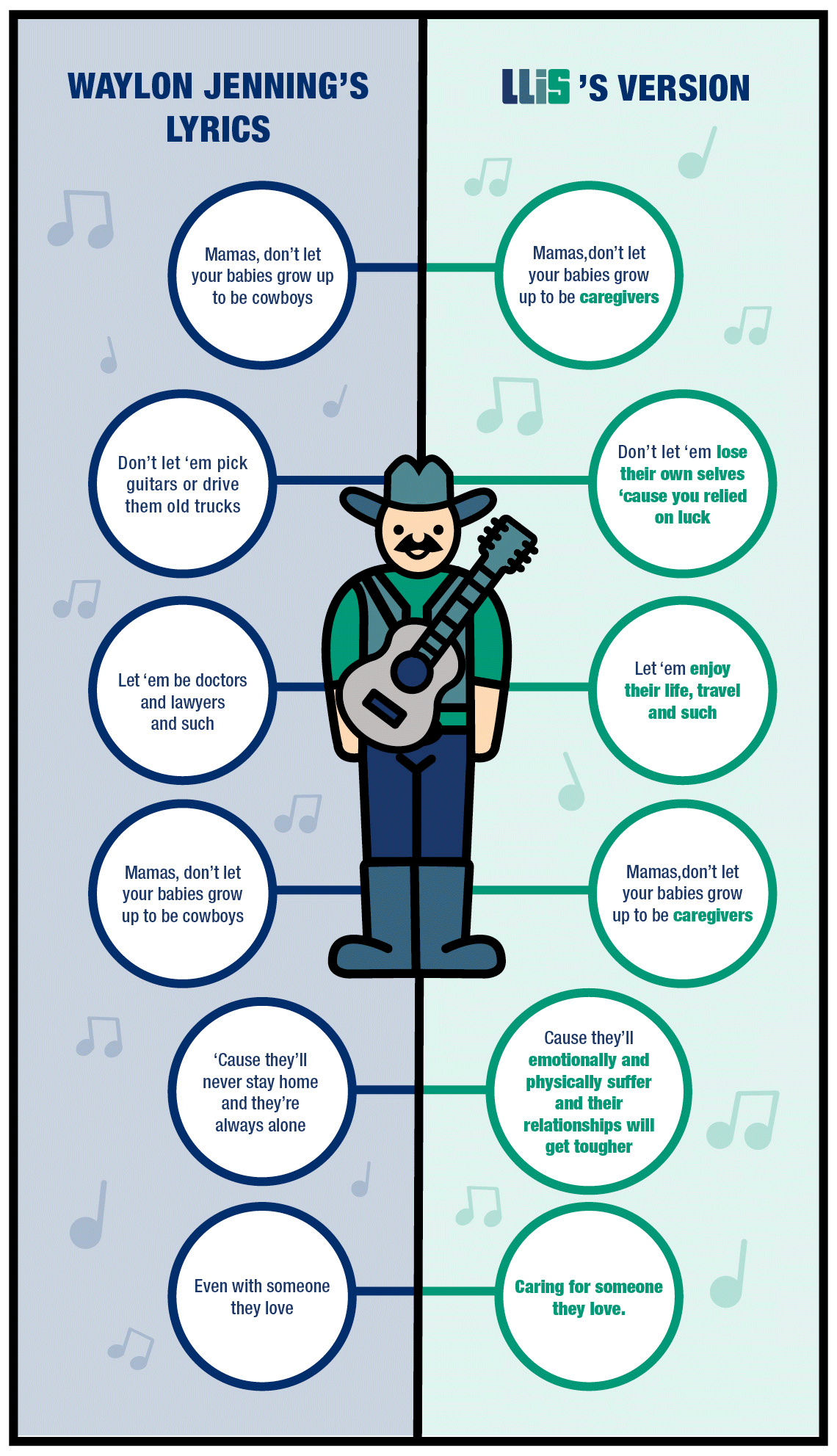

It’s not just mamas. Papas also don’t want to be a burden on their loved ones.

And, yes, most children will say to their aging parents: "You're not a burden!" But the fact is, being a caregiver does place a burden on finances, jobs, relationships, and health and wellbeing.

Caring for can mean:

Caring about can mean:

Caregivers provide care for all sorts of people: a spouse or significant other, a friend, a neighbor, a child. And the statistics about that caregiving are staggering:

"My wife will take care of me." If you're in a client meeting with a husband/wife and he says that, here are some reality check talking points:

You may also want to share this with those clients:

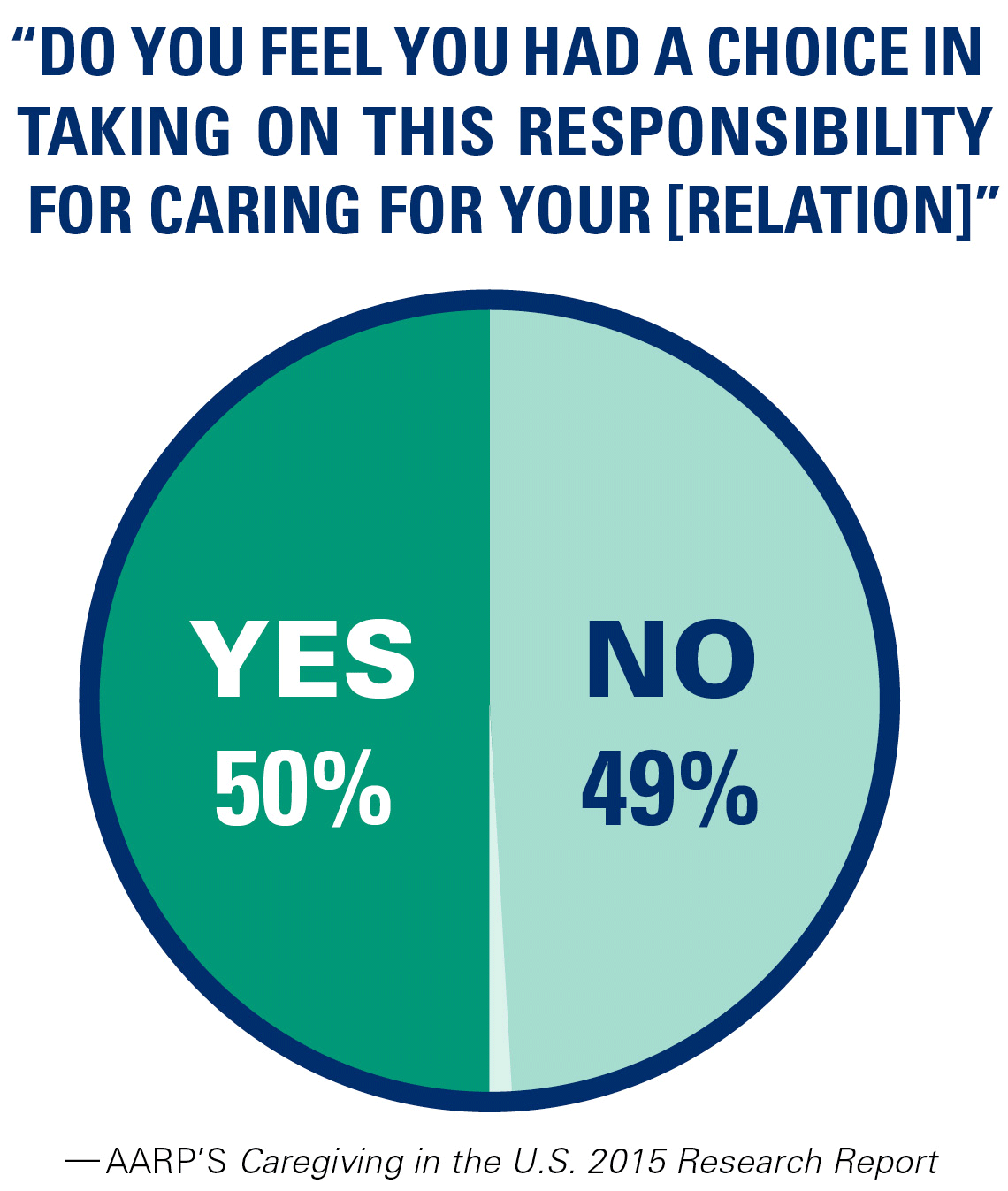

The feeling of obligation (lack of choice) is especially pronounced among those caregivers who live with their care recipient and who provide more than 20 hours of care weekly (64% reported no choice).

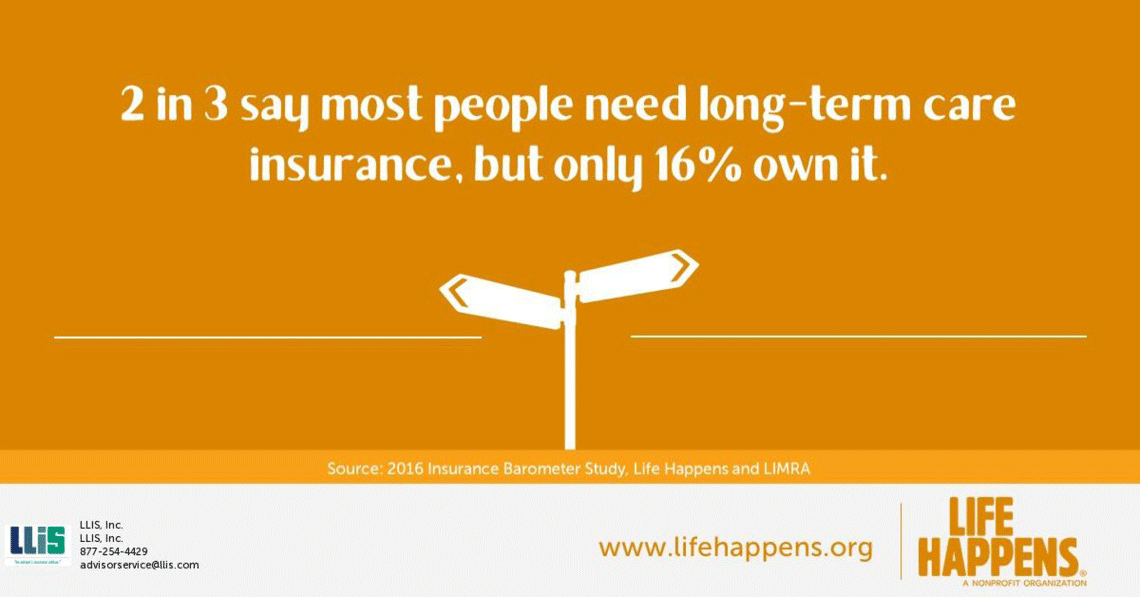

Here are a few modern-day issues and solutions:

Care about your loved ones, not for them. That's good advice for both women and men.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".