ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2019

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Google marijuana + disability insurance and you’ll find next to nothing. Why? Because it’s a newer issue that insurance companies are dealing with and underwriters are adjusting to how the market is handling it.

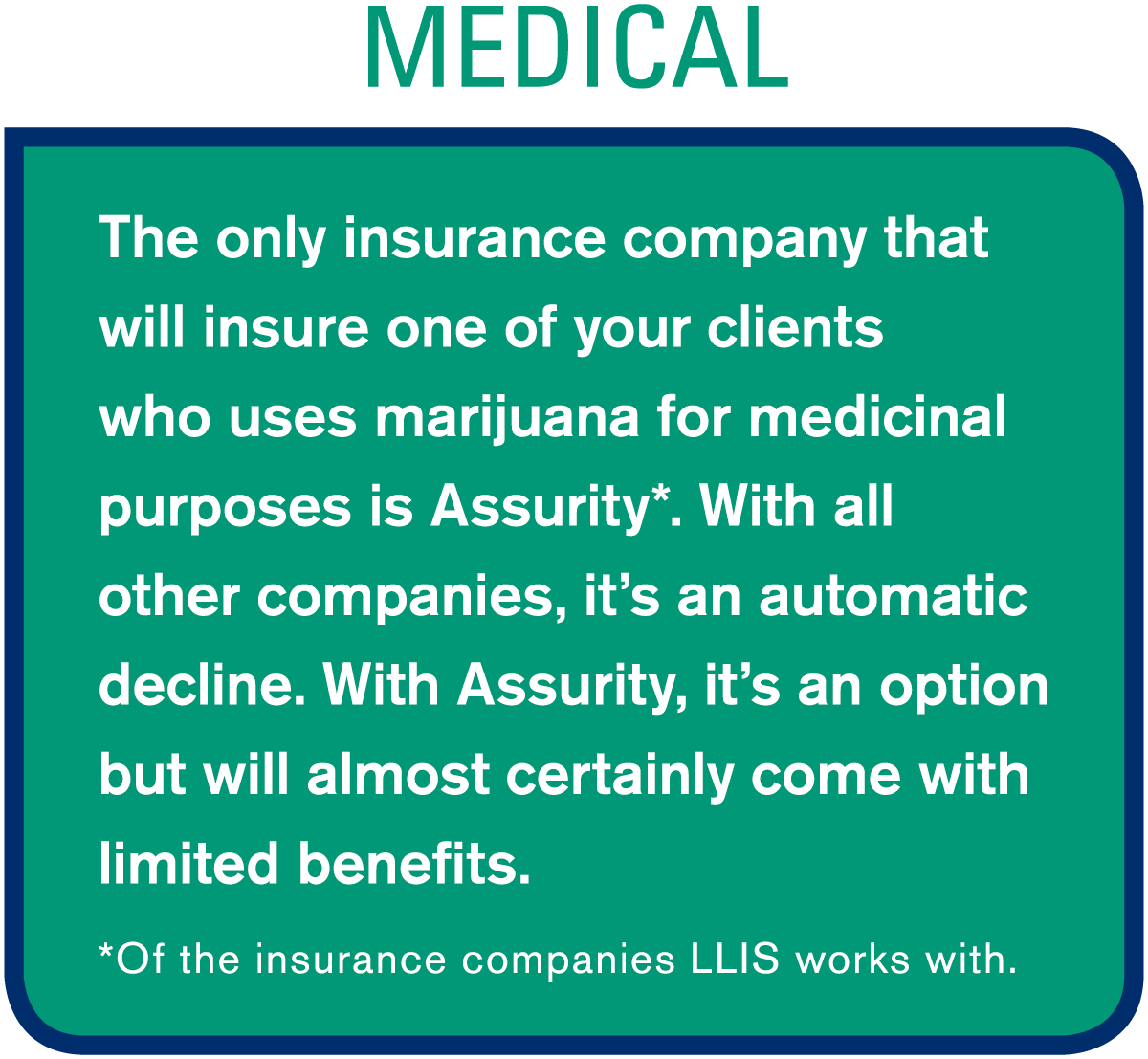

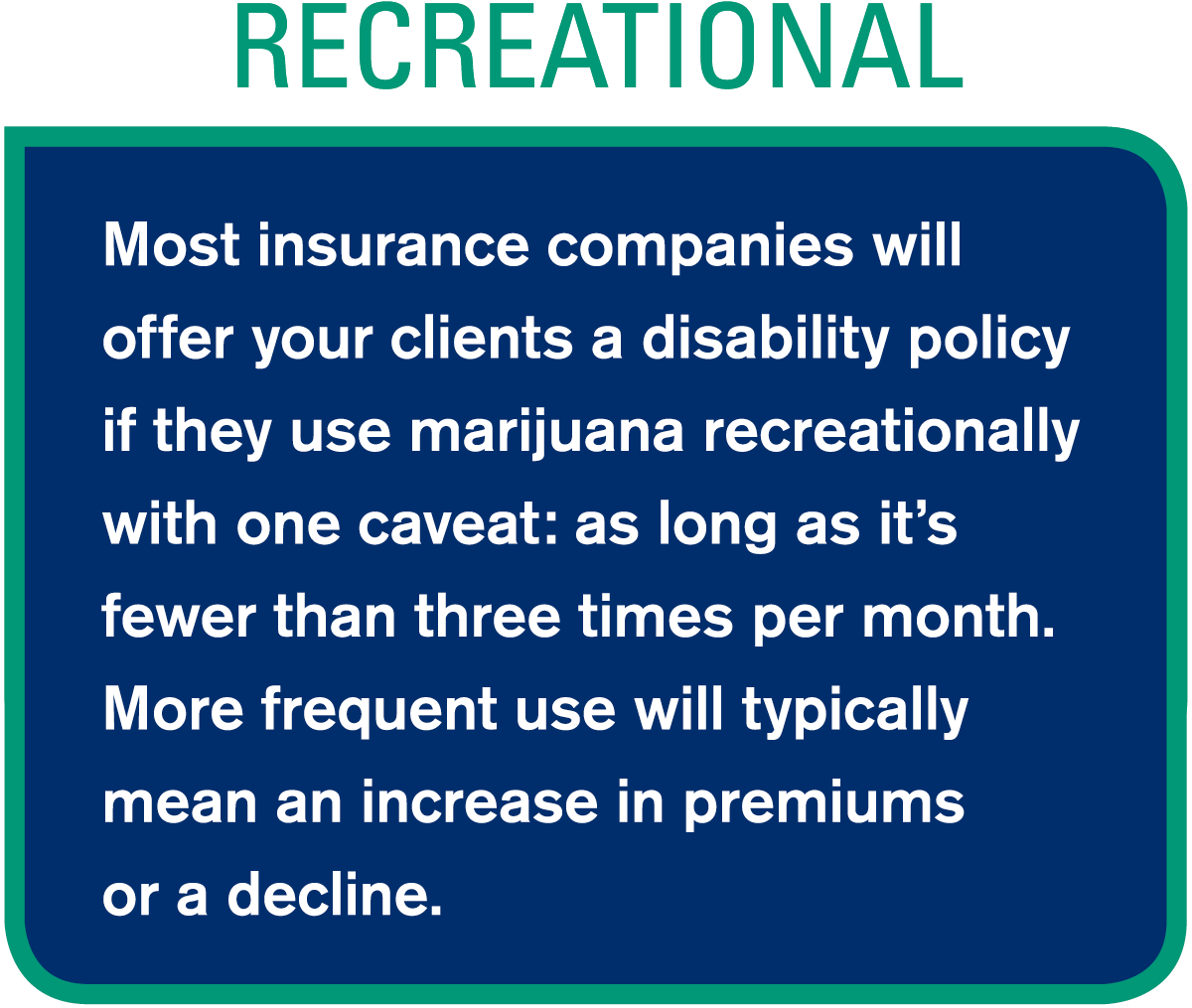

There are two types of marijuana usage in the eyes of the insurers: medical and recreational. And they’re handled quite differently, as you may expect. As of May 31st:

That probably sounds a bit backward, right? You may be thinking, “My client needs this drug to help with his (insert your client’s medical condition here). It’s not like he’s getting stoned all the time for the heck of it.”

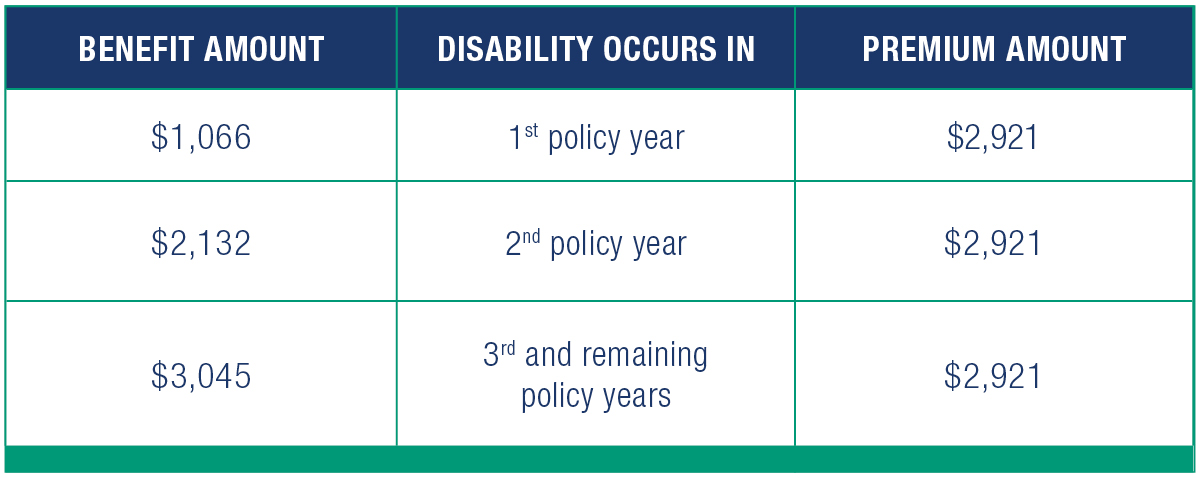

But medical marijuana is just that … medical. It’s approved to treat specific conditions. And those conditions may be ones that the insurance company may not cover anyway or may limit coverage. The most common issues we find are anxiety and mental/nervous conditions. The most common ways insurers deal with them is to remove some of the desirable riders like future increase option and partial disability benefits. Others may require a graded benefit offer like this:

If you google “life insurance agent changes the way insurance companies handle recreational marijuana underwriting” you probably won't find a picture of our own Brian Ciccarelli. But that's just what he did. While working with a client, Brian reminded the insurance company that other DI companies had made recent changes to how they underwrite marijuana users. He received this reply soon after:

This is to confirm that we will consider standard (no extra premium rating) on individuals using marijuana (or other THC products) recreationally less than one time per week, or 3 times per month. This assumes the usual stuff, such as stable employment, no chronic pain issues, no evidence of more significant drug use, etc., which covers most applicants we would see.

Also, we only apply smoker/tobacco rates based on tobacco or nicotine products. So, theoretically, an individual using it 3 times monthly could be considered with no extra premium rating and non-tobacco rates.

Thanks again for bringing this to our attention.

Way to go Brian!

LLIS can talk with underwriters about your clients' specific usage patterns. And it can be done without providing their name or personal information. Brian Ciccarelli can help with that type of question and many more DI inquiries.

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".