ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

ALLiS Login |

![]() (877) 254-4429

(877) 254-4429

SECOND QUARTER 2019

NEWS YOU CAN USE FROM THE EXPERTS AT LLIS

Lack of people investment is the main reason that 91% of employees resort to looking elsewhere.1

That investment can include employee engagement and education, and perks like flex time and insurance benefits.

Some of these perks can be inexpensive. Some of them can be a major spend. Advisors tell us that when they present the idea of providing life and disability benefits for their teams, their business owner/manager clients often think it’s out of reach. But with the right guidance, they may just find it’s both affordable and attractive.

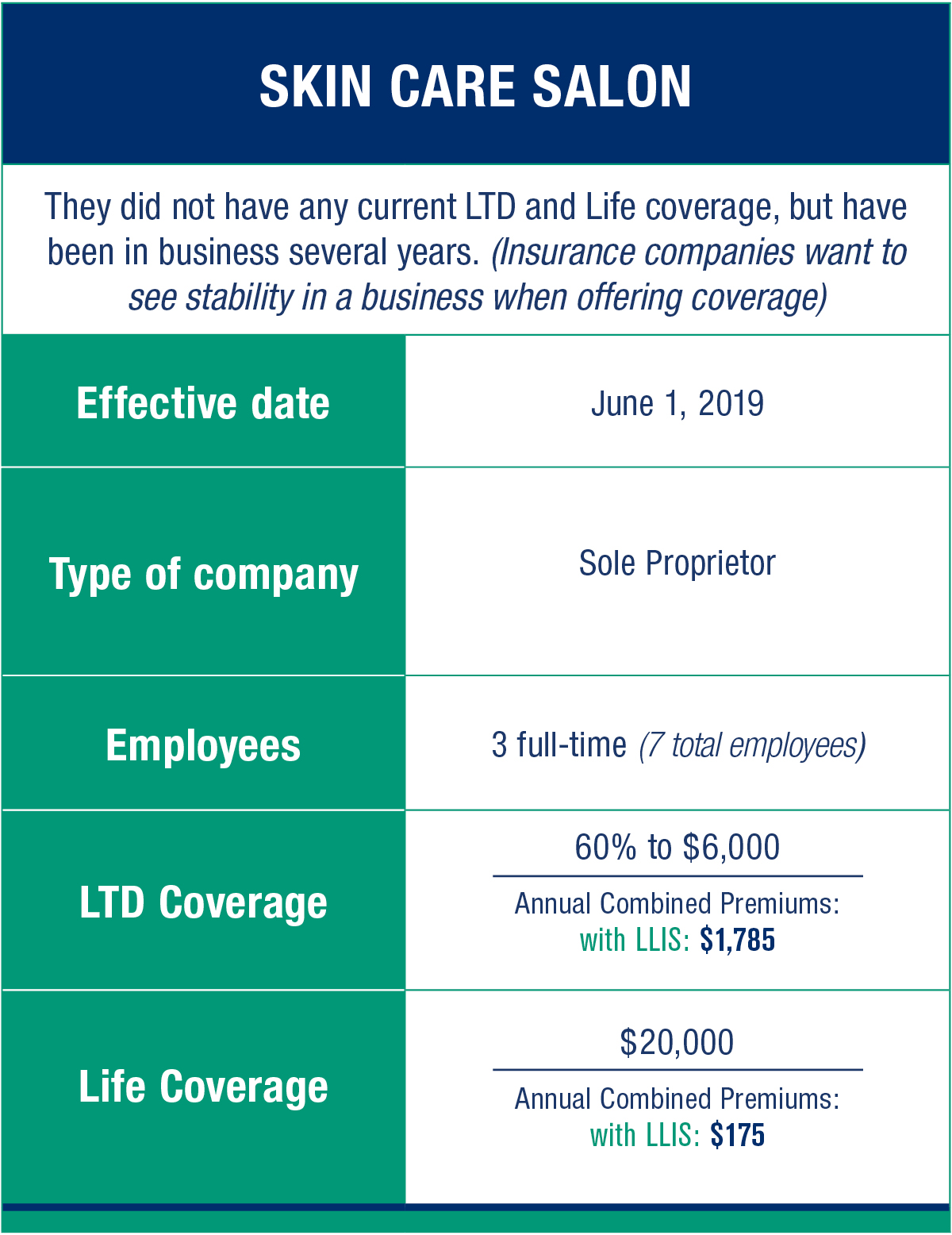

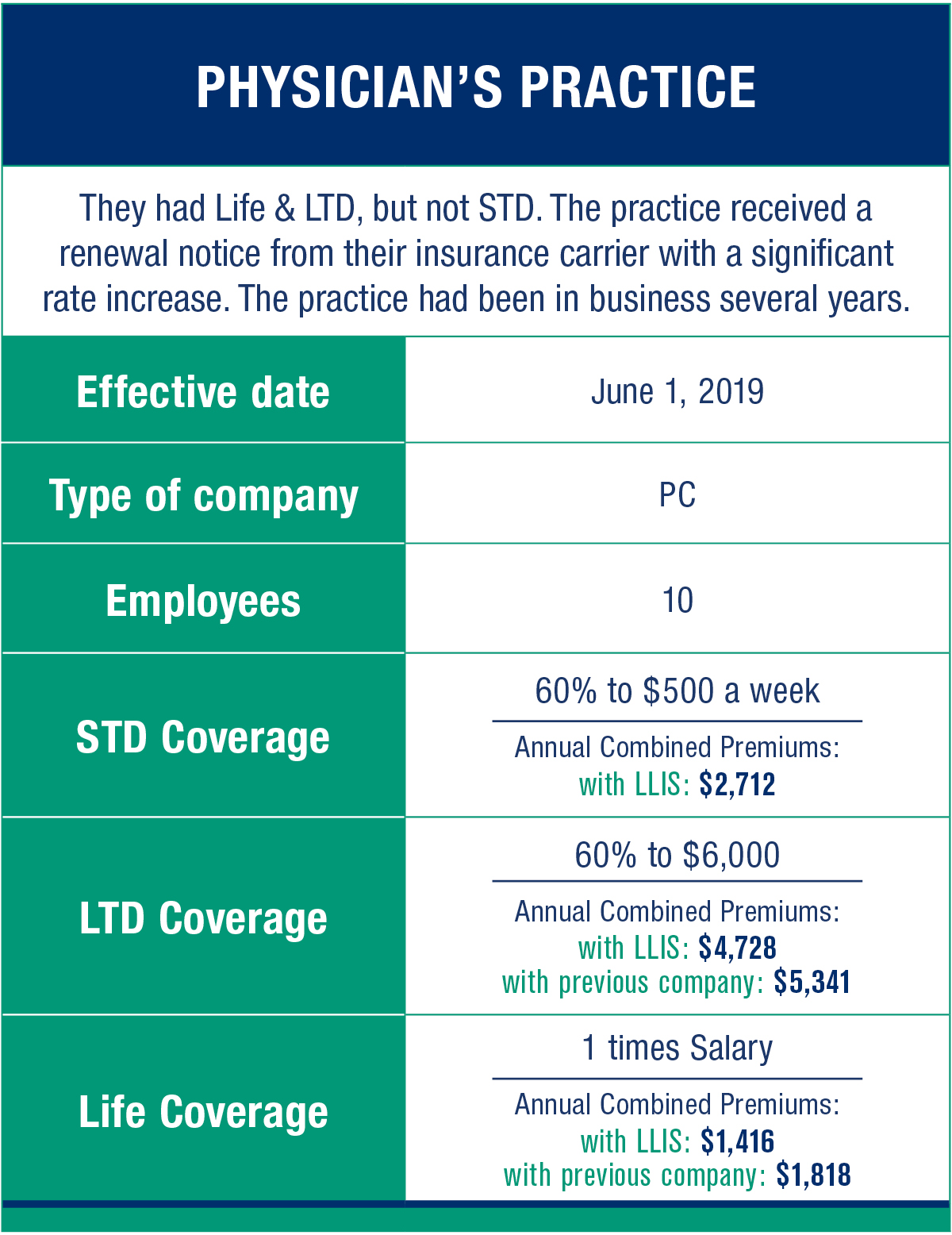

Here are three examples of plans (Short Term Disability=STD; Long Term Disability=LTD) we recently helped advisors find for their business owner clients (or themselves):

You can find more information about group Life and Disability for your clients in this 2018 issue of Policy Matters. And Kathy Bilodeau can guide you and your clients through this investment in their people.

1Gallup, State of the American Workforce Report (2013)

SOLUTIONS AVAILABLE THROUGH LLIS

Term Life Insurance | Low-Load Universal Life (Individual & Survivorship) | No Lapse Guaranteed Univeral Life (Individual & Survivorship) | Long Term Care Insurance | Disability Insurance | Critical Care Insurance | Low-Load Variable Annuity | Immediate and Fixed Annuities | Low-Load Variable Universal Life | Hybrid Life/LTCi | Hybrid Annuity/LTCi

(We recommend low-load permanent life insurance and annuities when possible)

(Not all policy types available in all states)

For a list of current providers, visit the Advisor Tools section of our website and click on "Insurance Companies We Work With".